2015 Straddle Claim example when purchasing an $8,000 formulary medication as your first purchase

Straddle Claims are single prescription drug purchases or claims that cross multiple phases of your Medicare Part D prescription drug plan coverage (or your Medicare Advantage plan that offers prescription drug coverage).

For instance, when you purchase your prescription drugs and the negotiated retail price of your purchase crosses you from your Initial Coverage phase (where you share prescription costs with your Medicare Part D plan) to your Medicare plan's Coverage Gap or Donut Hole phase (where you may be 100% responsible for your prescription drug costs) - the cost of the purchase will be split over the two Medicare plan phases.

In addition, if you are using a medication with a very high retail cost, you could find that a single purchase "straddles" more than one phase of your Medicare Part D plan coverage at one time and, depending on the retail drug cost (as in our example), it is possible to go through all phases of your Medicare prescription drug plan coverage at one time.

An $8,000 Straddle Claim example for 250mg Zytiga (r)

The following is a 2015 Straddle Claim example to help you work through the logic used to determine what you pay when you purchase a Medicare Part D drug with a high retail cost. In this example, we will use the prescription drug 250mg Zytiga (r), with an average negotiated retail drug price around $8,000 (August 2015).

If you purchased this $8,000 medication during the Initial Deductible portion of a Medicare Part D plan with a 25% cost-sharing, the estimated coverage cost would be calculated as:

(1) Initial Deductible phase

We will assume for this example that our stand-alone Medicare Part D plan has a standard 2015 Initial Deductible of $320. So, if you buy this medication as your first purchase of 2015 while still in the Initial Deductible, you will pay 100% of the drug cost up to the $320 deductible. The remaining balance of the $8,000 retail price or $7,680 ($8,000 - $320) falls or "straddles" into your Medicare Part D plan's Initial Coverage Phase (ICP).

(2) Initial Coverage phase (Straddle Claim Step #1)

The 2015 Initial Coverage Limit is $2,960. We will assume that for the Initial Coverage Phase of your Medicare Part D plan, your cost-sharing would be an additional 25% of the remaining Initial Coverage Limit $2,640 ($2,960 - $320) or an additional $660 cost to the Medicare plan beneficiary (25% of $2,640). So $5,040 ($7,680 - $2,640) then falls or "straddles" into the Donut Hole or Coverage Gap phase.

(3) Coverage Gap or Donut Hole phase (Straddle Claim Step #2)

As a note, a straddle claim does not skip the Donut Hole or Coverage Gap phase. However, a person with a straddle claim can take advantage of the Donut Hole discount. You can read more about the Donut Hole discount here: https://Q1News.com/228.html

In the 2015 Donut Hole, you will receive a 55% discount on all brand-name medications (you pay 45% of the retail price) and 95% of the retail drug price counts toward reaching your 2015 Total Out-of-Pocket spending limit (TrOOP) of $4,700 (or the equivalent of a total retail drug value of $6,680).

Since we have already spent $320 in the Initial Deductible and another $660 in the Initial Coverage Phase, only $3,720 ($4,700 - $320 - $660) remains of the TrOOP at which point we exit the Donut Hole.

Without considering anything else (see below for an adjustment due to the Donut Hole discount), for the $5,040 portion of the retail cost that falls into the Coverage Gap phase, you would pay an additional $1,674 or ($3,720 x 45%).

Since the portion of the costs that fell into the Coverage Gap ($5,040) exceeds the remaining amount of TrOOP ($3,720), then $1,320 ($5,040 - $3,720) falls or "straddles" into the Catastrophic Coverage phase of your Medicare Part D plan.

(4) Catastrophic Coverage phase (Straddle Claim Step #3)

In the Catastrophic Coverage phase, you will pay the greater of 5% of the retail price or $6.60 for brand-name medications. In our example, for the portion of this first drug purchase that falls into the Catastrophic Coverage phase, you would pay an additional $66 or (5% of $1,320) since it is greater than the minimum 2015 Catastrophic Coverage cost-share of $6.60 for brand-name drugs.

So your total estimated cost (without considering dispensing fees) for your first purchase of 250mg Zytiga would be: $320 + $660 + $1,674 + $66 = $2,720.

(You can compare this calculation to the slightly-lower value that we provide in our Drug Finder example below using the 2015 Texas Cigna-HealthSpring plan that totaled: $2,715.15.)

