Q1Group 2020 PDP Analysis: 2007 to 2020 stand-alone Medicare Part D premiums - The Highs and Lows

Back in July 2019, the Centers for Medicare and Medicaid Services (CMS) projected

that, based on the Medicare Part D plan (PDP and MAPD) provider bids, the average 2020 basic monthly Part D premium should be around $30 per

month - a decrease of $2.50 from the 2019 projected average premium of

$32.50.

And based on a preliminary analysis of only the 2020 stand-alone Part D plans, we found that the national average 2020 Medicare Part D premium (not considering plan enrollment) decreased from $47.21 in 2019 to $40.90 in 2020, supporting the CMS projection of the monthly Medicare Part D plan premiums decreasing over the past plan-year.

However, we also found that the national average monthly 2020 Medicare Part D premium, weighted by the number of people currently enrolled in each plan, will increase to $41.40 - a 6% increase over the 2019 weighted monthly premium of $39.13.

Important: This means that many current members of 2019 Part D plans can expect to see significant increases in their 2020 Part D plan premiums - unless they consider moving to a lower-premium 2020 Part D plan.

You can read more about the average and average weighted national Medicare Part D premium in our article: "Q1Group 2020 PDP Analysis: 58% of Medicare Part D beneficiaries can expect higher monthly stand-alone 2020 Medicare Part D prescription drug plan premiums"

Please note, the average monthly premium in each state or Medicare region will vary from the national average and can be seen in PDP-Facts.com by clicking on your state.

Here are a few highlights of the lowest and highest monthly Medicare Part D premiums across the country.

In two other states (Arizona and Wisconsin), the WellCare Wellness Rx (PDP) will have the lowest monthly premium of $13.10. WellCare will offer the same plan in other states with premiums ranging up to $15.70.

In all other states across the country, the new Humana Walmart Value Rx Plan (PDP) will have the lowest monthly premium of $13.20.

However, the 2020 SilverScript Plus (PDP) plan is the lowest-premium $0 deductible plan in many other states (premiums ranging from $56.70 in Arkansas to $101.40 in New Jersey).

