However, some Medicare Advantage plans do provide extended coverage for people who split their time between two different states.

Example: The UnitedHealthcare "Passport® travel program"

As a first example, some Medicare Advantage plans provided by UnitedHealthcare offer the UnitedHealth "Passport®" travel program that provided in-network cost-sharing benefits in two different states (or specific counties within different states) to meet the needs of the "Snowbird" or "Sunbird" population.

These Medicare Advantage plans have established networks in different states and plan members can receive in-network coverage or use healthcare providers in either network for the same in-network cost and the plan's same maximum out-of-pocket (MOOP) limits continue to apply.

In this example, the Medicare plan member is required to notify the Medicare plan carrier that the member is traveling outside of the service area and the "Passport" feature is then activated. The member can continue to use the Passport feature for up to 9-months and must notify the plan carrier when the member returns to the original service area. (Please note, if a member stays outside of their original service area over 9 months when the Passport feature is activated, the member can be disenrolled from the Medicare Advantage plan.)

To learn more about a Medicare Advantage plan's travel feature, you can call the plan or review the Medicare Advantage plan's Evidence of Coverage document for information under a section heading such as "Getting care using our plan’s optional visitor/traveler benefit".

https://www.uhcprovider.com/ content/dam/provider/docs/public/ health-plans/Passport-FAQs.pdf

https://www.uhcprovider.com/content/dam/provider/docs/public/health-plans /medicare/2021/2021-uhc-passport-faqs-ma-individual.pdf

Example: The UPMC for Life HMO "Travel Concierge Program"

For residents of some counties in Ohio and Pennsylvania, the University of Pittsburgh Medical Center (UPMC), through their UPMC Health Plan, offers UPMC for Life Medicare Advantage HMOs, that include the plan's "Travel Concierge Program" allowing HMO plan members to pay in-network cost-sharing when traveling to some states in the sunny-south.

The UPMC website notes that the HMO plan member will: "[p]ay the same cost-sharing as you would at home when seeing a [healthcare] provider in Arizona, Florida, Georgia, North Carolina, South Carolina, and Tennessee."

Like the UnitedHealthcare travel feature, the UPMC for Life plan documentation instructs the plan member who wishes to use the Travel Concierge Program to "[c]all the Health Care Concierge team before you see your provider so that we can help to coordinate your care."

Please see: (https://www.upmchealthplan.com /medicare/learn/plans/ learn-about-emergency-travel-assistance.aspx)

No multi-state travel program available in your area?

Traveling outside of your "home" network and changes in coverage or cost.

If you do not have any Medicare Advantage plans in your area that provide a "Passport" or "Concierge" -like feature, you still are able to travel with your Medicare Advantage plan.

As noted, all Medicare Advantage plan will provide you with emergency coverage outside of your plan’s service area or as you travel across the country. In addition, Medicare Advantage plans will provide other forms of coverage outside of your local service area.However, depending on your chosen Medicare Advantage plan, you may pay much more for out-of-network coverage and, perhaps more importantly, out-of-network coverage may not count toward meeting your annual Maximum Out-of-Pocket limit (or MOOP) - meaning that your out-of-network medical costs are not "capped" and could be very high.

As background, Medicare Advantage plans come in several forms and the availability of plans will depend on the ZIP code or county where you have your permanent address (the address used on federal income tax filing).

Here is a brief overview of the type of Medicare Advantage plans that might be in your area:

(1) Health

Maintenance Organization (HMO)

– This is usually the Medicare Advantage plan with the lowest premiums as they

have the most restrictive network of healthcare providers. In other words, if you travel, you may pay

the highest costs when seeking healthcare services outside of the plan's

established provider network. As mentioned above, the "passport" option may be included in an HMO.

(2) Health

Maintenance Organization with a Point of Service option (HMO-POS)

- An HMO-POS is a Medicare Advantage Plan that is a Health Maintenance

Organization with a more flexible network allowing plan Members to seek

care

outside of the traditional HMO network under certain situations or for

certain

treatment - all for an additional cost or co-payment rate. Again, your

out-of-network spending may not count toward your annual MOOP limit.

(3) Preferred

Provider Organization (PPO)

- This type of Medicare Advantage plan has a more flexible provider network as

compared to a HMO Medicare Advantage plan. With a Medicare Advantage PPO you can generally use doctors, hospitals,

and providers outside of the network without a referral - but for an additional

cost. As mentioned above, the "passport" option may be included in a regional PPO (RPPO).

But, the challenge with a PFFS plan can be that your doctors or healthcare provider may or may not accept the plan's terms and conditions - and each subsequent visit to a healthcare provider required that you re-affirm that the PFFS plan is still accepted. PFFS plans are not currently as popular as they were in past years due to changes in Medicare Advantage plan design requirements and many older PFFS plans were consolidated into more conventional Medicare Advantage plans with established networks. Today, only a limited number of Medicare Advantage PFFS plans still exist. You can click here to read about the decline of the Medicare Advantage PFFS plan.

