More 2020 Medicare Advantage plan choices, with increases in HMO and local PPO options

As noted in a recent press release from

the Centers for Medicare and Medicaid Services (CMS), "Medicare Advantage continues to be popular, with enrollment projected to increase to an all-time high of 24.4 million beneficiaries from the current enrollment of 22.2 million, out of approximately 60 million people currently enrolled in Medicare".

- A brief review of Medicare Advantage plans

Medicare Advantage plans come in two general forms, MAs (Medicare Advantage plans that do not include prescription drug coverage) and MAPDs or Medicare Advantage plan that includes prescription drug coverage (MAPD). A Medicare Advantage plan (MA or MAPD) includes your Medicare Part A (in-patient and hospitalization coverage), Medicare Part B (out-patient and physician coverage), may include additional healthcare benefits (basic dental, optical, hearing, and/or fitness coverage) - and non health-related benefits (food delivery and general transportation). A MAPD also includes your Medicare Part D drug coverage. If you enroll in some types of Medicare Advantage (MAs) that do not include drug coverage, you may not be permitted to also join a stand-alone Medicare Part D plan (PDP) (so be sure to check before you join).

- More 2020 Medicare Advantage plans than ever before

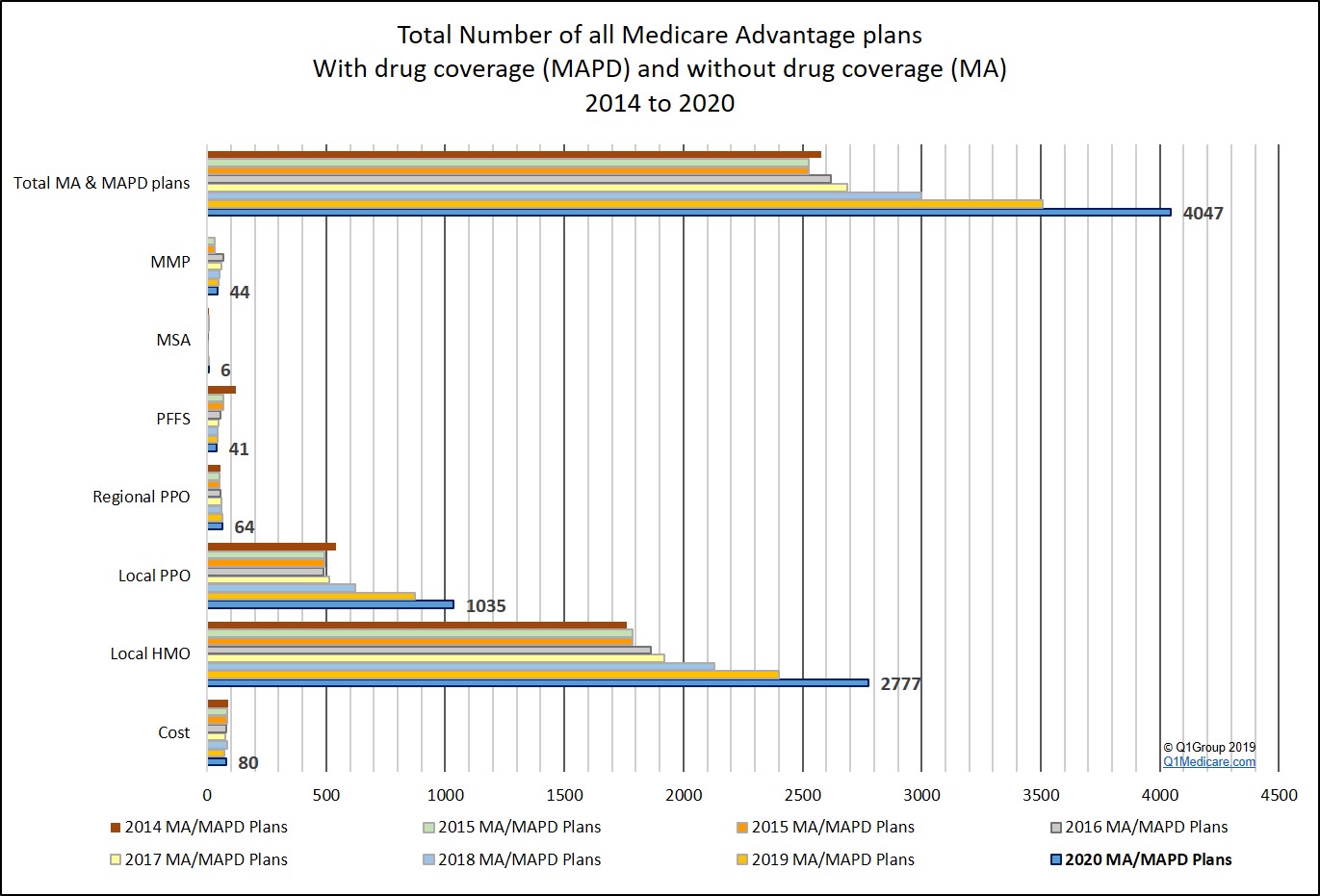

Overall, there will be 15% more Medicare Advantage plans available in 2020. Across the country, the number of 2020 Medicare Advantage plans (combined MAs and MAPDs) will increase to 4,047**, as compared to 3,508 Medicare Advantage plans offered nationwide in 2019.

