How to calculate the cost of a $12,000 Medicare Part D drug purchase using 2022 Straddle Claim logic.

If your first Medicare Part D drug purchase of the year is an expensive formulary medication, such as ZYTIGA® (that has a retail cost of $11,000 to $12,000), the

cost of this drug purchase would be calculated as a straddle claim - where the cost of a single drug purchase is calculated across two or more phases of your Medicare Part D coverage. In this example of a $12,000 drug, the :

- (1) the expensive drug purchase would start in the Initial Deductible (if any),

- (2) continue through the Initial Coverage Phase until you reach the Initial Coverage Limit ($4,430 in 2022),

- (3) then continue through the Coverage Gap (receiving the 75% brand-name drug Donut Hole discount)

- and (4) finally, continue into the final Catastrophic Coverage phase.

Tip: Straddle Claim calculations can change year-to-year.

As a note, although the math behind straddle claim logic remains consistent, the total cost of your first drug purchase can change year-to-year as your retail drug price changes and the Medicare plan limits change year-to-year. For example, in 2018, the total cost for the first purchase of a $10,000 brand-name drug would be around $2,880 (not including dispensing fees) - and in 2021, the total cost for this same $10,000 drug would be slightly less at around $2,751 - due to changes in annual plan limits.

However, since you end your first drug purchase in the Catastrophic Coverage phase, the next (or second) purchases of our example $10,000 drug would remain constant across years with a cost of $500 per purchase (5% of retail) for the remainder of the year.

Detailed Example: How to calculate the cost of a single $12,000 brand-name formulary drug purchase.

Step 1 - Assumptions: First, before we can estimated the cost of this $12,000 straddle claim we need to make a few assumptions about the Medicare Part D plan coverage (and your coverage may vary slightly from our assumptions):

- (1) the expensive drug purchase would start in the Initial Deductible (if any),

- (2) continue through the Initial Coverage Phase until you reach the Initial Coverage Limit ($4,430 in 2022),

- (3) then continue through the Coverage Gap (receiving the 75% brand-name drug Donut Hole discount)

- and (4) finally, continue into the final Catastrophic Coverage phase.

Tip: Straddle Claim calculations can change year-to-year.

As a note, although the math behind straddle claim logic remains consistent, the total cost of your first drug purchase can change year-to-year as your retail drug price changes and the Medicare plan limits change year-to-year. For example, in 2018, the total cost for the first purchase of a $10,000 brand-name drug would be around $2,880 (not including dispensing fees) - and in 2021, the total cost for this same $10,000 drug would be slightly less at around $2,751 - due to changes in annual plan limits.

However, since you end your first drug purchase in the Catastrophic Coverage phase, the next (or second) purchases of our example $10,000 drug would remain constant across years with a cost of $500 per purchase (5% of retail) for the remainder of the year.

Detailed Example: How to calculate the cost of a single $12,000 brand-name formulary drug purchase.

Step 1 - Assumptions: First, before we can estimated the cost of this $12,000 straddle claim we need to make a few assumptions about the Medicare Part D plan coverage (and your coverage may vary slightly from our assumptions):

- You are not eligible for the Medicare Part D Extra Help program or Low-Income Subsidy (LIS).

- This drug is included on your Medicare Part D plan's formulary (drug list) or you have been granted a Formulary Exception and this non-formulary drug is now being covered by your plan.

- This is your first drug purchase you are making with your Medicare Part D plan (for example, on January 1, 2022).

- Your Medicare Part D plan has a standard Initial Deductible of $480 and this brand drug is not excluded from the deductible.

- Your Medicare Part D plan has a standard Initial Coverage Limit of $4,430 (total retail drug value before you enter the Donut Hole).

- Your Medicare Part D plan charges a standard 25% co-insurance for this drug (you pay 25% of retail in the Initial Coverage Phase - but, please note your actual drug plan may have 33% cost-sharing for expensive drugs).

- Your Medicare Part D plan does not offer any supplemental or additional Donut Hole coverage beyond the standard 75% discount.

