If I only use one brand drug that costs $347 and has a $47 co-pay, will I enter the 2017 Donut Hole?

Yes. If your retail drug costs are $347 a month you will enter your Medicare Part D plan's 2017 Coverage Gap or Donut Hole in late-October or early-November 2017.

As a reminder . . .

You will enter the Donut Hole or Coverage Gap when the total retail value of your formulary prescription purchases exceeds your Medicare Part D plan's Initial Coverage Limit. In 2017, the standard Initial Coverage Limit is $3,700.

So, if your prescriptions have an average retail cost of over $308 per month (or a total retail cost over the standard Initial Coverage Limit of $3,700 per year), you will enter the 2017 Donut Hole or Coverage Gap.

In this example, if you purchase a medication with a retail cost of $347 and your Medicare Part D plan's co-pay is $47, the $347 retail cost will count toward meeting your $3,700 Initial Coverage Limit - or Donut Hole entry point and the $47 you spent will count toward your out-of-pocket limit (TrOOP) of $4,950 - or Donut Hole exit point.

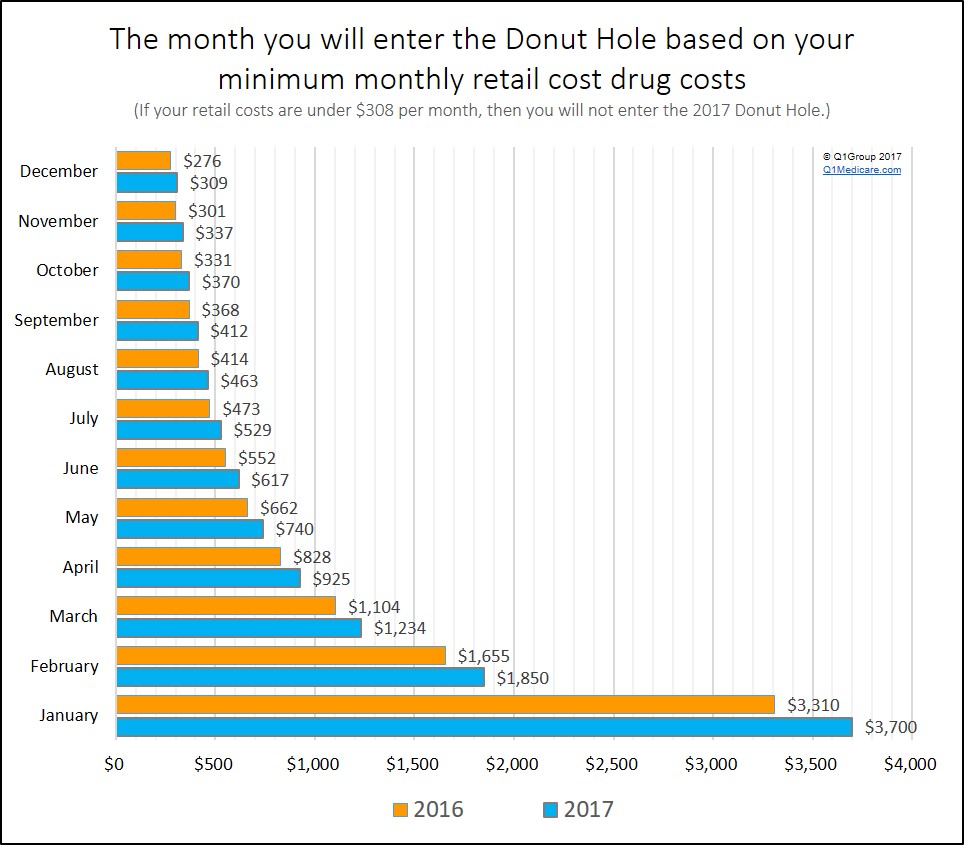

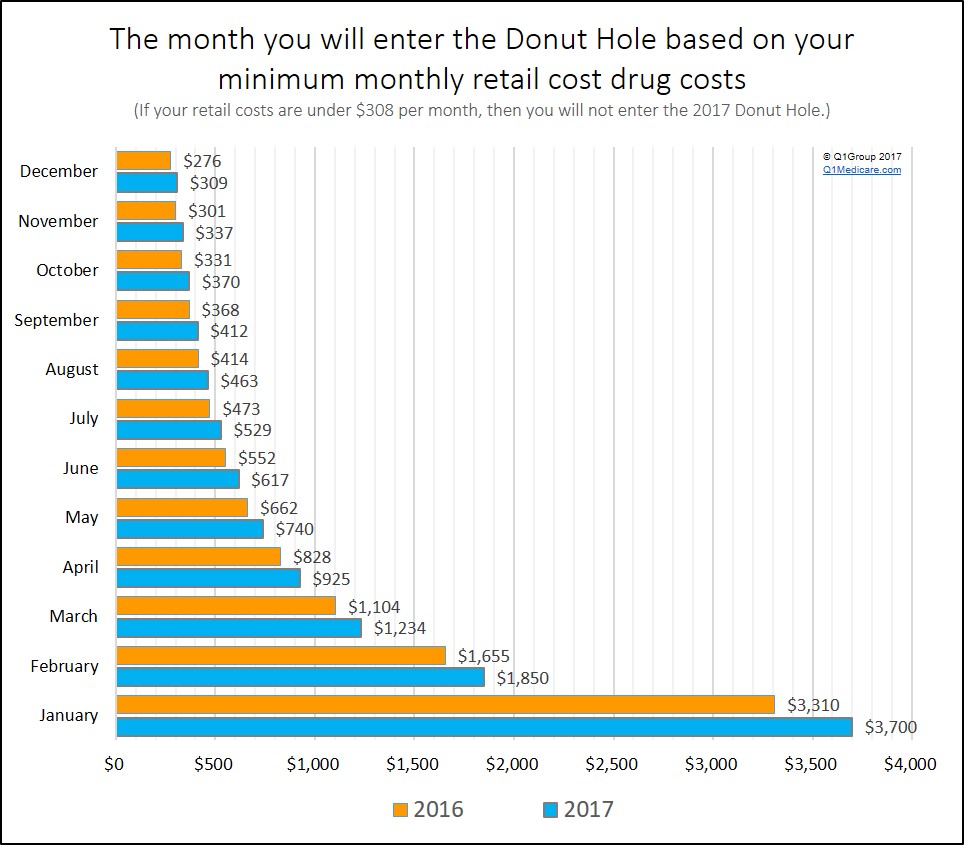

You can use the chart below to see how your average monthly retail drug costs would affect when you enter the Donut Hole.

The good news . . .

If the retail prices of your prescription drugs have not changed since 2016, then your 2017 Donut Hole or Coverage Gap should start just slightly later, since the 2017 Initial Coverage Limit is slightly higher than the 2016 Initial Coverage Limit of $3,310. You can see in the chart below when you would enter the Donut Hole in 2016 or 2017.

And once you reach the 2017 Donut Hole or Coverage Gap . . .

In 2017, you receive a 60% Donut Hole discount on brand-name drugs (you pay 40% of your plan's negotiated retail cost for brand-name prescriptions) and a 49% discount on generic drugs (you pay 51% of the retail cost for generics).

So if you are using a brand-name drug that has a $347 retail cost, you will pay 40% of the retail price or 0.40 * ($347) = $139 once you reach the 2017 Donut Hole.

You can read more here: "What kind of discount can we expect in the Medicare Part D Donut Hole or Coverage Gap?" https://Q1FAQ.com/470.html

Will I also exit the 2017 Donut Hole with this $347 drug?

No. Again, if the retail cost of your medications is over $309 each month, you will enter the Donut Hole sometime in 2017. For example, if the monthly average retail value of your prescriptions is over $617, you will enter the Donut Hole in June. However, you would need average monthly retail drug costs of around $621 to $675 before meeting your $4,950 TrOOP limit and exiting the 2017 Donut Hole (depending on your mix of brand-name and generic drugs).

As a reminder . . .

You will enter the Donut Hole or Coverage Gap when the total retail value of your formulary prescription purchases exceeds your Medicare Part D plan's Initial Coverage Limit. In 2017, the standard Initial Coverage Limit is $3,700.