(5) Medicare Savings Account (MSA) - Unlike other Medicare Advantage plans, Medical Savings Account plans are made up of a high-deductible health plan for your Medicare Part A and Medicare Part B coverage and a medical savings account funded by an annual tax-free deposit. So, you can use the money in your savings account to pay for Medicare Part A and Medicare Part B expenses, and when your MSA deductible is met, the plan pays for any further Medicare-covered services. You might find that the MSA (like a PFFS plan) does not have an established network of healthcare providers and you can visit any provider (doctor or hospital) that accepts the terms of the MSA (but, emergency care cannot be denied). You may also find that some MSAs have a healthcare network and you will pay more for coverage is you seek healthcare out-of-network.

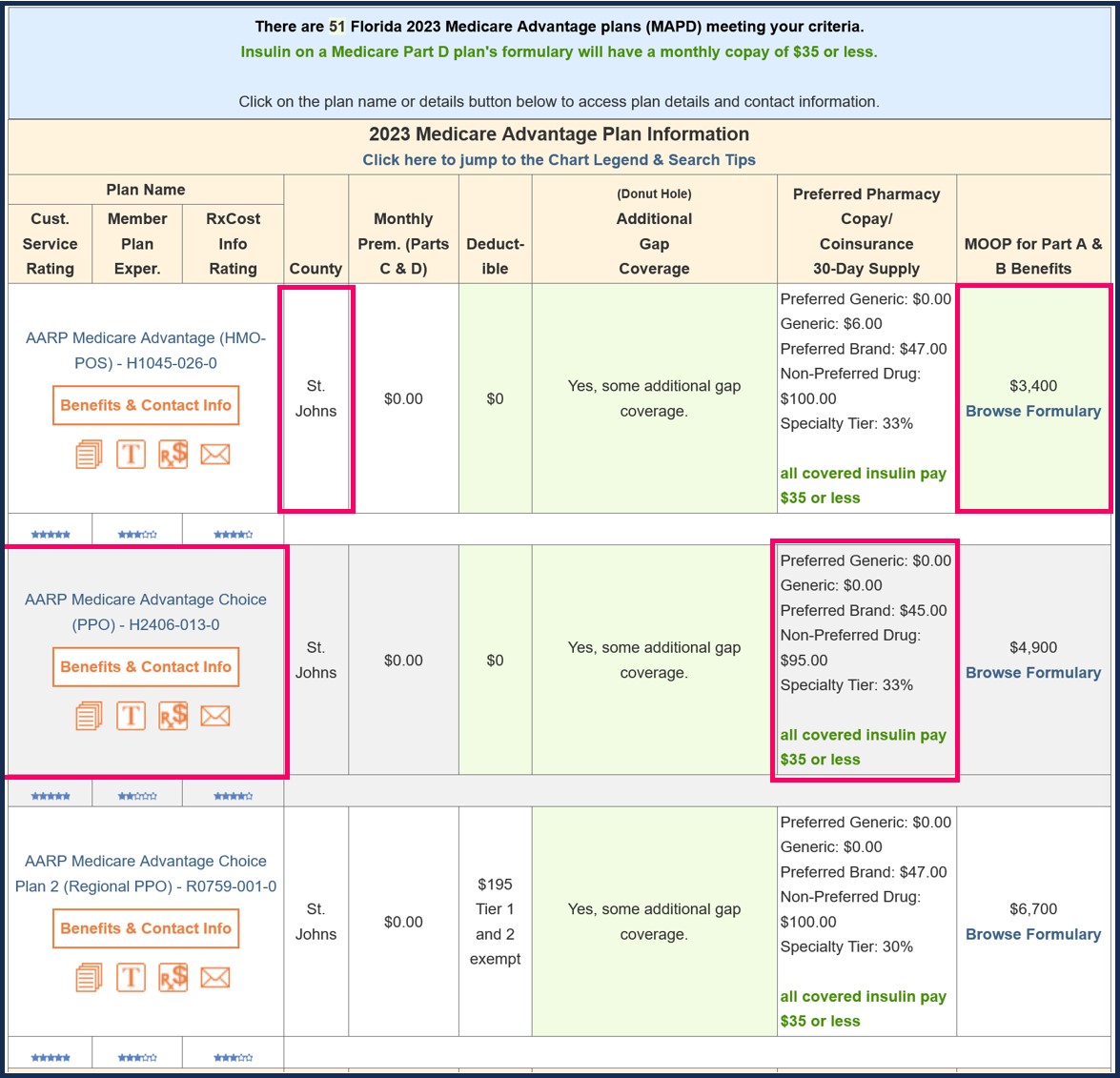

To see Medicare Advantage plans that are available in your Service Area, you can use our Medicare Advantage plan finder (MA-Finder.com). If you click on the Medicare plan name, you can see an overview of the plan's coverage.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service