- You will exit the Donut Hole when your out-of-pocket spending exceeds the annual TrOOP threshold of $7,050 (including the 70% of retail additional credit from the pharmaceutical manufacturer's portion of the brand-name drug Donut Hole discount that was paid on your behalf). so, you will pay 25% of the retail cost in the Coverage Gap or Donut Hole and receive 95% of the retail drug cost credited toward meeting your out-of-pocket spending threshold (before your enter the Catastrophic Coverage phase)

- We will not take into account any dispensing or vaccine fees - which usually only amount to a few dollars.

- You will pay a fixed 5% of the retail cost in the Catastrophic Coverage phase.

Step 2 - The Math: We calculate and add together what you will pay as your purchase "straddles" all four parts of your Medicare Part D coverage.

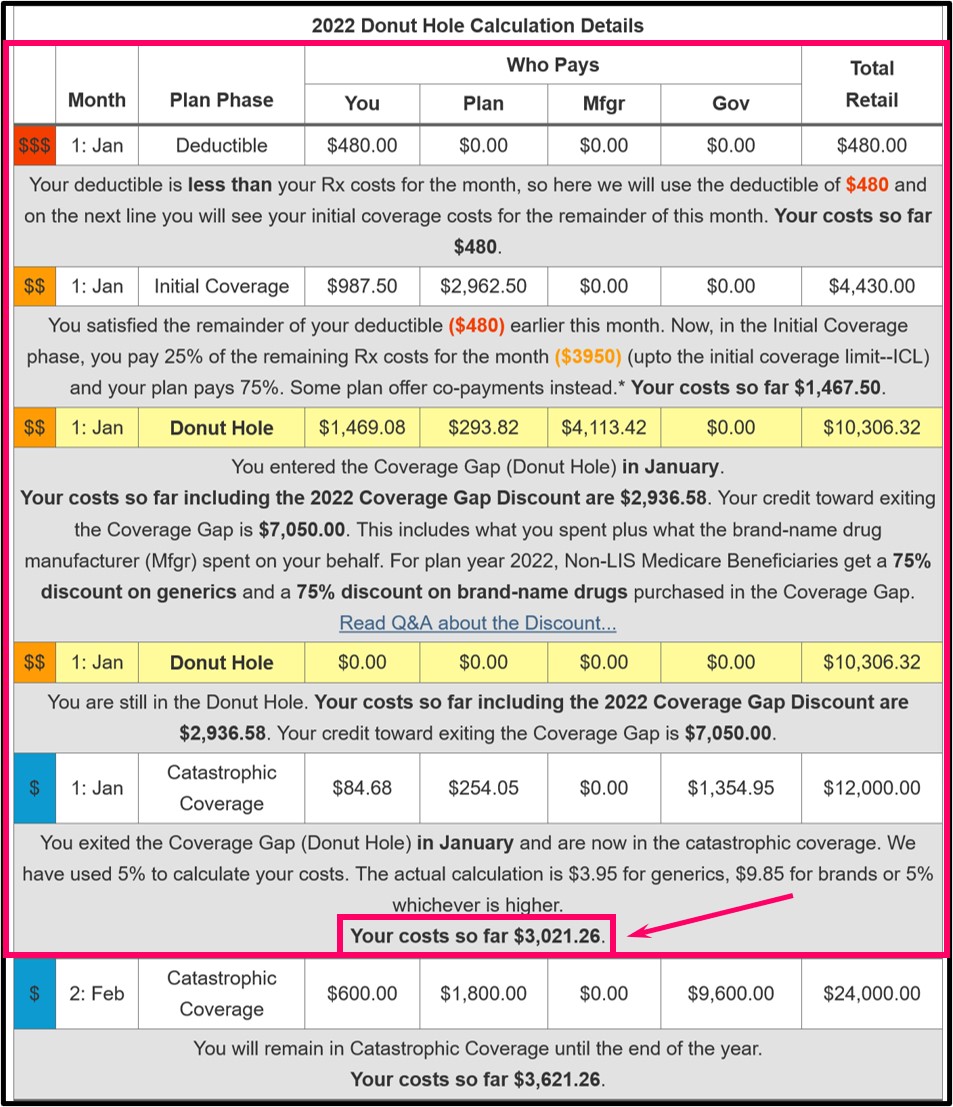

(1) Cost in the Initial Deductible: $480- added to the . . .

