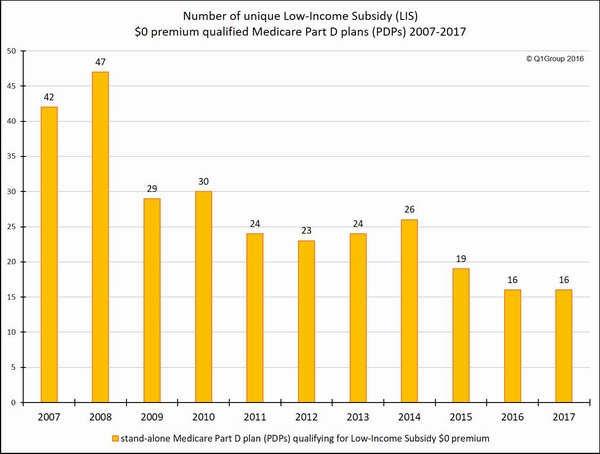

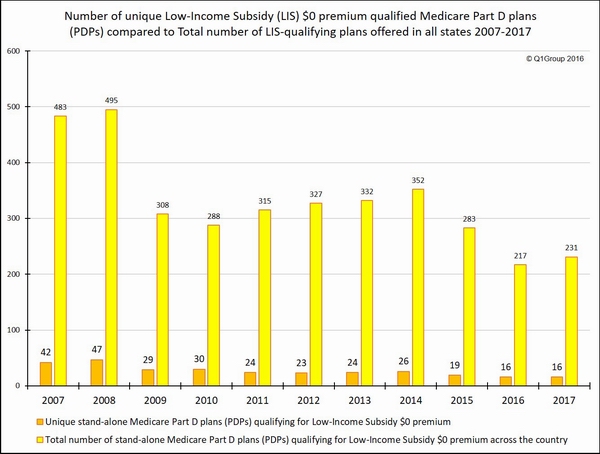

Based on the recently released Centers for Medicare and Medicaid Services (CMS) 2017 Medicare Part D landscape data, the same number of unique 2017 Medicare Part D plans qualify for the state’s Low-Income Subsidy (LIS) $0 premium as we found in 2016.

On our national stand-alone PDP-Facts page, you can scroll to the bottom to see a table showing the 2016 and 2017 Medicare Part D plans (sorted by Plan ID) qualifying for the $0 premium Low-Income Subsidy.

And, although fewer stand-alone 2017 Medicare Part D plans are being offered, more stand-alone 2017 Medicare Part D plans are qualifying for the state benchmark Low-Income Subsidy (LIS) $0 premiums.

As an example of state plan changes, Arkansas will offer 5 LIS $0 premium qualifying 2017 Medicare Part D plans as compared to the 4 LIS-qualifying plans last year and 12 plans offered back in 2014.

The state(s) with the smallest selection of LIS $0 qualifying plans is ...

The state offering the smallest selection of $0 premium 2017 LIS-qualifying Medicare Part D plans is Florida, offering three (3) $0-premium LIS plans (the same number of stand-alone Medicare Part D plans offered in 2016 ).

In 2016, the state offering the smallest selection of $0 premium LIS plans was Hawaii, with 2 qualifying plans (down from 9 plans in 2015). However, in 2017 Hawaii, added three additional Medicare Part D plans qualifying for the $0 premium, increasing the state’s full-LIS $0 qualifying 2017 PDPs to five.

The state(s) with the largest selection of LIS $0 qualifying plans is ...

The states (territories) offering the largest selection of ten (10) $0 premium LIS plans in 2017 is: Washington DC, Delaware, Maryland, and Arizona.

In comparison to 2017, in 2015, the states with the largest selection of LIS $0 premium plans were Alabama, Arizona, Idaho, Tennessee, and Utah, all with 12 Medicare Part D plans qualifying for the 2015 LIS $0 premium.

The state with the largest number of LIS recipients is ...

The state with the most Medicare beneficiaries qualifying for the low-income subsidy is California (almost 1.4 million “Extra Help” recipients). In 2017, California LIS recipients will again have six Medicare Part D plan choices qualifying for the $0 premium.

A few more 2017 LIS $0 premium facts:

- Seven (7) states are losing one LIS $0 premium plan

- Eighteen (18) states have no change in the number of LIS $0 premium plans being offered

- Twenty-three (23) states are gaining one LIS $0 premium plan

- North and South Carolina are both gaining two LIS $0 premium plans

Which Medicare Part D plans qualify for the full Low-Income Subsidy $0 premium in your state?

Each year, insurance companies adjust their Medicare Part D plan premiums, and some Medicare Part D plans raise their premiums and move their prescription drug plans above the state low-income subsidy (LIS) benchmark limits, while other Part D plan sponsors lower their monthly premiums so that their plans can qualify for a state’s $0 premium.

This means that the number of Medicare Part D plans qualifying for the LIS $0 premium can change each year.

