If I decide not to join any Medicare prescription drug plan, and I do not have any other prescription coverage, how long will I have to pay the late-enrollment premium penalty?

Forever, except for a few situations. The late-enrollment premium penalty is permanent for most people over 65 and you will pay the penalty as long as you are enrolled in a Medicare Part D prescription drug plan (or a Medicare Advantage plans that include drug coverage or MAPDs).

However, if you are under 65 and eligible for Medicare due to a disability, you will have a second chance to join a Medicare prescription drug plan when you turn 65 (during your Initial Enrollment Period) and if you join a Medicare drug plan at this time, you will move forward without the penalty.

Also, if you are eligible, or become eligible for the Medicare Part D financial Extra Help or Low-Income Subsidy (LIS) program, you will not pay a late-enrollment penalty.

Suggestion: If you are using no medications and are in good health, consider enrolling in a Medicare Part D plan with a low monthly premium and avoid a possible long-term penalty - or consider a Medicare Advantage plan that includes prescription drug coverage and has a low or $0 premium.

And now the bad news: How a late-enrollment penalty accumulates over time

However, if you are under 65 and eligible for Medicare due to a disability, you will have a second chance to join a Medicare prescription drug plan when you turn 65 (during your Initial Enrollment Period) and if you join a Medicare drug plan at this time, you will move forward without the penalty.

Also, if you are eligible, or become eligible for the Medicare Part D financial Extra Help or Low-Income Subsidy (LIS) program, you will not pay a late-enrollment penalty.

Suggestion: If you are using no medications and are in good health, consider enrolling in a Medicare Part D plan with a low monthly premium and avoid a possible long-term penalty - or consider a Medicare Advantage plan that includes prescription drug coverage and has a low or $0 premium.

And now the bad news: How a late-enrollment penalty accumulates over time

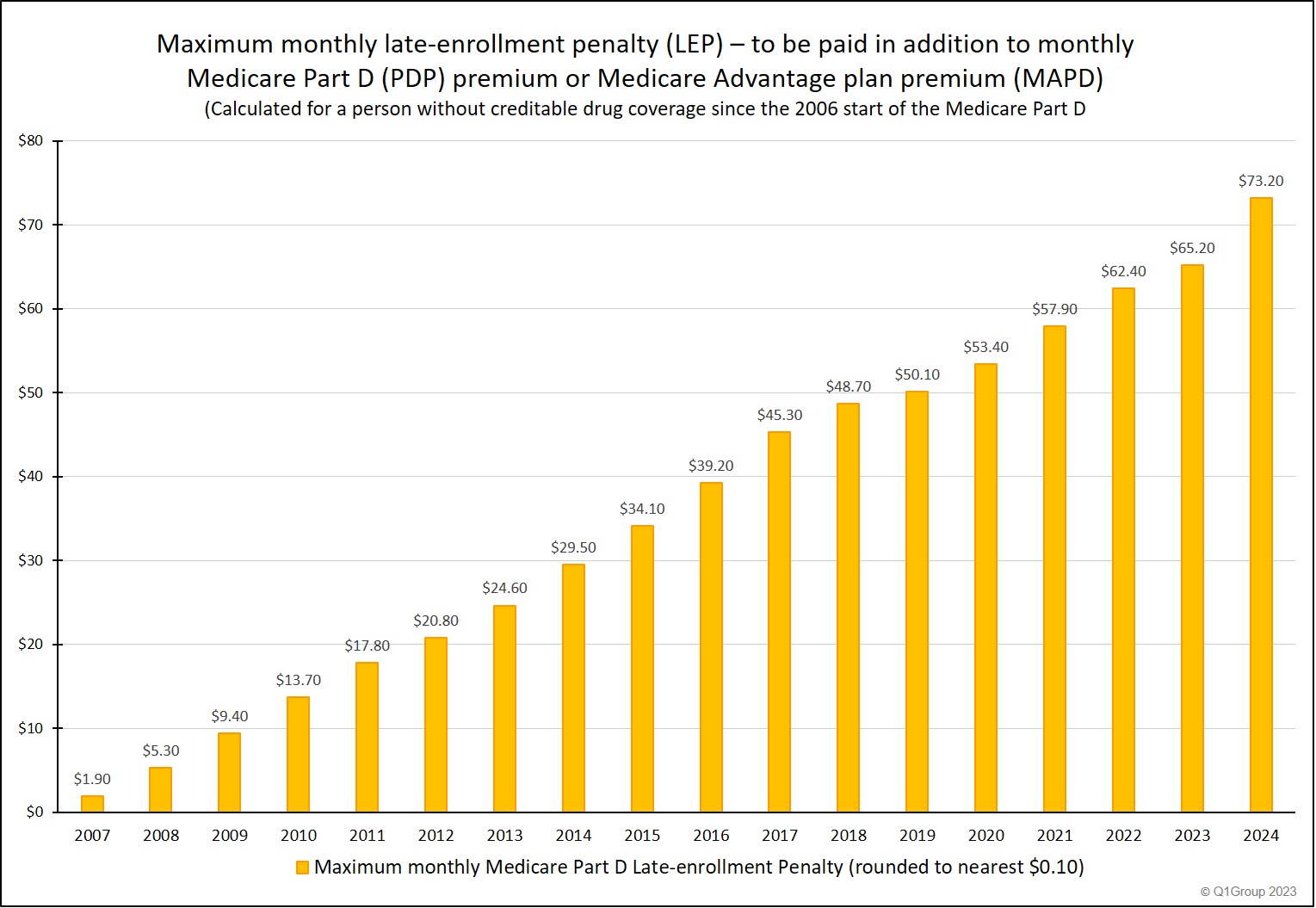

If you were eligible for Medicare Part D plan coverage back in January 2006 and never joined a Medicare Part D plan and are not eligible for the Extra Help (or Medicare LIS) program and have been without any other creditable prescription drug coverage (such as employer or VA coverage) since the start of the Medicare Part D program (211 months including all of 2023), then you would have a monthly late-enrollment penalty for of around $73.20 in 2024 – paid in addition to your monthly Medicare Part D plan premium.

This means you would pay an additional $878 over the course of the year.

We calculated the maximum penalty as (211 months without some form of creditable drug coverage) * (1% of $34.70 which is the 2024 annual Medicare Part D base premium) = $73.217 rounded to the nearest $0.10, so this person's 2024 late-enrollment penalty is $73.20 per month.

The ever-increasing "cost of waiting" to enroll in a Medicare Part D plan.

You can also read more about the late-enrollment premium penalty in our Medicare News section: "Late Enrollment Penalty".

Browse FAQ Categories

Compare Local Pharmacy Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service