Since we are assuming that your Medicare Part D plan has a standard $480 deductible and that this is your first drug purchase during the initial deductible phase, you will pay 100% of the drug cost up to your deductible of $480 and the remaining balance of the retail cost of $11,520 ($12,000 - $480) (retail price - deductible) carries over into your Initial Coverage Phase.

(2) Cost in the Initial Coverage Phase: $987.50 - added to the . . .

You stay in your Initial Coverage phase until you reach the Medicare plan's Initial Coverage Limit of $4,430 and since you already have spent $480 in the deductible before reaching the Initial Coverage Phase, you would have $3,950 ($4,430 - $480) of the total retail drug cost remaining before leaving the Initial Coverage Phase (you leave the Initial Coverage Phase when your retail drug costs exceed the plan's Initial Coverage Limit).

During the Initial Coverage phase, we assumed that you have a 25% cost-sharing, that is you pay 25% of retail in this phase. So in the Initial Coverage Phase, your cost-sharing would be 25% of the $3,950 balance or $987.50 (25% of $3,950 = $987.50).

Since the amount of the retail drug price falling into the Initial Coverage Phase from the Initial Deductible ($11,520) is greater than the remaining initial coverage balance $3,950, the remaining retail balance of $7,570 ($11,520 - $3,950) carries over (or "straddles") into the Coverage Gap or Donut Hole.

Your costs so far: Subtotal of accumulated cost after the Initial Coverage Phase: $480 + $987.50 = $1,467.50

(3) Cost in the Coverage Gap or Donut Hole phase: $1,469.08 - added to the . . .

You will stay in the Donut Hole or Coverage Gap until your total out-of-pocket costs reach the plan's total out-of-pocket spending threshold (TrOOP) of $7,050 (which should account for a retail drug cost of around $10,306). We are assuming you are using 100% brand-name drugs and receiving 95% credit for your Donut Hole purchases (the 25% Donut Hole Discount of retail you spend plus the 70% discount provided by the pharmaceutical industry on your behalf).

So the retail value of what you can purchase in your Donut Hole is ($7,050 (TrOOP) - $1,467.50 (out-of-pocket total before entering Donut Hole))/95% (amount of brand-name Donut Hole discount counted toward TrOOP) = $5,582.50/0.95 = $5,876.32

You will then pay 25% of the retail balance in the Donut Hole (with your 75% brand-name discount) or $5,876.32 * 25% = $1,469.08.

Keeping track of the $12,000 retail drug cost already applied to your Medicare Part D coverage:

The total retail drug cost value as you exit the Donut Hole: $4,430 (Initial Coverage Limit) + ($7,050 (TrOOP) - $1,467.50 (what you spent out-of-pocket before entering Donut Hole))/95% (amount of brand-name Donut Hole discount counted toward TrOOP threshold) = $10,306.32.

Subtotal of accumulated cost after the Coverage Gap: $480 + $987.60 + $1,469.08 = $2,936.68

(4) Cost in the Catastrophic Coverage phase: $84.68

We can calculate the remaining amount of the $12,000 retail drug cost that will carry into Catastrophic Coverage as $1,693.68 (the $12,000 (total retail drug cost) - $10,306.32 (total retail balance after Donut Hole)).

For this final portion of the $12,000 retail drug cost that falls into Catastrophic Coverage, you would pay an additional $84.68 or (5% of $1,693.68) since it is greater than the minimum brand-name 2022 Catastrophic Coverage cost-share of $9.85.

Total cost at the end of the Straddle Claim for a single $12,000 drug purchase:

$480 (initial deductible) + $987.50 (initial coverage phase) + $1,469.50 (Donut Hole) + $84.68 (catastrophic coverage)

= $3,021.26

(5) The next or second $12,000 drug purchase: Cost of any additional purchases of this $12,000 brand-name formulary drug (after the first purchase): $600

Any purchases of this same drug during the remainder of the year would be in the Catastrophic Coverage phase costing 5% of the $12,000 retail cost or $600.

