A preview of 2019: CMS releases the proposed 2019 Medicare Part D standard drug plan coverage parameters

On February 1st, the Centers for Medicare and

Medicaid Services (CMS) released

Part II of the 2019 Advance Notice and Draft Call Letter that included proposed defined

standard benefits for 2019 Medicare Part D prescription drug plan coverage.

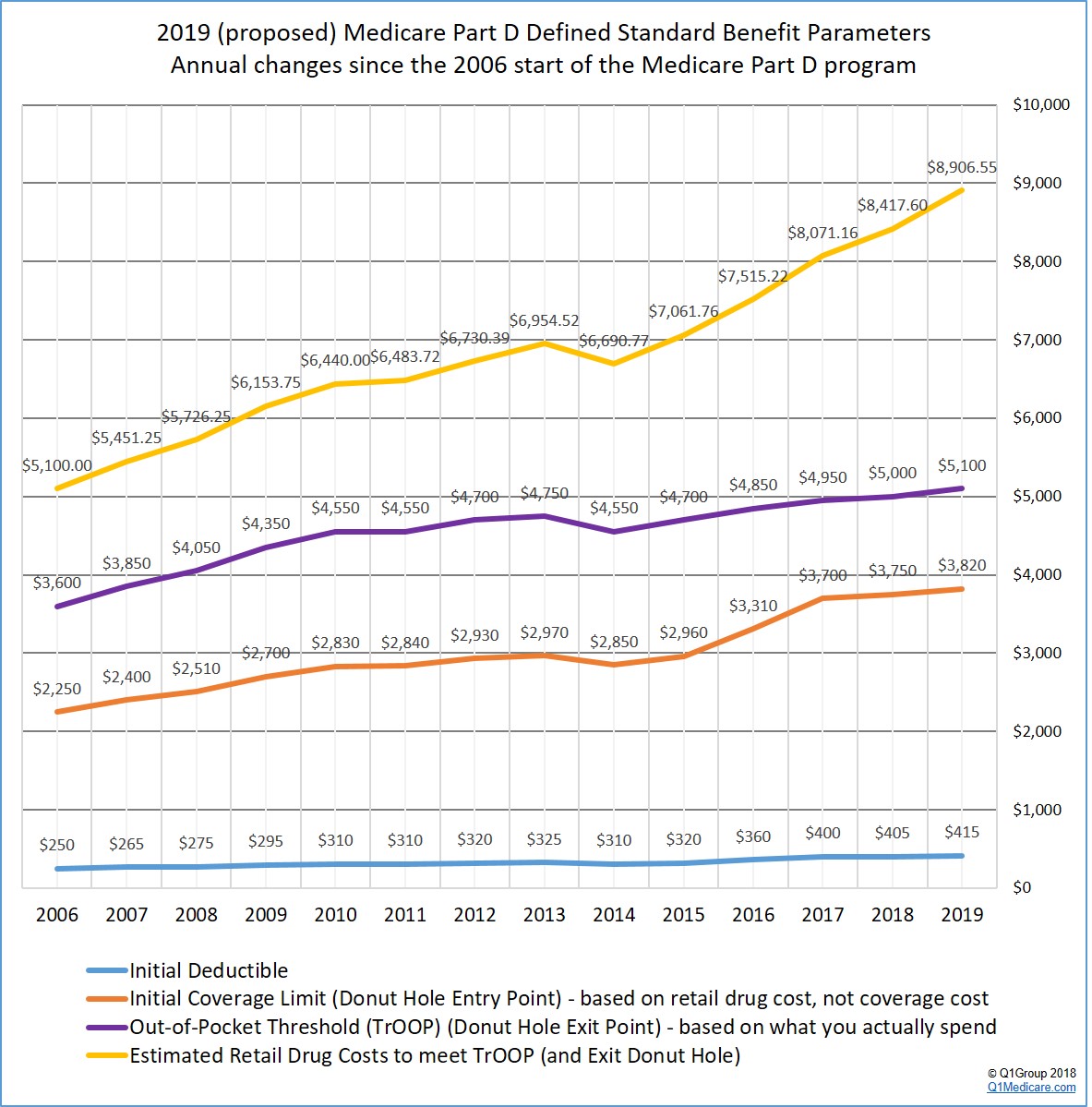

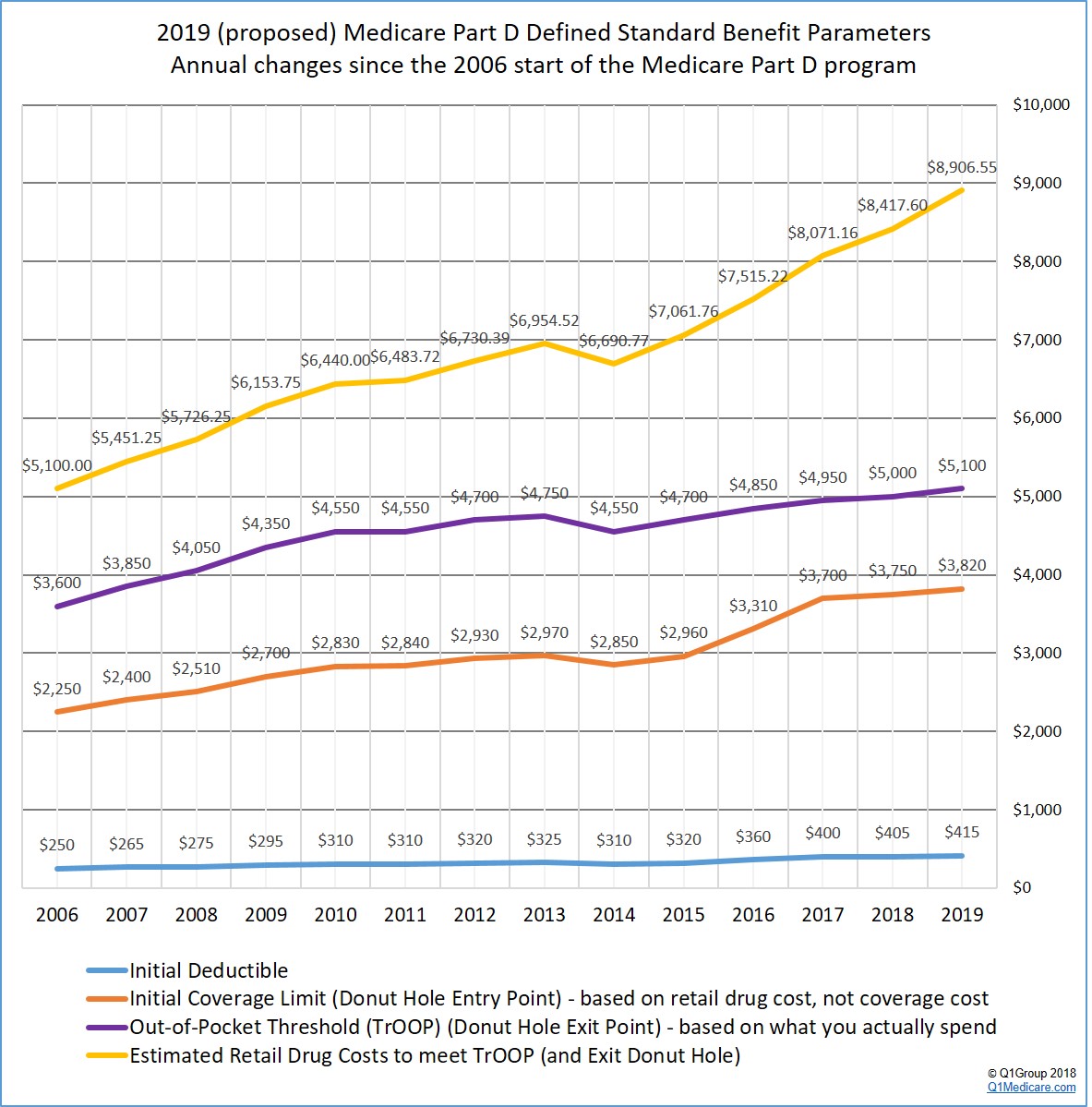

For an overview of annual plan changes, you can click here for a chart comparing Medicare Part D standard benefit parameters from the 2006 start of the Medicare Part D program through 2019. CMS is expected to release the finalized version of the 2019 Medicare Part D standard parameters in early April.

