Frequently Asked Questions about The Donut Hole or Coverage Gap

Most Viewed FAQs in Category

-

Dec, 28 2023 — Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your . . .

-

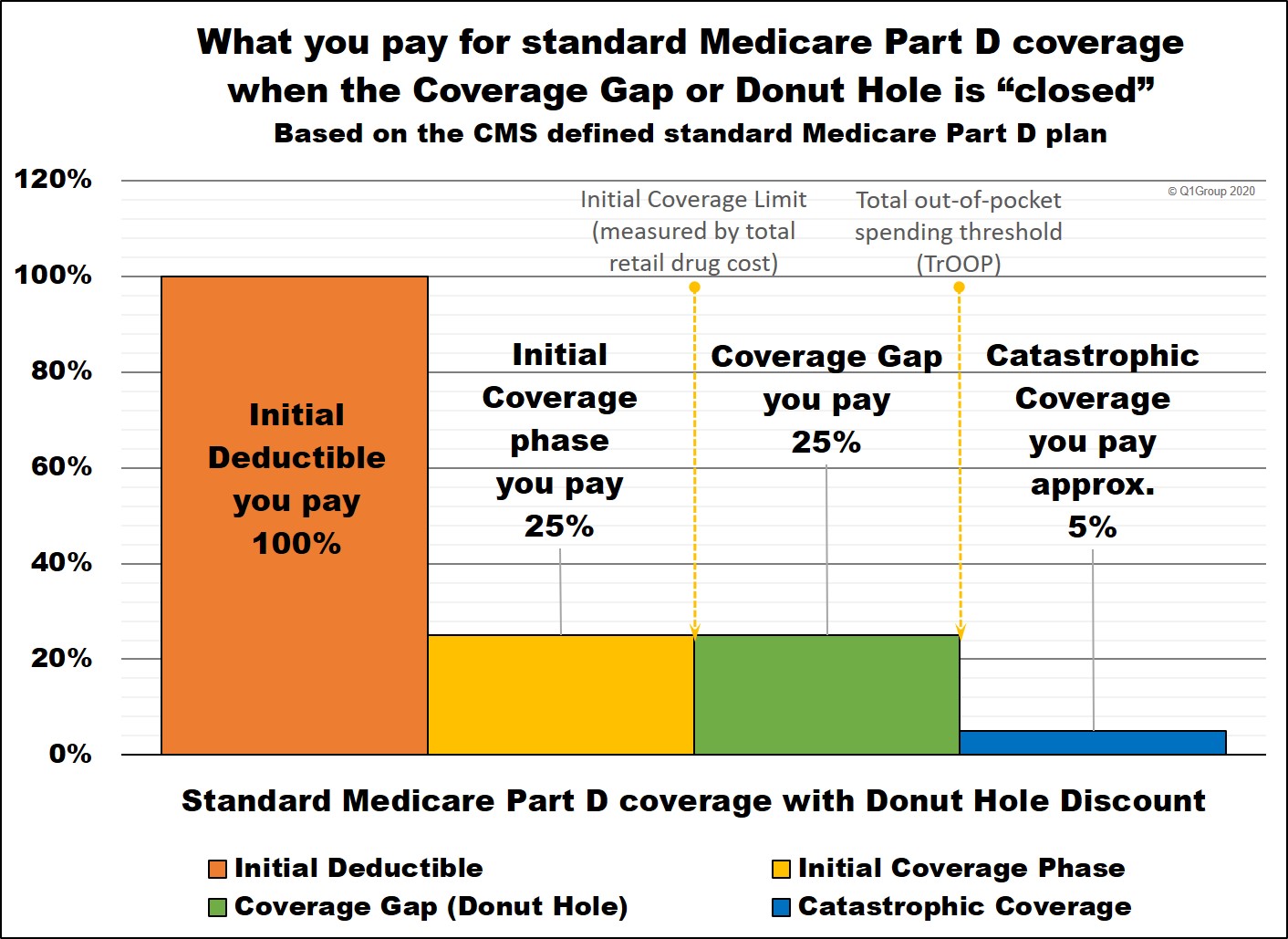

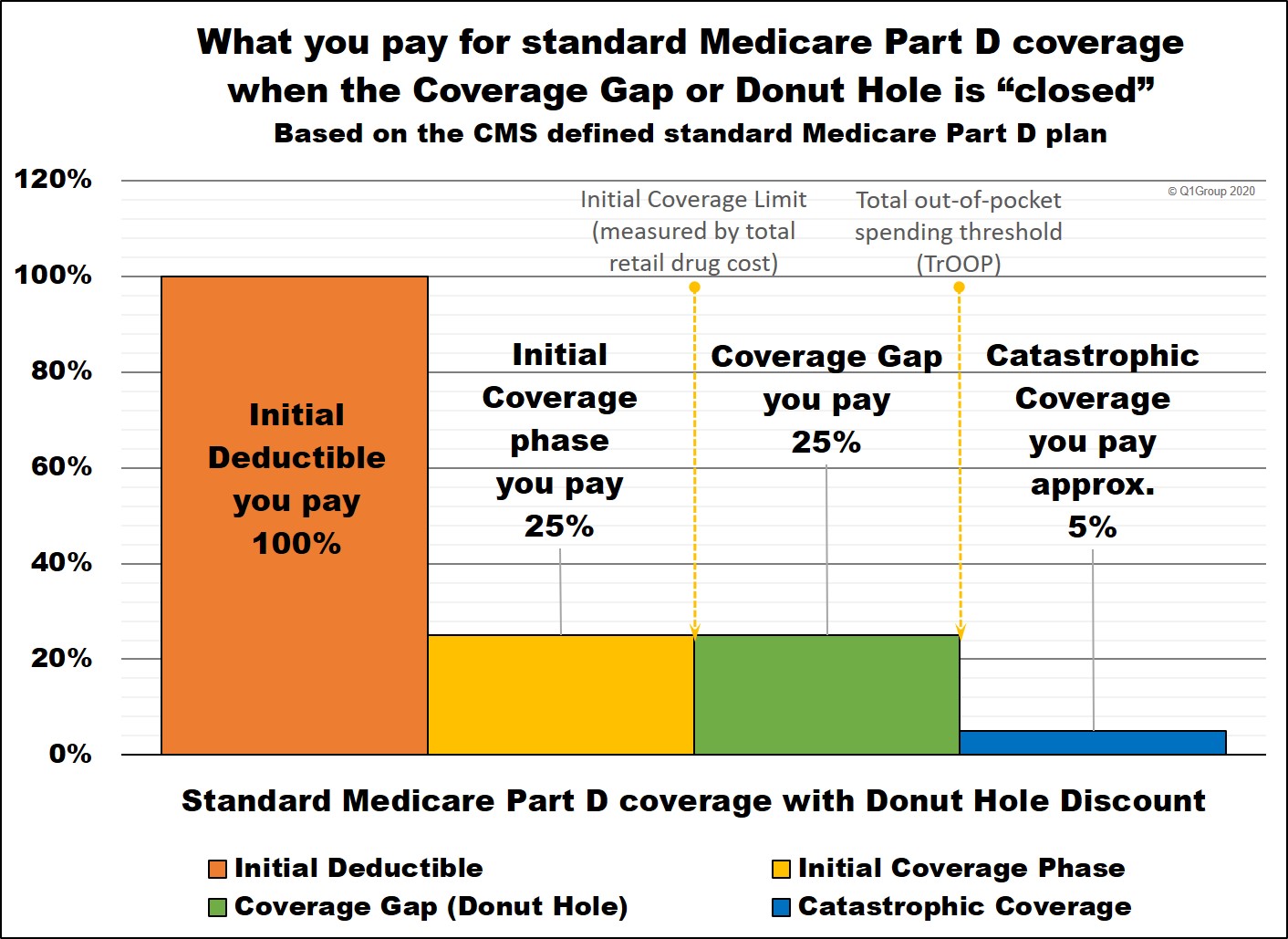

Feb, 02 2024 — The Donut Hole or Coverage Gap is the third part or phase of your Medicare Part D prescription drug coverage where you will pay 25% of the retail price for any prescriptions found on your plan's formu . . .

Feb, 02 2024 — The Donut Hole or Coverage Gap is the third part or phase of your Medicare Part D prescription drug coverage where you will pay 25% of the retail price for any prescriptions found on your plan's formu . . . -

Apr, 23 2024 — If you use a Special Enrollment Period to change Medicare Part D drug plans during the year, your drug purchase history moves with you to your new Medicare plan. So if you are in the Donut Hole and move to another Part D plan, most likely you will still be in the Donut Hole.

-

Jan, 21 2024 — Aside from the 75% Donut Hole discount that you receive on all formulary drugs purchased in the Coverage Gap, your Medicare Part D prescription drug plan may also provide supplemental Donut Hole cover . . .

-

Jun, 25 2023 — Review your Explanation of Benefits. Each month, your Medicare prescription drug plan will send you a printed Explanation of Benefits letter that will show you how close you are to entering . . .

-

May, 02 2023 — Yes. Our Medicare Part D Donut Hole Calculator or PDP-Planner is designed so seniors and other Medicare beneficiaries can see how their Part D drug spending could change throughout the year and . . .

May, 02 2023 — Yes. Our Medicare Part D Donut Hole Calculator or PDP-Planner is designed so seniors and other Medicare beneficiaries can see how their Part D drug spending could change throughout the year and . . . -

Jul, 12 2023 — Yes. If you use a great number of medications or one or more expensive medications, you can spend your way into, and out of the Coverage Gap or Donut Hole rather quickly. Review: When do you . . .

