2023 Medicare Part D Late-Enrollment Penalty rate will decrease - but maximum penalties can reach up to $783 for the year.

If you join a Medicare Part D prescription drug plan after you were first eligible

for Medicare coverage - or you were without Medicare drug coverage for a

period of more than 63 days - and you did not have any other creditable prescription coverage - then you may* be assessed a Medicare Part D late enrollment premium penalty (LEP). The penalty is an

additional amount you will pay every month for Part D coverage along with your monthly Part D plan's (PDP or MAPD) premium.

What is considered creditable drug coverage?

"Creditable drug coverage" is any prescription coverage that is at least as good as basic Medicare Part D prescription drug coverage - and if you have some form of creditable drug coverage, you do not need to join a Medicare Part D plan and will not be assessed a late-enrollment penalty if you someday choose to add Part D prescription drug coverage. Some examples of creditable drug coverage include VA (Veterans Administration) drug coverage, TRICARE, or employer/union drug coverage (but check with your employer / union health plan administrator to verify your drug coverage is "creditable" for purposes of Medicare Part D).

How is the Medicare Part D Late-Enrollment Penalty Calculated?

The LEP is calculated as 1% of the national base Medicare Part D premium for each month you were without some form of creditable prescription drug coverage. For example, if you did not have drug coverage the first year you were eligible for Medicare, you would pay a penalty of 12% (for 12 months without drug coverage) of the national base premium ($32.74 in 2023) or $3.90 per month in addition to your Medicare drug plan premium.

How long does someone pay a Late-Enrollment Penalty?

The late-enrollment penalty is permanent and you will pay the penalty (adjusted each year for the annual base Medicare Part D premium) as long as you have Medicare drug coverage.

Your Part D Late-Enrollment Penalty can change every year.

The Centers for Medicare and Medicaid Services (CMS) calculates and releases the national base Medicare Part D premium each year and in 2023, the national base Medicare Part D premium is $32.74 a decrease as compared the 2022 base premium of $33.37.

As reference, the following chart shows each year's national base Medicare Part D premium -- that is used to calculate late-enrollment penalties since 2006.

More about calculating your Medicare Part D late-enrollment penalty

As noted, the Medicare Part D late-enrollment premium penalty (LEP) is an additional monthly cost paid by Medicare Part D beneficiaries who did not enroll in a Medicare Part D prescription drug plan when they were first eligible and did not have any other form of "creditable" prescription drug coverage, or who were without "creditable" prescription drug coverage for more than 63 days. Although the number of months used to calculate a late-enrollment penalty may remain constant (for instance, 12 months), as noted above, the base Medicare Part D premium changes year-to year - so your monthly penalty can also change every year.

What is considered creditable drug coverage?

"Creditable drug coverage" is any prescription coverage that is at least as good as basic Medicare Part D prescription drug coverage - and if you have some form of creditable drug coverage, you do not need to join a Medicare Part D plan and will not be assessed a late-enrollment penalty if you someday choose to add Part D prescription drug coverage. Some examples of creditable drug coverage include VA (Veterans Administration) drug coverage, TRICARE, or employer/union drug coverage (but check with your employer / union health plan administrator to verify your drug coverage is "creditable" for purposes of Medicare Part D).

How is the Medicare Part D Late-Enrollment Penalty Calculated?

The LEP is calculated as 1% of the national base Medicare Part D premium for each month you were without some form of creditable prescription drug coverage. For example, if you did not have drug coverage the first year you were eligible for Medicare, you would pay a penalty of 12% (for 12 months without drug coverage) of the national base premium ($32.74 in 2023) or $3.90 per month in addition to your Medicare drug plan premium.

How long does someone pay a Late-Enrollment Penalty?

The late-enrollment penalty is permanent and you will pay the penalty (adjusted each year for the annual base Medicare Part D premium) as long as you have Medicare drug coverage.

Your Part D Late-Enrollment Penalty can change every year.

