The Big Picture: More 2021 SNP options

First, based on our analysis, the bad news is that about 15% of the 2020 Medicare Advantage Special

Needs Plans (SNPs) will be discontinued in 2021 —

as compared to around 13% of the 2019 Special Needs Plans that were discontinued in 2020.

However, the good news is a large number of new 2021 Medicare Advantage SNPs will be introduced -

and with these newly released SNPs, we will actually see an 14%

increase in the total nationwide 2021 SNP landscape, and a 23% increase in

chronic illness SNPs (c-SNPs). The vast

majority of SNPs remains Dual-Eligible (D-SNPs) (61%).

Across the country, we will see an increase in the total number of 2021 Medicare Advantage Special Needs Plans (SNPs); and SNP gains in some counties will more than offset SNP losses in other areas (or even the same counties).

You can see 2020/2021 SNP gains and losses with our Medicare Advantage plan comparison tool MA-Compare found at https://MA-Compare.com.

Reminder: A Medicare Advantage SNP is not designed for everyone.

Often you will find a Medicare Advantage SNP in your area that is very well-priced with feature-rich benefits and an extensive drug formulary - making the plan a very appealing coverage option. But, please remember that you cannot join (or remain in) a Medicare Advantage SNP unless you qualify for the plan’s “Special Need” - that is, SNPs are designed for people with specific conditions, diseases, or characteristics -- and you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

SNPs are divided into three major types of special need:

- Chronic Illness SNPs or C-SNPs (like diabetes, heart disease, or ESRD),

- Dual-Eligible Medicare/Medicaid SNPs or D-SNPs (for Medicare and Medicaid beneficiaries), and

- Institutional SNPs (for Nursing and Long-Term Care (LTC) residents).

