What happens after I meet my 2020 Medicare Part D plan's $6,350 TrOOP threshold (total out-of-pocket drug spending limit)?

What happens after I meet my 2020 Medicare Part D plan's $6,350 TrOOP threshold (total out-of-pocket drug spending limit)?

You exit the Coverage Gap (or Donut Hole) and enter into the

Catastrophic Coverage phase of your Medicare Part D coverage - and remain in Catastrophic Coverage for the remainder of the plan year (until December 31st).

Medicare Part D Catastrophic Coverage is the fourth and final phase of your Medicare Part D prescription drug plan coverage. You reach Catastrophic Coverage after you meet your Medicare Part D prescription drug plan's annual out-of-pocket spending limit (TrOOP). So, once TrOOP is met, you exit the Coverage Gap phase (Donut Hole) and enter the Catastrophic Coverage phase.

Question: Will my drug costs in the Catastrophic Coverage phase depend on my chosen Medicare Part D plan?

Yes. Your Catastrophic Coverage costs are calculated based on your plan's retail drug prices - and retail drug prices can vary plan-to-plan. In the Catastrophic Coverage phase, all Medicare Part D plans use the same cost-sharing structure (you pay the higher of 5% of retail or an annual fixed cost ($3.60 for generics or multi-source preferred drug or $8.95)).

So you may pay more for your drugs in Catastrophic Coverage if your Medicare prescription drug plan has higher negotiated retail drug prices as compared to someone who is in a Medicare Part D plan with lower negotiated drug costs.

In the Catastrophic Coverage phase there are only two (2) cost-sharing tiers and the cost-sharing can change each year (see chart in next section):

As a 2020 example, if you are using a brand-name, single-source formulary drug with a retail cost of $100, you would pay $8.95 as a co-pay for the drug in the Catastrophic Coverage phase because ... 5% of $100 = $5.00 and since $8.95 is greater than $5.00 - you pay the higher amount. As stated above, the 2020 brand-name drug Catastrophic Coverage cost-sharing is $8.95 or 5% of the retail drug cost, whichever is higher.

Question: Does my Medicare Part D coverage have a maximum out-of-pocket (MOOP) limit?

No. Unfortunately, your Medicare Part D prescription drug coverage does not have a maximum annual spending limit. Your annual out-of-pocket costs for Medicare Part D coverage are theoretically unlimited.

Cost-sharing in the Catastrophic Coverage phase changes slightly year-to-year.

The chart below shows the cost-sharing for the Catastrophic Coverage phase over the past few years. You can click the plan year to see examples and more details for a specific year or click here to see a chart of Medicare Part D plan parameters for all years since 2006.

Question: Will I get Catastrophic Coverage for non-formulary drugs?

No. Please keep in mind that the Catastrophic Coverage phase cost-sharing only applies to medications that are on your Part D plan's formulary (drug list). Therefore, if you are prescribed medication that is not covered on your Medicare Part D formulary, you will be responsible for 100% of the drug's cost - even when in the Catastrophic Coverage phase of your Medicare Part D plan coverage.

If you have a non-formulary medication, you may wish to request a formulary exception and ask to have your medication added to your formulary so that it will be covered during all phases of your Medicare Part D coverage.