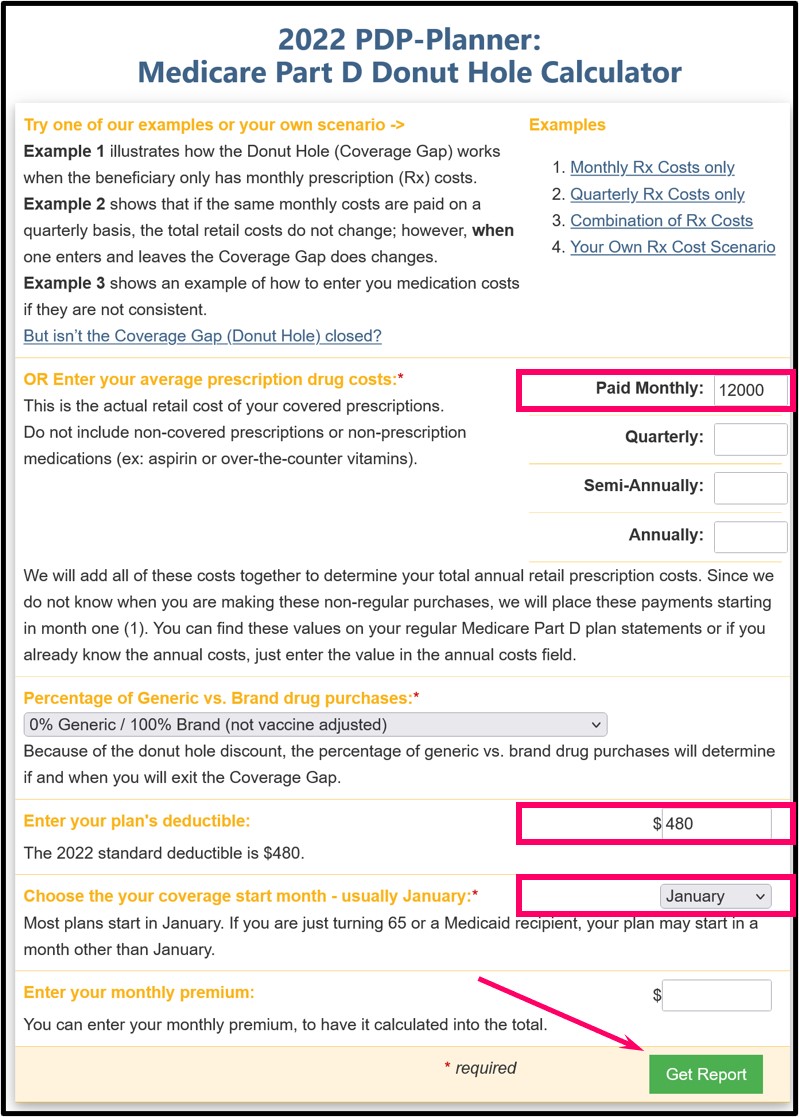

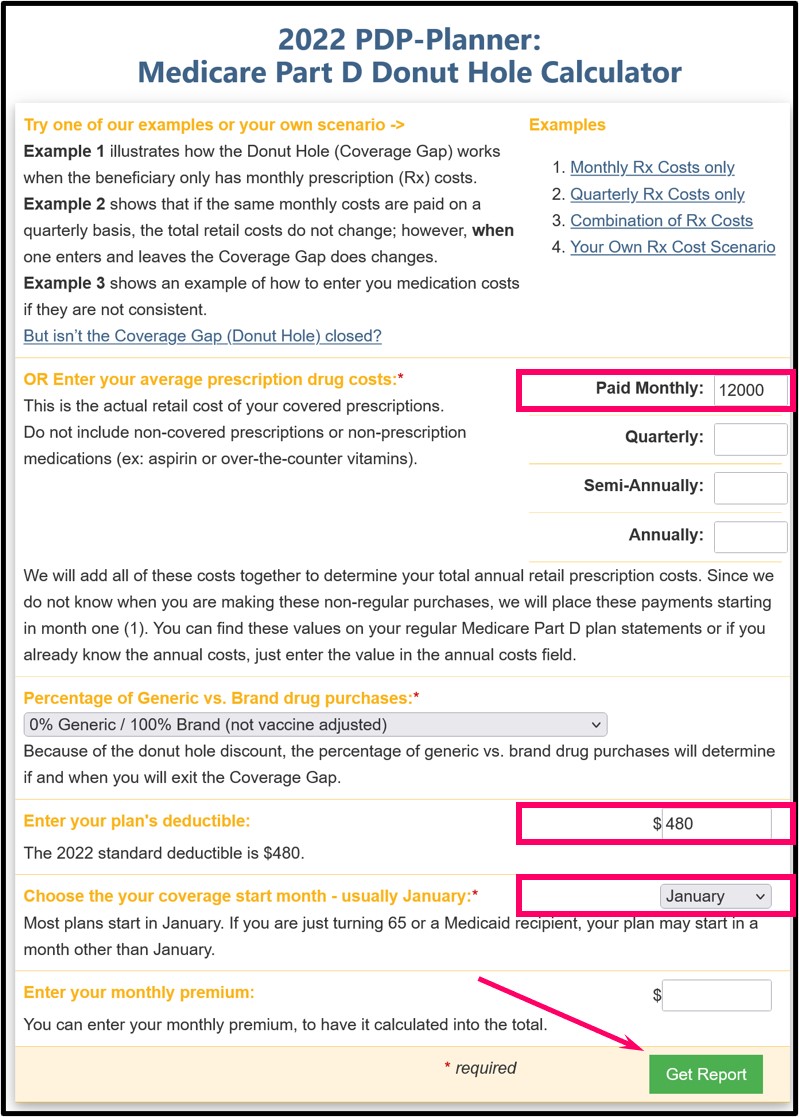

Step 3 (optional) - Skip the math and use our Donut Hole Calculator or Cost Estimator by starting at: PDP-Planner.com - then:

