Q1Group 2020 PDP Analysis: More stand-alone 2020 Medicare Part D prescription drug plan choices

According to the recently released Centers for Medicare and Medicaid Services (CMS) 2020 Medicare plan data, most Medicare beneficiaries across the country will have access to more Medicare Advantage plan and stand-alone 2020 Medicare Part D prescription drug plan (PDP) options.

Our analysis of the stand-alone Medicare Part D plan data supports the CMS press release finding the total number of stand-alone 2020 Medicare Part D plans will increase to 948 plans offered across the country as compared to 901 plans offered in 2019.

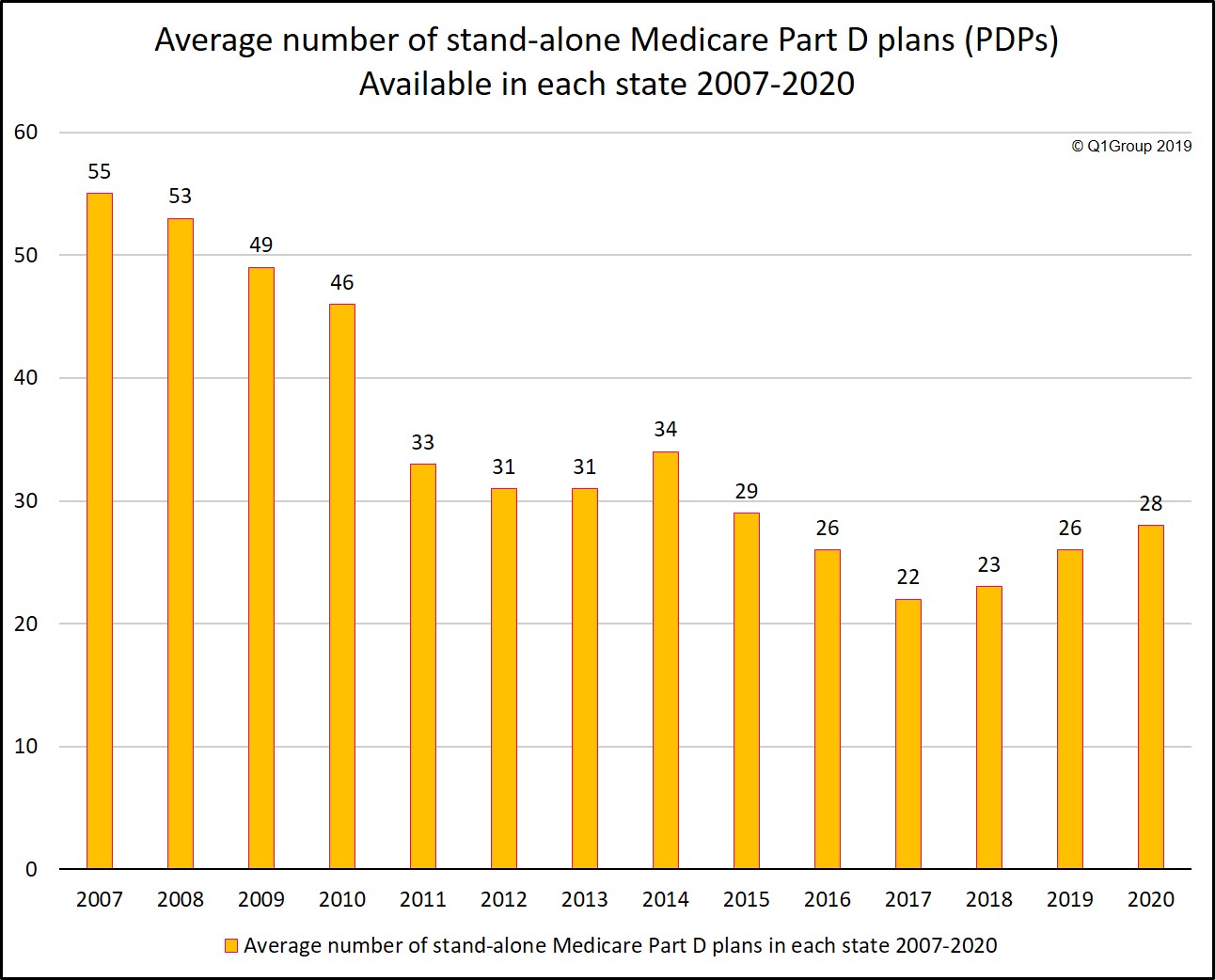

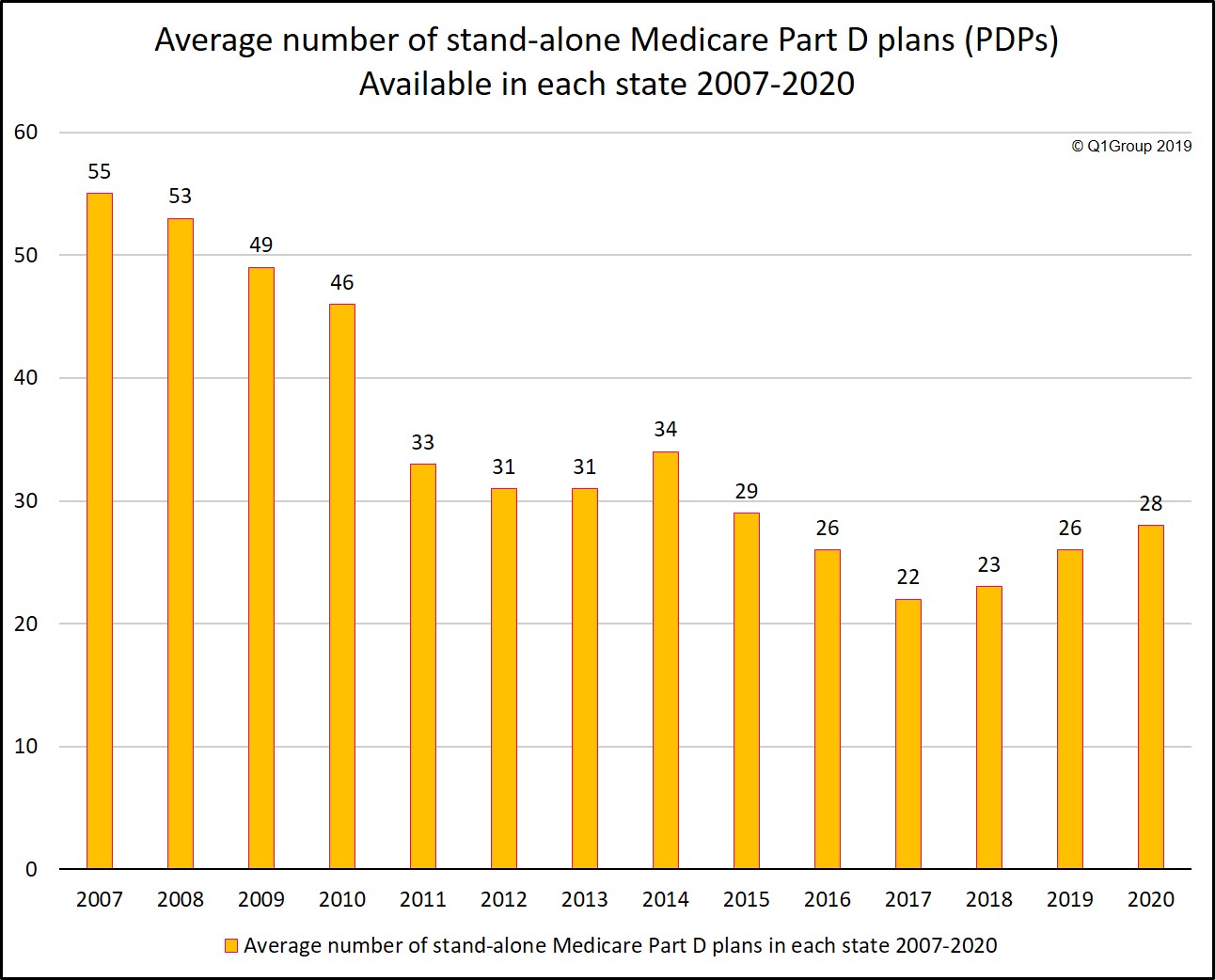

The average number of stand-alone 2020 Medicare Part D plans per state will increase to 28 plans - as compared to the 2019 national average of 26 stand-alone PDPs per state.

