With this announcement, CMS established the 2018 standard Medicare Part D initial deductible, initial coverage limit (ICL), and Donut Hole limits.

As reference, a chart comparing the standard Medicare Part D benefit parameters from 2014 through 2018 is available at: Q1Medicare.com/2018.

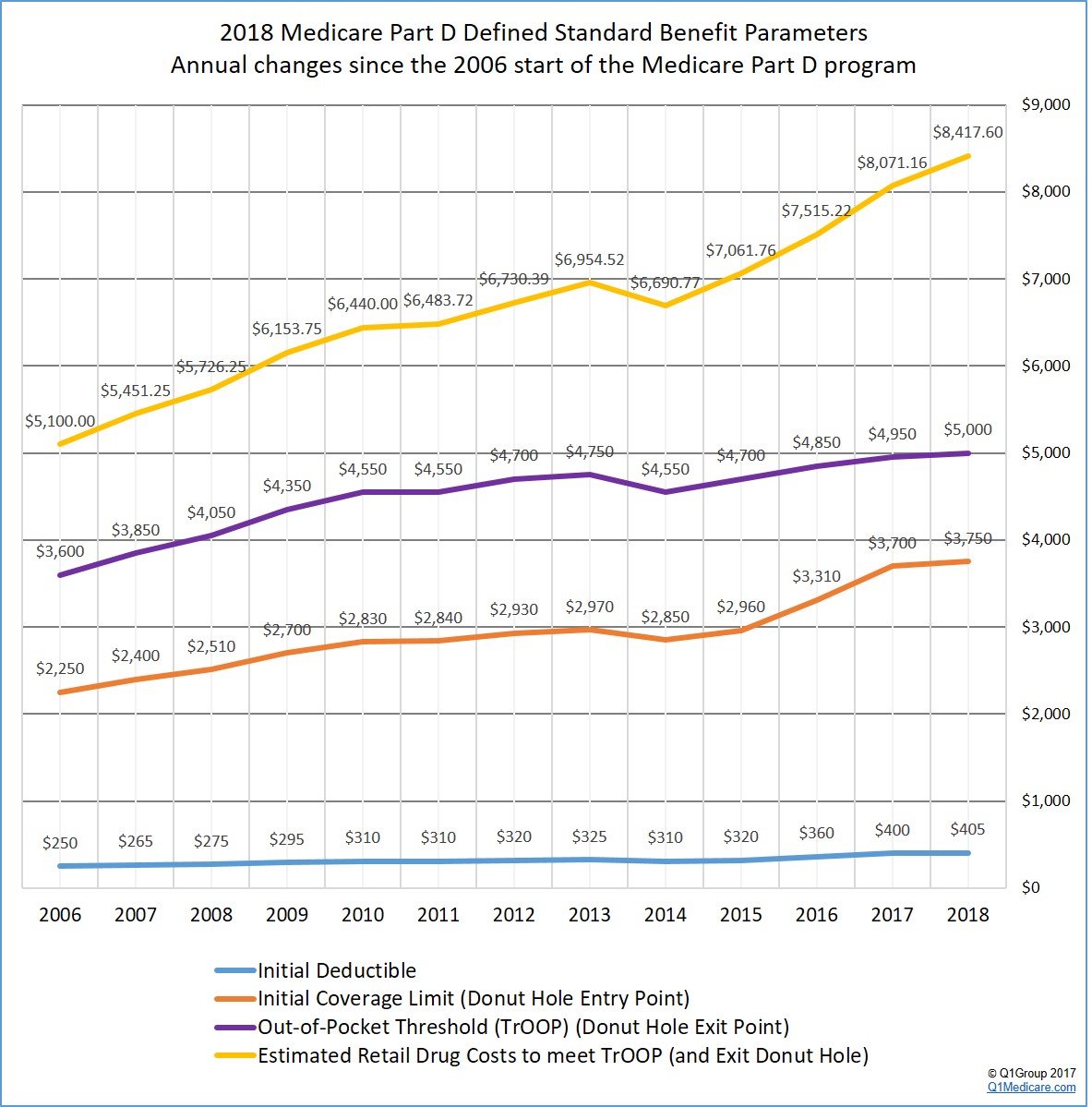

For an overview of past changes, you can click here for a chart comparing Medicare Part D standard benefit parameters from 2006 through 2018 or use: Q1Medicare.com/PartD-The-MedicarePartDOutlookAllYears.php.

Please note: The following graph shows the most-current 2018 Medicare Part D plan parameters and how they have changed since the 2006 beginning of the Medicare Part D program.

