Over 1.8 million people are currently enrolled in a 2020 Medicare Part D plan that is changing names in 2021

Is your 2020 Medicare Part D prescription drug plan changing names (and coverage) in 2021?

Over 1.8 million people are currently enrolled in a 2020 stand-alone Medicare Part D plan (PDP) that is changing plan names in 2021 - and also may be changing plan coverage.

How will you know whether your plan is changing names next year?

Current members of a 2020 Medicare Part D plan will be notified in their Annual Notice of Change (ANOC) letter about the plan's 2021 name change (along with other coverage changes) - and then you have the option to join another plan during the annual Open Enrollment Period (October 15 through December 7).

How many people are affected by 2021 Medicare Part D plan name changes?

Over 1.8 million people are currently enrolled in a 2020 stand-alone Medicare Part D plan (PDP) that is changing plan names in 2021 - and also may be changing plan coverage.

How will you know whether your plan is changing names next year?

Current members of a 2020 Medicare Part D plan will be notified in their Annual Notice of Change (ANOC) letter about the plan's 2021 name change (along with other coverage changes) - and then you have the option to join another plan during the annual Open Enrollment Period (October 15 through December 7).

How many people are affected by 2021 Medicare Part D plan name changes?

- 1,857,200 members in 143 Medicare PDPs (8 different plans across the country) will find the name of their 2021 plan is different from 2020 -- and the plan may also have with significant changes in 2021 plan coverage.

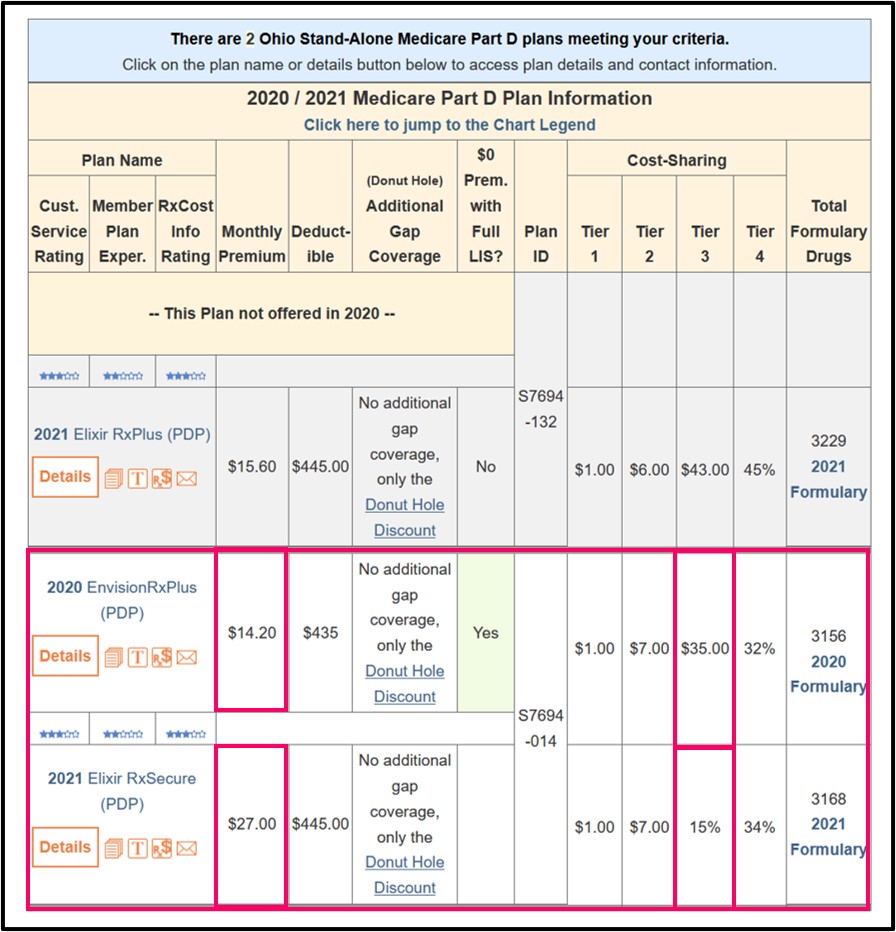

- For example, over 700,000 members of the 2020 EnvisionRxPlus (PDP) will find their plan’s name changing to the 2021 Elixir RxSecure (PDP), with a similarly-sized formulary, changes in cost-sharing for Tier 3 and Tier 4, and higher premiums (for example, members in Ohio will see a 90% premium increase in 2021).

