2021 Medicare Advantage plan (MA and MAPD) premiums remain low - with more $0 premium options

As noted by

the Centers for Medicare and Medicaid Services (CMS), monthly Medicare

Advantage plan premiums have remained stable or declined over the past several

years — and this trend continues into 2021 with most Medicare

Advantage plans (MA and MAPD

plans combined) continuing to have premiums under $50 per month - and 57% of

all Medicare Advantage plans having monthly premiums of $25 or

less.

Here are a few additional highlights of 2021 Medicare Advantage plan premium changes:

- More $0 premium Medicare Advantage plans.

In 2021, 43% of all Medicare Advantage plan will have a $0 premium. As a comparison, 39% of all 2020 Medicare Advantage plan have a $0 premium.

- More Medicare Advantage plans will have a premium under $50.

Overall, 79% of the 2021 Medicare Advantage plans (MA and MAPD) will have a premium of $50 or less. Overall, 76% of the 2020 Medicare Advantage plans have a premium of $50 or less.

- CMS also noted in their 2021 Medicare plan press release that:

"average 2021 premiums for Medicare Advantage plans are expected to decline 34.2 percent from 2017 while plan choice, benefits, and enrollment continue to increase. The Medicare Advantage average monthly premium will be the lowest in 14 years (since 2007) for the over 26 million Medicare beneficiaries projected to enroll in a Medicare Advantage plan for 2021."

(https://www.cms.gov/newsroom/press-releases/trump-administration-announces-historically-low-medicare-advantage-premiums-and-new-payment-model [emphasis added]