The Centers for Medicare and Medicaid Services (CMS) calculates and releases the national base Medicare Part D premium each year and in 2023, the national base Medicare Part D premium is $32.74 a decrease as compared the 2022 base premium of $33.37.

As reference, the following chart shows each year's national base Medicare Part D premium -- that is used to calculate late-enrollment penalties since 2006.

|

|

More about calculating your Medicare Part D late-enrollment penalty

As noted, the Medicare Part D late-enrollment premium penalty (LEP) is an additional monthly cost paid by Medicare Part D beneficiaries who did not enroll in a Medicare Part D prescription drug plan when they were first eligible and did not have any other form of "creditable" prescription drug coverage, or who were without "creditable" prescription drug coverage for more than 63 days. Although the number of months used to calculate a late-enrollment penalty may remain constant (for instance, 12 months), as noted above, the base Medicare Part D premium changes year-to year - so your monthly penalty can also change every year.

An example of how to estimate a 55-month 2023 Medicare Part D late-enrollment penalty

If you were previously without creditable prescription drug coverage from 2006 through 2010 (55 months without drug coverage) and then joined a Medicare Part D plan in 2011, you would pay (in addition to your monthly 2023 Medicare plan premium) a monthly penalty of $18.00 (55 months without drug coverage * 1% of $32.74 - rounded to the nearest $0.10) or around an additional $216.00 over the year for your drug coverage.

The chart below shows how your 55-month late-enrollment penalty would change over the years as the Part D "base" premium changes (these are monthly costs that you will pay in addition to your Medicare Part D or Medicare Advantage plan premium).

On a positive note: You are not responsible for calculating your own penalty. Your actual late-enrollment penalty will be calculated by the federal government, reported to your Medicare Part D or Medicare Advantage plan, and then reported to you. If you are wrongly assessed a late-enrollment penalty or believe that your penalty was incorrectly calculated, you have the right to appeal your late-enrollment penalty.