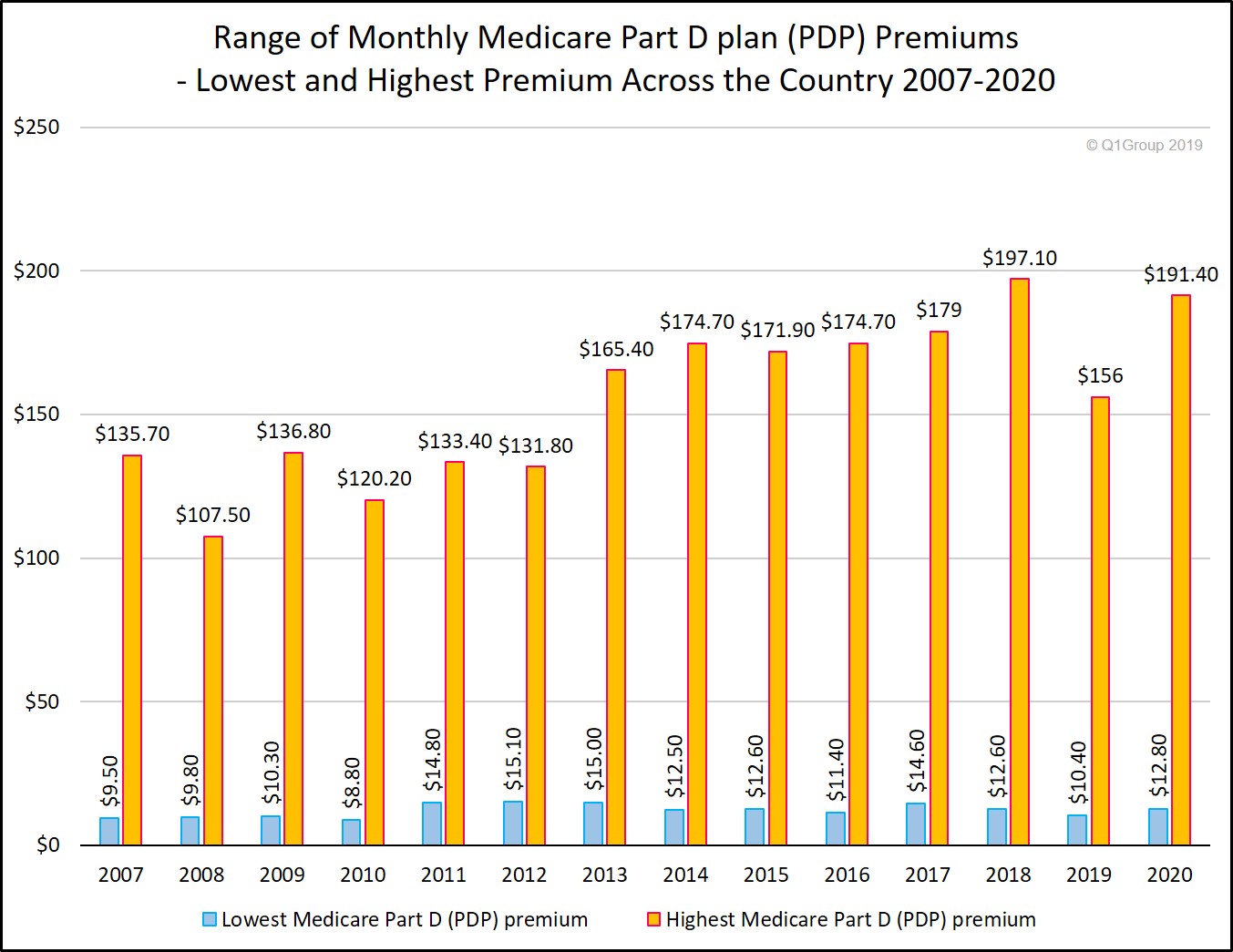

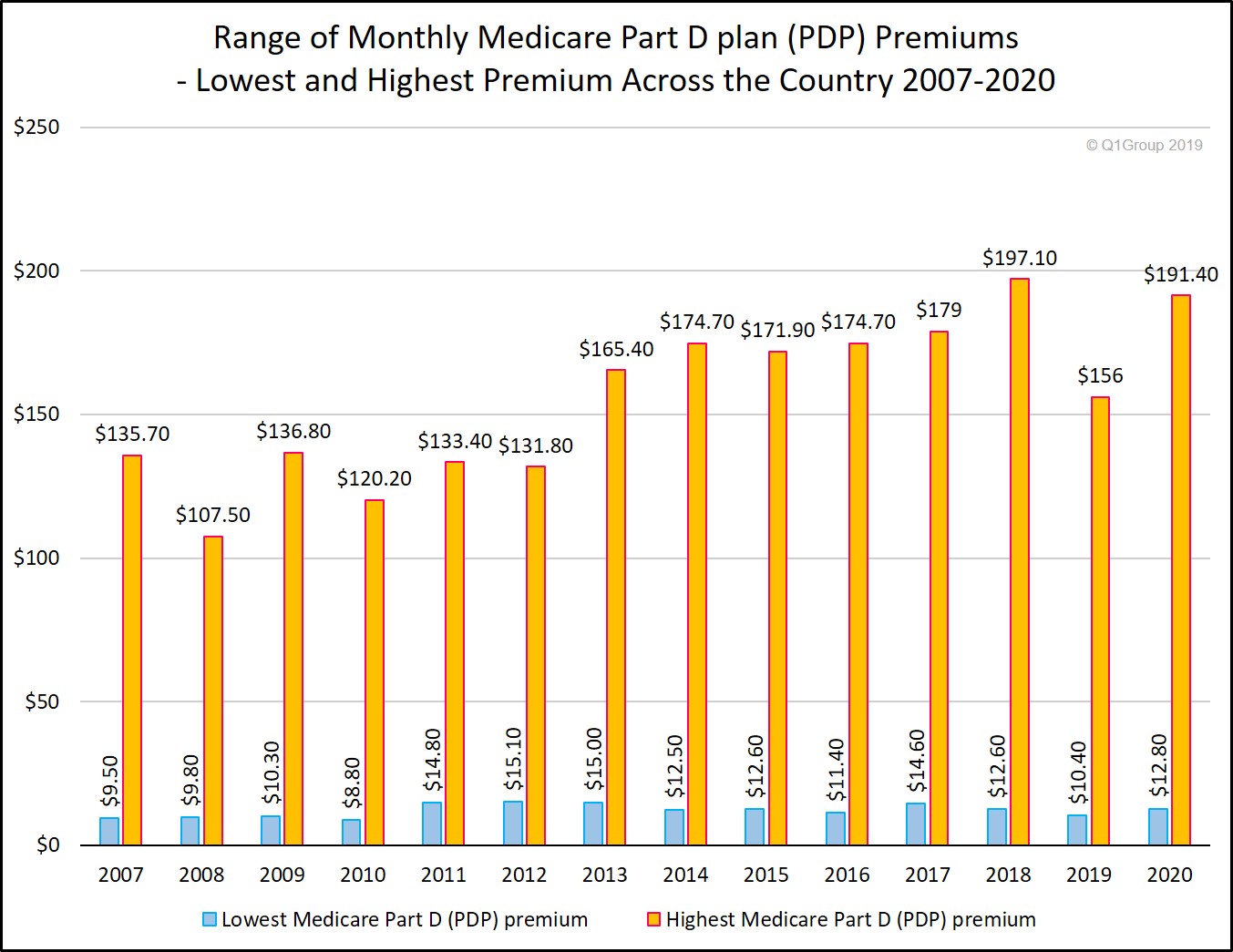

The all-time highest Medicare Part D premium was the 2018 Texas Blue Cross MedicareRx Plus (PDP) with a premium of $197.10 per month.

For more information, please see our PDP-Facts.com/2020 for Medicare Part D premium highs and lows in your state.

For more information, please see our PDP-Facts.com/2020 for Medicare Part D premium highs and lows in your state.

Reminder!

The annual Open Enrollment Period (or Annual Election Period) for Medicare Advantage plans and Medicare Part D drug plans begins on October 15 and continues through December 7.

Don't forget that your Medicare plan costs and coverage can change each year - so be sure to ensure that you have chosen the most economic healthcare coverage.

If you or another Medicare beneficiary needs assistance understanding how your 2019 Medicare plan is changing or to learn more about your 2020 Medicare plan coverage options, please call 1-800-MEDICARE (1-800-633-4227) and speak with a Medicare representative.

And based on a preliminary analysis of only the 2020 stand-alone Part D plans, we found that the national average 2020 Medicare Part D premium (not considering plan enrollment) decreased from $47.21 in 2019 to $40.90 in 2020, supporting the CMS projection of the monthly Medicare Part D plan premiums decreasing over the past plan-year.

However, we also found that the national average monthly 2020 Medicare Part D premium, weighted by the number of people currently enrolled in each plan, will increase to $41.40 - a 6% increase over the 2019 weighted monthly premium of $39.13.

Important: This means that many current members of 2019 Part D plans can expect to see significant increases in their 2020 Part D plan premiums - unless they consider moving to a lower-premium 2020 Part D plan.

You can read more about the average and average weighted national Medicare Part D premium in our article: "Q1Group 2020 PDP Analysis: 58% of Medicare Part D beneficiaries can expect higher monthly stand-alone 2020 Medicare Part D prescription drug plan premiums"

