On April 6, 2020, the Centers for Medicare and

Medicaid Services (CMS) released

the "2021 Announcement of Calendar Year (CY) 2021 Medicare Advantage (MA) Capitation Rates and Part C and Part D Payment Policies" (Announcement) that included finalized defined

standard benefits for 2021 Medicare Part D prescription drug plan coverage and other proposed changes to the Medicare program.

Each year, CMS releases the Medicare Part D benefit parameters for the "Defined Standard Benefit" and Medicare Part D plans use this information to determine plan coverage for the up-coming plan year. You can use the CMS parameters as a preview of how your Medicare

Part D plan coverage may change in January, 2021 (for example, if you currently pay a $435 deductible, your deductible in 2021 may be $445).

Actual plan options

and benefit details will be available for your review beginning October

1, 2020 and you can make 2021 plan changes during the fall annual Open Enrollment Period (AEP) (October 15th through December 7th).

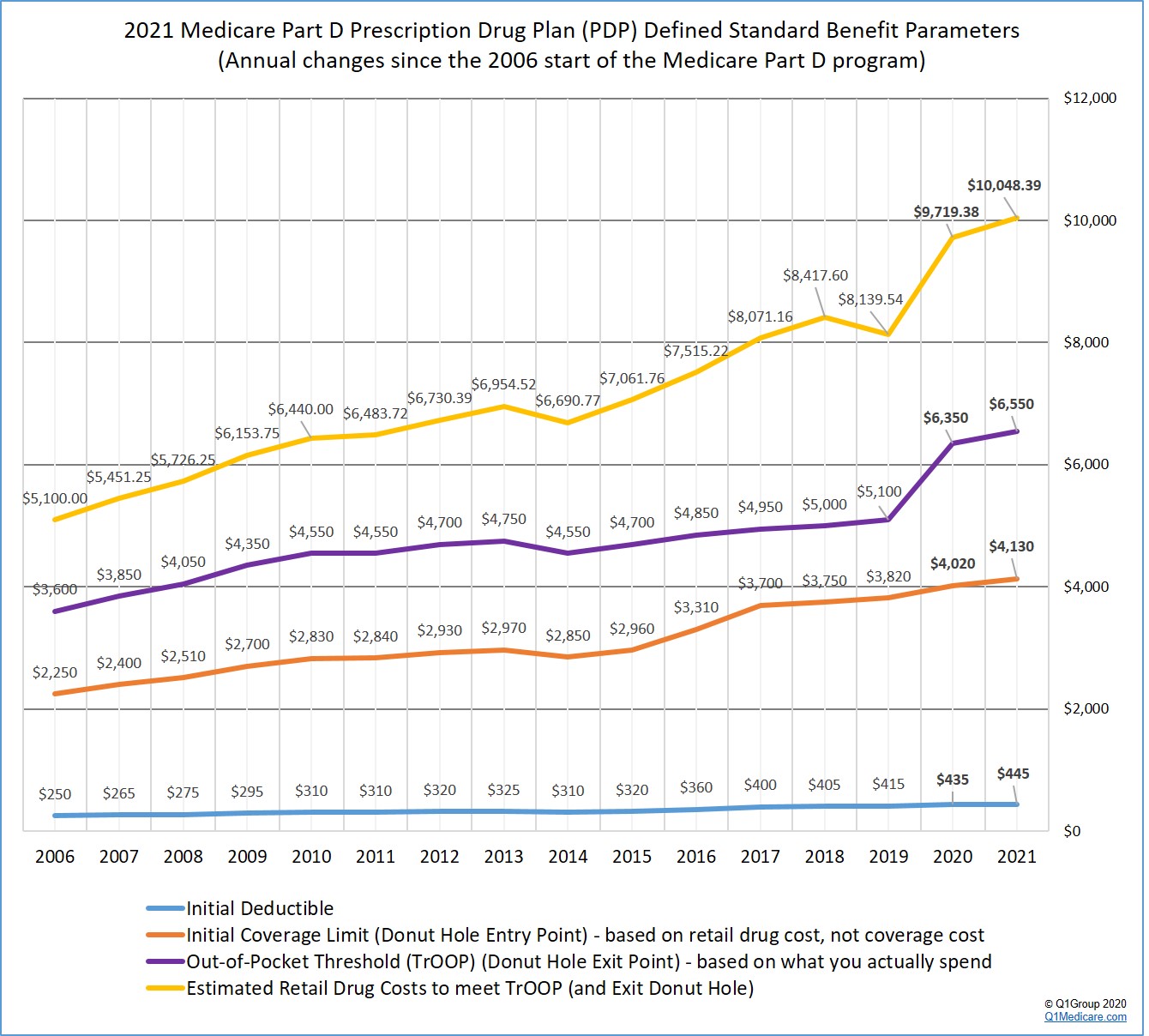

As an overview, the following graph shows the 2021 Medicare Part D plan parameters and how standard Medicare Part D plan coverage has changed since the 2006 beginning of the Medicare Part D program.

Based on the 2021 Announcement, here are the changes to the standard Medicare Part D prescription drug coverage:

- The standard 2021 Initial Deductible will increase about 2.3%.

The 2021 standard Initial Deductible will increase $10 to $445 from the current 2020 standard Initial Deductible of $435. As reference, the 2019 standard Initial Deductible was $415.

What this means to you: The Initial Deductible is the amount that you must pay before your Medicare Part D plan begins to share in the cost of coverage. If you enroll in a Medicare Part D prescription drug plan with a standard Initial Deductible, you will spend slightly more out-of-pocket in 2021 before your plan coverage begins.

As a note, the majority of 2020 Medicare Part D plans have an initial deductible - and we expect this trend to continue in 2021. But, as we see in 2020, many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the deductible, providing plan Members with immediate coverage for some lower-costing medications.

The Initial Deductible and the Donut Hole: The Initial Deductible will not affect when you enter the Donut Hole or Coverage Gap, but will impact when you leave the Donut Hole and enter the Catastrophic Coverage portion of your Medicare Part D plan coverage. In other words, what you spend toward your Initial Deductible is counted toward your total out-of-pocket spending threshold or TrOOP (see below for more about TrOOP).