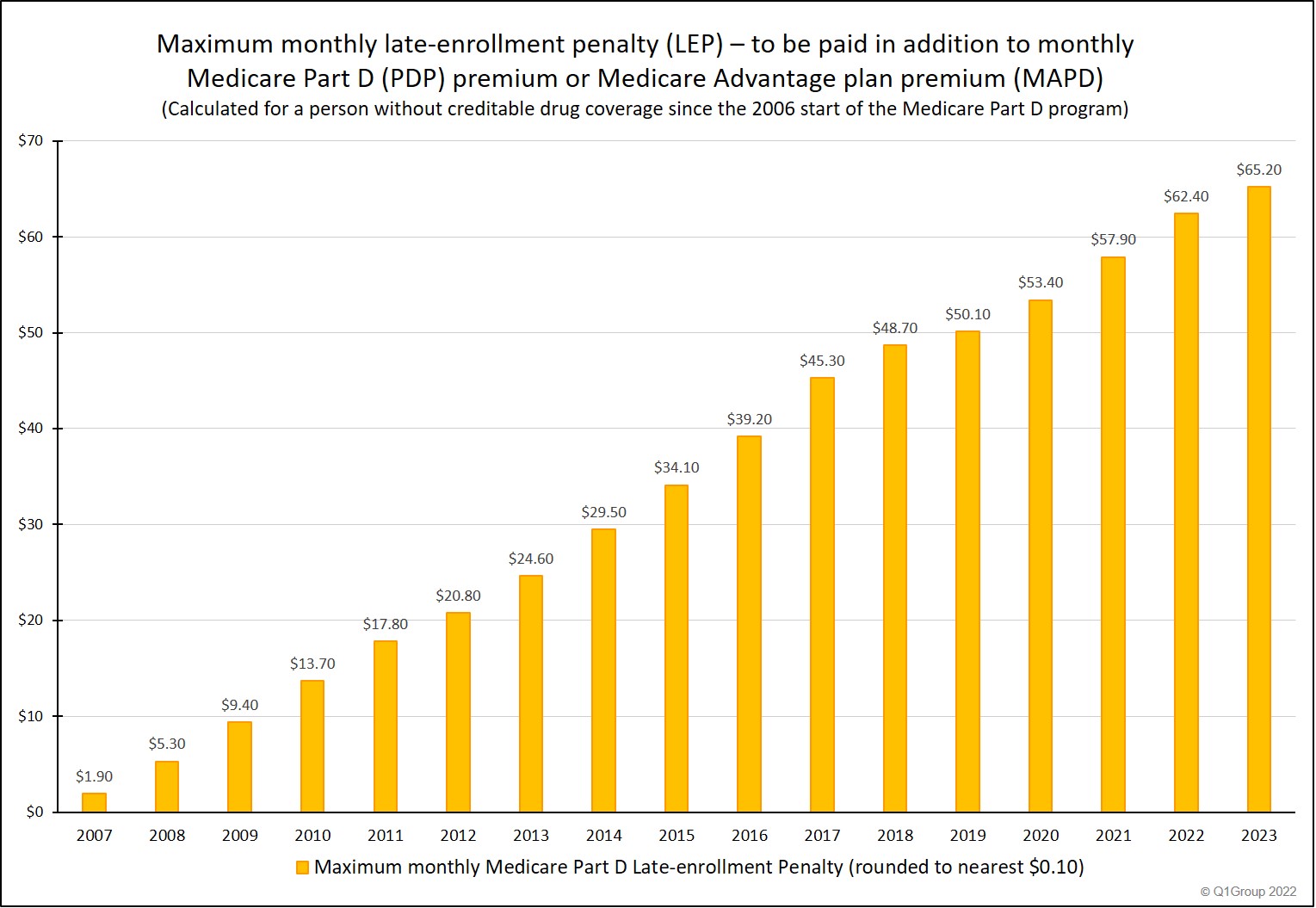

The cost of waiting: How large of a late-enrollment penalty could someone pay in 2023?

About $782.40 for the year. It is possible that you could have a late-enrollment penalty reaching as high as an additional $65.20 per month that must be paid in addition to your 2023 Medicare Part D or Medicare Advantage plan premium.

Here are the assumptions we used for our maximum LEP calculations.

- You were eligible for Medicare back before January 2006 and

- You never joined a Medicare Part D plan until January 2023 and

- You are not eligible for the financial Extra Help program and

- You have been without any other creditable prescription drug coverage since the start of the Medicare Part D program (199 months) (we begin to count months starting with June 2006 through December 2022).

Below is a chart showing the ever-increasing "cost of waiting" to enroll in a Medicare Part D plan when you do not have any other creditable drug coverage.

Important: The penalty and the decision to enroll - or not to enroll when you are first eligible for Medicare Part D plan coverage . . .

We use the "maximum penalty" chart (above) to emphasize the possible costs you may incur if you do not have any other drug coverage and delay enrollment your Medicare Part D plan.

Aside from the penalty, if you decide to postpone Medicare Part D enrollment and then find that you have prescription needs, you may need to wait until the next annual Open Enrollment Period (starting October 15th and continuing through December 7th) to join a plan with coverage starting the following January 1st - and you will need to pay all of your prescription costs out-of-pocket until your Part D plan coverage starts.

Our suggestion: Even if you currently use no prescription medications and are in good health, look at the monthly costs on our above chart and consider enrolling in a Medicare Part D plan or Medicare Advantage plan with the lowest monthly premium -- perhaps a Medicare Advantage plan that offers prescription drug coverage (MAPD) with a $0 premium. And then consider your Medicare Part D plan as typical "insurance" that is available should you need it.