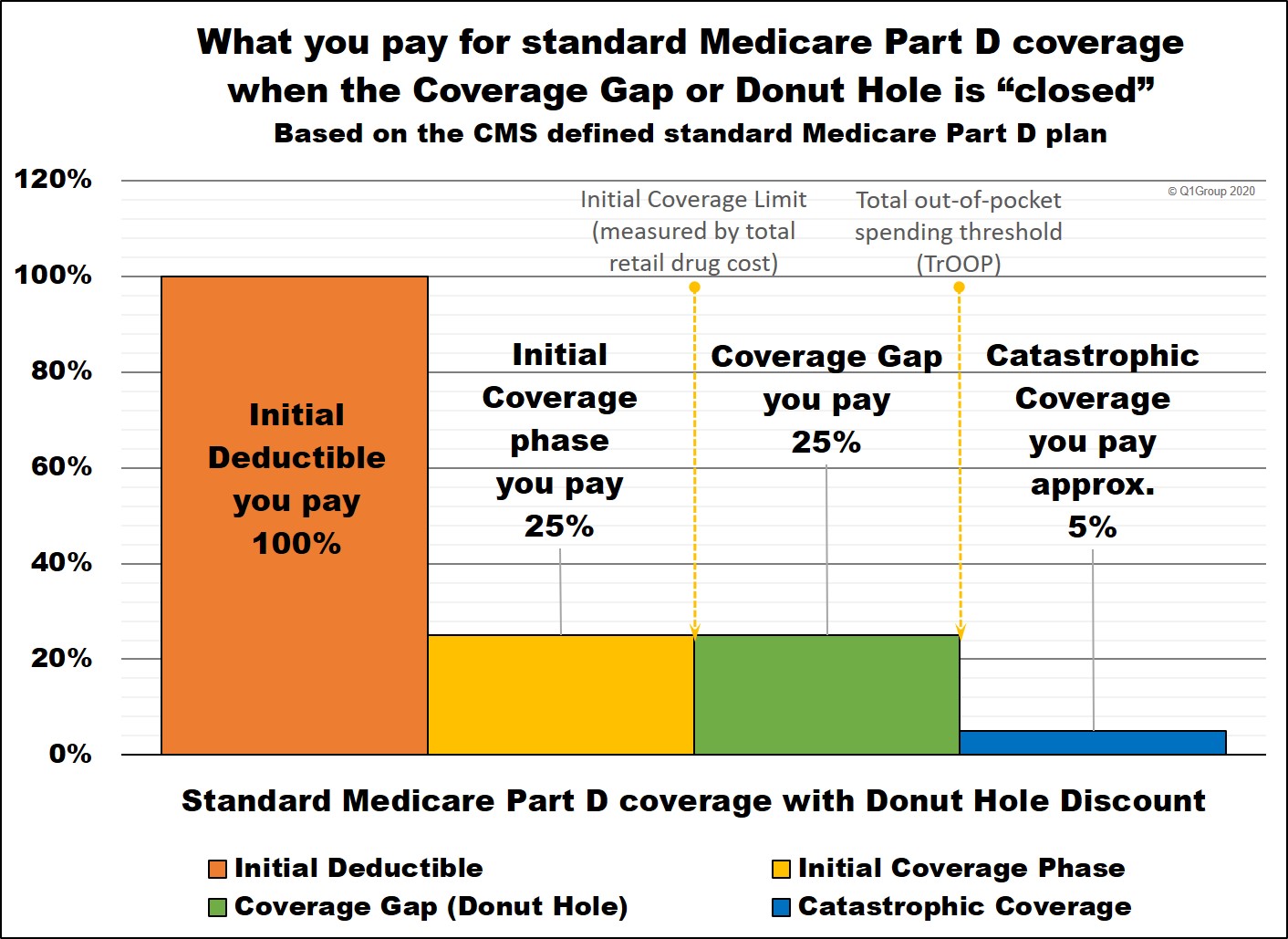

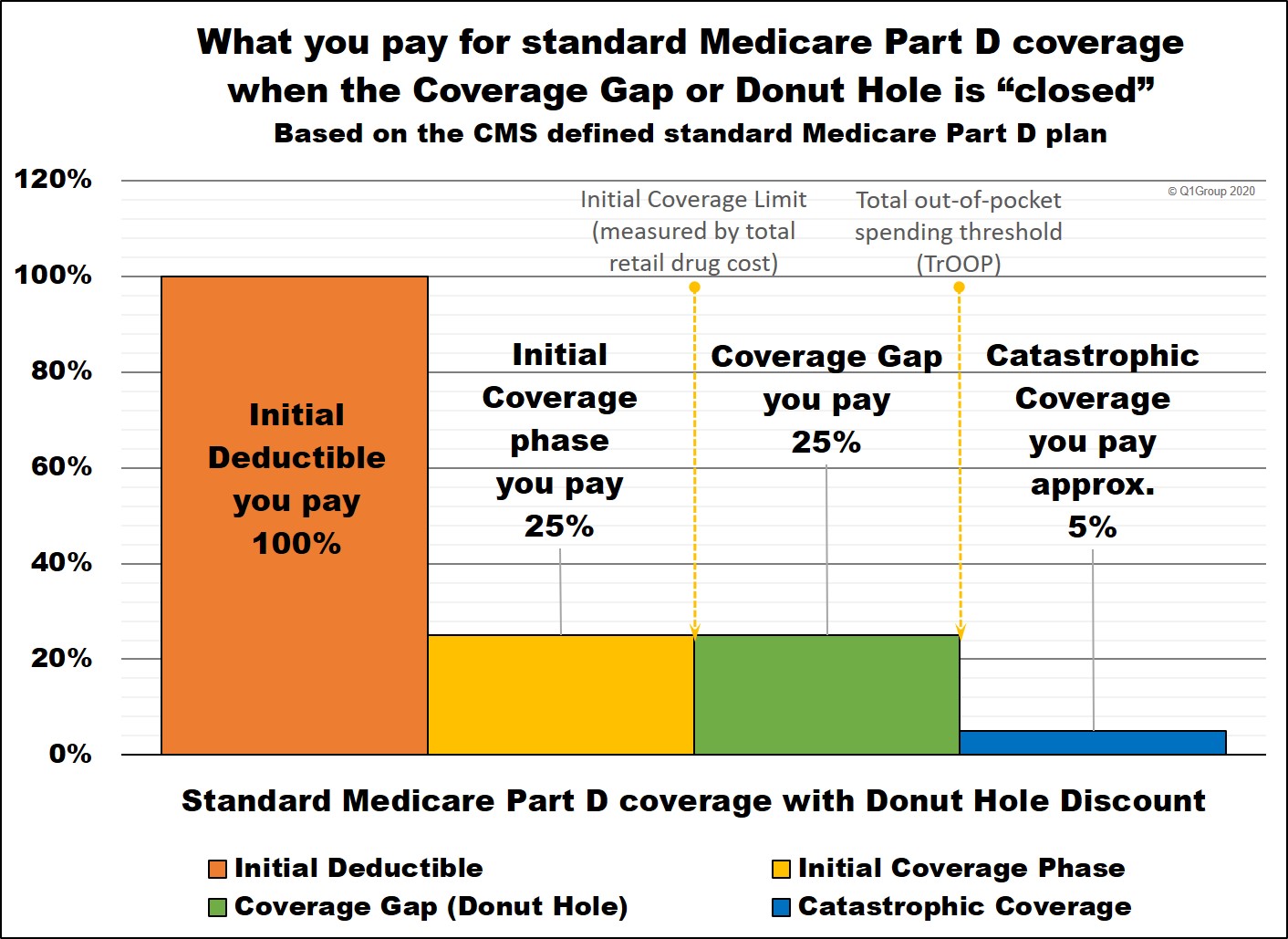

How your cost-sharing changes in each phase of your Medicare Part D plan coverage.

Here is how example formulary drug purchases are calculated throughout your 2020 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

* 25% co-pay or cost-sharing

** 75% Brand-name Donut Hole Discount

*** 75% Generic Donut Hole Discount

**** In 2020, you pay 5% of retail or $8.95 for brand drugs whatever is higher or 5% of retail or $3.60 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

Medicare Part D Catastrophic Coverage is the fourth and final phase of your Medicare Part D prescription drug plan coverage. You reach Catastrophic Coverage after you meet your Medicare Part D prescription drug plan's annual out-of-pocket spending limit (TrOOP). So, once TrOOP is met, you exit the Coverage Gap phase (Donut Hole) and enter the Catastrophic Coverage phase.

Question: Will my drug costs in the Catastrophic Coverage phase depend on my chosen Medicare Part D plan?

Yes. Your Catastrophic Coverage costs are calculated based on your plan's retail drug prices - and retail drug prices can vary plan-to-plan. In the Catastrophic Coverage phase, all Medicare Part D plans use the same cost-sharing structure (you pay the higher of 5% of retail or an annual fixed cost ($3.60 for generics or multi-source preferred drug or $8.95)).

So you may pay more for your drugs in Catastrophic Coverage if your Medicare prescription drug plan has higher negotiated retail drug prices as compared to someone who is in a Medicare Part D plan with lower negotiated drug costs.