(5) Cost beyond the first purchase?

For the remainder of the 2015 plan year, you would pay 5% of the retail price for each additional 250mg Zytiga prescription or 5% * $8,000 = $400. (Please note, the retail cost of the 250mg Zytiga can change throughout the plan year and so your cost in the Catastrophic Coverage phase will fluctuate with the Medicare Part D plan's actual retail price.) - In theory, while in the Catastrophic Coverage Phase you will pay either 5% of the retail cost or $6.60 for a bran-name drug whichever number is larger - and $400 is larger than $6.60.

Please note: Our estimated straddle claim calculations also does not reflect the pharmacy dispensing fees, sales tax, and vaccine administration fees (if any) that a Medicare beneficiary will also pay. Plus, we also need to take into account the 5% of the retail cost that is covered by your Medicare Part D plan that does not count toward your $4,700 TrOOP during the Donut Hole discount and that calculation is following.

Important: Here is an adjustment in coverage cost to allow for the 95% credit you get when purchasing brand-name drugs in the 2015 Donut Hole.

As noted above, once you have paid $320 in the Initial Deductible and $660 in the Initial Coverage phase, you have $3,720 ($4,700 - $980) out-of-pocket costs before exiting the 2015 Donut Hole and enter the 2015 Catastrophic Coverage phase, and since we know that you get 95% credit for brand-name drug purchases toward exiting the Donut Hole, you would need to actually have retail drug costs of $3,916 to exit the Donut Hole ($3,720 / .95).

In this case, the total retail cost to exit the Donut Hole will not be the standard $6,680, but instead $6,876 ($3,916 + $2,960).

So your actual Donut Hole cost would be 45% of the total $3,916 = $1,762 (slightly more than the $1,674 that we used above). This means that, of the $5,040 remaining retail cost that over-flows or “straddles” into the Donut Hole phase, you will get credit for the first $3,916 as part of the Donut Hole and the remainder or $1,124 ($5,040 - $3,916) will carry into your Medicare Part D plan’s Catastrophic Coverage phase.

Again, There is a $3,916 retail drug cost in the Donut Hole – you pay $1,762 (45%) – and receive TrOOP credit for $3,720 (95%).

During the Catastrophic Coverage phase you will pay the higher of $6.60 or 5% of the retail cost. In our case, 5% of the $1,124 that carries forward or "straddles" into this phase is greater than $6.60, so you will pay 5% of the remaining retail cost or an additional $56.

Total Adjusted Cost: So the total estimate (adjusted for the Donut Hole discount) for your first purchase of Zytiga 250mg is:

$320 (Initial Deductible)

+ $660 (Initial Coverage phase)

+ $1,762 (Donut Hole phase)

+ $56 (Catastrophic Coverage)

= $2,798 (which may be less than a Medicare beneficiary actually pays due to rounding, the actual retail drug price, tax, and pharmacy dispensing fees)

* 55% Discount (you pay 45% and receive 95% credit toward TrOOP)

** 5% of retail cost or $6.60 for brand medications, whichever is higher(in 2015 you get 55% discount)

Where can you find the average negotiated retail prices?

We have all average negotiated retail drug prices online for all Medicare Part D and Medicare Advantage plans in our Drug Finder tool (Q1Rx.com). However, your actual retail cost will depend on your Medicare prescription drug plan and pharmacy where the prescription is fulfilled. In addition your Medicare prescription drug plan's retail drug prices can fluctuate week-to-week and pharmacy-to-pharmacy, so our prices will always be an approximation.

Here is a link to our Drug Finder, showing the average retail drug prices for all stand-alone Texas Medicare Part D plans covering our example medication, 250mg Zytiga (as of Summer 2015): https://Q1Rx.com/2015/57894015012

(We used Texas as our example state, but any state can be chosen for Medicare Part D plans or a Zip Code entered for Medicare Advantage plans that include prescription drug coverage).

Our Drug Finder short-cut to Straddle Claims

Following the above link to our Drug Finder results for Texas Medicare Part D plans, you can click on the cost-sharing amount for any Medicare plan (for instance, from the link above, you can choose the 25% co-insurance on Cigna-HealthSpring Rx Secure (PDP) (S5617-108-0) and see the estimated coverage cost when this medication was purchased in the Initial Deductible phase as: $2,715.15.