- You can review 2021 Medicare prescription drug only plan changes using: PDP-Compare.com/2021.

| Stand-alone Medicare Part D plans (PDPs) with name changes and possibly significant feature changes |

||

| Plan Name | States | Members Affected |

| EnvisionRxPlus (PDP) will become Elixir RxPlus (PDP) |

in 29 states | 138,874 |

| EnvisionRxPlus (PDP) will become Elixir RxSecure (PDP) | in 20 states | 705,961 |

| EnvisionRxSecure (PDP) will become Elixir RxSecure (PDP) |

in 5 states | 51,915 |

| AR Blue Cross - Medi-Pak Rx Basic (PDP) will become BlueMedicare Value Rx (PDP) |

AR | 19,920 |

Need a faster way to see if your Medicare Part D or Medicare Advantage plan is changing in 2021?

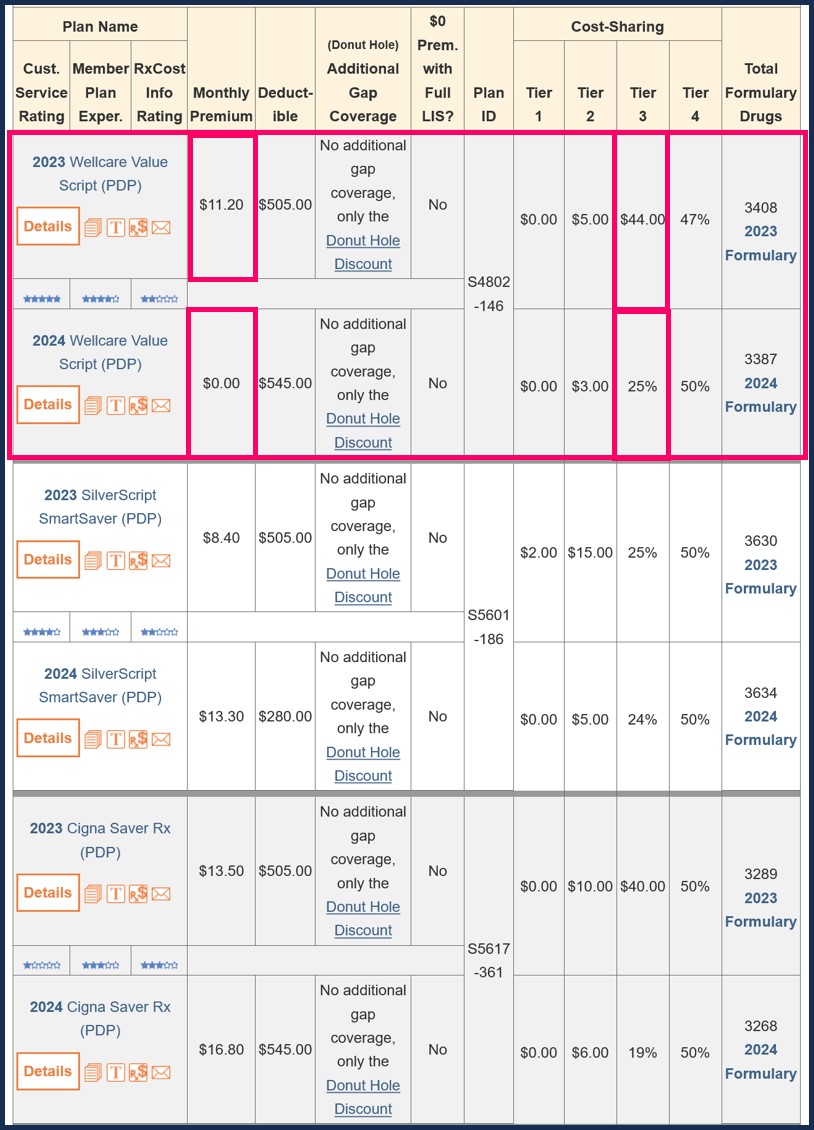

Our PDP-Compare and MA-Compare tools allow you to compare annual 2020/2021 changes in all stand-alone Medicare Part D prescription drug plans (PDPs) or Medicare Advantage plans (MAs or MAPDs) across the country showing changes in monthly premiums and plan design changes, as well as changes in co-payments or co-insurance rates for different drug tiers along with the most recent Medicare quality star ratings.

The following graphic shows an example of PDP-Compare plan name changes during the 2020/2021 annual Open Enrollment Period.

Not sure where to begin with all this information?

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2021 Medicare Part D and Medicare Advantage plan options.

Medicare beneficiaries can telephone Medicare at 1-800-633-4227, speak with a Medicare representative, and learn more about their 2021 Medicare Part D and Medicare Advantage plan options.

News Categories

Check for Savings Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service