Q1Group 2019 PDP Analysis: Most 2019 stand-alone Medicare Part D prescription drug plans will have some initial deductible ranging from $15 to $415

About 71% of all 2019 stand-alone Medicare Part D prescription drug plans will have an initial deductible ranging from $15 to $415. (Remember, you usually pay 100% of your initial deductible before your Medicare Part D plan begins to provide coverage - but, see the exceptions below when a plan may exclude low-costing formulary Tiers from the deductible.)

As background, the standard or model CMS 2019 Medicare Part D plan includes a $415 initial deductible (as compared to the standard $405 initial deductible in 2018 Medicare Part D plans) and many stand-alone 2019 Medicare Part D prescription drug plans (PDPs) will follow this CMS standard Medicare Part D plan design - although, 2019 initial deductible can range from $15 to $415.

As a state-specific example, of the 26 stand-alone 2019 Medicare Part D plans available in Ohio, 18 plans will have an initial deductible ranging from $100 to $415, and eight (8) stand-alone Medicare Part D plans will have a $0 initial deductible. You can see our PDP-Facts.com/2019 for Medicare Part D premium information in your state.

How many stand-alone 2019 Medicare Part D plans will have the $415 standard Initial Deductible?

Approximately 52% of all 2019 stand-alone Medicare Part D plans (468 of the 901 PDPs) will have a $415 initial deductible (or more specifically, of all the 2019 PDPs having an initial deductible (638 PDPs), 73% will have the standard deductible of $415). In comparison, approximately 48% of all 2018 stand-alone Medicare Part D plans (403 of the 782 PDPs) had a $405 standard initial deductible.**

The $0 initial deductible Medicare Part D plan losing favor over time.

