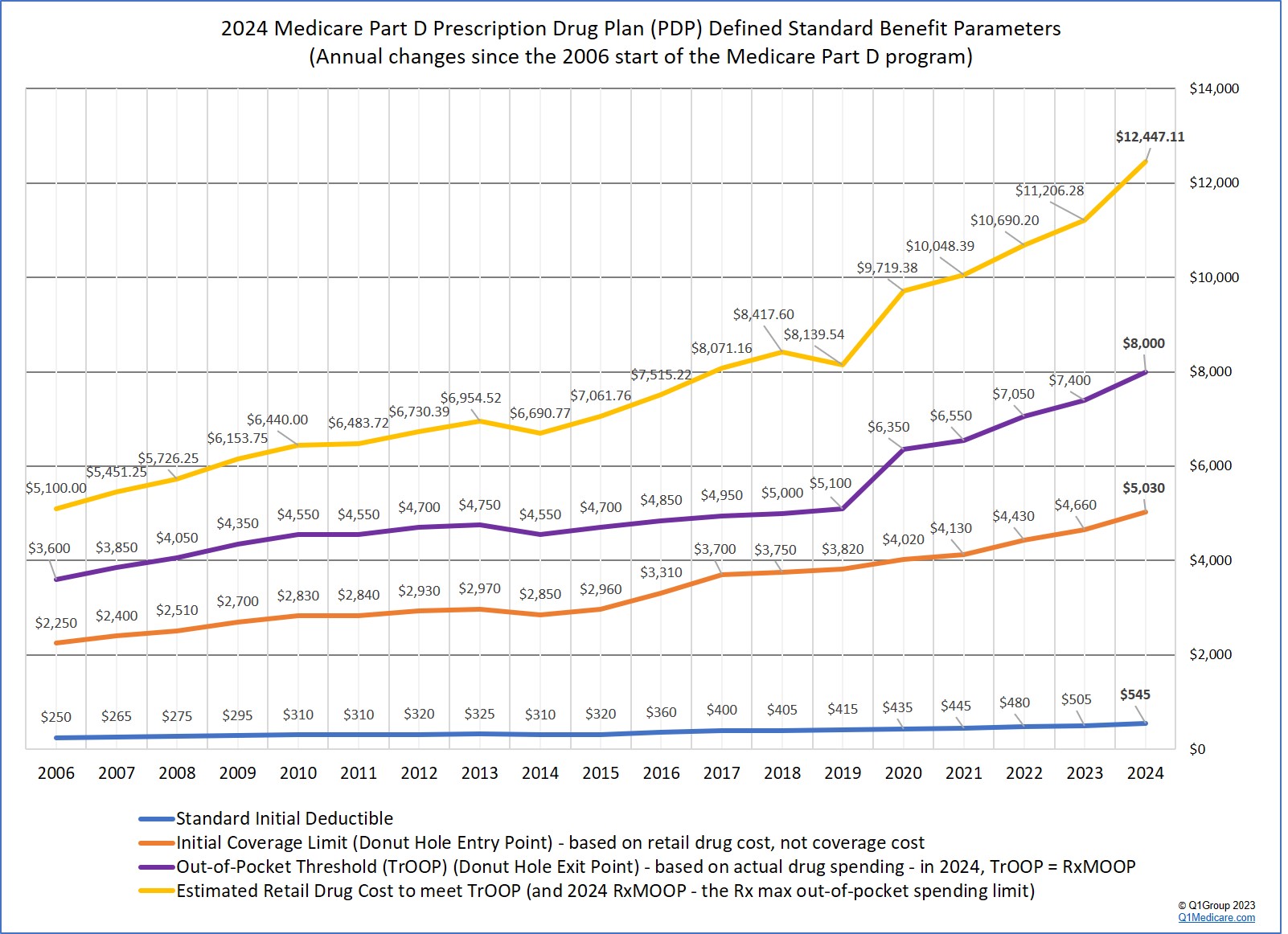

For example, you exit the Donut Hole portion of your 2021 Medicare Part D prescription drug plan and enter into your plan's Catastrophic Coverage phase when your total out-of-pocket costs (TrOOP) reach $6,550 (increasing to $7,050 in 2022).

But, is it possible to calculate when you exit the Donut Hole based on retail drug cost?

