Reminder of three important 2020 changes to Medicare Part D and Medicare Advantage plans that can affect your 2022 healthcare coverage

As a reminder, don’t forget that there were some key changes to the Medicare Part D and Medicare Advantage programs in 2020 and these changes are worth emphasizing as we head toward the 2022 annual Open Enrollment Period (AEP) and you may be considering your 2022 Medicare plan coverage.

(1) Medicare Advantage plan now accept members with ESRD or kidney failure.

Even if you are a Medicare beneficiary suffering from End-Stage Renal Disease (ESRD), you can join a Medicare Advantage plan. This new-in-2021 rule also applies to employer/union Medicare plans (EGHP), but, depending on your state, may not include Medicare Advantage Dual-Eligible Special Needs Plans (D-SNPs) and Medicare-Medicaid Plans (MMPs). You can click here for more details.

Please note, we now have more Medicare Advantage plan coverage details online within our Medicare Advantage Plan Finder (https://MA-Finder.com), including dialysis cost-sharing.

(2) Many Medicare drug plans cover insulin for only $35 per month.

As part of the Medicare Part D "Senior Savings Model", about 30% of 2021 Medicare prescription drug plans offer different types of insulin at a maximum co-pay of $35 per month throughout all phases of your drug coverage: deductible, initial coverage, and the Coverage Gap (or Donut Hole).

The coverage of insulin at a maximum copay of $35 per month can be provided by: (1) stand-alone Medicare Part D plans (PDPs) with enhanced alternative features, (2) Medicare Advantage plans that include drug coverage (MAPDs), and (3) Chronic Illness or Institutional Special Needs Plans (SNPs). You can click here to learn more.