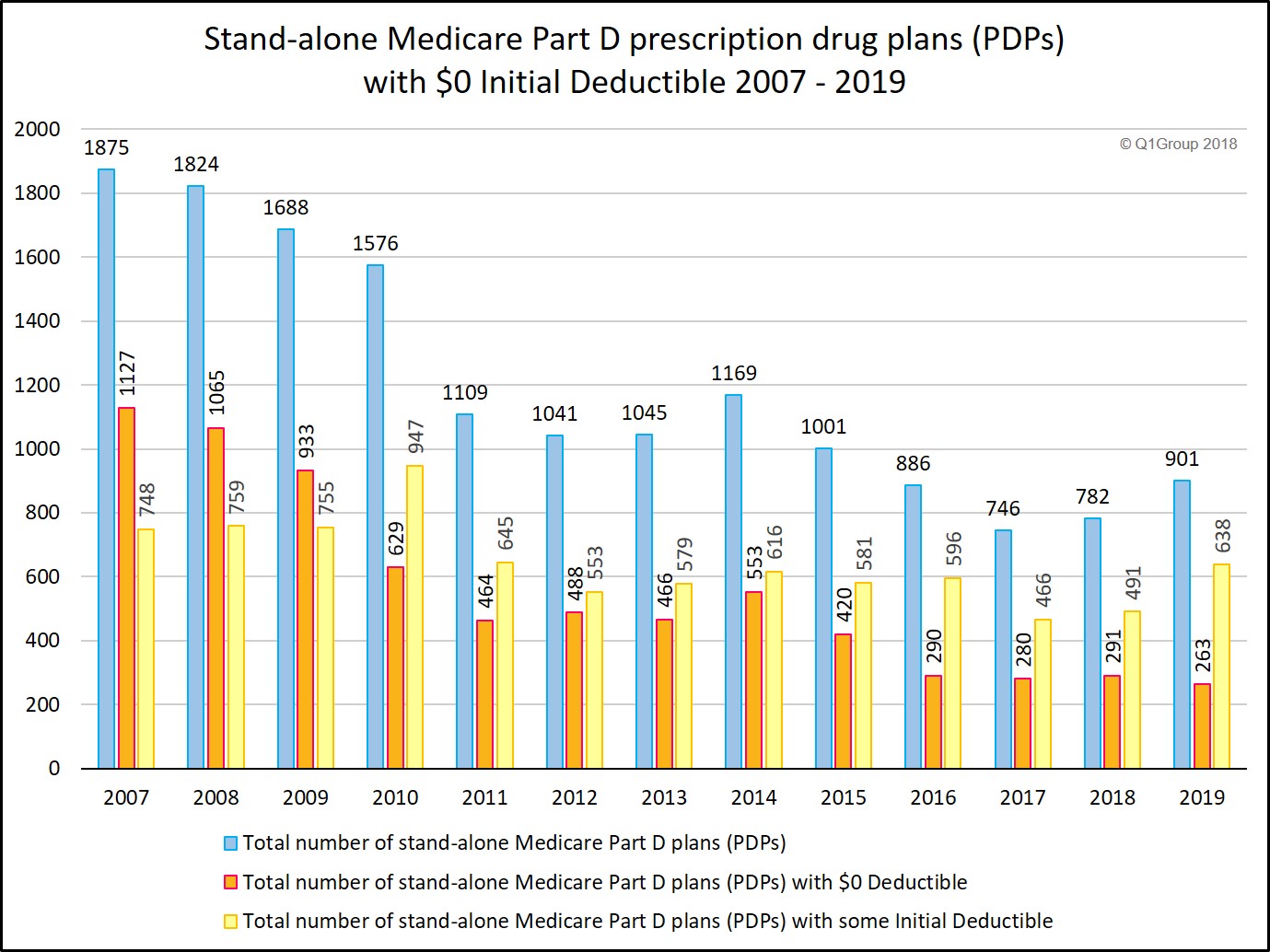

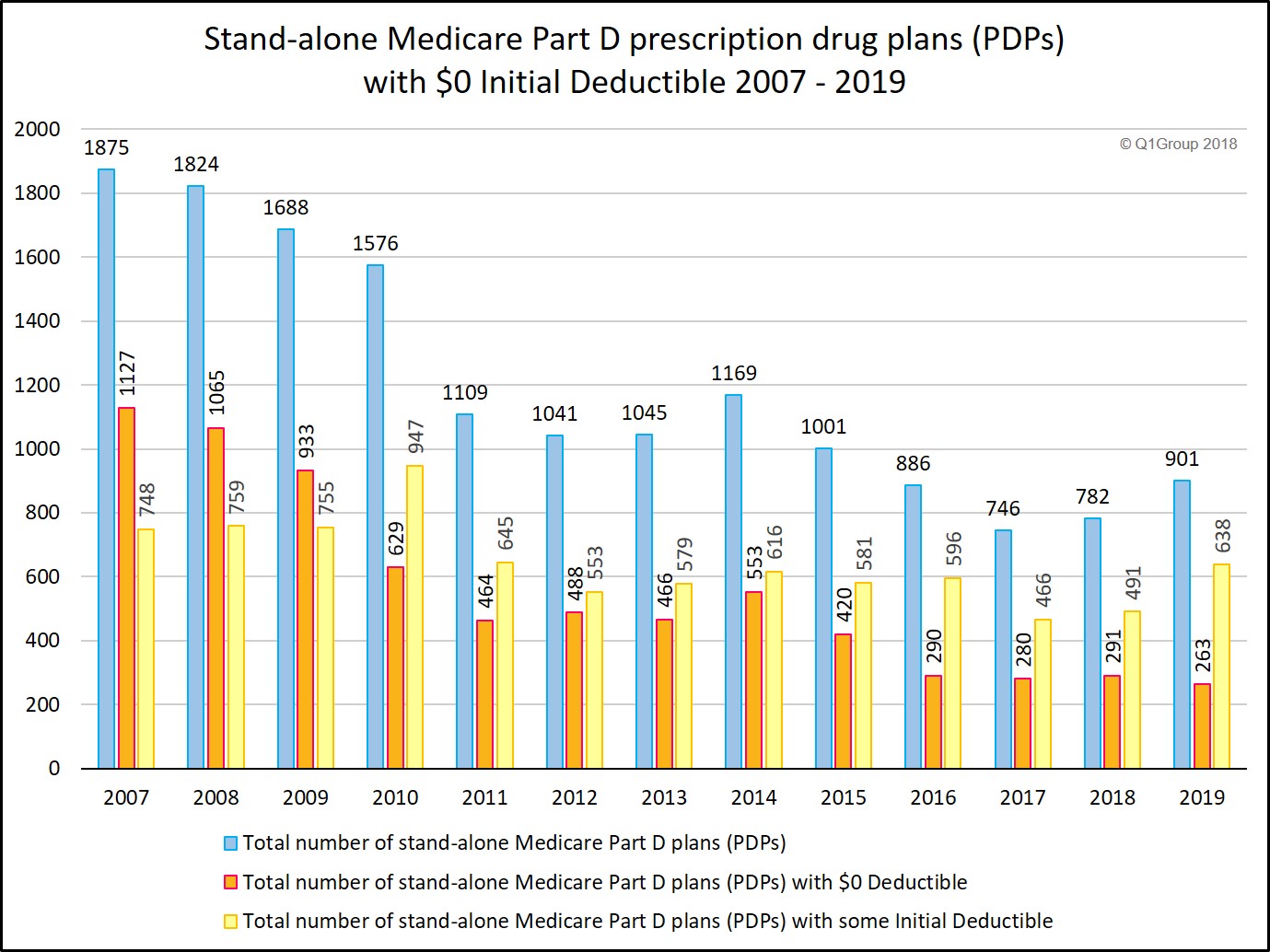

In fact, according to our calculations, only 29% of all 2019 stand-alone Medicare Part D plans will offer a $0 initial deductible (as compared to 37% of the 2018 Medicare Part D plans - and looking way back, compared to 60% of 2007 PDPs that had a $0 deductible).**

Here is a chart showing the changes of Medicare Part D plan designs since 2007 with fewer Medicare Part D plans now offering a $0 initial deductible.