-

Jul, 01 2023 — Only the retail cost of formulary drugs purchased with your Medicare Part D prescription drug plan count toward entering the Coverage Gap or Donut Hole. Only your out-of-pocket drug spending (Tr . . .

-

Jul, 10 2023 — If you reach the Coverage Gap, you will receive a 75% discount on all of your Medicare Part D plan's formulary drugs. The Donut Hole Discount has increased over the past years, but should remai . . .

-

Feb, 04 2024 — You can determine when (or if) you will enter your Medicare Part D Donut Hole or Coverage Gap by just dividing your Medicare Part D prescription drug plan's Initial Coverage Limit by 12 months and t . . .

-

Nov, 15 2023 — Maybe. Some Medicare Part D plans offer some additional Gap Coverage (beyond the Donut Hole discount) to plan members reaching the Donut Hole or Coverage Gap. If you are using generic drug . . .

-

Jul, 09 2023 — The Donut Hole (or Coverage Gap) is the third part of your Medicare Part D plan coverage and is a term used to describe a "gap" or pause in your Medicare Part D prescription drug coverage where - pri . . .

-

Feb, 02 2024 — If your formulary medications have a total retail cost over $420 each month, you will exceed your 2024 Medicare Part D plan's $5,030 Initial Coverage Limit and enter the Donut Hole or Coverage Gap sometime before December 31st.

-

Nov, 03 2023 — Yes. If your Medicare Advantage plan includes prescription drug coverage (MAPD), then the Donut Hole or Coverage Gap portion of your coverage works just like a stand-alone Medicare Part D pres . . .

Newest FAQs in Category

-

Apr, 23 2024 — If you use a Special Enrollment Period to change Medicare Part D drug plans during the year, your drug purchase history moves with you to your new Medicare plan. So if you are in the Donut Hole and move to another Part D plan, most likely you will still be in the Donut Hole.

-

Feb, 04 2024 — You can determine when (or if) you will enter your Medicare Part D Donut Hole or Coverage Gap by just dividing your Medicare Part D prescription drug plan's Initial Coverage Limit by 12 months and t . . .

-

Feb, 02 2024 — The Donut Hole or Coverage Gap is the third part or phase of your Medicare Part D prescription drug coverage where you will pay 25% of the retail price for any prescriptions found on your plan's formu . . .

Feb, 02 2024 — The Donut Hole or Coverage Gap is the third part or phase of your Medicare Part D prescription drug coverage where you will pay 25% of the retail price for any prescriptions found on your plan's formu . . . -

Feb, 02 2024 — If your formulary medications have a total retail cost over $420 each month, you will exceed your 2024 Medicare Part D plan's $5,030 Initial Coverage Limit and enter the Donut Hole or Coverage Gap sometime before December 31st.

-

Jan, 21 2024 — Aside from the 75% Donut Hole discount that you receive on all formulary drugs purchased in the Coverage Gap, your Medicare Part D prescription drug plan may also provide supplemental Donut Hole cover . . .

-

Dec, 28 2023 — Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your . . .

-

Nov, 15 2023 — Maybe. Some Medicare Part D plans offer some additional Gap Coverage (beyond the Donut Hole discount) to plan members reaching the Donut Hole or Coverage Gap. If you are using generic drug . . .

-

Nov, 03 2023 — Yes. If your Medicare Advantage plan includes prescription drug coverage (MAPD), then the Donut Hole or Coverage Gap portion of your coverage works just like a stand-alone Medicare Part D pres . . .

-

Jul, 12 2023 — Yes. If you use a great number of medications or one or more expensive medications, you can spend your way into, and out of the Coverage Gap or Donut Hole rather quickly. Review: When do you . . .

-

Jul, 10 2023 — If you reach the Coverage Gap, you will receive a 75% discount on all of your Medicare Part D plan's formulary drugs. The Donut Hole Discount has increased over the past years, but should remai . . .

-

Jul, 09 2023 — The Donut Hole (or Coverage Gap) is the third part of your Medicare Part D plan coverage and is a term used to describe a "gap" or pause in your Medicare Part D prescription drug coverage where - pri . . .

-

Jul, 01 2023 — Only the retail cost of formulary drugs purchased with your Medicare Part D prescription drug plan count toward entering the Coverage Gap or Donut Hole. Only your out-of-pocket drug spending (Tr . . .

-

Jun, 25 2023 — Review your Explanation of Benefits. Each month, your Medicare prescription drug plan will send you a printed Explanation of Benefits letter that will show you how close you are to entering . . .

-

May, 02 2023 — Yes. Our Medicare Part D Donut Hole Calculator or PDP-Planner is designed so seniors and other Medicare beneficiaries can see how their Part D drug spending could change throughout the year and . . .

May, 02 2023 — Yes. Our Medicare Part D Donut Hole Calculator or PDP-Planner is designed so seniors and other Medicare beneficiaries can see how their Part D drug spending could change throughout the year and . . .

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service