Below is a chart showing how the average number of stand-alone Medicare Part D plans per state has changed since 2007.

And although most other states will gain one to three (3) additional 2020 PDPs, Connecticut, Massachusetts, Rhode Island, Vermont, and New Mexico will have one less PDP option in 2020.

The Lows and Highs

As was true in past years, Alaska Medicare beneficiaries will again have the smallest selection of 2020 stand-alone Medicare Part D plans with 24 plan options - an increase over the 22 PDP choices offered in 2019.

California will offer the widest selection of 32 stand-alone 2020 Medicare Part D plans - an increase over the 30 PDP options in 2019.

For more information, a detailed overview of the 2020 stand-alone Medicare Part D landscape data can be found at PDP-Facts.com or in the Q1Medicare.com PDP-Facts section with Part D plan summaries on a national and state level.

Reminder: No need to rush.

Medicare Part D plan carriers can start marketing their plans on October 1st and the annual Medicare Part D annual Open Enrollment Period for Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7th, with 2020 Medicare plan coverage beginning on January 1st

For more information, starting October 1st, Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2020 Medicare Part D and Medicare Advantage plan options.

A note about Medicare Advantage plans

The above information is from our Medicare Part D plan landscape summaries and based only on stand-alone Medicare Part D prescription drug plans (or PDPs) and does not include Medicare Advantage plan data. However, a number of the 2020 Medicare Advantage plans may be available in your area and can include comprehensive Medicare Part D prescription drug coverage, along with Medicare Part A (hospitalization), Medicare Part B (out-patient and physician), and additional healthcare - and non health-related - benefits (these Medicare plans are also called MAPD plans). You can use https://MA-Finder.com/2020 to review Medicare Advantage plans.

Not sure where to begin with all this information or you have a question for us? No problem, click here to let us know.

Our analysis of the stand-alone Medicare Part D plan data supports the CMS press release finding the total number of stand-alone 2020 Medicare Part D plans will increase to 948 plans offered across the country as compared to 901 plans offered in 2019.

The average number of stand-alone 2020 Medicare Part D plans per state will increase to 28 plans - as compared to the 2019 national average of 26 stand-alone PDPs per state.

Below is a chart showing how the average number of stand-alone Medicare Part D plans per state has changed since 2007.

Medicare Part D plans gained and lost

New York will have the largest increase in stand-alone PDPs with four (4) additional plan choices in 2020.And although most other states will gain one to three (3) additional 2020 PDPs, Connecticut, Massachusetts, Rhode Island, Vermont, and New Mexico will have one less PDP option in 2020.

The Lows and Highs

As was true in past years, Alaska Medicare beneficiaries will again have the smallest selection of 2020 stand-alone Medicare Part D plans with 24 plan options - an increase over the 22 PDP choices offered in 2019.

California will offer the widest selection of 32 stand-alone 2020 Medicare Part D plans - an increase over the 30 PDP options in 2019.

For more information, a detailed overview of the 2020 stand-alone Medicare Part D landscape data can be found at PDP-Facts.com or in the Q1Medicare.com PDP-Facts section with Part D plan summaries on a national and state level.

Reminder: No need to rush.

Medicare Part D plan carriers can start marketing their plans on October 1st and the annual Medicare Part D annual Open Enrollment Period for Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7th, with 2020 Medicare plan coverage beginning on January 1st

For more information, starting October 1st, Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2020 Medicare Part D and Medicare Advantage plan options.

A note about Medicare Advantage plans

The above information is from our Medicare Part D plan landscape summaries and based only on stand-alone Medicare Part D prescription drug plans (or PDPs) and does not include Medicare Advantage plan data. However, a number of the 2020 Medicare Advantage plans may be available in your area and can include comprehensive Medicare Part D prescription drug coverage, along with Medicare Part A (hospitalization), Medicare Part B (out-patient and physician), and additional healthcare - and non health-related - benefits (these Medicare plans are also called MAPD plans). You can use https://MA-Finder.com/2020 to review Medicare Advantage plans.

Not sure where to begin with all this information or you have a question for us? No problem, click here to let us know.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service