- The

Initial Coverage Limit will increase 2.7%.

The 2021 Initial Coverage Limit (ICL) will increase $110 to $4,130 from the current 2020 ICL of $4,020 (as reference, the 2019 ICL was $3,820). The Initial Coverage Limit marks the point where you enter the Donut Hole or Coverage Gap. Medicare Part D beneficiaries enter the Donut Hole when the total negotiated retail value of their prescription drug purchases exceeds their plan’s Initial Coverage Limit.

What this means to you: You will be able to buy slightly more medications before reaching the 2021 Donut Hole or Coverage Gap (assuming that the retail price of your medications does not increase over time).

- Will you enter the 2021 Donut Hole?

If you purchase medications with an average retail value of over $345 per month (based on your current retail drug prices remaining stable), then you will enter the 2021 Donut Hole at some point during the year. For more information, please see our 2021 Donut Hole calculator to estimate when (or if) you will enter the Donut Hole: https://PDP-Planner.com/2021

- The 2021 Donut Hole discount for generic drugs remains at 75%.

If you reach the 2021 Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the drug discount is 75%. So your generic formulary drug costs in the Donut Hole will be 25% of your plan's negotiated retail prices.

What this means to you: If you are in the 2021 Donut Hole and your generic medication has a retail cost of $100, you will pay only $25 for a refill. And the $25 that you spend for a formulary drug will count toward your 2021 out-of-pocket spending limit or TrOOP of $6,550.

- The

Donut Hole discount for brand-name drugs remains at 75%.

The 2021 brand-name drug Donut Hole discount remains at 75% (you pay 25% of retail costs). The pharmaceutical industry will be responsible for 70% of the cost of medications in the Coverage Gap, therefore you will receive credit for 95% of the retail drug cost toward meeting your 2021 total out-of-pocket maximum or Donut Hole exit point (the 25% of retail costs you pay plus the 70% drug manufacturer discount).

What this means to you: If you reach the 2021 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the formulary medication, and receive $95 credit toward meeting your 2021 out-of-pocket spending limit – or Donut Hole exit point.

