Q1Group 2016 MA/MAPD Analysis: Changes in the 2016 Medicare Advantage Special Needs Plan (SNP) landscape still result in a net gain of 2016 SNPs

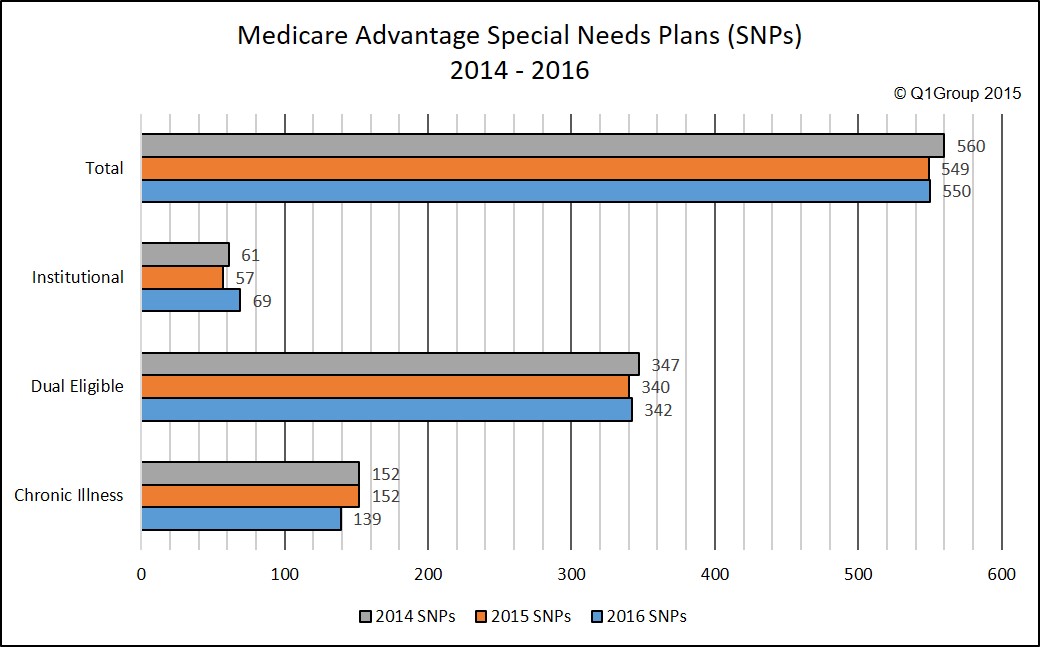

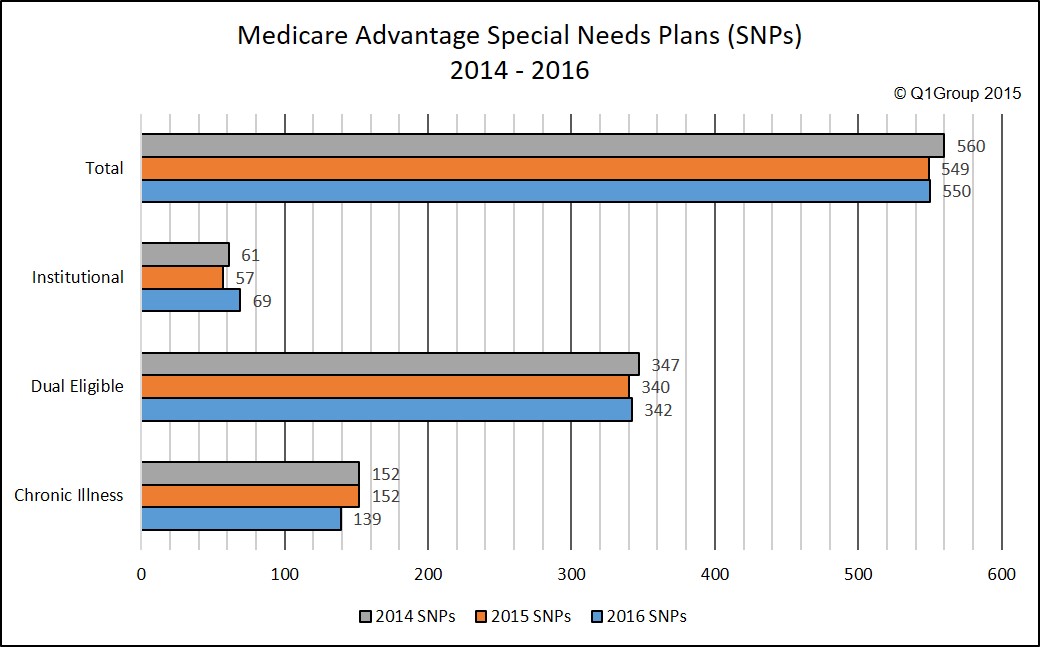

Over 24% of the 2015 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2016 as compared to 16% of the 2014 Special Needs Plans that were discontinued in 2015. The good news is that such a large number of new SNPs are being introduced in 2016, that overall, there is actually an increase of one (1) SNP for 2016 with a net loss of Chronic Illness SNPs, but an increase in the number of Institutional SNPs.

Special Needs Plans are a type of Medicare Advantage plan with benefits, provider choices, and drug formularies (list of covered drugs) designed to best meet the specific needs of a particular group of people who meet certain requirements such as people suffering from a chronic condition or have limited income and assets. You cannot join a Medicare Advantage SNP unless you qualify for the plan’s “Special Need”.

SNPs are divided into three major types of special needs: Chronic Illness SNPs (like diabetes), Dual Eligible D-SNPs (for Medicare and Medicaid beneficiaries), and Institutional SNPs (for Nursing and Long Term Care (LTC) residents). The chart below summarizes the 2016 Special Needs Plan landscape in comparison to 2015

You can learn more about the 2016 SNPs that are available in your area by using our Medicare Advantage plan finder (MA-Finder.com/2016). As an example of all 2016 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate 100% for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full-dual eligible Medicare/Medicaid beneficiaries.

From the Medicare Advantage plan information; there are a total of 550 Special Needs Plans available in 2016, the majority of SNPs are designed for people eligible for both Medicare and Medicaid.

The counties with the most Special Needs Plans available are in the State of New York.

