What is the 2016 Initial Coverage Limit and how does the ICL work?

The 2016 standard Initial Coverage Limit (ICL) is $3,310.

The Initial Coverage Limit is the measured by the retail cost of your drug purchases and is used to determine when you leave your Medicare plan's Initial Coverage Phase and enter the Donut Hole or Coverage Gap portion of your Medicare Part D prescription drug plan.

For example, if you purchase a medication with a retail cost of $100 and your Medicare Part D plan pays $70 toward the prescription and you pay a $30 co-payment, the total retail value of $100 counts toward meeting your Initial Coverage Limit and moves you $100 closer to entering the Donut Hole.

The standard Initial Coverage Limit (entry point to the Coverage Gap or Donut Hole) can vary each year. In 2006, at the start of the Medicare Part D program, the Initial Coverage Limit was $2,250 and now the ICL has increased in 2016 to $3,310. You can view how the standard Initial Coverage Limit has changed over the past ten years here: https://q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php.

The Initial Coverage Limit can actually vary between Medicare Part D plan providers. In other words, with some Medicare plans you will enter the Donut Hole or Coverage Gap faster than with other Medicare plans. Although this does not happen much today with stand-alone Medicare Part D plans, some 2016 Medicare Advantage plans that include prescription drug coverage (MAPDs) will offer a variation on the standard drug plan Initial Coverage Limit of $3,310, with 2016 Initial Coverage Limits ranging from $2,550 to $8,000. You can click here to read more about 2016 Medicare Advantage plans that have an increased or decreased Initial Coverage Limit.

Important:

The Initial Coverage Limit only includes purchases of formulary medications. Purchases of non-formulary drugs, over-the-counter drugs, or bonus drugs (such as ED drugs like Viagra) are not counted toward reaching your ICL.

Important:

The retail cost of your formulary medications is counted toward your Initial Coverage Limit and the negotiated retail price of a medication can vary at different network pharmacies. For instance, the medication "Amlodipine Besylate/Benazepril Hydrochloride CAP 10-20MG" is covered by the 2016 Cigna-HealthSpring Rx Secure-Extra (PDP). However the retail price can vary at different network pharmacies. The retail costs for a 30-day supply at a

Walmart pharmacy is $17.36 (preferred cost-sharing pharmacy) and the retail cost for the same medication at a CVS pharmacy is $66.33 (standard or non-preferred cost-sharing pharmacy) (source: Medicare.gov Plan Finder, 01.06.2016). So, if you filled your prescription for this medication at a Walmart pharmacy, you would have around $49 less counted toward the 2016 ICL.

Important:

Please note that a single purchase of an expensive medication (for example, with a retail cost of over $3,310), will exceed the Initial Coverage Limit and push you through the Initial Coverage Phase and into the Coverage Gap.