- The amount you need to spend (TrOOP) to exit the 2021 Donut Hole will increase by 3.15%

Your 2021 Total Out-of-Pocket Cost (TrOOP) threshold will increase by $200 to $6,550 from the current 2020 TrOOP limit of $6,350. TrOOP is the actual dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap and into the Catastrophic Coverage phase of your Medicare Part D plan and TrOOP does not include monthly premiums or non-formulary purchases. As reference, the 2019 TrOOP limit was $5,100.

What this means to you: If you reach the 2021 Donut Hole, you will need to spend slightly more money before exiting the Donut Hole and entering the 2021 Catastrophic Coverage portion of your Medicare Part D plan coverage.

The good news: As noted above, brand-name medication purchases in the 2021 Donut Hole are discounted by 75% (you pay 25%), but you will receive credit of 95% of the retail drug price toward meeting the 2021 TrOOP threshold.

Tip: How will these changes in 2021 Medicare Part D plan coverage affect you?

If you are trying to get an idea of your 2021 prescription drug spending budget, you can use our 2021 Donut Hole calculator (found at PDP-Planner.com/2021) to estimate your actual out-of-pocket spending based on your estimated mix of generic and brand-name drugs purchased in the 2021 Coverage Gap.

What does it take to exit the 2021 Donut Hole?

Example #1 with drug mix of: 89.50% brands and 10.50% generics

Using Medicare's past drug usage estimate*, the average person will have purchases of 89.50% brand drugs and 10.50% generic drugs in the 2021 Donut Hole - and assuming your 2021 Part D plan has a $445 deductible and the retail cost of your drugs is about $838 per month, you can expect your actual annual out-of-pocket drug costs to be around $2,846 before meeting the $6,550 TrOOP and exiting the Donut Hole - your Medicare Part D plan would spend about $3,496 and the pharmaceutical manufacturers would spend about $3,706.

The total retail value of your drug purchases needed to exit the Donut Hole would be around $10,056 (not adjusting for dispensing and vaccine fees). We are also not including your monthly premium costs in this estimate.

Example #2: Exiting the Donut Hole when your Donut Hole drug mix is 100% generics

If you purchase only generic drugs (100% generic) in the Donut Hole - and again, we assume your Part D has a $445 deductible and the retail cost of your drugs is about $2,073 per month, you can expect your actual annual costs to be $6,550 (or the same as the 2021 TrOOP) before exiting the Donut Hole - your Medicare Part D plan would spend about $18,317 and the pharmaceutical manufacturers would spend $0.

The total retail value of your drug purchases needed to exit the Donut Hole would be $24,876.

Example #3: Exiting the Donut Hole when your Donut Hole drug mix is 100% brand

If you purchase only brand drugs (100% brands) - and assuming your Part D plan has a $445 deductible and the retail cost of your drugs is about $798 per month, you can expect your actual annual costs to be around $2,728 before meeting the $6,550 TrOOP and exiting the Donut Hole - your Medicare Part D plan would spend about $3,036 and the pharmaceutical manufacturers would spend about $3,812.

The total retail value of your drug purchases needed to exit the Donut Hole would be $9,576.

What this means to you: You will spend more out-of-pocket to exit the 2021 Donut Hole as compared to 2020 - and you would exit the Donut Hole and enter Catastrophic Coverage faster by using brand-name medications in the Donut Hole since the pharmaceutical industry brand-name discount will accelerate you toward meeting your TrOOP. In fact, the estimated retail value of drug purchases needed to exit the 2021 Donut Hole will increase 3.39%.

* CMS estimates that a person will use a mix of 89.50% brand drugs and 10.50% generic drugs while in the 2021 Donut Hole (a decrease in estimated brand-name drug use as compared to the 2020 estimated mix of 90.18% brand drugs and 9.82% generic drugs while in the Donut Hole).

As reference, in 2019, CMS estimated a mix of 89.31% brand drugs and 10.69% generic drugs and the estimated retail cost to meet 2019 TrOOP and exit the 2019 Donut Hole is $8,139.54; in 2018, the CMS retail drug-cost estimate was calculated using a mix of 87.9% brand drugs and 12.1% generic drugs and the estimated retail cost to meet 2018 TrOOP and exit the 2018 Donut Hole is $8,417.60.