If you scroll down from this Drug Finder $2,715.15 total, you can see a simplified version of how we calculate the Straddle Claim for this medication under a specific Medicare Part D plan (without adjusting for the Donut Hole discount). Here is an example link to this information is:

Straddle Claims and the Medicare Plan Finder

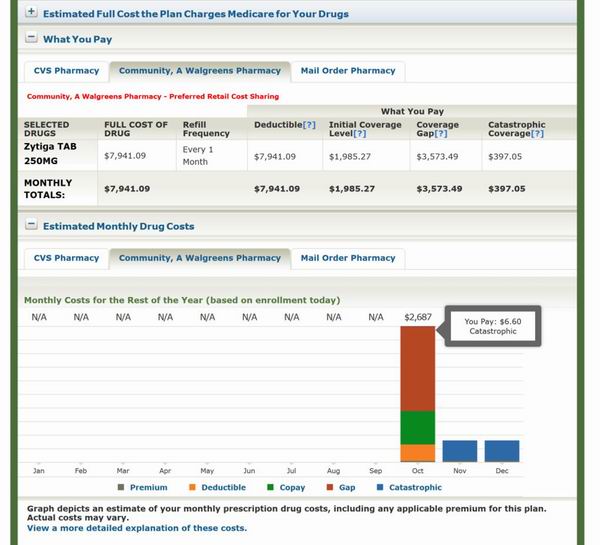

Here is an example of how the Medicare.gov site handles the purchase of the same $8,000 medication (Zytiga 250mg) on the same Medicare Part D plan (Texas Cigna-HealthSpring Rx Secure (PDP) (S5617-108-0). In this example, the Medicare calculations differ from our calculations above, for example, showing the catastrophic coverage phase cost of $6.60 as compared to our calculated cost of $56. On the chart the Donut Hole cost is also not adjusted for 95% of the brand-name drug retail cost. The Medicare chart shows the Full Cost of Zytiga as $7,941.09 (at preferred pharmacy Walgreens). The cost in the Deductible is shown as the full retail value of $7,941.09. The cost in the Initial Coverage Level is shown as $1,985.27. The cost in the Coverage Gap or Donut Hole is $3,573.49. Again, the Catastrophic Coverage phase shows a cost of $6.60. (Source Medicare.gov, Zipcode: 75201, Current Plan: Unknown, Current Subsidy: No Extra Help, Drug List ID: 9708794240, Password Date: 9/6/2015).

For instance, when you purchase your prescription drugs and the negotiated retail price of your purchase crosses you from your Initial Coverage phase (where you share prescription costs with your Medicare Part D plan) to your Medicare plan's Coverage Gap or Donut Hole phase (where you may be 100% responsible for your prescription drug costs) - the cost of the purchase will be split over the two Medicare plan phases.

In addition, if you are using a medication with a very high retail cost, you could find that a single purchase "straddles" more than one phase of your Medicare Part D plan coverage at one time and, depending on the retail drug cost (as in our example), it is possible to go through all phases of your Medicare prescription drug plan coverage at one time.

An $8,000 Straddle Claim example for 250mg Zytiga (r)

The following is a 2015 Straddle Claim example to help you work through the logic used to determine what you pay when you purchase a Medicare Part D drug with a high retail cost. In this example, we will use the prescription drug 250mg Zytiga (r), with an average negotiated retail drug price around $8,000 (August 2015).

If you purchased this $8,000 medication during the Initial Deductible portion of a Medicare Part D plan with a 25% cost-sharing, the estimated coverage cost would be calculated as:

(1) Initial Deductible phase

We will assume for this example that our stand-alone Medicare Part D plan has a standard 2015 Initial Deductible of $320. So, if you buy this medication as your first purchase of 2015 while still in the Initial Deductible, you will pay 100% of the drug cost up to the $320 deductible. The remaining balance of the $8,000 retail price or $7,680 ($8,000 - $320) falls or "straddles" into your Medicare Part D plan's Initial Coverage Phase (ICP).

(2) Initial Coverage phase (Straddle Claim Step #1)

The 2015 Initial Coverage Limit is $2,960. We will assume that for the Initial Coverage Phase of your Medicare Part D plan, your cost-sharing would be an additional 25% of the remaining Initial Coverage Limit $2,640 ($2,960 - $320) or an additional $660 cost to the Medicare plan beneficiary (25% of $2,640). So $5,040 ($7,680 - $2,640) then falls or "straddles" into the Donut Hole or Coverage Gap phase.