Here are a few highlights of the standard 2018 Medicare Part D prescription drug coverage based on the CMS 2018 Final Call Letter:

- The standard Medicare Part D Initial Deductible will increase only slightly.

The 2018 standard Initial Deductible will increase by only $5 to $405 from the current 2017 standard Initial Deductible of $400. As reference, the 2016 standard Initial Deductible was $360 and the 2015 Initial Deductible was $320.

As a reminder: The Initial Deductible is the amount that you pay out-of-pocket before your Medicare Part D plan begins to share the cost of coverage. Your Initial Deductible will not affect when you enter the Donut Hole or Coverage Gap, but will impact when you leave the Donut Hole and enter the Catastrophic Coverage phase.

This means: If you enroll in a Medicare Part D prescription drug plan with a standard $405 Initial Deductible, you will spend slightly more out-of-pocket in 2018 before your plan coverage begins. However, as we see in 2017, many popular Medicare Part D plans exclude lower-costing Tier 1 and Tier 2 drugs from the deductible, providing immediate coverage for some lower costing medications.

- The Initial Coverage Limit will increase by $50.

The 2018 Initial Coverage Limit (ICL) will increase $50 to $3,750 from the current 2017 ICL of $3,700. The 2016 Initial Coverage Limit was $3,310 and the 2015 Initial Coverage Limit was $2,960.

As a reminder: Medicare beneficiaries will leave the Initial Coverage Phase and enter the Donut Hole or Coverage Gap when the total negotiated retail value of their prescription drug purchases exceeds their plan’s Initial Coverage limit. So if you purchase a medication with a $100 retail cost and pay $30, the $100 counts toward meeting your ICL or Initial Coverage Limit.

This means: You will be able to buy slightly more medications before reaching the 2018 Donut Hole or Coverage Gap. Please note, if you purchase medications with an average retail value of less than $312 per month, you will not enter the 2018 Donut Hole.

- The 2018 Donut Hole discount will increase for generic drugs.

If you reach the 2018 Donut Hole or Coverage Gap phase of your Medicare Part D plan coverage, the 2018 generic drug discount will increase from 49% to 56%.

This means: If you are in the 2018 Donut Hole and your generic medication has a retail cost of $100, you will pay $44. And the $44 that you spend will count toward your 2018 out-of-pocket spending limit or TrOOP.

- The 2018 Donut Hole discount will increase for brand-name drugs.

The 2018 brand-name drug discount will increase from 60% to 65% and you will receive credit for 85% of the retail drug cost toward meeting your 2018 total out-of-pocket maximum or Donut Hole exit point (the 35% of retail costs you spend plus the 50% drug manufacturer discount).

This means: If you reach the 2018 Donut Hole and purchase a brand-name medication with a retail cost of $100, you will pay $35 for the medication, and receive $85 credit toward meeting your 2018 out-of-pocket spending limit – or Donut Hole exit point.

- Total Out-of-Pocket Costs or TrOOP will increase $50.

The 2018 TrOOP threshold will increase by only $50 to $5,000 from the current 2017 TrOOP limit of $4,950. As reference, the 2016 TrOOP limit was $4,850 and the 2015 TrOOP threshold value was $4,700.

As a reminder: TrOOP is the dollar figure you must spend (or someone else spends on your behalf) to get out of the Donut Hole or Coverage Gap and into the Catastrophic Coverage phase of your Medicare Part D plan. But, TrOOP does not include monthly premiums or IRMAA. As noted above, brand-name medication purchases in the 2018 Donut Hole are discounted by 65% (you pay 35%), but you will receive credit of 85% of the retail drug price toward meeting the 2018 TrOOP threshold.

This means: You will have to spend just slightly more to get out of the 2018 Donut Hole than you did in 2017. If you purchase only generic medications while in the Donut Hole, you would be able purchase medications worth a retail value of around $7,509 before reaching your TrOOP or exiting the Donut Hole and entering Catastrophic Coverage. Based on past drug purchases, CMS estimates that most people will use a mix of 10.8% generics and 89.2% brand name drugs during the Donut Hole, and so following with these estimates, you would have to purchase prescriptions with a retail value of around $8,472 before existing the 2018 Donut Hole.

So, on average, if a person purchases medications with a total retail cost of over $702 per month, they will exit the Donut Hole and enter the Catastrophic Coverage phase of their Medicare Part D plan. If you only purchase generic medications, you would need to purchase generic medications with an average retail value of $626 per month before exiting the 2018 Donut Hole.

