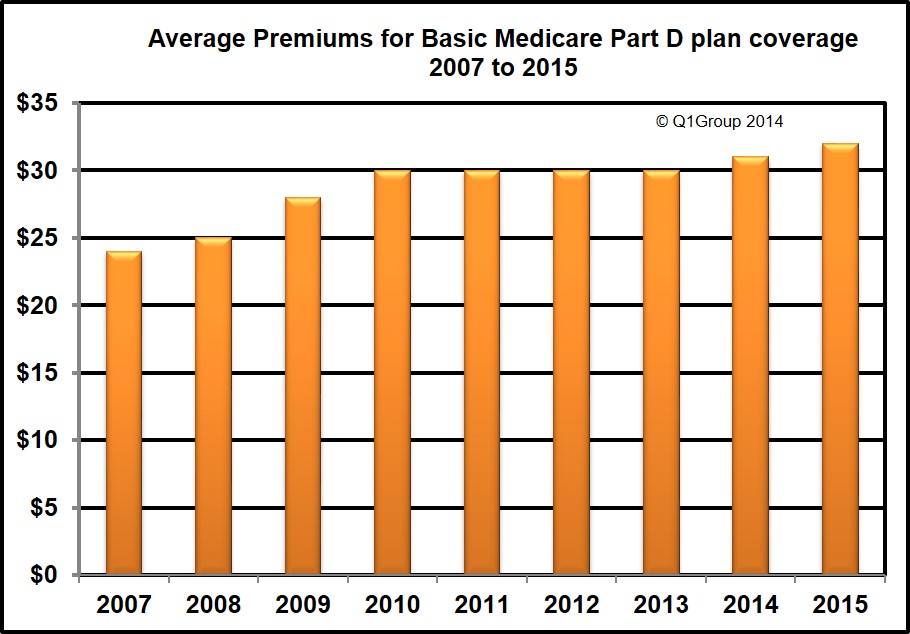

The Centers for Medicare and Medicaid Services (CMS) announced that average monthly Medicare Part D premiums should increase slightly in 2015. Based on the Medicare Part D plan carrier bids, the average monthly premium for 2015 should be around $32, up one dollar from the $31 estimate in 2014.

Medicare beneficiaries are warned that the average monthly Medicare Part D premium figure may not represent the actual changes in their Medicare Part D prescription drug plan premiums - and they should be prepared to research other, more economic forms of health and prescription coverage.

- We calculated the 2014 average monthly premium across all

stand-alone Medicare Part D plans (not considering Medicare Advantage

plans offering prescription drug coverage or MAPDs) to be $53.80 or $41.23 when weighted by stand-alone Medicare Part D plan enrollment.

- We calculated the 2013 average monthly premium across all stand-alone Medicare Part D plans to be $53.26 or $40.63 when weighted by all stand-alone Medicare Part D plan enrollment.

- We calculated the 2012 average premium across all stand-alone Medicare Part D plans to be $53.99 or $39.62 when weighted by plan enrollment.

- In 2011, we calculated the average monthly premium across all stand-alone Medicare Part D plans as $53.77 -- or $41.05 when weighted by Medicare Part D plan enrollment.

July 31, 2014

Contact: press@cms.hhs.gov

Medicare prescription drug premiums projected to remain low

On the heels of the 49th anniversary of the signing of Medicare and Medicaid into law, the Centers for Medicare & Medicaid Services (CMS) projected today that the average premium for a basic Medicare Part D prescription drug plan in 2015 will increase by about $1, to an estimated $32 per month, continuing its historically low growth rate.

This news comes after the announcements this week of continued unprecedented low levels of growth in Medicare spending and continued savings by seniors and people with disabilities on out of pocket drug costs. According to the recent Medicare Trustees report, the life of the Trust Fund has been extended to 2030, up from its projection of 2017 in 2009. The report also shows that Part B premiums are expected to stay the same rather than increase for the second year in a row. Additionally, an HHS report found that per capita Medicare spending growth has averaged 2 percent over 2009 – 2012, and nearly 0 percent in 2013, one-third of the growth rate over the 2000-2008 period. The Administration also recently announced that more than 8.2 million people with Medicare have saved over $11.5 billion since 2010 on prescription drugs as a result of the Affordable Care Act, an average of $1,407 per beneficiary. The Affordable Care Act closes the donut hole over time.

“Seniors and people with disabilities are benefiting from steady prescription drug premiums and a competitive and transparent marketplace for Medicare drug plans,” said CMS Administrator Marilyn Tavenner. “And thanks to the Affordable Care Act, they are seeing improved benefits and saving on their medications.”

For the last four years – for plan years 2011, 2012, 2013, and 2014 – the average premium for a Medicare Part D basic plan has been $30 or $31. This is better than critics of the Affordable Care Act predicted in 2009 when they claimed that closing the donut hole would cause premiums to skyrocket. Today’s projection for the average premium for 2015 is based on bids submitted by drug and health plans for basic drug coverage for the 2015 benefit year, and calculated by the Centers for Medicare & Medicaid Services Office of the Actuary.

The upcoming Medicare annual open enrollment period – which begins October 15 and ends December 7 – allows for people with Medicare to choose their plans for next year by comparing their current coverage and quality ratings to other plan offerings. New benefit choices are effective January 1, 2015.

To view the Part D Base Beneficiary Premium, the Part D National Average Monthly Bid Amount, the Part D Regional Low-Income Premium Subsidy Amounts, the De Minimis Amount, and the Medicare Advantage Regional Benchmarks, go to: www.cms.gov/Medicare/Health-Plans/MedicareAdvtgSpecRateStats/Ratebooks-and-Supporting-Data.html, and select “2015.”

To learn more about the Medicare Part D prescription drug benefit, go to: www.medicare.gov/part-d/.

# # #

[Emphasis and Highlighting added]- 2024 PY CMS Press Release: Q1News.com/1007

- 2023 PY CMS Press Release: Q1News.com/981

- 2022 PY CMS Press Release: Q1News.com/887

- 2021 PY CMS Press Release: Q1News.com/833

- 2020 PY CMS Press Release: Q1News.com/780

- 2019 PY CMS Press Release: Q1News.com/718

- 2018 PY CMS Press Release: Q1News.com/639

- 2017 PY CMS Press Release: Q1News.com/581

- 2016 PY CMS Press Release: Q1News.com/481

- 2015 PY CMS Press Release: Q1News.com/360

- 2014 PY CMS Press Release: Q1News.com/300

- 2013 PY CMS Press Release: Q1News.com/224

- 2012 PY CMS Press Release: Q1News.com/163

- 2011 PY CMS Press Release: Q1News.com/149

- 2010 PY CMS Press Release: Q1News.com/131

- 2009 PY CMS Press Release: Q1News.com/93

- 2008 PY CMS Press Release: Q1News.com/34

- 2007 PY CMS Press Release: Q1News.com/164

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service