(3) Coverage Gap or Donut Hole phase (Straddle Claim Step #2)

As a note, a straddle claim does not skip the Donut Hole or Coverage Gap phase. However, a person with a straddle claim can take advantage of the Donut Hole discount. You can read more about the Donut Hole discount here: https://Q1News.com/228.html

In the 2015 Donut Hole, you will receive a 55% discount on all brand-name medications (you pay 45% of the retail price) and 95% of the retail drug price counts toward reaching your 2015 Total Out-of-Pocket spending limit (TrOOP) of $4,700 (or the equivalent of a total retail drug value of $6,680).

Since we have already spent $320 in the Initial Deductible and another $660 in the Initial Coverage Phase, only $3,720 ($4,700 - $320 - $660) remains of the TrOOP at which point we exit the Donut Hole.

Without considering anything else (see below for an adjustment due to the Donut Hole discount), for the $5,040 portion of the retail cost that falls into the Coverage Gap phase, you would pay an additional $1,674 or ($3,720 x 45%).

Since the portion of the costs that fell into the Coverage Gap ($5,040) exceeds the remaining amount of TrOOP ($3,720), then $1,320 ($5,040 - $3,720) falls or "straddles" into the Catastrophic Coverage phase of your Medicare Part D plan.

(4) Catastrophic Coverage phase (Straddle Claim Step #3)

In the Catastrophic Coverage phase, you will pay the greater of 5% of the retail price or $6.60 for brand-name medications. In our example, for the portion of this first drug purchase that falls into the Catastrophic Coverage phase, you would pay an additional $66 or (5% of $1,320) since it is greater than the minimum 2015 Catastrophic Coverage cost-share of $6.60 for brand-name drugs.

So your total estimated cost (without considering dispensing fees) for your first purchase of 250mg Zytiga would be: $320 + $660 + $1,674 + $66 = $2,720.

(You can compare this calculation to the slightly-lower value that we provide in our Drug Finder example below using the 2015 Texas Cigna-HealthSpring plan that totaled: $2,715.15.)

(5) Cost beyond the first purchase?

For the remainder of the 2015 plan year, you would pay 5% of the retail price for each additional 250mg Zytiga prescription or 5% * $8,000 = $400. (Please note, the retail cost of the 250mg Zytiga can change throughout the plan year and so your cost in the Catastrophic Coverage phase will fluctuate with the Medicare Part D plan's actual retail price.) - In theory, while in the Catastrophic Coverage Phase you will pay either 5% of the retail cost or $6.60 for a bran-name drug whichever number is larger - and $400 is larger than $6.60.

Please note: Our estimated straddle claim calculations also does not reflect the pharmacy dispensing fees, sales tax, and vaccine administration fees (if any) that a Medicare beneficiary will also pay. Plus, we also need to take into account the 5% of the retail cost that is covered by your Medicare Part D plan that does not count toward your $4,700 TrOOP during the Donut Hole discount and that calculation is following.

Important: Here is an adjustment in coverage cost to allow for the 95% credit you get when purchasing brand-name drugs in the 2015 Donut Hole.

As noted above, once you have paid $320 in the Initial Deductible and $660 in the Initial Coverage phase, you have $3,720 ($4,700 - $980) out-of-pocket costs before exiting the 2015 Donut Hole and enter the 2015 Catastrophic Coverage phase, and since we know that you get 95% credit for brand-name drug purchases toward exiting the Donut Hole, you would need to actually have retail drug costs of $3,916 to exit the Donut Hole ($3,720 / .95).

In this case, the total retail cost to exit the Donut Hole will not be the standard $6,680, but instead $6,876 ($3,916 + $2,960).

So your actual Donut Hole cost would be 45% of the total $3,916 = $1,762 (slightly more than the $1,674 that we used above). This means that, of the $5,040 remaining retail cost that over-flows or “straddles” into the Donut Hole phase, you will get credit for the first $3,916 as part of the Donut Hole and the remainder or $1,124 ($5,040 - $3,916) will carry into your Medicare Part D plan’s Catastrophic Coverage phase.