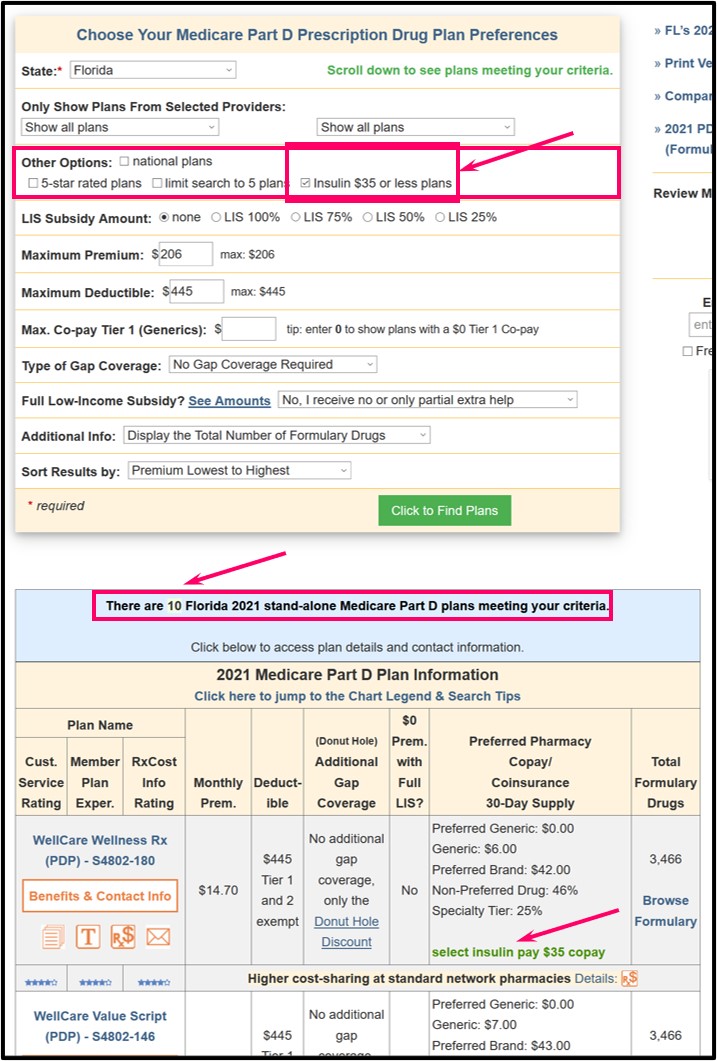

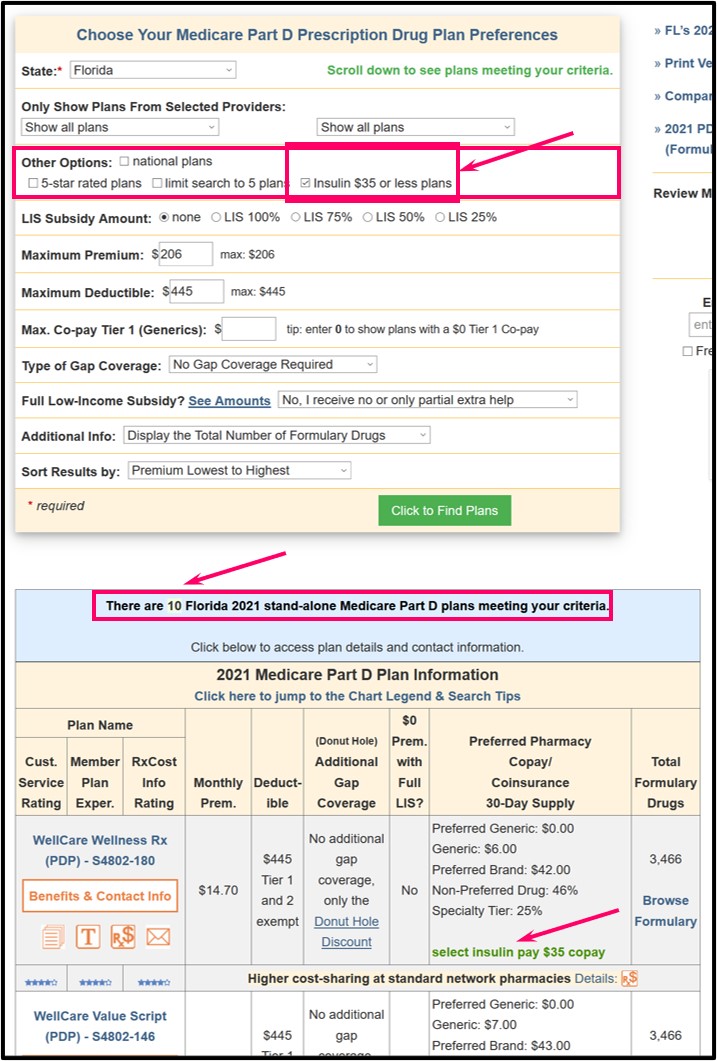

We updated our Medicare Part D Plan Finder (https://PDP-Finder.com) and our Medicare Advantage Plan Finder (https://MA-Finder.com) to include information about a plan’s participation in the Senior Savings Model.

For example, we have a "filter" at the top of the Plan Finder search box so you can check "Insulin $35 or less plans" to only see Medicare plans that include the Senior Savings Model (in this example, 10 Medicare Part D plans in Florida).

For more information about the $35 insulin coverage and examples of how to find Medicare Part D drug plans with $35 insulin coverage, please see our Frequently Asked Question "How will I know if my Medicare Part D drug plan covers insulin for $35 or less?"

For more information about the $35 insulin coverage and examples of how to find Medicare Part D drug plans with $35 insulin coverage, please see our Frequently Asked Question "How will I know if my Medicare Part D drug plan covers insulin for $35 or less?"

(3) Medicare Advantage plans can increase their maximum out-of-pocket limit (MOOP) to $7,550.

MOOP applies to in-network Medicare Part A and Medicare Part B eligible medical cost-sharing. Please note that local and regional PPO Medicare Advantage plans can have a combined maximum MOOP of $11,300 (in-network and out-of-network).

And this means: You may see your Medicare Advantage plan covered healthcare expenses increase slightly, but Part A & Part B expenses will not exceed $7,550 for in-network cost-sharing.

Key Take-Away: Be prepared to read your September 2021 Annual Notice of Change Letter (ANOC) to see if your 2022 MOOP is increasing – this may help you determine how much you need to budget in 2022 for in-network Medicare Part A and Medicare Part B coverage.

(1) Medicare Advantage plan now accept members with ESRD or kidney failure.

Even if you are a Medicare beneficiary suffering from End-Stage Renal Disease (ESRD), you can join a Medicare Advantage plan. This new-in-2021 rule also applies to employer/union Medicare plans (EGHP), but, depending on your state, may not include Medicare Advantage Dual-Eligible Special Needs Plans (D-SNPs) and Medicare-Medicaid Plans (MMPs). You can click here for more details.

Please note, we now have more Medicare Advantage plan coverage details online within our Medicare Advantage Plan Finder (https://MA-Finder.com), including dialysis cost-sharing.

(2) Many Medicare drug plans cover insulin for only $35 per month.

As part of the Medicare Part D "Senior Savings Model", about 30% of 2021 Medicare prescription drug plans offer different types of insulin at a maximum co-pay of $35 per month throughout all phases of your drug coverage: deductible, initial coverage, and the Coverage Gap (or Donut Hole).

The coverage of insulin at a maximum copay of $35 per month can be provided by: (1) stand-alone Medicare Part D plans (PDPs) with enhanced alternative features, (2) Medicare Advantage plans that include drug coverage (MAPDs), and (3) Chronic Illness or Institutional Special Needs Plans (SNPs). You can click here to learn more.

We updated our Medicare Part D Plan Finder (https://PDP-Finder.com) and our Medicare Advantage Plan Finder (https://MA-Finder.com) to include information about a plan’s participation in the Senior Savings Model.

For example, we have a "filter" at the top of the Plan Finder search box so you can check "Insulin $35 or less plans" to only see Medicare plans that include the Senior Savings Model (in this example, 10 Medicare Part D plans in Florida).

(3) Medicare Advantage plans can increase their maximum out-of-pocket limit (MOOP) to $7,550.

MOOP applies to in-network Medicare Part A and Medicare Part B eligible medical cost-sharing. Please note that local and regional PPO Medicare Advantage plans can have a combined maximum MOOP of $11,300 (in-network and out-of-network).

And this means: You may see your Medicare Advantage plan covered healthcare expenses increase slightly, but Part A & Part B expenses will not exceed $7,550 for in-network cost-sharing.

Key Take-Away: Be prepared to read your September 2021 Annual Notice of Change Letter (ANOC) to see if your 2022 MOOP is increasing – this may help you determine how much you need to budget in 2022 for in-network Medicare Part A and Medicare Part B coverage.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service