As a result, CMS calculates that a person will be able to purchase drugs with an approximate retail value of $10,048.39 before meeting the $6,550 out-of-pocket threshold (TrOOP) and exiting the 2021 Donut Hole.

Our Donut Hole calculations vs. the CMS cost estimate:

Please note, as shown in the examples above, our estimated cost using our Donut Hole Calculator is $10,056 which is a slightly higher than the CMS total retail drug cost estimate. The variation between our calculations and CMS is because of rounding differences and the consideration of small "dispensing" and "vaccine administration fees" that are being used in the CMS calculation.

Still not sure how the 2021 Donut Hole or Coverage Gap functions?

To help you visualize how your current drug spending relates to your Medicare Part D plan coverage, we have our updated 2021 Donut Hole calculator online at: PDP-Planner.com/2021. As noted, our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2021 Medicare Part D plan coverage. We have several options for you to choose the percentage of generic and brand drugs you use and you can even change your mix of prescriptions to be 100% generic or 100% brand.

To get you started, you can click here to see an example of the 2021 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost.

(Spoiler alert: If the retail cost of your formulary medications is $800 per month, you can expect to spend about $2,731.07 out-of-pocket in 2021 - assuming a $445 deductible and an average cost-sharing of 25% of retail - and not including monthly premiums).

- Will you exit the Donut Hole and enter the 2021 Catastrophic Coverage phase?

Based on CMS drug purchase estimates, if your monthly retail formulary drug costs are more than $838 per month, you will exit the 2021 Donut Hole and enter Catastrophic Coverage portion of your Medicare Part D plan.

- 2021 fixed Catastrophic Coverage

costs increase slightly.

The Catastrophic Coverage portion of your Medicare Part D plan begins when you leave the Coverage Gap or Donut Hole. In the 2021 Catastrophic Coverage phase, you pay a minimum of $9.20 for brand drugs or $3.70 for generics (or 5% of retail costs, whichever is higher). As reference, in the 2019 Catastrophic Coverage phase, you paid a minimum of $8.50 for brand drugs or $3.40 for generics (or 5%, whichever is higher).

What this means to you: If you purchase a brand name medication with a retail price of over $184 or a generic medication with a retail price of over $74, you will pay 5% of retail or more than the minimum $9.20 for brand drugs or $3.70 for generics - so if your medication has a retail cost over $184, you will pay 5% of retail, the same as you would have paid in past years.

For example, if you are using the expensive medication IMBRUVICA 140 MG CAPSULE (90 EA) (NDC: 57962014009), your monthly retail drug costs may be over $4,500, so your catastrophic coverage cost would be approximately $225 per month since this 5% of retail cost is more than the minimum $9.20 brand-name catastrophic coverage cost (based on 2020 retail drug costs).

- On June 2, 2020, CMS published the final rule for "Medicare and Medicaid Programs; Contract Year 2021 and 2022 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, Medicaid Program, Medicare Cost Plan Program, and Programs of All-Inclusive Care for the Elderly" - and here are a few of the Medicare program changes found in the 2021 CMS Advance Notice, February 18, 2020 proposed CMS regulations and the June 2, 2020 final CMS regulations.

-- Starting in 2020, CMS will no longer publish a final Call Letter and instead will release the Call Letter as a regulation.

In the 2021 Advance Notice, CMS proposed "to codify much of the guidance typically included in the annual Call Letter through the [calendar year] 2021 and 2022 MA and Part D Proposed Rule." Therefore, "CMS will not be publishing a Call Letter for 2021."

-- All Medicare plans would provide "Real-Time Drug Price Comparison Tools"

Starting in 2022, CMS would require all Medicare prescription drug plans to provide an online tool (Beneficiary Real Time Benefit Tool (RTBT)) so that plan members could instantly see formulary details and shop for the best-priced formulary medications or find low-cost alternative medications. (see § 423.128)

As noted in the proposed regulations: "This tool would allow enrollees to view a plan-defined subset of the information included in the prescriber RTBT system, which will include accurate, timely, and clinically appropriate patient-specific real-time formulary and benefit information (including cost, formulary alternatives and utilization management requirements)."