Yes, but the calculation is more complex with the Donut Hole discount and you need to look at whether the Medicare plan has a deductible, the total cost-sharing of drugs purchased before the Donut Hole, and the exact percentage of brand name drugs or generic drugs purchased while in the Donut Hole. To assist with this calculation, each year the Centers for Medicare and Medicaid Services (CMS) calculates an estimated retail value of drug purchases necessary to reach the total out-of-pocket spending threshold and exit the Donut Hole.

The CMS estimate is based on historical Donut Hole purchases (percentages of generic and brand drugs) and uses the annual Medicare Defined Standard Part D plan initial deductible and 25% co-insurance to determine the costs of all medications.

For example, in 2021, CMS expects (based on history) that most people will purchase 89.5% brands and 10.5% generics in the Donut Hole. Based on the standard 2021 deductible of $445, CMS estimates that people will exit the Donut Hole (or meet the 2021 TrOOP limit of $6,550) when they have retail drug costs of $10,048.39.

So, yes, there are two different numbers (retail drug cost and out-of-pocket cost) that both represent "exiting the Donut Hole", but since the introduction of the Donut Hole discount, the relationship between these two numbers has become more confusing and a bit less relevant.

As a historical note: Before the start of the Donut Hole discount in 2011, with a little math, a person could calculate their Donut Hole exit point (or when they enter the Catastrophic Coverage phase) with either their total out-of-pocket spending (TrOOP) or their total retail drug cost.

How retail drug prices and out-of-pocket spending define the Donut Hole

Nowadays, with the Donut Hole discount it is easier to use two different numbers to define your Medicare drug plan’s Donut Hole or Coverage Gap (retail cost and actual cost):

(1) Retail Drug Cost: You enter the Donut Hole based on the total negotiated retail value of your medications. For instance, when the total value of the retail cost of your 2021 drug purchases exceeds the 2021 Initial Coverage Limit of $4,130 ($4,430 in 2022), you leave your Medicare Part D plan's Initial Coverage Phase and enter into the Donut Hole or Coverage Gap.

(2) Out-of-pocket Costs: As noted above, we estimate when you exit the 2021 Donut Hole based on out-of-pocket spending (not retail drug cost). For example, after your actual spending for covered Medicare Part D medications has reached $6,550, you exit the 2021 Donut Hole.

How does all this work in reality?

Initial Coverage Phase: If you are in your 2021 Medicare Part D plan’s Initial Coverage Phase (before the Donut Hole), and you purchase a medication with a $100 retail cost, and pay your Medicare Part D plan’s $30 co-payment out of your own pocket (the Medicare plan pays the other $70), you get $30 credit toward the $6,550 Donut Hole exit point and $100 toward meeting your $4,130 Initial Coverage Limit.

(The $30 is just used as an example co-payment, the actual cost depends on your chosen Medicare Part D plan.)

Donut Hole Phase: Now when you are in the Donut Hole and you buy the same $100 medication, and your Medicare plan does not have any Donut Hole coverage, you will get a 75% discount on all brand-name drugs bought in the Donut Hole, or a 75% discount on generic drugs purchased in the Donut Hole. However, since a portion of the brand-name discount is paid by the pharmaceutical industry - you get credit for this amount of what someone paid for you toward exiting the Donut Hole.

So, if your $100 medication was a brand-name drug, then you will pay only $25 for the drug - but, you will get credit for $95 toward meeting your $6,550 out-of-pocket threshold or Donut Hole exit point. This $95 represents the $25 that you paid and the $70 that was paid on your behalf by the brand-name drug manufacturer. You do not get credit for the $5 that was paid by your Medicare Part D plan. You can read more in our Drug Discount FAQ: https://Q1FAQ.com/470.html.

To learn more about costs before, during, and after the Donut Hole, please see our Donut Hole Calculator or

PDP-Planner and you can use the Example #1 based on someone who buys $800 worth

of Medicare Part D drugs per month: https://q1medicare.com/PartD-DoughnutHoleCalculatorsDonutHole.php?pgtype=ex1

Scrolling down to the bottom chart on this page illustrates how the retail

price and the out-of-pocket costs compare throughout the Medicare Part D plan phases – with

variations based on the Donut Hole discount at the bottom.

Again, depending on the Medicare beneficiary's purchasing habits or prescriptions (generic drugs

vs. brand-drugs), the retail price may not be relevant as the person

may not have reached the annual TrOOP level – so they may be able to purchase

more medications in the Donut Hole before reaching Catastrophic Coverage.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service