The following graph shows the proposed 2019 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed each year since the 2006 beginning of the Medicare Part D program.

For an overview of annual plan changes, you can click here for a chart comparing Medicare Part D standard benefit parameters from the 2006 start of the Medicare Part D program through 2019. CMS is expected to release the finalized version of the 2019 Medicare Part D standard parameters in early April.

The following graph shows the proposed 2019 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed each year since the 2006 beginning of the Medicare Part D program.

And in more detail . . .

Based on the CMS information we have at this time, here are a few proposed changes to the standard 2019 Medicare Part D prescription drug coverage:

- The standard Initial Deductible is proposed to

increase slightly.

The 2019 standard Initial Deductible is proposed to increase by $10 to $415 from the current 2018 standard Initial Deductible of $405. As reference, the 2017 standard Initial Deductible was $400, the 2016 standard Initial Deductible was $360, and the 2015 Initial Deductible was $320.

Important: The Initial Deductible will not affect when you enter the Donut Hole or Coverage Gap, but will impact when you leave the Donut Hole and enter Catastrophic Coverage. In other words, your initial deductible is counted toward out-of-pocket threshold or TrOOP (see below for more about TrOOP).

This means: The Initial Deductible is the amount that you pay yourself before your Medicare Part D plan begins to share in the cost of coverage. If you enroll in a Medicare Part D prescription drug plan with a standard Initial Deductible, you will spend slightly more out-of-pocket in 2019 before your plan coverage begins. As a note, the majority of 2018 Medicare Part D plans have an initial deductible. But, as we see in 2018, many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the deductible, providing immediate coverage for some lower-costing medications.

- The

Initial Coverage Limit may increase.

The 2019 Initial Coverage Limit (ICL) is proposed to increase $70 to $3,820 from the current 2018 ICL of $3,750. The Initial Coverage Limit marks the Donut Hole entry point. Medicare beneficiaries enter the Donut Hole or Coverage Gap when the total negotiated retail value of their prescription drug purchases exceeds their plan’s Initial Coverage limit. As reference, the 2017 Initial Coverage Limit was $3,700, the 2016 Initial Coverage Limit was $3,310, and the 2015 Initial Coverage Limit was $2,960.

This means: If CMS approves the proposal in April, you will be able to buy slightly more medications before reaching the 2019 Donut Hole or Coverage Gap. Please note, if you purchase medications with an average retail value of less than $318 per month, you will not enter the 2019 Donut Hole.

- The

Donut Hole discount will increase for generic drugs.

Next year, if you reach the Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the 2018 generic drug discount will increase from 56% to 63%. (So your generic drug costs in the Gap will be 37% of retail prices.)

This means: If you are in the 2019 Donut Hole and your generic medication has a retail cost of $100, you will pay $37. And the $37 that you spend for a formulary drug will count toward your 2019 out-of-pocket spending limit or TrOOP.

- The

Donut Hole discount will increase for brand-name drugs.

Update 02/12/18: President Trump signed the Bipartisan Budget Act of 2018 (Pub.L. 115-123) on Friday, February 9, 2018 that effectively "closes" the Coverage Gap with the brand-name Donut Hole discount increasing to 75% of retail in 2019 (you pay 25% of retail costs). According to the new law, the pharmaceutical industry will be responsible for 70% of the cost of medications in the Coverage Gap, therefore you will receive credit for 95% of the retail drug cost toward meeting your 2019 total out-of-pocket maximum or Donut Hole exit point (the 25% of retail costs you pay plus the 70% drug manufacturer discount).

This means: If you reach the 2019 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the formulary medication, and receive $95 credit toward meeting your 2019 out-of-pocket spending limit – or Donut Hole exit point.

As a historical note: The original CMS Draft Call Letter text noted that the 2019 brand-name drug discount will increase from 65% to 70% (you pay 30% of brand-name retail prices) and you will receive credit for 80% of the retail drug cost toward meeting your 2019 total out-of-pocket maximum or Donut Hole exit point (the 30% of retail costs you pay plus the 50% drug manufacturer discount). We expect the CMS Final Call Letter that should be issued in April 2018 will reflect the new values set forth in the Bipartisan Budget Act of 2018 (Pub.L. 115-123).