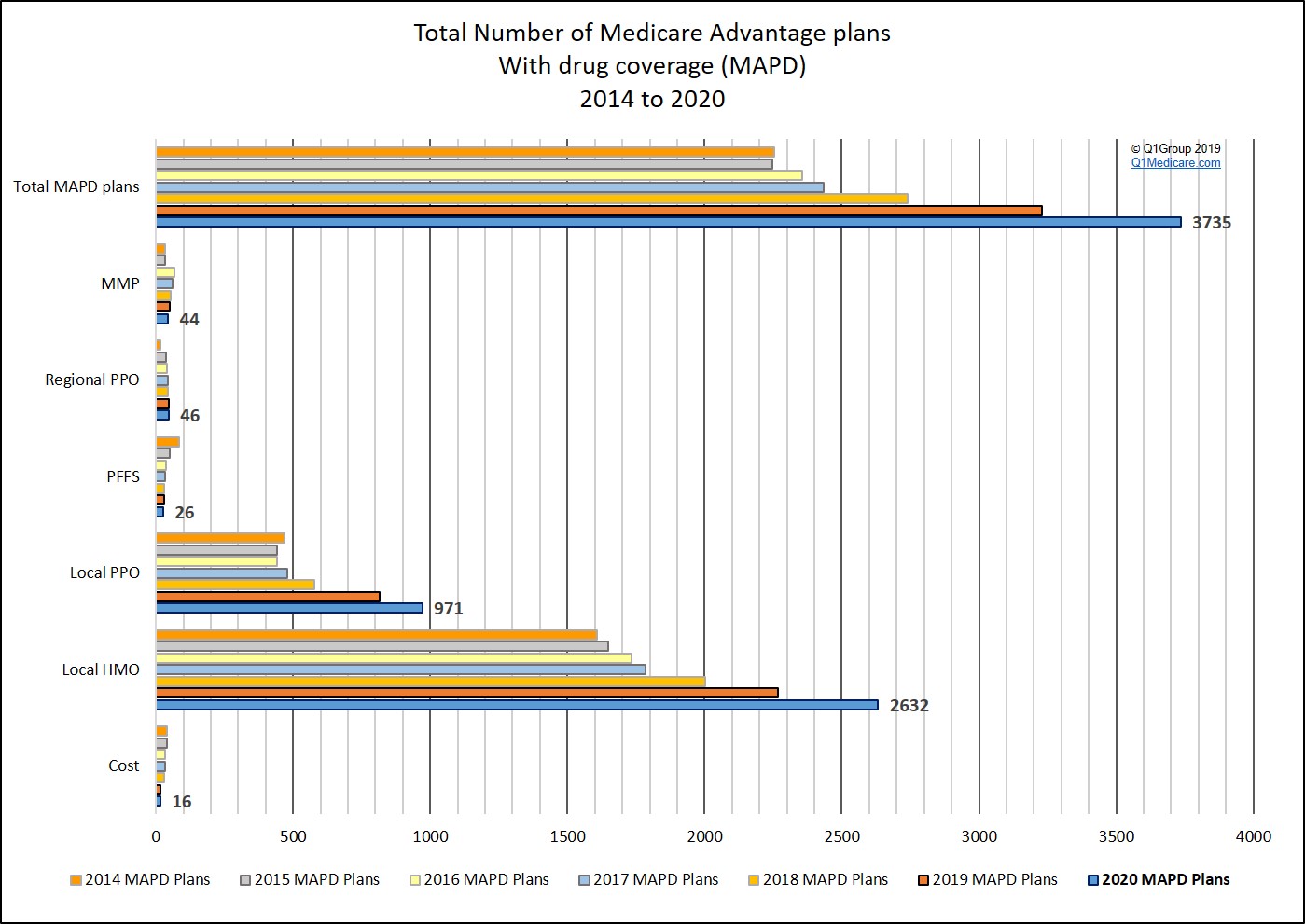

- Like 2019, Most 2020 Medicare Advantage plans provide Part D drug coverage (MAPDs)

92% of 2020 Medicare Advantage plans include prescription drug coverage (MAPDs) -- the same percentage as in 2019.