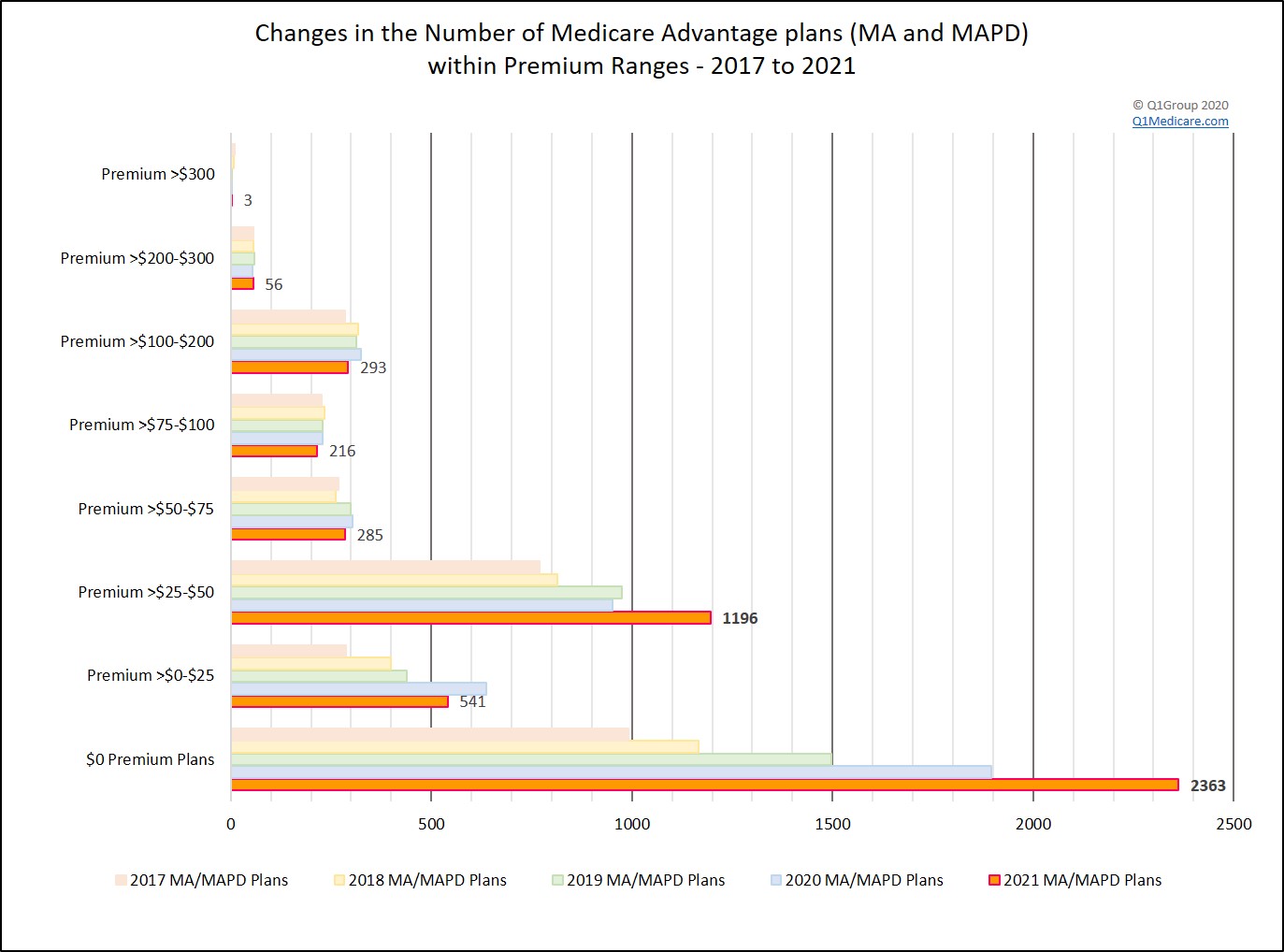

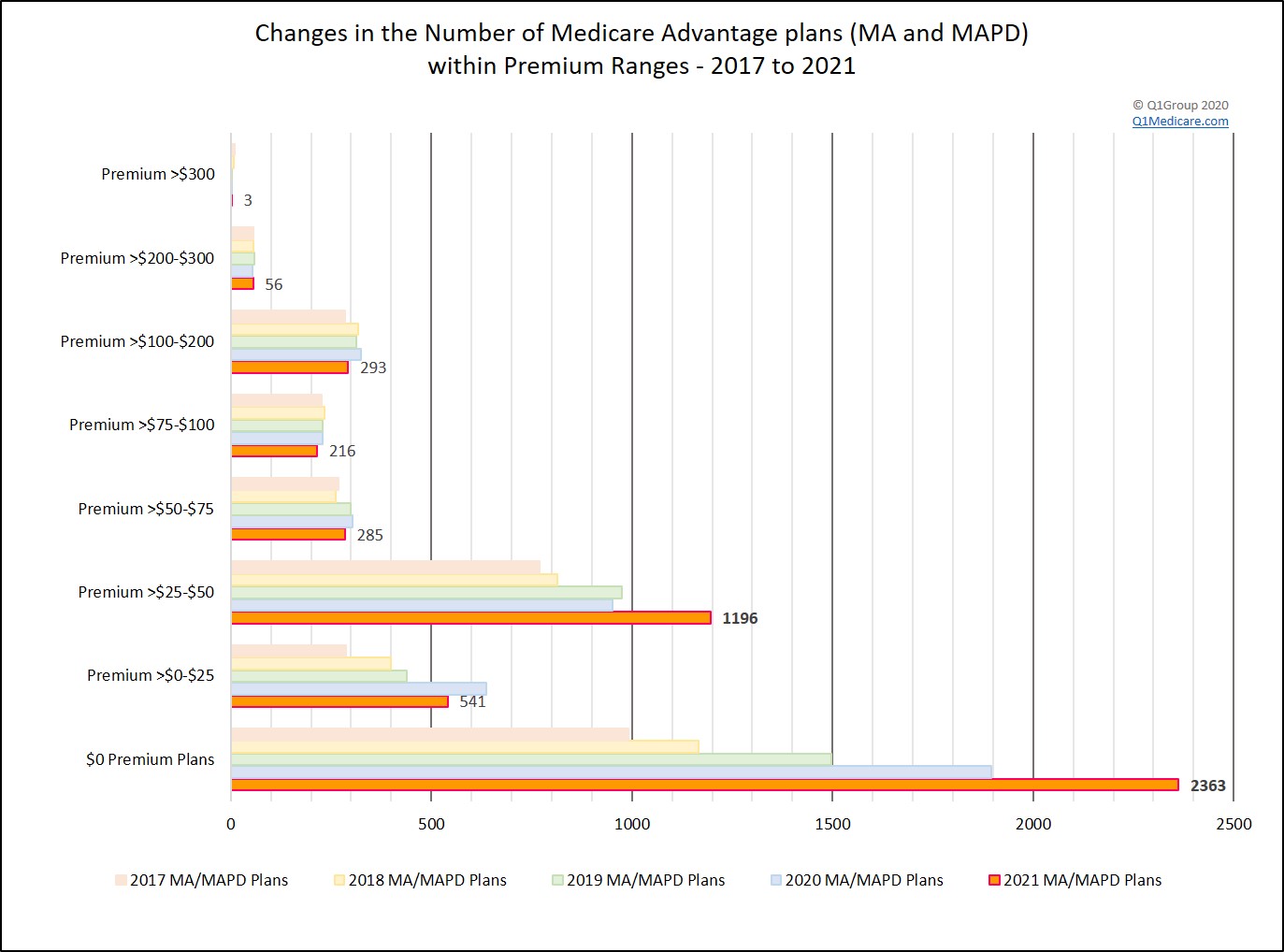

For more detail, here is a table showing how MA/MAPD premiums have varied over the past five years.

