Q1Group 2017 MA/MAPD Analysis: Changes in the 2017 Medicare Advantage Special Needs Plan (SNP) landscape still result in a net gain of 2017 SNPs

More discontinued Special Needs Plans (SNPs) in 2017

Over 22% of the 2016 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2017 as compared to 24% of the 2015 Special Needs Plans that were discontinued in 2016.

And on the positive side ...

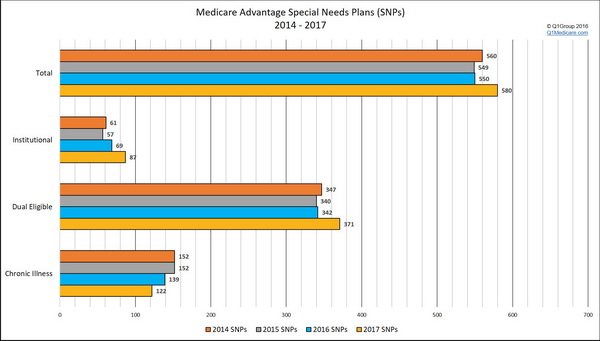

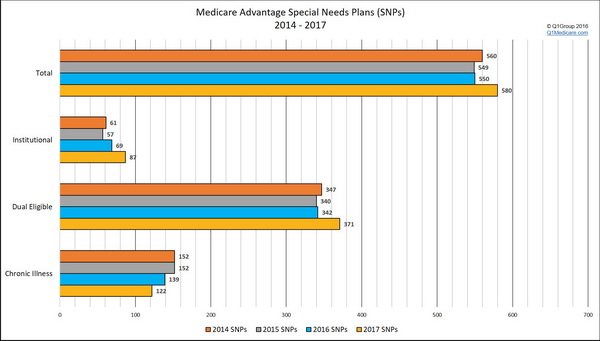

The good news is that there is a large number of new SNPs being introduced in 2017. Overall, there is a net increase of 30 SNPs for 2017. There will be a net loss of Chronic Illness SNPs, but an increase in the number Dual Eligible and Institutional SNPs.

As background, Special Needs Plans are a type of Medicare Advantage plan with benefits, provider choices, and drug formularies (list of covered drugs) designed to best meet the specific needs of a particular group of people who meet certain requirements such as people suffering from a chronic condition or have limited income and assets. You cannot join a Medicare Advantage SNP unless you qualify for the plan’s “Special Need”.

SNPs are divided into three major types of special needs:

You can learn more about the 2017 SNPs that are available in your area by using our Medicare Advantage plan finder (MA-Finder.com/2017 or add your ZIP code MA-Finder.com/2017/90001).

You can learn more about the 2017 SNPs that are available in your area by using our Medicare Advantage plan finder (MA-Finder.com/2017 or add your ZIP code MA-Finder.com/2017/90001).

Here is an example of all 2017 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate 100% for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full-dual eligible Medicare/Medicaid beneficiaries.

The counties with the most Special Needs Plans available are in the State of New York.

Medicare Advantage Chronic Illness Special Needs Plans can be further divided into the type of chronic illness that the plan is designed to address.

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see a small over all increase in reach, although availability is not as widespread as it was in 2013. There is a notable increase in both dual eligible and institutional SNPs and continuation in the decline in the number of chronic illness SNPs.

You can use our MA-Finder to review all 2017 Medicare Advantage Special Needs Plans available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

Reminder: SNPs tailor their benefits, provider choices, and drug formularies (list of covered drugs) to best meet the specific needs of the groups they serve. Medicare SNPs limit plan membership to people with specific diseases or characteristics -- you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

Over 22% of the 2016 Medicare Advantage Special Needs Plans (SNPs) will be discontinued in 2017 as compared to 24% of the 2015 Special Needs Plans that were discontinued in 2016.

And on the positive side ...

The good news is that there is a large number of new SNPs being introduced in 2017. Overall, there is a net increase of 30 SNPs for 2017. There will be a net loss of Chronic Illness SNPs, but an increase in the number Dual Eligible and Institutional SNPs.

As background, Special Needs Plans are a type of Medicare Advantage plan with benefits, provider choices, and drug formularies (list of covered drugs) designed to best meet the specific needs of a particular group of people who meet certain requirements such as people suffering from a chronic condition or have limited income and assets. You cannot join a Medicare Advantage SNP unless you qualify for the plan’s “Special Need”.