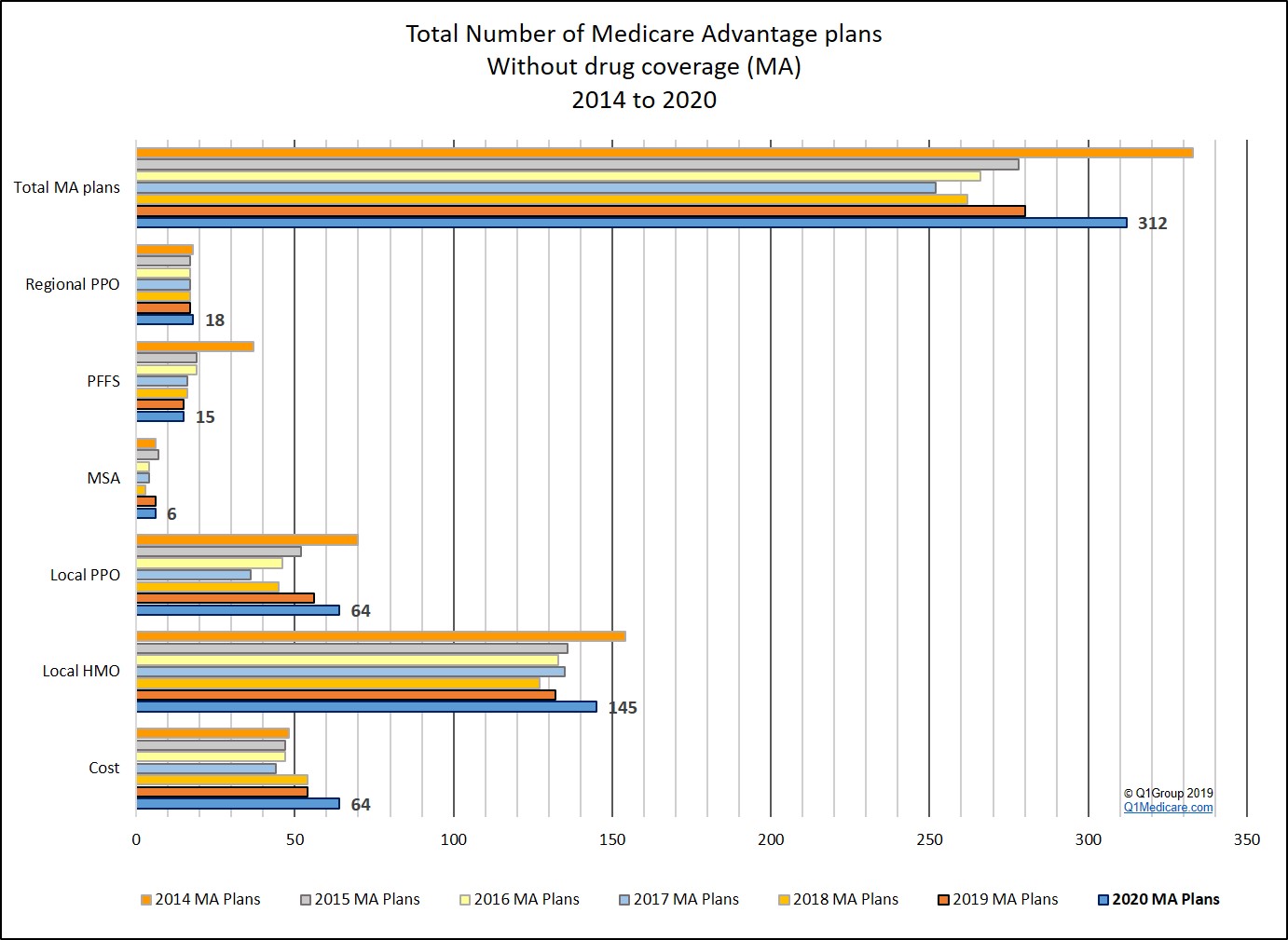

- A few more 2020 Medicare Advantage plan options that do not include drug coverage (MAs)

There is a slight increase in the number of 2020 Medicare Advantage plans without prescription coverage (MA) as compared to 2019.

- More Medicare Advantage HMOs options offered in 2020

The majority (around 68.6%) of 2020 Medicare Advantage plans will be HMOs (Health Maintenance Organizations) with a 15% increase in the number of 2020 HMO plans over 2019.

Members of a Medicare Advantage HMOs (MA-only) are not permitted to enroll in a stand-alone Medicare Part

D plan (PDP) and will need another source for their drug coverage.

- More Local PPOs

There will be a 18.6% increase in 2020 Medicare Advantage Local PPOs (Preferred Provider Organizations) plans as compared to 2019.

Members of a Medicare Advantage PPOs (MA-only) are not permitted to enroll in a stand-alone Medicare Part D plan (PDP) and will need another source for their drug coverage.

- The declining Medicare Advantage PFFS plan offering

The number of Medicare Advantage Private Fee for Service (PFFS) plans continues to decline in 2020 (a 7% decrease in PFFS plans). As a note, PFFS plans have continued to decrease since 2015 when the number of Medicare Advantage PFFS (MA and MAPD) plans decreased by 43%. In particular, 2015 Medicare Advantage PFFS plans offering prescription drug coverage (MAPDs) decreasing by 66% or losing 33 PFFS plans.

Members of a Medicare Advantage PFFS (MA-only) can enroll in any available stand-alone Medicare Part D plan (PDP) for their drug coverage.

- Only a few 2020 MSAs offered, but Medical Savings Accounts (MSAs) are now available to more beneficiaries in 2020.