| Premium Range | 2021 MA/MAPD Plans | 2020 MA/MAPD Plans | 2019 MA/MAPD Plans | 2018 MA/MAPD Plans | 2017 MA/MAPD Plans | |||||

| # | % | # | % | # | % | # | % | # | % | |

| Total Plans | 4,958 | 4,405 | 3,817 | 3,259 | 2,899 | |||||

| MSA no Premium | 5 | 0.10% | 6 | 0.14% | 6 | 0.16% | 3 | 0.09% | 4 | 0.14% |

| $0 Premium Plans | 2,363 | 47.66% | 1,895 | 43.02% | 1,496 | 39.19% | 1,166 | 35.78% | 992 | 34.22% |

| Premium >$0-$25 | 541 | 10.91% | 637 | 14.46% | 438 | 11.47% | 400 | 12.27% | 287 | 9.90% |

| Premium >$25-$50 | 1,196 | 24.12% | 951 | 21.59% | 974 | 25.52% | 813 | 24.95% | 769 | 26.53% |

| Premium $0-$50 | 4,100 | 82.69% | 3,483 | 79.07% | 2,908 | 76.19% | 2,379 | 73.00% | 2,048 | 70.65% |

| Premium >$50-$75 | 285 | 5.75% | 304 | 6.90% | 298 | 7.81% | 261 | 8.01% | 269 | 9.28% |

| Premium >$75-$100 | 216 | 4.36% | 230 | 5.22% | 230 | 6.03% | 234 | 7.18% | 227 | 7.83% |

| Premium >$100-$200 | 293 | 5.91% | 325 | 7.38% | 313 | 8.20% | 318 | 9.76% | 285 | 9.83% |

| Premium >$200-$300 | 56 | 1.13% | 54 | 1.23% | 60 | 1.57% | 57 | 1.75% | 57 | 1.97% |

| Premium >$300 | 3 | 0.06% | 3 | 0.07% | 2 | 0.05% | 7 | 0.21% | 9 | 0.31% |

The corresponding chart below illustrates the stability of Medicare Advantage

plan premiums for plan years 2017 through 2021 - with an increase in

lower-premium (or $0 premium) 2021 Medicare plans.

Please remember, your 2021 Medicare Advantage plan premium may increase.

Please remember, your 2021 Medicare Advantage plan premium may increase.

The overall stability of Medicare Advantage plan premiums does not indicate that your current 2020 Medicare Advantage plan premium will remain the same in 2021. To see how your 2020 Medicare Advantage plan premium is changing in 2021, please use our Medicare Advantage plan comparison tool (MA-Compare.com/2021) - just enter your ZIP code to get started.

You can also review your Medicare Advantage plan's Annual Notice of Change (ANOC) letter that you should receive in late-September or early-October. You can call your Medicare Advantage plan using the toll-free number on your Member ID card to learn more about 2021 plan premiums.

You can also telephone Medicare at 1-800-633-4227 to speak with a Medicare representative for more information about your 2021 Medicare Advantage plan options.

October 15th starts the annual Open Enrollment Period

The annual Medicare Open Enrollment Period (or Annual Coordinated Election Period -- AEP) for 2021 Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7th, with 2021 Medicare plan coverage beginning on January 1, 2021.

In addition, members of Medicare Advantage plans are given a second annual enrollment period once the new plan years begins. The annual Medicare Advantage Open Enrollment Period (MA OEP) begins on January 1st, 2021 and continues through March 31st.

During the MA-OEP, current members of 2021 Medicare Advantage plans can change to a different 2021 Medicare Advantage plan or return to Original Medicare and enroll in a stand-alone Medicare Part D plan (PDP), with their new 2021 Medicare plan coverage beginning on the first day of the month following their enrollment.

The overall stability of Medicare Advantage plan premiums does not indicate that your current 2020 Medicare Advantage plan premium will remain the same in 2021. To see how your 2020 Medicare Advantage plan premium is changing in 2021, please use our Medicare Advantage plan comparison tool (MA-Compare.com/2021) - just enter your ZIP code to get started.

You can also review your Medicare Advantage plan's Annual Notice of Change (ANOC) letter that you should receive in late-September or early-October. You can call your Medicare Advantage plan using the toll-free number on your Member ID card to learn more about 2021 plan premiums.

You can also telephone Medicare at 1-800-633-4227 to speak with a Medicare representative for more information about your 2021 Medicare Advantage plan options.

October 15th starts the annual Open Enrollment Period

The annual Medicare Open Enrollment Period (or Annual Coordinated Election Period -- AEP) for 2021 Medicare Part D plans and Medicare Advantage plans begins on October 15th and continues through December 7th, with 2021 Medicare plan coverage beginning on January 1, 2021.

In addition, members of Medicare Advantage plans are given a second annual enrollment period once the new plan years begins. The annual Medicare Advantage Open Enrollment Period (MA OEP) begins on January 1st, 2021 and continues through March 31st.

During the MA-OEP, current members of 2021 Medicare Advantage plans can change to a different 2021 Medicare Advantage plan or return to Original Medicare and enroll in a stand-alone Medicare Part D plan (PDP), with their new 2021 Medicare plan coverage beginning on the first day of the month following their enrollment.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service