An example provided by CMS was that "beneficiaries would be able to compare drug prices at the doctor’s office to find the most cost- effective prescription drugs for their health needs. In addition, if a doctor recommends a specific cholesterol-lowering drug, the patient could easily look up what the copay would be and see if a different, similarly effective option might save the patient money."

-- Medicare plans would add a second, lower-costing Specialty Drug Tier (Tier for preferred Specialty Drugs)

Since Medicare Part D plans currently have a Specialty Drug Tier with a fixed percentage cost-sharing structure (25% to 50% of retail), many of the higher-costing formulary drugs are still very expensive for plan members. CMS proposes that Medicare plans now add a second (or "preferred") Specialty Tier with a lower cost-sharing rate and that CMS will set "a maximum allowable cost sharing that would apply to the higher cost-sharing specialty tier [of 25% to 33%]". With such a cost-sharing structure, CMS hopes that "[p]lans would be able to demand a better deal from manufacturers of the highest-cost drugs in exchange for placing their products on the “preferred” specialty tier."

-- Tiering Exception requests for Specialty Tier Drugs to "preferred" Specialty Drugs

CMS also proposes that Part D plans would be required to allow tiering exception requests effectively moving a drug from the higher-costing Specialty Tier to the lower-costing "preferred" Specialty Tier. CMS stated in the proposed regulations: "Because we propose that the exemption from tiering exceptions for specialty tier drugs would apply only to tiering exceptions to non-specialty tiers, our proposal would require Part D sponsors to permit tiering exception requests for drugs on the higher-cost specialty tier to the lower-cost specialty tier."

-- Create a Star Rating Category to reward plans for promoting lower-costing generics

CMS is seeking initial comments on the idea of adding a Star Rating category that "would reward plans based on the rate at which they encourage market adoption of these [lower price generics and biosimilars or] competitor products and lower [prescription] costs for patients."

-- Medicare beneficiaries with End-Stage Renal Disease (ESRD) will be allowed to join a 2021 Medicare Advantage plan

Starting in 2021, CMS will allow Medicare beneficiaries with ESRD or kidney failure to join a Medicare Advantage plan of their choosing. (Section 17006(a) of the "21st Century Cures Act amended the Social Security Act to allow all Medicare-eligible individuals with ESRD to enroll in MA plans beginning January 1, 2021"). CMS notes that the proposal, "will give patients with ESRD access to more affordable Medicare coverage choices and extra [or supplemental] benefits such as transportation or home- delivered meals." Currently, Medicare beneficiaries with ESRD cannot join a 2020 Medicare Advantage plan. Although people who develop ESRD while enrolled in a MAPD or MA can keep their Medicare Advantage plan.

-- Medicare beneficiaries may have access to Medicare drug plans with fixed $35 or less insulin co-pays

As part of the new CMS "Part D Senior Savings Model", some 2021 Medicare prescription drug plans across the country may choose to offer different types of insulin at a maximum co-pay of $35 per month throughout all phases of your drug coverage: deductible, initial coverage, and the Coverage Gap (or Donut Hole). The coverage of $35 insulin per month can be provided by: (1) stand-alone Medicare Part D plans (PDPs) with enhanced alternative features, (2) Medicare Advantage plans that include drug coverage (MAPDs), and (3) Chronic Illness or Institutional Special Needs Plans (SNPs).

-- Exclusion of Kidney Organ Acquisition Costs from MA Benchmarks

The February 2020 CMS Announcement noted: "With this new enrollment option [for Medicare beneficiaries with ESRD], the [21st Century Cures Act] also made related payment changes in the [Medicare Advantage or MA plans] and [Medicare fee-for-service] programs. Effective January 1, 2021, MA organizations will no longer be responsible for organ acquisition costs for kidney transplants for MA beneficiaries, and such costs will be excluded from MA benchmarks and covered under the FFS program instead."

-- Medicare network adequacy strengthened with the expansion of Telehealth benefits utilized by Medicare Advantage plans

The February 2020 CMS Announcement noted: "CMS is proposing to build on the current [telehealth] benefits and give Medicare Advantage plans more flexibility to count telehealth providers in certain specialty areas like [dermatology, psychiatry, cardiology, otolaryngology, and neurology] towards network adequacy standards, which would encourage greater use of telehealth services as well as increase plan choices for beneficiaries. These proposed changes aim to give seniors more plan choices in rural areas, increase competition between plans, and allow providers to take advantage of the latest healthcare technologies and innovations."