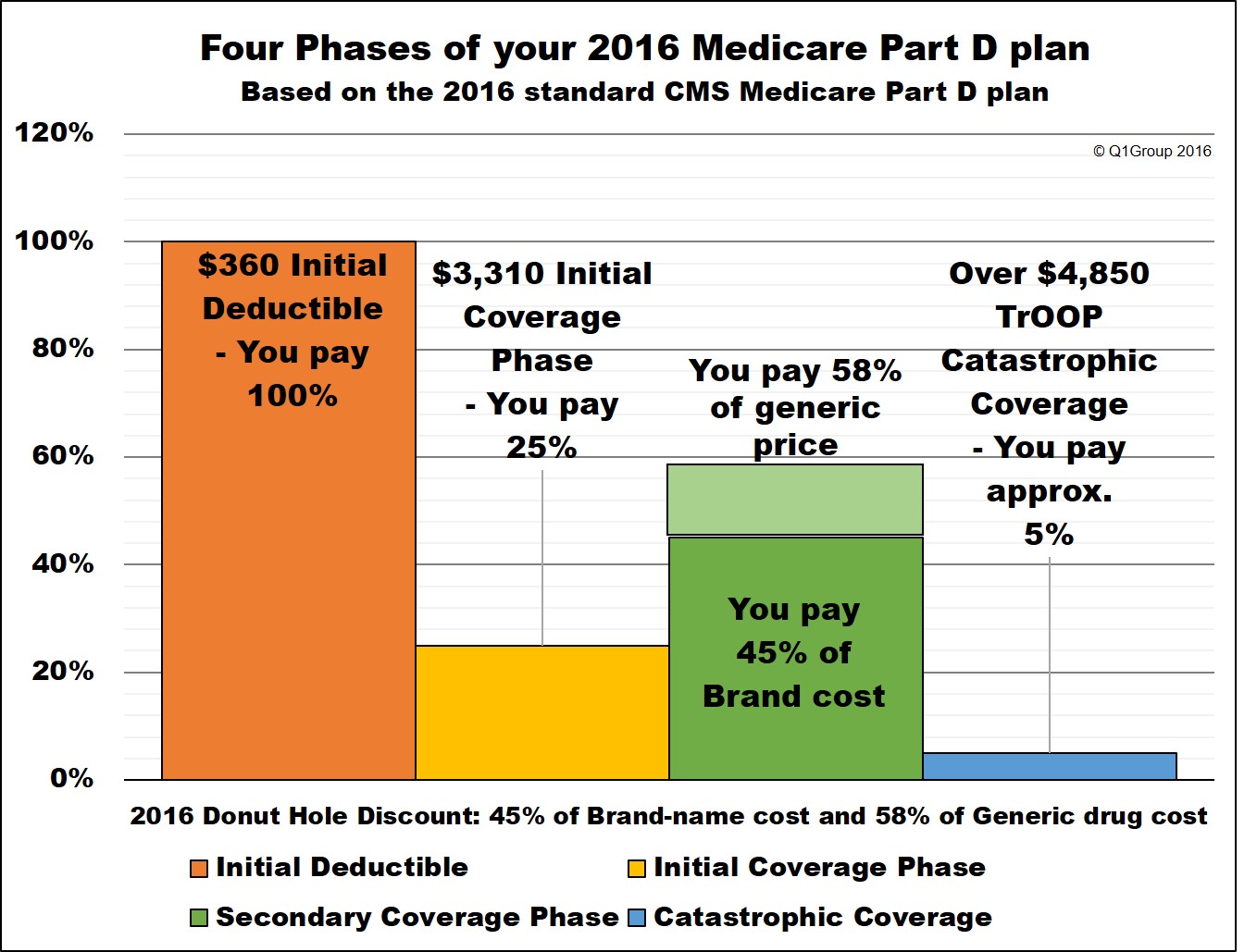

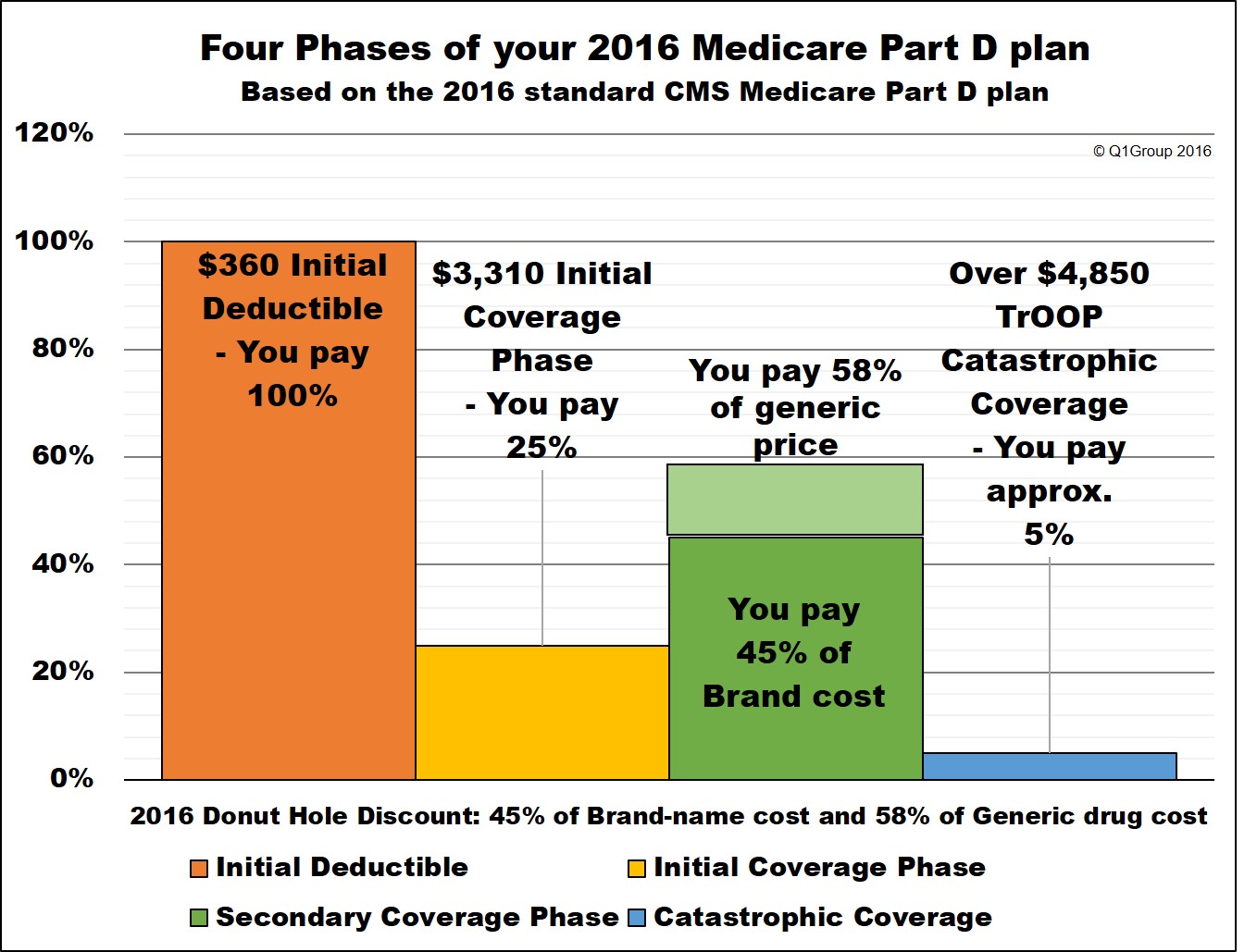

Again, the Initial Coverage Limit is the number that determines when you leave your Medicare Part D plan's Initial Coverage Phase and enter into the Donut Hole or Coverage Gap. So once you have received coverage for formulary drugs worth a retail value of over $3,310, you will enter the 2016 Donut Hole. As a reminder, your Medicare Part D prescription drug plan includes four different phases or parts:

(1) The Initial Deductible is where you pay 100% of your retail drug costs until you reach your deductible amount ($360 in 2016). Many people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase. The Initial Deductible has no effect on when you enter the Donut Hole, but will affect when you enter the Catastrophic Coverage phase.

(2) The Initial Coverage Phase is where you and your Medicare Part D plan share in the cost of your medication purchases based on your plan's cost-sharing (such as a $30 co-payment or 25% co-insurance). When the retail value of your drug purchases exceeds your Initial Coverage Limit (ICL or Donut Hole entry point), you will leave your Initial Coverage Phase and enter the Coverage Gap or Donut Hole.

Please note that the Initial Coverage Limit is not measured by what you have spent on medications. Instead, the ICL is the total retail value of your prescription drug purchases. So this is the amount that you pay for your prescriptions plus what your Medicare Part D plan is paying.

So if you buy a $1000 prescription drug and you pay a $60 co-pay (the Medicare Part D plan pays the other $940), the total $1000 retail cost is credited toward your 2016 Initial Coverage Limit of $3,310. In this case, after the $1000 drug purchase, you have $2,310 remaining in drug purchases before entering the 2016 Donut Hole.

You may find that your plan's retail drug costs are not the same as another Medicare Part D plan's cost. In other words, you might buy a medication like Atorvastatin (10mg) and your plan will have a retail price of $20, although you may only pay a $4 co-pay. However, a friend with another Part D plan may use the same medication and also have a $4 co-pay, but the retail price for their plan will be around $7. So, the same medication can have the same co-pay, but different negotiated retail prices depending on the Medicare plan - and so different retail costs have different impacts on the Initial Coverage Limit.

As you can imagine, if you purchase of an expensive medication (for example, with a retail cost of over $3,500), your coverage costs may be $750 or less, but the retail cost may exceed the Initial Coverage Limit and push you through the Initial Coverage Phase and into the Coverage Gap - with just one single purchase.