SNPs are divided into three major types of special needs:

- Chronic Illness SNPs (like diabetes),

- Dual Eligible D-SNPs (for Medicare and Medicaid beneficiaries), and

- Institutional SNPs (for Nursing and Long Term Care (LTC) residents).

| 2017 Special Needs Plans by Type of Special Need |

||||||||

| SNP Type | 2017 Plans | 2016 Plans | Net Change | % Net Change | Dropped Plans | % of '16 SNPs Dropped | 2015 Plans | 2014 Plans |

| Chronic Illness | 122 | 139 | -17 | -12% | 39 | 28% | 152 | 152 |

| Dual Eligible | 371 | 342 | 29 | 8% | 66 | 19% | 340 | 347 |

| Institutional | 87 | 69 | 18 | 26% | 17 | 25% | 57 | 61 |

| Total | 580 | 550 | 30 | 5% | 122 | 22% | 549 | 560 |

The chart below summarizes the 2017 Special Needs Plan landscape in comparison to 2016.

Here is an example of all 2017 Special Needs Plans available in Allegheny County, PA.

Please note, if you are using our MA-Finder and looking for a Dual-Eligible Medicare/Medicaid SNP (D-SNP), be sure to indicate 100% for the "LIS Subsidy Amount" to see the actual D-SNP monthly premiums for full-dual eligible Medicare/Medicaid beneficiaries.

The counties with the most Special Needs Plans available are in the State of New York.

| Counties with the Largest Number of 2017 Special Needs Plans |

|

| Locations | SNPs |

| Queens County, NY | 37 |

| Bronx County, NY | 35 |

| Kings County, NY | 35 |

| New York County, NY | 35 |

| Miami-Dade County, FL | 34 |

| Los Angeles County, CA | 32 |

| Broward County, FL | 31 |

| Richmond County, NY | 28 |

| Nassau County, NY | 27 |

| Pinellas County, FL | 27 |

Medicare Advantage Chronic Illness Special Needs Plans can be further divided into the type of chronic illness that the plan is designed to address.

| 2017 Special Needs – Chronic Illness Plans Compared to the 2016 Plan Year |

|||||

| Chronic Illness | Number of SNPs | ||||

| 2017 Plans | 2016 Plans | Change | 2015 Plans | 2014 Plans | |

| Cardiovascular Disorders | 3 | 3 | 0 | 51 | 3 |

| Cardiovascular Disorders & Chronic Heart Failure | 14 | 14 | 0 | 18 | 17 |

| Cardiovascular Disorders, Chronic Heart Failure & Diabetes | 49 | 49 | 0 | ||

| Chronic and Disabling Mental Health Conditions | 2 | 2 | 0 | 3 | 2 |

| Chronic Heart Failure | 4 | 4 | 0 | 4 | 2 |

| Chronic Heart Failure & Diabetes | 7 | 7 | 0 | 58 | 41 |

| Chronic Lung Disorders | 13 | 13 | 0 | 13 | 15 |

| Dementia | 2 | 2 | 0 | 2 | 2 |

| Diabetes Mellitus | 29 | 36 | -7 | 46 | 55 |

| End-stage Renal Disease Requiring Dialysis (any mode of dialysis) | 10 | 10 | 0 | 5 | 5 |

| HIV/AIDS | 3 | 3 | 0 | 4 | 6 |

| Total Chronic Illness SNPs | 136 | 143 | -7 | 204 | 148 |

When comparing SNP reach (SNP plan multiplied by counties in the plan’s service area) we see a small over all increase in reach, although availability is not as widespread as it was in 2013. There is a notable increase in both dual eligible and institutional SNPs and continuation in the decline in the number of chronic illness SNPs.

| 2017 Special Needs Plan Reach by Type of Need |

|||||||

| SNP Type | 2017 | 2016 | Change '16 to '17 |

Percent Change '16 to '17 |

2015 | 2014 | 2013 |

| Chronic Illness | 2,108 | 2,551 | -443 | -17% | 2,978 | 2,611 | 6,402 |

| Dual Eligible | 6,364 | 5,594 | 770 | 14% | 5,342 | 4,973 | 5,284 |

| Institutional | 732 | 556 | 176 | 32% | 450 | 439 | 537 |

| Total | 9,204 | 8,701 | 503 | 6% | 8,770 | 8,023 | 12,223 |

You can use our MA-Finder to review all 2017 Medicare Advantage Special Needs Plans available in your area (just enter your ZIP code after clicking on the link or go to MA-Finder.com to start.)

Reminder: SNPs tailor their benefits, provider choices, and drug formularies (list of covered drugs) to best meet the specific needs of the groups they serve. Medicare SNPs limit plan membership to people with specific diseases or characteristics -- you must meet (and continue to meet) the plan's "Special Need" to be eligible for enrollment.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service