** Please note that we are not considering Medicare Part D prescription drug plans (PDPs) in U.S. Territories or Puerto Rico.

2019 Medicare Part D plans with some Formulary Tiers excluded from the Initial Deductible

For example, the 2018 Humana Walmart Rx Plan has a $405 initial deductible with some of the generic formulary medications excluded from the deductible.

How does this work? This means that, if you were still within your $405 initial deductible and purchase a medication such as Atorvastatin Calcium (generic Lipitor®), you would not pay full retail price, but would instead be charged only a copayment for this generic medication (when purchased at one of the Medicare Part D plan’s preferred network pharmacy -- such as a Walmart pharmacy). And as always, if your Medicare Part D plan’s cost-sharing is more than your drug’s retail price, then you pay the lesser retail price (you never pay more than your negotiated retail price).

Reminder: Your Medicare plan costs and coverage can (and probably will) change each year.

If you are interested in changing your Medicare plan enrollment, the annual Open Enrollment Period (or Annual Election Period) for Medicare Advantage plans and Medicare Part D drug plans begins on October 15 and continues through December 7, 2018.

Not sure where to begin?

If you or another Medicare beneficiary needs assistance understanding how your 2018 Medicare plan is changing or to learn more about your 2019 Medicare plan coverage options, please call 1-800-MEDICARE (1-800-633-4227) and speak with a Medicare representative.

As background, the standard or model CMS 2019 Medicare Part D plan includes a $415 initial deductible (as compared to the standard $405 initial deductible in 2018 Medicare Part D plans) and many stand-alone 2019 Medicare Part D prescription drug plans (PDPs) will follow this CMS standard Medicare Part D plan design - although, 2019 initial deductible can range from $15 to $415.

As a state-specific example, of the 26 stand-alone 2019 Medicare Part D plans available in Ohio, 18 plans will have an initial deductible ranging from $100 to $415, and eight (8) stand-alone Medicare Part D plans will have a $0 initial deductible. You can see our PDP-Facts.com/2019 for Medicare Part D premium information in your state.

How many stand-alone 2019 Medicare Part D plans will have the $415 standard Initial Deductible?

Approximately 52% of all 2019 stand-alone Medicare Part D plans (468 of the 901 PDPs) will have a $415 initial deductible (or more specifically, of all the 2019 PDPs having an initial deductible (638 PDPs), 73% will have the standard deductible of $415). In comparison, approximately 48% of all 2018 stand-alone Medicare Part D plans (403 of the 782 PDPs) had a $405 standard initial deductible.**

The $0 initial deductible Medicare Part D plan losing favor over time.

In fact, according to our calculations, only 29% of all 2019 stand-alone Medicare Part D plans will offer a $0 initial deductible (as compared to 37% of the 2018 Medicare Part D plans - and looking way back, compared to 60% of 2007 PDPs that had a $0 deductible).**

Here is a chart showing the changes of Medicare Part D plan designs since 2007 with fewer Medicare Part D plans now offering a $0 initial deductible.

** Please note that we are not considering Medicare Part D prescription drug plans (PDPs) in U.S. Territories or Puerto Rico.

2019 Medicare Part D plans with some Formulary Tiers excluded from the Initial Deductible

As was true in 2018, a number of stand-alone 2019 Medicare Part D plans having an initial

deductible should exclude some of their formulary tiers from the initial deductible and provide

immediate coverage for these drugs, even though the initial deductible is not met.

For example, your Medicare Part D plan may have a $415 initial deductible, but your Tier 1 and Tier 2 formulary drugs are excluded from the deductible, meaning you do not need to pay the $415 before getting coverage for these lower-costing drugs.

For example, the 2018 Humana Walmart Rx Plan has a $405 initial deductible with some of the generic formulary medications excluded from the deductible.

How does this work? This means that, if you were still within your $405 initial deductible and purchase a medication such as Atorvastatin Calcium (generic Lipitor®), you would not pay full retail price, but would instead be charged only a copayment for this generic medication (when purchased at one of the Medicare Part D plan’s preferred network pharmacy -- such as a Walmart pharmacy). And as always, if your Medicare Part D plan’s cost-sharing is more than your drug’s retail price, then you pay the lesser retail price (you never pay more than your negotiated retail price).

Reminder: Your Medicare plan costs and coverage can (and probably will) change each year.

If you are interested in changing your Medicare plan enrollment, the annual Open Enrollment Period (or Annual Election Period) for Medicare Advantage plans and Medicare Part D drug plans begins on October 15 and continues through December 7, 2018.

Not sure where to begin?

If you or another Medicare beneficiary needs assistance understanding how your 2018 Medicare plan is changing or to learn more about your 2019 Medicare plan coverage options, please call 1-800-MEDICARE (1-800-633-4227) and speak with a Medicare representative.

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service