The standard Initial Coverage Limit (entry point to the Coverage Gap or Donut Hole) can vary each year. For instance, the Initial Coverage Limit is $3,310 in 2016 as compared to the Initial Coverage Limit of $2,250 in 2006 . You can view the standard Initial Coverage Limits for the past several years here: https://q1medicare.com/2016/

At times, the Initial Coverage Limit can also vary between Medicare Part D plan providers. With the approval of Medicare (or CMS) Medicare Part D plans are allowed to deviate from the annual standard Initial Coverage Limit value and a few companies may offer Part D plans with lower Initial Coverage Limits - although this is rare in today's market.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once you exceed the Initial Coverage Limit and where you were originally responsible for 100% of your drug costs (so this was like a second deductible phase). In 2016, you will receive a 55% discount on brand-name drugs and a 42% discount on generic drugs (you will pay 45% of your plan's negotiated retail cost for brand-name prescriptions and 58% of the retail cost for generics). The Donut Hole will be reduced to a fixed 25% co-insurance cost-sharing structure for both generics and brand-name drugs by 2020. You can read more about the current Donut Hole Discount here: Q1FAQ.com/470

(4) The Catastrophic Coverage Phase is the last phase of your Medicare Part D plan and you enter once your total out-of-pocket drug costs exceed a certain point (over $4,850 in 2016). During this phase you will exit the Donut Hole or Coverage Gap and will receive your medications at a low-fixed price, paying around 5% of the retail price for the remainder of the year.

* 25% co-pay

** 55% Discount

*** 42% Discount

**** approx. 5% of retail or $7.40 for brand drugs (or $2.95 for generics) whichever is larger (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

The Initial Coverage Limit is the measured by the retail cost of your drug purchases and is used to determine when you leave your Medicare plan's Initial Coverage Phase and enter the Donut Hole or Coverage Gap portion of your Medicare Part D prescription drug plan.

For example, if you purchase a medication with a retail cost of $100 and your Medicare Part D plan pays $70 toward the prescription and you pay a $30 co-payment, the total retail value of $100 counts toward meeting your Initial Coverage Limit and moves you $100 closer to entering the Donut Hole.

The standard Initial Coverage Limit (entry point to the Coverage Gap or Donut Hole) can vary each year. In 2006, at the start of the Medicare Part D program, the Initial Coverage Limit was $2,250 and now the ICL has increased in 2016 to $3,310. You can view how the standard Initial Coverage Limit has changed over the past ten years here: https://q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php.

The Initial Coverage Limit can actually vary between Medicare Part D plan providers. In other words, with some Medicare plans you will enter the Donut Hole or Coverage Gap faster than with other Medicare plans. Although this does not happen much today with stand-alone Medicare Part D plans, some 2016 Medicare Advantage plans that include prescription drug coverage (MAPDs) will offer a variation on the standard drug plan Initial Coverage Limit of $3,310, with 2016 Initial Coverage Limits ranging from $2,550 to $8,000. You can click here to read more about 2016 Medicare Advantage plans that have an increased or decreased Initial Coverage Limit.

Important:

The Initial Coverage Limit only includes purchases of formulary medications. Purchases of non-formulary drugs, over-the-counter drugs, or bonus drugs (such as ED drugs like Viagra) are not counted toward reaching your ICL.

Important:

The retail cost of your formulary medications is counted toward your Initial Coverage Limit and the negotiated retail price of a medication can vary at different network pharmacies. For instance, the medication "Amlodipine Besylate/Benazepril Hydrochloride CAP 10-20MG" is covered by the 2016 Cigna-HealthSpring Rx Secure-Extra (PDP). However the retail price can vary at different network pharmacies. The retail costs for a 30-day supply at a

Walmart pharmacy is $17.36 (preferred cost-sharing pharmacy) and the retail cost for the same medication at a CVS pharmacy is $66.33 (standard or non-preferred cost-sharing pharmacy) (source: Medicare.gov Plan Finder, 01.06.2016). So, if you filled your prescription for this medication at a Walmart pharmacy, you would have around $49 less counted toward the 2016 ICL.

Important:

Please note that a single purchase of an expensive medication (for example, with a retail cost of over $3,310), will exceed the Initial Coverage Limit and push you through the Initial Coverage Phase and into the Coverage Gap.

Again, the Initial Coverage Limit is the number that determines when you leave your Medicare Part D plan's Initial Coverage Phase and enter into the Donut Hole or Coverage Gap. So once you have received coverage for formulary drugs worth a retail value of over $3,310, you will enter the 2016 Donut Hole. As a reminder, your Medicare Part D prescription drug plan includes four different phases or parts:

(1) The Initial Deductible is where you pay 100% of your retail drug costs until you reach your deductible amount ($360 in 2016). Many people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase. The Initial Deductible has no effect on when you enter the Donut Hole, but will affect when you enter the Catastrophic Coverage phase.