Not sure how the Donut Hole or Coverage Gap works with your Medicare Part D coverage?

To help you visualize how your drug spending relates to your Medicare Part D plan coverage, we have our updated 2018 Donut Hole calculator found at PDP-Planner.com/2018. Our Donut Hole calculator helps you estimate what you can expect to pay throughout the different phases of your 2018 Medicare Part D plan coverage. As a default we use the CMS assumption that you will use 89.2% brand drugs and 10.8% generic drugs. You can change your mix of prescriptions to be 100% generic or 100% brand. To get you started, you can click here to see an example of the 2018 Medicare prescription drug plan phases for someone with $800 per month brand drug retail cost.

- The minimum cost-sharing in the Catastrophic Coverage phase will increase slightly.

In the 2018 Catastrophic Coverage phase, you pay a minimum of $8.35 for brand drugs or $3.35 for generics (or 5%, whichever is higher). In 2017 Catastrophic Coverage you pay a minimum of $8.25 for brand drugs or $3.30 for generics.

As a reminder: Once someone has exceeded their TrOOP threshold, they will exit the Donut Hole or Coverage Gap and enter the 2018 Catastrophic Coverage phase

This means: Based on CMS drug purchase estimates, if your monthly retail costs are over $702 per month, you will exit the 2018 Donut Hole and enter Catastrophic Coverage portion of your Medicare Part D plan. If you exit the 2018 Donut Hole and purchase a generic drug with a retail price of $100, you will pay the greater of $3.35 or 5% of $100 (in this case, you will pay $5 since this is greater than $3.35). If you exit the 2018 Donut Hole and purchase a brand name drug with a retail price of $100, you will pay the greater of $8.35 or 5% of $100 (in this case, you will pay $8.35 since this is greater than $5). If you exit the 2018 Donut Hole and purchase a brand name drug with a retail price of $5,000, you will pay the greater of $8.35 or 5% of $5,000 (in this case, you pay $250 since this is greater than $8.35).

- No 2018 Medicare Advantage plan can have an in-network Maximum Out-of-Pocket (MOOP) spending limit over $6,700.

CMS sets a limit on how high a Medicare Advantage plan can set their Medicare Part A and Medicare Part B Maximum Out-of-Pocket limit (MOOP) and, as in 2017, 2016 and 2015, no Medicare Advantage plan can have a MOOP higher than $6,700 for in-network eligible medical cost-sharing (and mandatory MOOP limits might range from $3,401 to $6,700). Please note that local and regional PPO (Preferred Provider Organization) Medicare Advantage plans can have a combined maximum MOOP of $10,000 (in-network and out-of-network).

This means: Although your Medicare Advantage plan can raise your maximum out-of-pocket spending limit (MOOP) in 2018, you can expect that your Medicare Advantage plan covered healthcare expenses will not exceed $6,700 for in-network cost-sharing. (Key Point: Be prepared to read your October 2017 Annual Notice of Change Letter to see if your MOOP increased - this may help you determine how much you need to budget in 2018 for in-network Medicare Part A and Medicare Part B coverage.)

Question: Will all 2018 Medicare Part D prescription drug plans follow these new plan limits?

No. The Medicare Part D defined standard benefit parameters are released each year by Medicare and set minimum standards for next year’s Medicare Part D prescription drug plan coverage. However, Medicare Part D providers are allowed to deviate from the defined standard benefits and offer Medicare Part D prescription drug plans with more enhanced features such as a $0 initial deductible, lower Initial Coverage Limit, or additional coverage in the Donut Hole or Coverage Gap. For example, you can click here to see an analysis of how many 2017 Medicare Part D plans offered a $0 deductible as compared to the standard 2017 initial deductible of $400.

Question: When will we be able to see the actual 2018 Medicare Part D and Medicare Advantage plans?

CMS will publish the 2018 Medicare plan information in late-September or early-October.Some Medicare Part D and Medicare Advantage plan providers have their 2018 Medicare Part D and Medicare Advantage plan information prepared earlier in the year and these providers often share a basic overview of their upcoming plan information with their agents and brokers. However, 2018 Medicare plan information will not be released until the end of September or the start of October.

You can watch your mail in late-September for a printed copy of the 2018 Medicare & You Handbook that includes information about the Medicare Part D and Medicare Advantage plans offered in your service area. During this same time (late-September), you can also watch your mail for your Medicare plan's Annual Notice of Change (ANOC) letter that will detail how your 2017 Medicare plan is changing in 2018.

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service