Medicare Advantage Chronic Illness Special Needs Plans can be further divided into the type of chronic illness that the plan is designed to address. You might note from the following table that some of the 2015 SNPs were discontinued and replaced with SNPs covering more than one chronic condition. For example, a new addition for 2016 is a combined chronic illness SNP for "Cardiovascular Disorders, Chronic Heart Failure and Diabetes".

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see a small decline in reach after the 2015 rebound in reach following the significant reductions in service area in the 2014 plan year.

You can use our MA-Finder to review all 2016 Medicare Advantage Special Needs Plans available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

Reminder: SNPs tailor their benefits, provider choices, and drug formularies (list of covered drugs) to best meet the specific needs of the groups they serve. Medicare SNPs limit plan membership to people with specific diseases or characteristics -- you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

Special Needs Plans are a type of Medicare Advantage plan with benefits, provider choices, and drug formularies (list of covered drugs) designed to best meet the specific needs of a particular group of people who meet certain requirements such as people suffering from a chronic condition or have limited income and assets. You cannot join a Medicare Advantage SNP unless you qualify for the plan’s “Special Need”.

SNPs are divided into three major types of special needs: Chronic Illness SNPs (like diabetes), Dual Eligible D-SNPs (for Medicare and Medicaid beneficiaries), and Institutional SNPs (for Nursing and Long Term Care (LTC) residents). The chart below summarizes the 2016 Special Needs Plan landscape in comparison to 2015

You can learn more about the 2016 SNPs that are available in your area by using our Medicare Advantage plan finder (MA-Finder.com/2016). As an example of all 2016 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate 100% for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full-dual eligible Medicare/Medicaid beneficiaries.