Please note, the average monthly premium in each state or Medicare region will vary from the national average and can be seen in PDP-Facts.com by clicking on your state.

Here are a few highlights of the lowest and highest monthly Medicare Part D premiums across the country.

- The lowest-premium 2020 stand-alone Medicare Part D plans

In two other states (Arizona and Wisconsin), the WellCare Wellness Rx (PDP) will have the lowest monthly premium of $13.10. WellCare will offer the same plan in other states with premiums ranging up to $15.70.

In all other states across the country, the new Humana Walmart Value Rx Plan (PDP) will have the lowest monthly premium of $13.20.

- The lowest-premium 2020 stand-alone Medicare Part D plan - with a $0 deductible

The 2020 Medicare Part D plan with the lowest monthly premium - and a $0 initial deductible - is the Wisconsin Anthem MediBlue Rx Plus (PDP) plan, with a premium of $42.30 per month.

However, the 2020 SilverScript Plus (PDP) plan is the lowest-premium $0 deductible plan in many other states (premiums ranging from $56.70 in Arkansas to $101.40 in New Jersey).

- The 2020 stand-alone Medicare Part D plan with the highest-premium

The all-time highest Medicare Part D premium was the 2018 Texas Blue Cross MedicareRx Plus (PDP) with a premium of $197.10 per month.

The chart below shows how the low and high Medicare Part D premiums have varied over the past years.

Reminder!

The annual Open Enrollment Period (or Annual Election Period) for Medicare Advantage plans and Medicare Part D drug plans begins on October 15 and continues through December 7.

Don't forget that your Medicare plan costs and coverage can change each year - so be sure to ensure that you have chosen the most economic healthcare coverage.

If you or another Medicare beneficiary needs assistance understanding how your 2019 Medicare plan is changing or to learn more about your 2020 Medicare plan coverage options, please call 1-800-MEDICARE (1-800-633-4227) and speak with a Medicare representative.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service