| 2021 Special Needs Medicare Advantage Plans by Type of Special Need |

||||||||

| SNP Type | 2021 Plans |

2020 Plans | Net Change* | % Net Change | Dropped Plans* | % of '20 SNPs Dropped | 2019 Plans | 2018 Plans |

| Chronic Illness | 203 | 165 | 38 | 23% | 25 | 15% | 127 | 132 |

| Dual-Eligible | 598 | 540 | 58 | 11% | 78 | 14% | 465 | 401 |

| Institutional | 174 | 150 | 24 | 16% | 23 | 15% | 125 | 97 |

| Total | 975 | 855 | 120 | 14% | 126 | 15% | 580 | 630 |

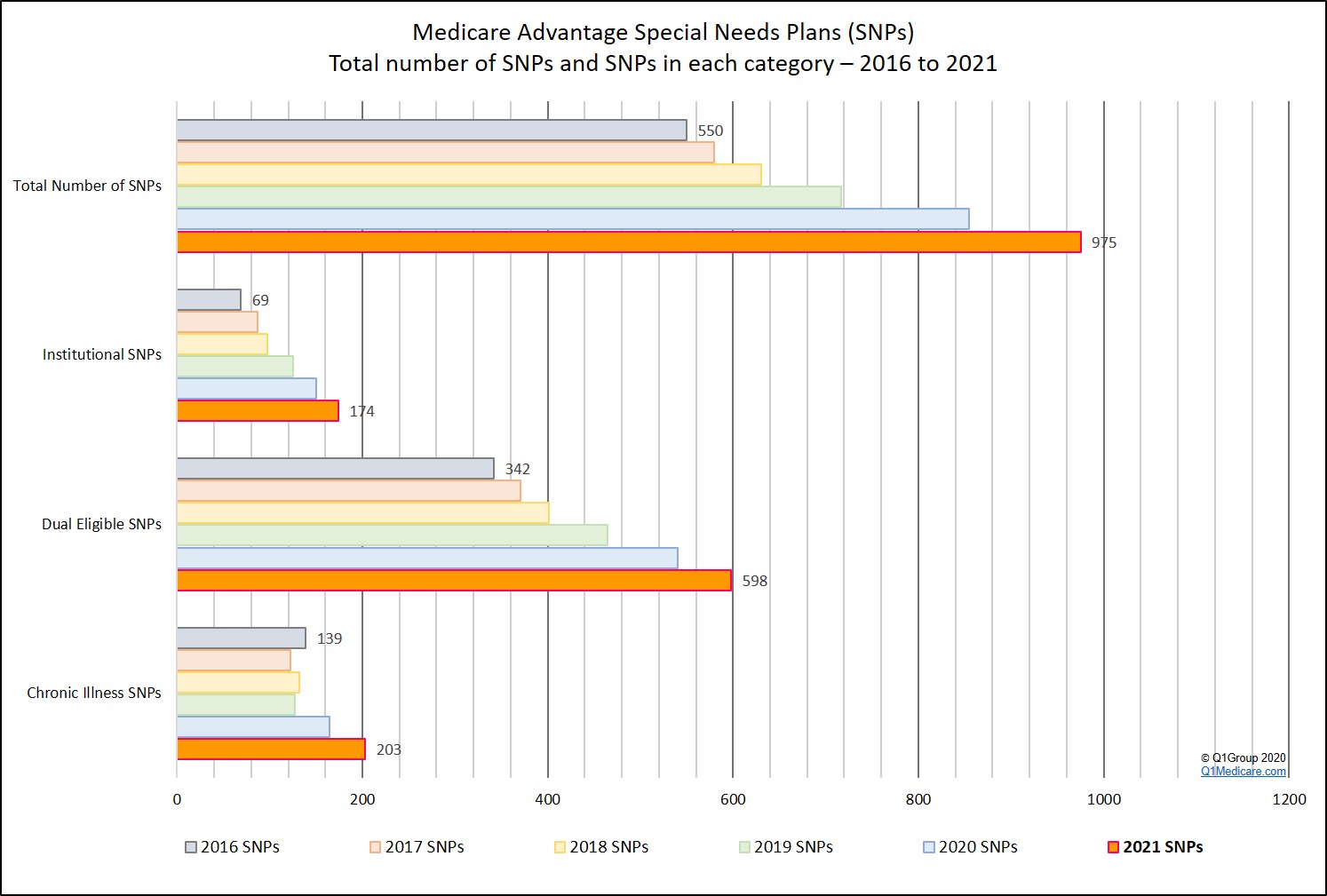

The chart below summarizes the 2021 Special Needs Plan landscape and how the SNP landscape has changed over the years.

To get you started, here is an example of all 2021 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate "100%" for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full dual-eligible Medicare/Medicaid beneficiaries.

As in past years, the most Special Needs Plans are available within a few counties located in New York, Florida, and California.

| Counties with the Largest Number of 2021 Special Needs Plans |

||||||||

| Locations | SNPs | |||||||

| Kings County, NY | 53 | |||||||

| Queens County, NY | 53 | |||||||

| New York County, NY | 52 | |||||||

| Bronx County, NY | 49 | |||||||

| Hillsborough County, FL | 44 | |||||||

| Pinellas County, FL | 43 | |||||||

| Nassau County, NY | 42 | |||||||

| Pasco County, FL | 41 | |||||||

| Miami-Dade County, FL | 40 | |||||||

| Orange County, FL | 40 | |||||||

| Broward County, FL | 39 | |||||||

| Polk County, FL | 39 | |||||||

A further note on Chronic Illness SNPs (C-SNPs)

Medicare Advantage Chronic Illness Special Needs Plans can be further divided into the type of chronic illness that the plan is designed to address.

| 2021 Special Needs – Chronic Illness Plans Compared to the 2020 Plan Year |

|||||

| Chronic Illness | Number of SNPs | ||||

| 2021 Plans | 2020 Plans | Net Change | 2019 Plans | 2018 Plans | |

| Cardiovascular Disorders | 1 | 0 | 1 | 0 | 1 |

| Cardiovascular Disorders & Chronic Heart Failure | 14 | 10 | 4 | 6 | 10 |

| Cardiovascular Disorders and Diabetes | 6 | 2 | 4 | 4 | 0 |

| Cardiovascular Disorders, Chronic Heart Failure & Diabetes | 3 | 67 | -64 | 45 | 45 |

| Chronic and Disabling Mental Health Conditions | 93 | 2 | 91 | 6 | 2 |

| Cardiovascular Disorders, Chronic Heart Failure, Diabetes Mellitus | 3 | 2 | 1 | 2 | 2 |

| Chronic Heart Failure | 3 | 1 | 2 | 1 | 0 |

| Chronic Heart Failure & Diabetes | 3 | 6 | -3 | 5 | 6 |

| Chronic Lung Disorders | 23 | 16 | 7 | 12 | 14 |

| Dementia | 7 | 8 | -1 | 6 | 6 |

| Diabetes Mellitus | 34 | 37 | -3 | 27 | 28 |

| End-stage Renal Disease Requiring Dialysis (any mode of dialysis) | 9 | 10 | -1 | 8 | 15 |

| End-stage Renal Disease Requiring Dialysis or HIV/AIDS | 4 | 0 | 4 | 2 | 0 |

| HIV/AIDS | 0 | 4 | -4 | 3 | 3 |

| Total Chronic Illness SNPs | 203 | 165 | 38 | 127 | 132 |

Changes within the SNP county-specific landscape

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see an overall increase in plan reach. There is a notable increase in both dual-eligible SNPs and a small increase in the number of chronic illness and institutional SNPs.

| 2021 Special Needs Plan Reach by Type of Need |

|||||||

| SNP Type | 2021 | 2020 | Change '20 to '21 | Percent Change '20 to '21 | 2019 | 2018 | 2013 |

| Chronic Illness | 2,667 | 2,364 | 303 | 13% | 2,131 | 2,113 | 6,402 |

| Dual-Eligible | 15,235 | 11,930 | 3,305 | 28% | 9,393 | 7,990 | 5,284 |

| Institutional | 2,441 | 1,906 | 535 | 28% | 1,503 | 1,165 | 537 |

| Total | 20,343 | 16,200 | 4,143 | 26% | 13,027 | 11,268 | 12,223 |

You can use our MA-Finder to review all 2021 Medicare Advantage Special Needs Plans available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

To learn more about Special Needs Plans in your area, please call Medicare at 1-800-633-4227 and speak with a Medicare representative about your Medicare plan options.

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service