-- Further expansion of Medicare plan provisions to combat the opioid epidemic

CMS proposes to implement more of the Substance Use-Disorder Prevention that Promotes Opioid Recovery and Treatment (SUPPORT) for Patients and Communities Act expanding "drug management programs [such as Prior Authorization or Quantity Limits] and medication therapy management programs, through which Part D plans review with providers opioid utilization trends that may put beneficiaries at-risk and provide beneficiary-centric interventions." CMS also proposes more communication between the Medicare beneficiaries with a history of opioid addiction and plan sponsors or healthcare providers.

As noted in the proposed regulations: "A past overdose is the risk factor most predictive for another overdose or suicide-related event.1 In light of this fact, in section 2006 of the SUPPORT Act, Congress required CMS to include Part D beneficiaries with a history of opioid-related overdose (as defined by the Secretary) as PARBs [or potential at-risk beneficiary] under a Part D plan’s [Drug Management Program (DMP)]. CMS is also required under this section to notify the sponsor of such identifications. In line with this requirement, we are proposing to modify the definition of “potential at-risk beneficiary” at § 423.100 to include a Part D eligible individual who is identified as having a history of opioid-related overdose, as we propose to define it. Inclusion of beneficiaries with a history of opioid-related overdose as PARBs in DMPs will allow Part D plan sponsors and providers to work together to closely assess these beneficiaries’ opioid use and determine whether any additional action is warranted."

-- Exclusion of certain beneficiaries from Drug Management Programs (DMPs) expanded to beneficiaries with Sickle Cell Disease (SCD)

CMS notes that Medicare beneficiaries "with active cancer-related pain, residing in a long-term care facility, or receiving hospice, palliative, or end-of-life care currently meet the definition of 'exempt individuals' with respect to DMPs" and now CMS holds that "[d]ue to concerns of misapplication of opioid restrictions in the sickle cell disease (SCD) patient population, CMS is proposing that, starting in plan year 2021, beneficiaries with SCD are classified as exempt individuals."

-- CMS to create regulations for Special Enrollment Periods (SEPs) dealing with Exception Conditions

The proposed SEPs include the "SEP for Individuals Affected by a FEMA-Declared Weather-Related Emergency or Major Disaster, the SEP for Employer/Union Group Health Plan (EGHP) elections, the SEP for Individuals Who Disenroll in Connection with a CMS Sanction, . . . the SEP for Individuals Enrolled in a Plan Placed in Receivership, and the SEP for Individuals Enrolled in a Plan that has been identified by CMS as a Consistent Poor Performer."

https://www.cms.gov/files/document/2021-announcement.pdf

https://www.cms.gov/files/document/2021-advance-notice-part-ii.pdf

https://www.cms.gov/newsroom/fact-sheets/ 2021-medicare-advantage-and -part-d-advance-notice-part-ii-fact-sheet-0

https://www.cms.gov/newsroom/fact-sheets/ contract-year-2021-and-2022-medicare-advantage -and-part-d-proposed-rule-cms-4190-p-1

2021 Announcement in Proposed Regulations: Medicare and Medicaid Programs: Contract Year 2021 and 2022 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, Medicaid Program, Medicare Cost Plan Program and Programs of All-Inclusive Care for the Elderly), https://www.federalregister.gov/documents/2020/ 02/18/2020-02085/ medicare-and-medicaid-programs-contract-year-2021-and-2022-policy- and-technical-changes-to-the (https://s3.amazonaws.com/public-inspection.federalregister.gov/ 2020-02085.pdf)

https://www.govinfo.gov/content/pkg/FR-2018-04-16/pdf/2018-07179.pdf

https://www.mintz.com/sites/default/files/media/documents/2020-02-07/CY%202021%20Part%20C%20Bid%20Review%20Memorandum_Final%202.6.2020.pdf

https://www.govinfo.gov/content/pkg/FR-2020-06-02/pdf/2020-11342.pdf

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service