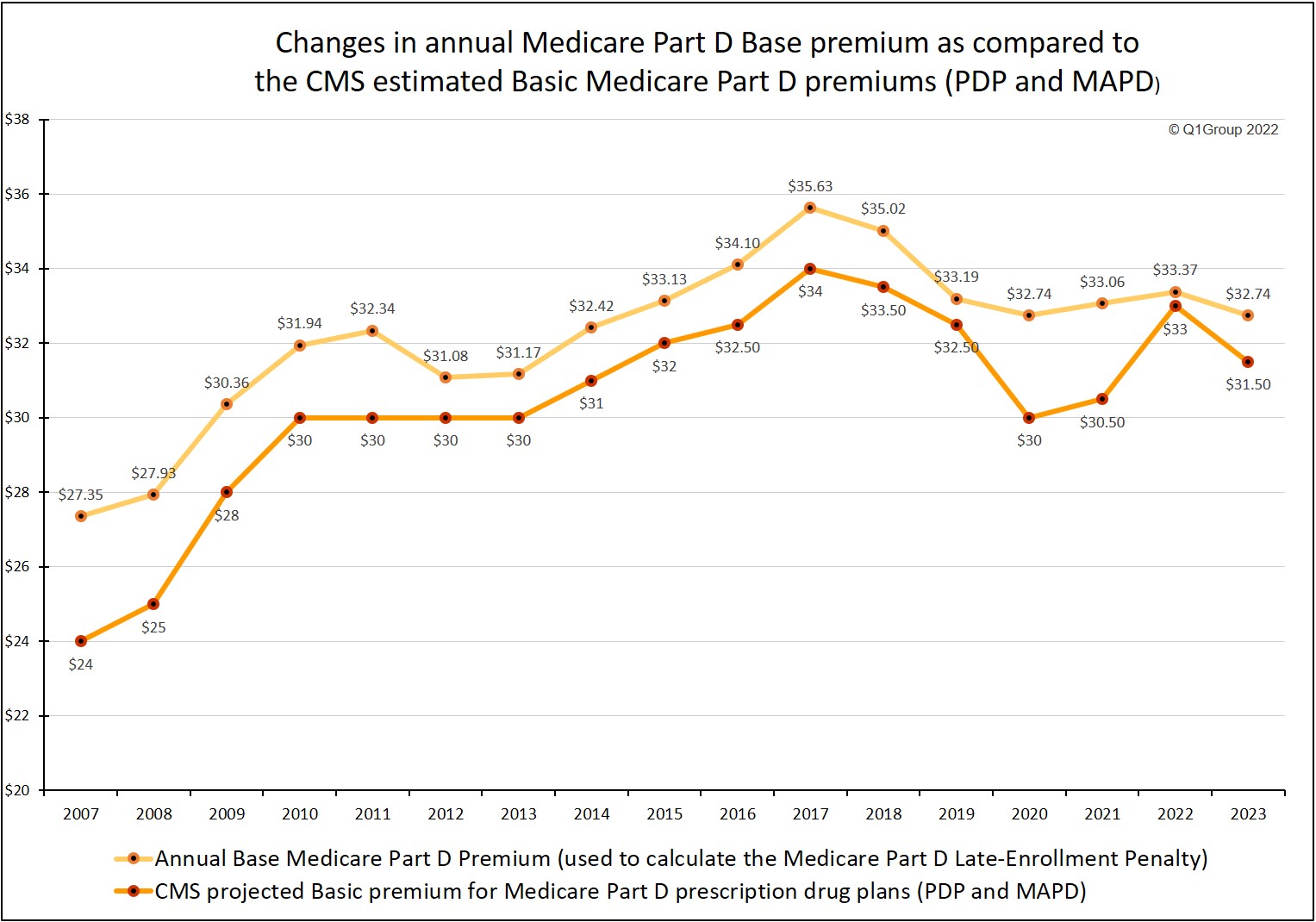

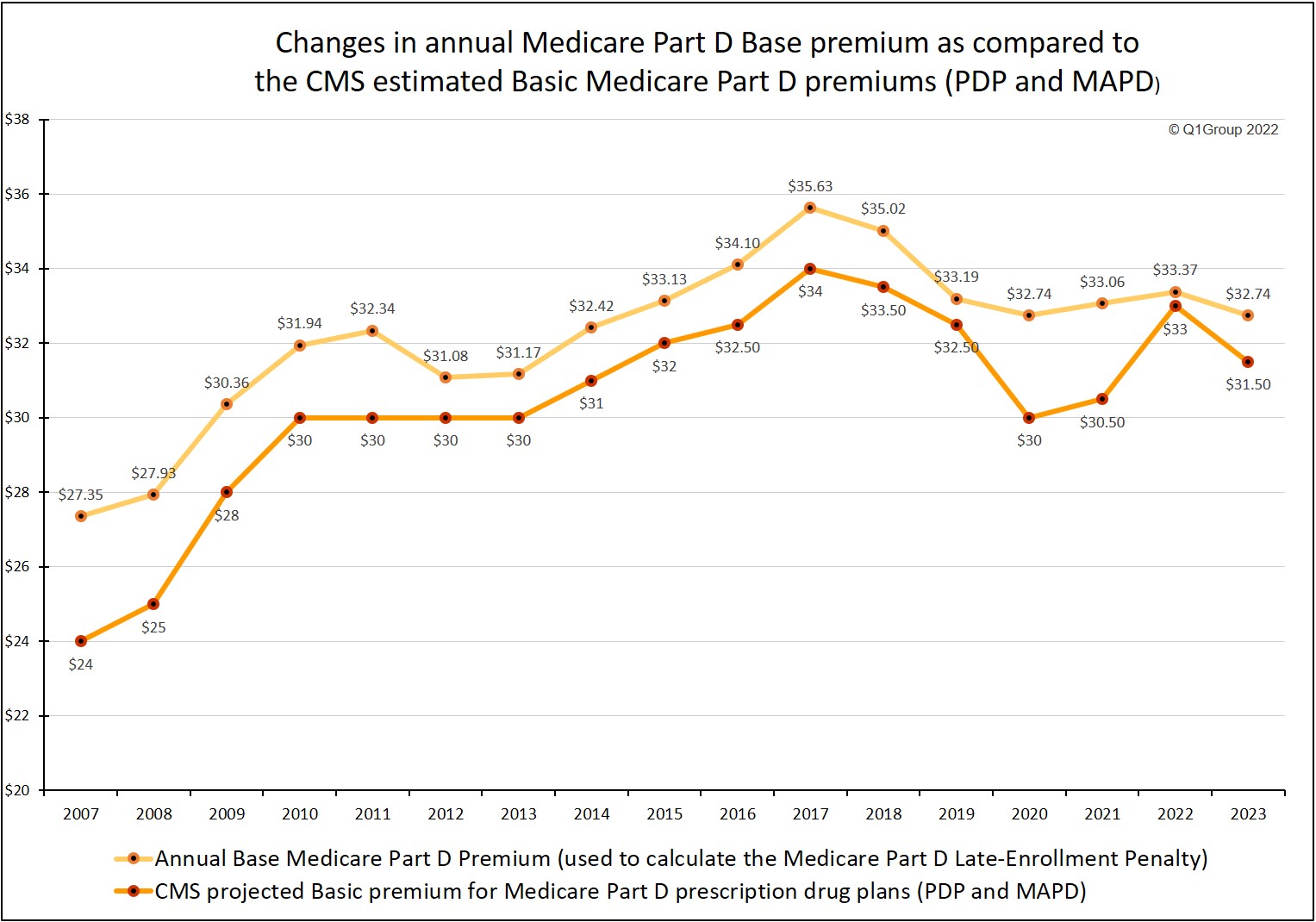

Question: How does the annual base Medicare Part D premium compare to the CMS projected average basic Medicare Part D premium?

The Basic Medicare Part D Premium.

Each year the Centers for Medicare and Medicaid Services (CMS) calculates a projected average basic Medicare Part D premium, based on the proposed Medicare Part D (PDP) and Medicare Advantage plan (MAPD) plan premiums submitted by plan providers (such as Aetna or Humana) - and weighted by current Medicare drug plan enrollment. This basic premium is usually released in a CMS Press Release in late-July or early-August every year.