(2) The Initial Coverage Phase is where you and your Medicare Part D plan share in the cost of your medication purchases based on your plan's cost-sharing (such as a $30 co-payment or 25% co-insurance). When the retail value of your drug purchases exceeds your Initial Coverage Limit (ICL or Donut Hole entry point), you will leave your Initial Coverage Phase and enter the Coverage Gap or Donut Hole.

Please note that the Initial Coverage Limit is not measured by what you have spent on medications. Instead, the ICL is the total retail value of your prescription drug purchases. So this is the amount that you pay for your prescriptions plus what your Medicare Part D plan is paying.

So if you buy a $1000 prescription drug and you pay a $60 co-pay (the Medicare Part D plan pays the other $940), the total $1000 retail cost is credited toward your 2016 Initial Coverage Limit of $3,310. In this case, after the $1000 drug purchase, you have $2,310 remaining in drug purchases before entering the 2016 Donut Hole.

You may find that your plan's retail drug costs are not the same as another Medicare Part D plan's cost. In other words, you might buy a medication like Atorvastatin (10mg) and your plan will have a retail price of $20, although you may only pay a $4 co-pay. However, a friend with another Part D plan may use the same medication and also have a $4 co-pay, but the retail price for their plan will be around $7. So, the same medication can have the same co-pay, but different negotiated retail prices depending on the Medicare plan - and so different retail costs have different impacts on the Initial Coverage Limit.

As you can imagine, if you purchase of an expensive medication (for example, with a retail cost of over $3,500), your coverage costs may be $750 or less, but the retail cost may exceed the Initial Coverage Limit and push you through the Initial Coverage Phase and into the Coverage Gap - with just one single purchase.

The standard Initial Coverage Limit (entry point to the Coverage Gap or Donut Hole) can vary each year. For instance, the Initial Coverage Limit is $3,310 in 2016 as compared to the Initial Coverage Limit of $2,250 in 2006 . You can view the standard Initial Coverage Limits for the past several years here: https://q1medicare.com/2016/

At times, the Initial Coverage Limit can also vary between Medicare Part D plan providers. With the approval of Medicare (or CMS) Medicare Part D plans are allowed to deviate from the annual standard Initial Coverage Limit value and a few companies may offer Part D plans with lower Initial Coverage Limits - although this is rare in today's market.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once you exceed the Initial Coverage Limit and where you were originally responsible for 100% of your drug costs (so this was like a second deductible phase). In 2016, you will receive a 55% discount on brand-name drugs and a 42% discount on generic drugs (you will pay 45% of your plan's negotiated retail cost for brand-name prescriptions and 58% of the retail cost for generics). The Donut Hole will be reduced to a fixed 25% co-insurance cost-sharing structure for both generics and brand-name drugs by 2020. You can read more about the current Donut Hole Discount here: Q1FAQ.com/470

(4) The Catastrophic Coverage Phase is the last phase of your Medicare Part D plan and you enter once your total out-of-pocket drug costs exceed a certain point (over $4,850 in 2016). During this phase you will exit the Donut Hole or Coverage Gap and will receive your medications at a low-fixed price, paying around 5% of the retail price for the remainder of the year.

|

When you purchase a formulary medication |

||||||

|

Retail Cost (ICL) |

You Pay |

Medicare Plan Pays |

Pharma Mfgr Pays |

Gov. pays |

Amount toward your TrOOP |

|

|

Initial Deductible |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

|

Initial Coverage Phase * |

$100 |

$25 |

$75 |

$0 |

$0 |

$25 |

|

Coverage Gap - brand-name ** |

$100 |

$45 |

$5 |

$50 |

$0 |

$95 |

|

Coverage Gap - generic *** |

$100 |

$58 |

$42 |

$0 |

$0 |

$58 |

|

Catastrophic Coverage (generic)**** |

$100 |

$15 |

$0 |

$80 |

$5 |

|

* 25% co-pay

** 55% Discount

*** 42% Discount

**** approx. 5% of retail or $7.40 for brand drugs (or $2.95 for generics) whichever is larger (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service