So, if your prescriptions have an average retail cost of over $308 per month (or a total retail cost over the standard Initial Coverage Limit of $3,700 per year), you will enter the 2017 Donut Hole or Coverage Gap.

In this example, if you purchase a medication with a retail cost of $347 and your Medicare Part D plan's co-pay is $47, the $347 retail cost will count toward meeting your $3,700 Initial Coverage Limit - or Donut Hole entry point and the $47 you spent will count toward your out-of-pocket limit (TrOOP) of $4,950 - or Donut Hole exit point.

You can use the chart below to see how your average monthly retail drug costs would affect when you enter the Donut Hole.

|

Minimum

Average Monthly Retail Drug Cost |

||

|---|---|---|

| You will enter the Donut Hole in . . . |

If your 2017 monthly retail drug costs are over . . . |

If your 2016 monthly retail drug costs are over . . . |

| January | $3,700 | $3,310 |

| February | $1,850 | $1,655 |

| March | $1,234 | $1,104 |

| April | $925 | $828 |

| May | $740 | $662 |

| June | $617 | $552 |

| July | $529 | $473 |

| August | $463 | $414 |

| September | $412 | $368 |

| October | $370 | $331 |

| November | $337 | $301 |

| December | $309 | $276 |

The good news . . .

If the retail prices of your prescription drugs have not changed since 2016, then your 2017 Donut Hole or Coverage Gap should start just slightly later, since the 2017 Initial Coverage Limit is slightly higher than the 2016 Initial Coverage Limit of $3,310. You can see in the chart below when you would enter the Donut Hole in 2016 or 2017.

And once you reach the 2017 Donut Hole or Coverage Gap . . .

In 2017, you receive a 60% Donut Hole discount on brand-name drugs (you pay 40% of your plan's negotiated retail cost for brand-name prescriptions) and a 49% discount on generic drugs (you pay 51% of the retail cost for generics).

So if you are using a brand-name drug that has a $347 retail cost, you will pay 40% of the retail price or 0.40 * ($347) = $139 once you reach the 2017 Donut Hole.

You can read more here: "What kind of discount can we expect in the Medicare Part D Donut Hole or Coverage Gap?" https://Q1FAQ.com/470.html

Will I also exit the 2017 Donut Hole with this $347 drug?

No. Again, if the retail cost of your medications is over $309 each month, you will enter the Donut Hole sometime in 2017. For example, if the monthly average retail value of your prescriptions is over $617, you will enter the Donut Hole in June. However, you would need average monthly retail drug costs of around $621 to $675 before meeting your $4,950 TrOOP limit and exiting the 2017 Donut Hole (depending on your mix of brand-name and generic drugs).

News Categories

Prescription Discounts for Everyone

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service