- Total

Out-of-Pocket Cost (TrOOP) is proposed to increase. (This is the Donut Hole exit point.)

The 2019 TrOOP threshold will increase by $100 to $5,100 from the current 2018 TrOOP limit of $5,000. TrOOP is the dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap and into the Catastrophic Coverage phase of your Medicare Part D plan. As noted above, brand-name medication purchases in the 2019 Donut Hole are discounted by 75% (you pay 25%), but you will receive credit of 95% of the retail drug price toward meeting the 2019 TrOOP threshold. Remember that TrOOP does not include monthly premiums or non-formulary purchases. As reference, the 2017 TrOOP limit was $4,950, the 2016 TrOOP limit was $4,850, and the 2015 TrOOP threshold value was $4,700.

This means: You will have to spend just slightly more to get out of the 2019 Donut Hole as compared to 2018.

Not sure how the 2019 Donut Hole or Coverage Gap functions?

To help you visualize how your current drug spending relates to your Medicare Part D plan coverage, we have our updated 2019 Donut Hole calculator found at PDP-Planner.com/2019. Our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2019 Medicare Part D plan coverage. We have several options for you to choose the percentage of generic and brand drugs you use and you can even change your mix of prescriptions to be 100% generic or 100% brand. To get you started, you can click here to see an example of the 2019 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost.

- The estimated retail value of drug purchases needed to exit the Donut Hole will increase.

CMS estimates that a person will use a mix of 89.31% brand drugs and 10.69% generic drugs while in the Donut Hole. As a result, CMS calculates that a person will be able to purchase drugs with an approximate retail value of $8,906.55 before meeting the out-of-pocket threshold (TrOOP) and exiting the 2019 Donut Hole.

Update 02/09/2018: This CMS retail drug-cost estimate was calculated using the previous 2019 Donut Hole discount and before the new budget law that changes the 2019 Donut Hole discount and the pharmaceutical industries contribution to TrOOP. Accordingly this retail figure will increase and should be reflected in the CMS Final Call Letter that will be released in April 2018.

As reference, in 2018, the CMS drug-cost estimate was calculated using the mix of 87.9% brand drugs and 12.1% generic drugs and the estimated retail cost to meet 2018 TrOOP and exit the 2018 Donut Hole is $8,417.60 .

This means: Based on (pre-budget) CMS drug purchase estimates, if your monthly retail costs are more than $743 per month, you will exit the 2019 Donut Hole and enter Catastrophic Coverage portion of your Medicare Part D plan.

- Catastrophic Coverage

costs could change slightly.

The Catastrophic Coverage portion of your Medicare Part D plan begins when you leave the Coverage Gap or Donut Hole. In the 2019 Catastrophic Coverage phase, you pay a minimum of $8.50 for brand drugs or $3.40 for generics (or 5% of retail costs, whichever is higher). In the 2018 Catastrophic Coverage phase, you pay a minimum of $8.35 for brand drugs or $3.35 for generics (or 5%, whichever is higher). In 2017 Catastrophic Coverage you paid a minimum of $8.25 for brand drugs or $3.30 for generics.

This means: If you purchase a brand name medication with a retail price of over $170 or a generic medication with a retail price of over $68, you will pay 5% of retail or more than the minimum $8.50 for brand drugs or $3.40 for generics. For example, if you are using the expensive generic medication IMATINIB MESYLATE 400 MG TABLET [a generic for Gleevec (r)] (30 EA ) (NDC: 47335047583), your monthly retail drug costs may be $8,792.38, so your catastrophic coverage cost would be $439.62 since this 5% of retail cost is more than the minimum $3.40 generic catastrophic coverage cost.

References:

https://www.cms.gov/Newsroom/MediaReleaseDatabase/Press-releases/2018-Press-releases-items/2018-02-01.html

(Pub.L. 115-123) https://www.congress.gov/bill/115th-congress/house-bill/1892/

https://www.cms.gov/Newsroom/MediaReleaseDatabase/Press-releases/2018-Press-releases-items/2018-02-01.html

(Pub.L. 115-123) https://www.congress.gov/bill/115th-congress/house-bill/1892/

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service