In the chart below, we see that there are only six Medicare Medical Savings Accounts (MSAs) being offered in 2020. However, these MSAs will be available in 29 states (1,883 counties) across the country and available to millions of Medicare beneficiaries. In comparison, 2019 MSAs were offered in 19 states (1,262 counties) - and in 2018, MSAs were available to Medicare beneficiaries in only 111 counties across two states.

Unlike other Medicare Advantage (MA) plans, MSAs are made up of a high-deductible health plan and a medical savings account funded by an annual tax-free deposit. MSA members can use the medical savings account to pay for healthcare costs before the health plan deductible is met.

MSA members can enroll in any available stand-alone Medicare Part D plan (PDP) for their drug coverage.

Jump to 2017 - 2020 MAPD Plan chart

Jump to 2017 - 2020 MA Plan chart

Jump to Health Plan Type definitions

| Change in the Number of All Medicare Advantage plans (both MA & MAPD) |

||||||

| Number of Medicare Advantage plans (MA & MAPD) | ||||||

| Health Plan Type | 2020 | 2019 | Change '19 to '20 | 2018 | 2017 | |

| Cost | 80 | 72 | 8 | 11% | 84 | 77 |

| Local HMO | 2,777 | 2,400 | 377 | 16% | 2,130 | 1,920 |

| Local PPO | 1,035 | 873 | 162 | 19% | 622 | 515 |

| Regional PPO | 64 | 63 | 1 | 2% | 62 | 61 |

| All PPOs | 1,099 | 936 | 163 | 17% | 684 | 576 |

| PFFS | 41 | 44 | -3 | -7% | 46 | 48 |

| MSA | 6 | 6 | 0 | 0% | 3 | 4 |

| MMP | 44 | 50 | -6 | -12% | 54 | 62 |

| Total MA & MAPD plans | 4,047 | 3,508 | 539 | 15% | 3,001 | 2,687 |

**Why our numbers vary slightly from the number of Medicare Advantage plans reported by Medicare

Medicare Advantage plans can be defined by three numbers: (Contract_ID, Plan_ID, Segment_ID) and may appear on your plan documents as "H1234-001-001". In the analysis of the total number of Medicare Advantage plans, we look only to a Plan_ID level. Therefore, the number of Medicare Advantage plans that we report is slightly different than the number of Medicare Advantage plans reported by the Centers for Medicare and Medicaid Services (CMS).