In 2022, the projected average basic Part D premium was $33.01 up 4.9% from the 2021 from the actual basic premium.

The 2023 projected average basic Part D premium is $31.50 down 1.8% from the 2022 from the actual basic premium.

The Base Medicare Part D Premium.

The Part D "base" premium (or national base monthly Medicare Part D premium) mentioned throughout this article is used to calculate your late-enrollment penalty. The Medicare Part D base premium is also calculated by CMS each year ($32.74 in 2023) and released at the same time as the projected "basic premium".

The following chart shows how the CMS projected average "basic" Medicare Part D premium compares to the annual "base" Medicare Part D premium used to calculate the late-enrollment penalty.

You can read more about the 2023 projected average basic Medicare Part D premium in our article, "CMS projects a 1.8% decrease in 2023 Medicare prescription drug plan premiums" found at Q1News.com/981.

Don't agree with your penalty? Appealing your late-enrollment penalty . . .

In certain situations, such as when you have only VA coverage or employer drug coverage or union drug coverage and no Medicare drug plan coverage, you can appeal your late-enrollment penalty - but don't stop paying your penalty until your penalty appeal is successful.

* Extra Help recipients: No Part D late-enrollment penalties for low-income Medicare beneficiaries.

Reminder: As noted above, no late-enrollment penalties are assessed on Medicare beneficiaries who qualify for the Medicare Part D financial Extra-Help or Low-Income Subsidy (LIS) program (and if you qualify for your state's Medicaid program, you automatically qualify for Medicare Part D Extra Help). For additional assistance understanding your Medicare benefits, please call a Medicare representative at 1-800-633-4227 (1-800-Medicare).

Sources include:

https://www.medicare.gov/ drug-coverage-part-d/ costs-for-medicare-drug-coverage/ part-d-late-enrollment-penalty

https://www.cms.gov/ medicarehealth-plansmedicareadvtg specratestatsrate books-and-supporting-data/2023

You can click on the following link if you would like to read more from CMS on the Medicare Part D late-enrollment penalty (2020 Tip Sheet): Q1News.com/815

For more information about the late-enrollment penalty, please take a look at our Late-Enrollment Penalty (LEP) FAQ section.

Finally, remember: The Medicare Part B program also has a late enrollment penalty that is separate from the Part D late-enrollment penalty.

You can read more about the 2023 projected average basic Medicare Part D premium in our article, "CMS projects a 1.8% decrease in 2023 Medicare prescription drug plan premiums" found at Q1News.com/981.

Don't agree with your penalty? Appealing your late-enrollment penalty . . .

In certain situations, such as when you have only VA coverage or employer drug coverage or union drug coverage and no Medicare drug plan coverage, you can appeal your late-enrollment penalty - but don't stop paying your penalty until your penalty appeal is successful.

* Extra Help recipients: No Part D late-enrollment penalties for low-income Medicare beneficiaries.

Reminder: As noted above, no late-enrollment penalties are assessed on Medicare beneficiaries who qualify for the Medicare Part D financial Extra-Help or Low-Income Subsidy (LIS) program (and if you qualify for your state's Medicaid program, you automatically qualify for Medicare Part D Extra Help). For additional assistance understanding your Medicare benefits, please call a Medicare representative at 1-800-633-4227 (1-800-Medicare).

Sources include:

https://www.medicare.gov/ drug-coverage-part-d/ costs-for-medicare-drug-coverage/ part-d-late-enrollment-penalty

https://www.cms.gov/ medicarehealth-plansmedicareadvtg specratestatsrate books-and-supporting-data/2023

You can click on the following link if you would like to read more from CMS on the Medicare Part D late-enrollment penalty (2020 Tip Sheet): Q1News.com/815

For more information about the late-enrollment penalty, please take a look at our Late-Enrollment Penalty (LEP) FAQ section.

Finally, remember: The Medicare Part B program also has a late enrollment penalty that is separate from the Part D late-enrollment penalty.

News Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service