In the Catastrophic Coverage phase there are only two (2) cost-sharing tiers and the cost-sharing can change each year (see chart in next section):

- generics and preferred brand drugs that are multi-source drugs —

In 2020, you will pay the greater of $3.60 OR 5% of the

plan's negotiated retail drug cost

- all other drugs (such as brand-name, single-source drugs) — In 2020, you will pay the greater of $8.95 OR 5% of the plan's negotiated retail drug cost for medication.

As a 2020 example, if you are using a brand-name, single-source formulary drug with a retail cost of $100, you would pay $8.95 as a co-pay for the drug in the Catastrophic Coverage phase because ... 5% of $100 = $5.00 and since $8.95 is greater than $5.00 - you pay the higher amount. As stated above, the 2020 brand-name drug Catastrophic Coverage cost-sharing is $8.95 or 5% of the retail drug cost, whichever is higher.

Question: Does my Medicare Part D coverage have a maximum out-of-pocket (MOOP) limit?

No. Unfortunately, your Medicare Part D prescription drug coverage does not have a maximum annual spending limit. Your annual out-of-pocket costs for Medicare Part D coverage are theoretically unlimited.

Cost-sharing in the Catastrophic Coverage phase changes slightly year-to-year.

The chart below shows the cost-sharing for the Catastrophic Coverage phase over the past few years. You can click the plan year to see examples and more details for a specific year or click here to see a chart of Medicare Part D plan parameters for all years since 2006.

|

Catastrophic Coverage Phase Cost-Sharing |

|||

| Plan Year | TrOOP | Generics or Preferred Brand Drugs that are Multi-Source Drugs |

All Other Drugs (e.g., brand-name) |

| 2020 | $6,350 | $3.60 | $8.95 |

| 2019 | $5,100 | $3.40 | $8.50 |

| 2018 | $5,000 | $3.35 | $8.35 |

| 2017 | $4,950 | $3.30 | $8.25 |

| 2016 | $4,850 | $2.95 | $7.40 |

| 2015 | $4,700 | $2.65 | $6.60 |

| 2014 | $4,550 | $2.55 | $6.35 |

| 2013 | $4,750 | $2.65 | $6.60 |

Question: Will I get Catastrophic Coverage for non-formulary drugs?

No. Please keep in mind that the Catastrophic Coverage phase cost-sharing only applies to medications that are on your Part D plan's formulary (drug list). Therefore, if you are prescribed medication that is not covered on your Medicare Part D formulary, you will be responsible for 100% of the drug's cost - even when in the Catastrophic Coverage phase of your Medicare Part D plan coverage.

If you have a non-formulary medication, you may wish to request a formulary exception and ask to have your medication added to your formulary so that it will be covered during all phases of your Medicare Part D coverage.

How your cost-sharing changes in each phase of your Medicare Part D plan coverage.

Here is how example formulary drug purchases are calculated throughout your 2020 Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

||||||

|

Retail Cost |

You Pay |

Medicare Plan Pays |

Pharma Mfgr Pays |

Gov. Pays |

Amount toward your TrOOP |

|

|

Initial Deductible |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

|

Initial Coverage Phase * |

$100 |

$25 |

$75 |

$0 |

$0 |

$25 |

|

Coverage Gap - brand-name discount ** |

$100 |

$25 |

$5 |

$70 |

$0 |

$95 |

|

Coverage Gap - generic discount *** |

$100 |

$25 |

$75 |

$0 |

$0 |

$25 |

|

Catastrophic Coverage (brand drug) **** |

$200 |

$10 |

$30 |

$0 |

$160 |

n/a |

|

Catastrophic Coverage (generic drug) **** |

$100 |

$5 |

$15 |

$0 |

$80 |

n/a |

* 25% co-pay or cost-sharing

** 75% Brand-name Donut Hole Discount

*** 75% Generic Donut Hole Discount

**** In 2020, you pay 5% of retail or $8.95 for brand drugs whatever is higher or 5% of retail or $3.60 for generic or multi-source drugs whatever is higher (80% paid by Medicare, 15% paid by Medicare plan, and around 5% by plan member)

News Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service