As the recent 2019 CMS press release stated: "Beneficiaries will have more [Medicare Advantage] plan choices, with about 1,200 more Medicare Advantage plans operating in 2020 than in 2018".

However, in our article, "2020 Medicare Advantage plan (MA and MAPD) premiums remain low", we evaluate Medicare Advantage plan premiums at a Segment_ID level, thus increasing our sample. In this article, you can see that (using the Segment_ID), the increase in the number of plans from 2018 to 2020 is 1,146 - much closer to the 1,200 value stated in the 2019 CMS press release.

Reminder: Types of Medicare Advantage Plans

As you browse through the 2020 Medicare Advantage plans, you will see in our Medicare Advantage search tools that there are seven common types of Medicare Advantage plans offered.

- HMO - Health Maintenance Organization plans

HMOs are wellness-based Medicare Advantage plans and usually have the most-restrictive healthcare provider network, meaning that your healthcare costs may be considerably higher if you go outside of your plan’s established network. Also, depending on your HMO plan, you may only have access health services outside of your plan network with a referral from your doctor. Local HMOs are often very affordable compared to other Medicare Advantage plans because the restrictive network and focus on wellness helps to control healthcare costs. The majority of 2020 Medicare Advantage plans will be HMOs (Health Maintenance Organizations).

- HMO POS - Health Maintenance Organization with Point-of-Service option plans

These Medicare Advantage HMO’s have a more flexible healthcare network allowing you to seek care outside of your plan’s network by paying a higher cost-sharing rate. An HMO-POS is often chosen by people who travel part of the year, but still return home for the majority of their healthcare needs. Again, expect out-of-network healthcare costs to be more than in-network. For instance, you may have a $30 co-payment when you visit a healthcare provider in-network (at home) and pay $60 when you visit a provider outside of the plan’s network (while traveling).

Important: In past years, some Members of a HMO-POS plans were "crosswalked" or moved into HMOs (without the POS option). Be sure to read your Annual Notice of Change (ANOC) carefully to be sure that you still have your POS option.

Please also note, depending on your HMO-POS plan, you may find that out-of-network costs do not count toward your Maximum Out of Pocket (MOOP) limit or you may have a much higher out-of-network MOOP — check with your plan's Member Services department for more details.

- PPO - Preferred Provider Organization plans

Medicare Advantage PPOs have a less-restrictive provider network, but again, you probably will pay a higher cost-sharing rate when you visit a healthcare provider outside of your plan’s network.

- PFFS - Private Fee for Service plans

Although very popular (and affordable) several years ago, fewer Medicare Advantage PFFS plans are now available (only 41 PFFS plans are available in 2020). PFFS plans have the most flexible network, meaning that you can go to any health care provider as long as the provider accepts Medicare and the terms and conditions of your PFFS plan. As noted, although PFFS plans will continue to be rare in 2020, some people still find PFFS plans as a flexible and economical alternative to other Medicare Advantage plans. If you choose a PFFS plan that does not include prescription drug coverage, you have the option to join a separate stand-alone Medicare Part D plan (PDP).

- SNP - Special Needs plans

SNPs are Medicare Advantage plans designed for a people with specific conditions or financial needs. Certain SNPs are available only to diabetics, people with chronic cardiac conditions, nursing home residents, or people dual eligible for both Medicare and Medicaid (D-SNPs). If you do not meet the plan’s “special need”, you will not be permitted to join the Special Needs plan. In a separate article, "Significant changes in the 2020 Medicare Advantage Special Needs Plan (SNP) landscape", we look closer at the 2020 SNPs (https://Q1News.com/785.html).