More on Medicare Part D Extra Help

The Medicare Part D Extra Help or the Low-Income Subsidy (LIS) is a federal program helping low-income Medicare beneficiaries pay a portion of their Medicare Part D prescription drug costs. Based on a person’s income and financial resources, the Extra Help or LIS program pays all or part of a person’s monthly Medicare Part D plan premiums and a significant portion of the beneficiary’s medication costs.

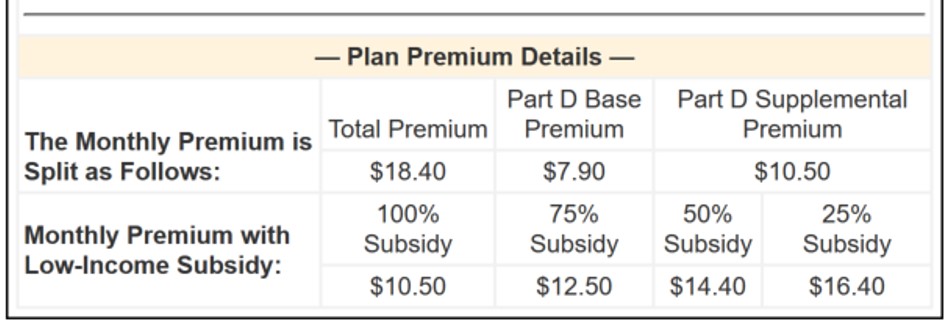

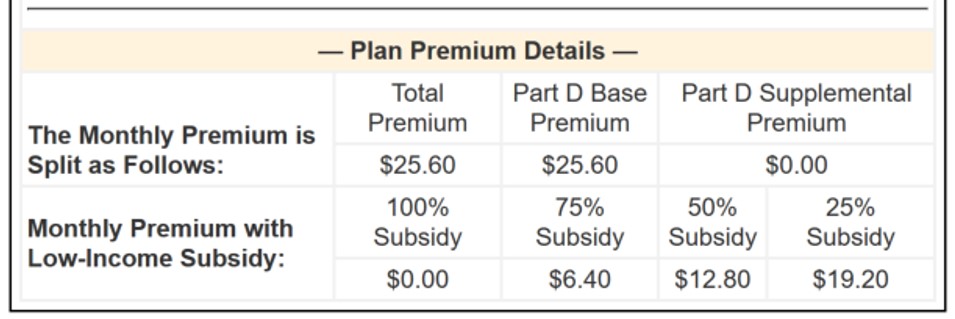

If you qualify for the full-LIS program, you can choose a Medicare Part D plan that qualifies for your state’s $0 monthly premium or allow yourself to be automatically enrolled in a plan that qualifies for the $0 premium. If you enroll in a Medicare Part D plan that does not qualify for the $0 premium, you will pay a portion of the premium. The monthly premium amount you will pay is shown under the "Benefit Details" button on our Medicare Part D plan finder.

As can be seen in the above graphic, if you qualify for only partial-LIS benefits (such as 50% LIS), you will also only pay a portion of the plan's monthly premium.

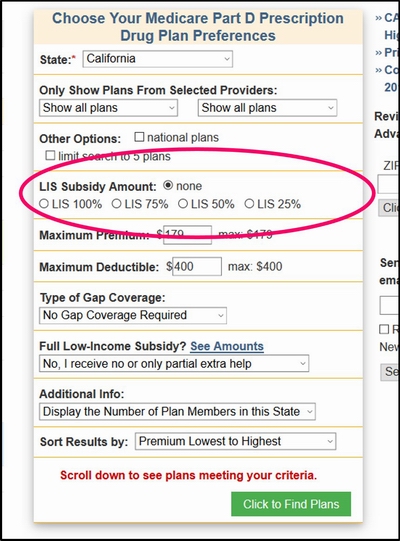

Please note, our Medicare Part D plan finder allows you to view the premiums of a Medicare Part D plan based on whether you receive full- or partial-LIS benefits.

The 2017 PDP-Finder.com feature looks like this:

A Brief note about automatic plan reassignment and people who are "choosers"

Because of changes in the annual Medicare Part D plan premiums and state LIS benchmarks, some full low-income subsidy qualifying Medicare beneficiaries (such as people who are Medicare / Medicaid dual-eligible beneficiaries) may be automatically reassigned to new 2017 Medicare Part D plans that will still qualify for the $0 monthly premium.

However, Extra Help recipients who "chose" their own plan in the past (or "choosers") may not be auto-reassigned to a new 2017 LIS qualifying plan and may need to select a new 2017 Medicare Part D plan or Medicare Advantage plan that includes drug coverage that still meets the $0 monthly premium threshold (or pay the small monthly premium). As reference, you can use our PDP-Finder to see LIS qualifying plans in your state. Be sure to select “Yes, show only plans that qualify for $0 premium". Click here to see an example for Texas.

Not sure where to begin?

For more information on Medicare Part D plans that qualify for your state's low-income $0 premium benchmark, please call Medicare toll-free at 1-800-633-4227 and speak with a Medicare representative to learn more about your Medicare Part D and Medicare Advantage plan options.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service