Again, There is a $3,916 retail drug cost in the Donut Hole – you pay $1,762 (45%) – and receive TrOOP credit for $3,720 (95%).

During the Catastrophic Coverage phase you will pay the higher of $6.60 or 5% of the retail cost. In our case, 5% of the $1,124 that carries forward or "straddles" into this phase is greater than $6.60, so you will pay 5% of the remaining retail cost or an additional $56.

Total Adjusted Cost: So the total estimate (adjusted for the Donut Hole discount) for your first purchase of Zytiga 250mg is:

$320 (Initial Deductible)

+ $660 (Initial Coverage phase)

+ $1,762 (Donut Hole phase)

+ $56 (Catastrophic Coverage)

= $2,798 (which may be less than a Medicare beneficiary actually pays due to rounding, the actual retail drug price, tax, and pharmacy dispensing fees)

|

When you purchase a formulary medication |

||||||

|

Retail |

You Paid |

Accumulated Total of Retail Cost |

Amount toward your TrOOP | Brand Name 95% TrOOP adjustment |

Accumulated |

|

|

Initial Deductible |

$320 |

$320 |

$320 |

$320 |

$320 |

|

|

Initial Coverage Phase (25% co-pay) |

$2,640 |

$660 |

$2,960 |

$660 |

$980 |

|

|

Coverage Gap - brand-name * |

$3,916 |

$1,762 |

$6,876 |

$3,720 |

$4,700 |

|

|

Catastrophic Coverage ** |

$1,124 |

$56 |

$8,000 |

|

||

|

Total |

$8,000 |

$2,798 |

|

|

||

* 55% Discount (you pay 45% and receive 95% credit toward TrOOP)

** 5% of retail cost or $6.60 for brand medications, whichever is higher(in 2015 you get 55% discount)

Where can you find the average negotiated retail prices?

We have all average negotiated retail drug prices online for all Medicare Part D and Medicare Advantage plans in our Drug Finder tool (Q1Rx.com). However, your actual retail cost will depend on your Medicare prescription drug plan and pharmacy where the prescription is fulfilled. In addition your Medicare prescription drug plan's retail drug prices can fluctuate week-to-week and pharmacy-to-pharmacy, so our prices will always be an approximation.

Here is a link to our Drug Finder, showing the average retail drug prices for all stand-alone Texas Medicare Part D plans covering our example medication, 250mg Zytiga (as of Summer 2015): https://Q1Rx.com/2015/57894015012

(We used Texas as our example state, but any state can be chosen for Medicare Part D plans or a Zip Code entered for Medicare Advantage plans that include prescription drug coverage).

Our Drug Finder short-cut to Straddle Claims

Following the above link to our Drug Finder results for Texas Medicare Part D plans, you can click on the cost-sharing amount for any Medicare plan (for instance, from the link above, you can choose the 25% co-insurance on Cigna-HealthSpring Rx Secure (PDP) (S5617-108-0) and see the estimated coverage cost when this medication was purchased in the Initial Deductible phase as: $2,715.15.

If you scroll down from this Drug Finder $2,715.15 total, you can see a simplified version of how we calculate the Straddle Claim for this medication under a specific Medicare Part D plan (without adjusting for the Donut Hole discount). Here is an example link to this information is:

Straddle Claims and the Medicare Plan Finder

Here is an example of how the Medicare.gov site handles the purchase of the same $8,000 medication (Zytiga 250mg) on the same Medicare Part D plan (Texas Cigna-HealthSpring Rx Secure (PDP) (S5617-108-0). In this example, the Medicare calculations differ from our calculations above, for example, showing the catastrophic coverage phase cost of $6.60 as compared to our calculated cost of $56. On the chart the Donut Hole cost is also not adjusted for 95% of the brand-name drug retail cost. The Medicare chart shows the Full Cost of Zytiga as $7,941.09 (at preferred pharmacy Walgreens). The cost in the Deductible is shown as the full retail value of $7,941.09. The cost in the Initial Coverage Level is shown as $1,985.27. The cost in the Coverage Gap or Donut Hole is $3,573.49. Again, the Catastrophic Coverage phase shows a cost of $6.60. (Source Medicare.gov, Zipcode: 75201, Current Plan: Unknown, Current Subsidy: No Extra Help, Drug List ID: 9708794240, Password Date: 9/6/2015).

News Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service