From the Medicare Advantage plan information; there are a total of 550 Special Needs Plans available in 2016, the majority of SNPs are designed for people eligible for both Medicare and Medicaid.

| 2016 Special Needs Plans by Type of Special Need |

|||||||

| SNP Type | 2016 Plans | 2015 Plans | Net Change | % Net Change | Dropped Plans | % of '15 SNPs Dropped | 2014 Plans |

| Chronic Illness | 139 | 152 | -13 | -9% | 35 | 23% | 152 |

| Dual Eligible | 342 | 340 | 2 | 1% | 75 | 22% | 347 |

| Institutional | 69 | 57 | 12 | 21% | 23 | 40% | 61 |

| Total | 550 | 549 | 1 | 0.2% | 133 | 24% | 560 |

The counties with the most Special Needs Plans available are in the State of New York.

| Counties with the Largest Number of 2016 Special Needs Plans |

|

| Locations | SNPs |

| Queens County, NY | 45 |

| Bronx County, NY | 43 |

| Kings County, NY | 41 |

| New York County, NY | 41 |

| Richmond County, NY | 34 |

| Miami-Dade County, FL | 33 |

| Los Angeles County, CA | 32 |

| Nassau County, NY | 29 |

| Orange County, CA | 26 |

| San Bernardino County, CA | 25 |

Medicare Advantage Chronic Illness Special Needs Plans can be further divided into the type of chronic illness that the plan is designed to address. You might note from the following table that some of the 2015 SNPs were discontinued and replaced with SNPs covering more than one chronic condition. For example, a new addition for 2016 is a combined chronic illness SNP for "Cardiovascular Disorders, Chronic Heart Failure and Diabetes".

| 2016 Special Needs – Chronic Illness Plans Compared to the 2015 Plan Year |

||||

| Chronic Illness | Number of SNPs | |||

| 2016 Plans | 2015 Plans | Change | 2014 Plans | |

| Cardiovascular Disorders | 3 | 51 | -48 | 3 |

| Cardiovascular Disorders & Chronic Heart Failure | 14 | 18 | -4 | 17 |

| Cardiovascular Disorders, Chronic Heart Failure & Diabetes | 49 | 49 | ||

| Chronic and Disabling Mental Health Conditions | 2 | 3 | -1 | 2 |

| Chronic Heart Failure | 4 | 4 | 0 | 2 |

| Chronic Heart Failure & Diabetes | 7 | 58 | -51 | 41 |

| Chronic Lung Disorders | 13 | 13 | 0 | 15 |

| Dementia | 2 | 2 | 0 | 2 |

| Diabetes Mellitus | 36 | 46 | -10 | 55 |

| End-stage Renal Disease Requiring Dialysis (any mode of dialysis) | 10 | 5 | 5 | 5 |

| HIV/AIDS | 3 | 4 | -1 | 6 |

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see a small decline in reach after the 2015 rebound in reach following the significant reductions in service area in the 2014 plan year.

| 2016 Special Needs Plan Reach by Type of Need |

||||||

| SNP Type | 2016 | 2015 | Change '15 to '16 |

Percent Change '15 to '16 |

2014 | 2013 |

| Chronic Illness | 2,551 | 2,978 | -427 | -14% | 2,611 | 6,402 |

| Dual Eligible | 5,594 | 5,342 | 252 | 5% | 4,973 | 5,284 |

| Institutional | 556 | 450 | 106 | 24% | 439 | 537 |

| Total | 8,701 | 8,770 | -69 | -1% | 8,023 | 12,223 |

You can use our MA-Finder to review all 2016 Medicare Advantage Special Needs Plans available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

Reminder: SNPs tailor their benefits, provider choices, and drug formularies (list of covered drugs) to best meet the specific needs of the groups they serve. Medicare SNPs limit plan membership to people with specific diseases or characteristics -- you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

News Categories

Prescription Discounts for the Whole Family

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service