- MSA - Medical Savings Account plans

MSAs are like Health Savings Accounts (HSAs) — a high-deductible health plan combined with a medical spending account that you can use to pay for your health care costs. MSAs do not provide prescription drug coverage and you would need to join a separate stand-alone Medicare Part D plan (PDP) for your prescription needs. More people will have access to MSA plans in 2020. Although there are only six (6) MSA plans in 2020, MSAs are available in 1,883 counties across 29 states.

- MMP - Medicare-Medicaid Plans

MMP plans were introduced in 2014 and are only offered in 155 counties across nine (9) states. As noted by CMS: "A Medicare-Medicaid Plan (MMP) [like a D-SNP] is a private health plan that has been competitively selected and approved to provide integrated care to eligible full-benefit Medicare-Medicaid enrollees under the CMS Financial Alignment Demonstration." (CMS, “Financial Alignment Initiative,”(https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/FinancialAlignmentInitiative/FinancialModelstoSupportStatesEffortsinCareCoordination.html.)

MMPs only serve full-benefit dual-eligible (Medicare/Medicaid) beneficiaries and some additional limitations may apply.

| Change in the Number of MAPD plans | |||||||

| Number of Medicare Advantage plans with Drug Coverage | |||||||

| Health Plan Type | 2020 | Change '19 to '20 |

2019 | Change '18 to '19 |

2018 | Change '17 to '18 |

2017 |

| Cost | 16 | -2 | 18 | -12 | 30 | -3 | 33 |

| Local HMO | 2,632 | 364 | 2,268 | 265 | 2,003 | 218 | 1,785 |

| Local PPO | 971 | 154 | 817 | 240 | 577 | 98 | 479 |

| PFFS | 26 | -3 | 29 | -1 | 30 | -2 | 32 |

| Regional PPO | 46 | 0 | 46 | 1 | 45 | 1 | 44 |

| MMP | 44 | -6 | 50 | -4 | 54 | -8 | 62 |

| Total MAPD Plans | 3,735 | 507 | 3,228 | 489 | 2,739 | 304 | 2,435 |

Note the increases in Local HMO and Local PPO MAPD options for 2020 - with a further decline in MMP, Cost, and PFFS Medicare Advantage plans.

| Change in the Number of Medicare Advantage plans without Drug Coverage (MAs) |

|||||||

| Number of MA Plans |

|||||||

| Health Plan Type | 2020 | Change '19 to '20 |

2019 | Change '18 to '19 |

2018 | Change '17 to '18 |

2017 |

| Cost | 64 | 10 | 54 | 0 | 54 | 10 | 44 |

| Local HMO | 145 | 13 | 132 | 5 | 127 | -8 | 135 |

| Local PPO | 64 | 8 | 56 | 11 | 45 | 9 | 36 |

| MSA | 6 | 0 | 6 | 3 | 3 | -1 | 4 |

| PFFS | 15 | 0 | 15 | -1 | 16 | 0 | 16 |

| Regional PPO | 18 | 1 | 17 | 0 | 17 | 0 | 17 |

| Total MA Plans w/o Rx Cov. | 312 | 32 | 280 | 18 | 262 | 10 | 252 |

Reviewing local Medicare plan options and comparing changes from 2019

You can also see how each 2019 Medicare Advantage plan is changing in 2020 using our Medicare Advantage comparison tool found at: MA-Compare.com/2020.

Reminder: October 15th starts the annual Open Enrollment Period

The annual Medicare Open Enrollment Period (or Annual Coordinated Election Period - AEP) for 2020 Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7th, with 2020 Medicare plan coverage beginning on January 1, 2020.

In addition, members of Medicare Advantage plans are given a second annual enrollment period once the new plan years begins. The annual Medicare Advantage Open Enrollment Period (MA OEP) begins on January 1st and continues through March 31st. During the MA-OEP, current members of 2020 Medicare Advantage plans can change to a different 2020 Medicare Advantage plan or return to Original Medicare and enroll in a stand-alone Medicare Part D plan (PDP), with their new 2020 Medicare plan coverage beginning on the first day of the month following their enrollment.

For more information, you can telephone Medicare at 1-800-633-4227 to speak with a Medicare representative.

News Categories

Check Local Pharmacy Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service