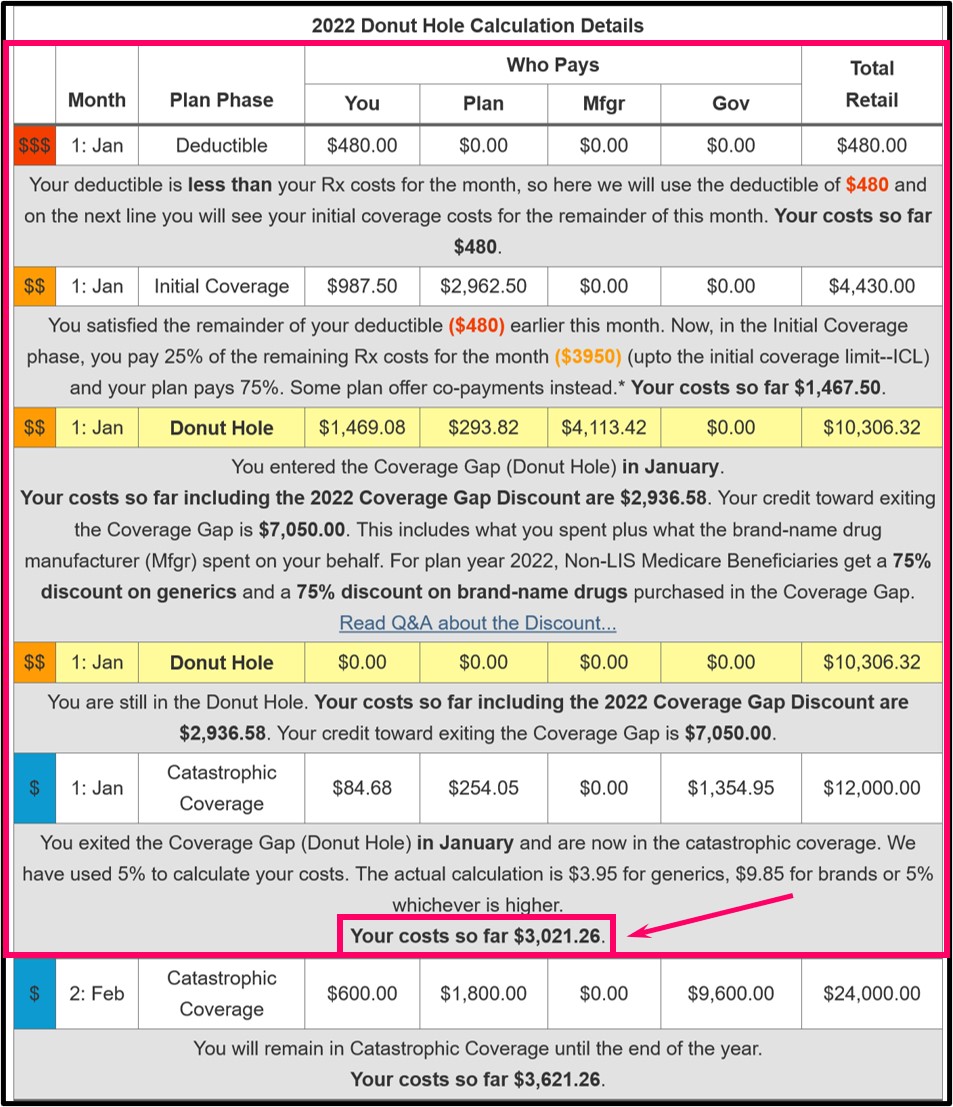

The end result of the PDP-Planner or Donut Hole Calculator should look something like the following if you use $480 as your standard initial deductible and you will see that the first drug purchase (1:Jan) is calculated over all four phases of the Medicare Part D drug plan.

- Enter the retail drug price (such as 12,000) into "Paid Monthly" (no "$" needed - so type in 12,000, not $12,000)

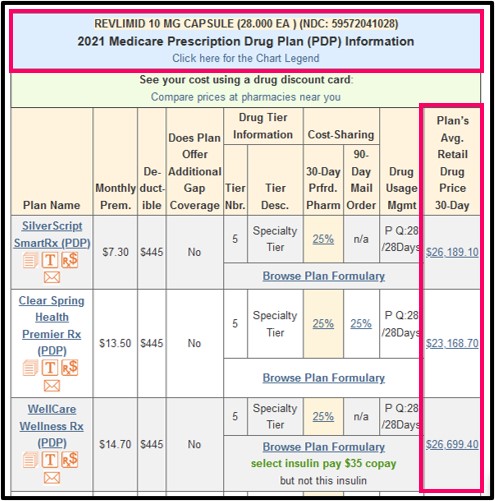

- Tip: No idea of the retail cost for your expensive prescription drug?

If you cannot find the retail drug price for your prescription, you can use our Q1Rx Drug Finder (Q1Rx.com) to estimate the plan's retail drug price. Begin by entering your drug, choose the strength, and, if available, we will show the "average" retail drug price for the given prescription drug across all pharmacies in a plan's Service Area (state or ZIP Code area). You will actually see the average retail drug prices for all Medicare drug plans in your chosen area that cover your chosen drug. Your actual retail drug price can vary slightly depending on the chosen pharmacy where you purchase the formulary drug.

- Next, choose your mix of generic and brand drug - in this

example, we have one brand-name $12,000 drug so we selected "0% Generic /

100% Brand (not vaccine adjusted).

- Then, input your Medicare plan's annual deductible ($0, $435, $445, $480 or whatever you have for your plan).

- Choose "January" as the starting month so you can see the whole year (or choose a date when your plan coverage began).

- Click on the green "Get Report" button.

The end result of the PDP-Planner or Donut Hole Calculator should look something like the following if you use $480 as your standard initial deductible and you will see that the first drug purchase (1:Jan) is calculated over all four phases of the Medicare Part D drug plan.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service