What do I need to know about my new Medicare card?

The Centers for Medicare and Medicaid Services (CMS) is mailing new Medicare cards to all 57.7 million Medicare beneficiaries (starting back in April 2018) and will continue through April 2019*.

Update 01/22/2019 - Mailings Complete! Your new Medicare card should have arrived by now. If you did not get your new Medicare card, please do the following:

Update 01/22/2019 - Mailings Complete! Your new Medicare card should have arrived by now. If you did not get your new Medicare card, please do the following:

- Look to see if you have received a plain white envelope from the Department of Health and Human Services.

- If you did not receive your card, please call Medicare at 1-800-Medicare (1-800-633-4227). The call center representative can check the status of your new card. Be sure to verify your mailing address for accuracy.

- You can sign in to your secure MyMedicare.gov account to see your Medicare Number and print your official card. If you do not have a MyMedicare account, you can sign up at MyMedicare.gov.

While you are waiting for your new Medicare card, you can continue to use your current Medicare card for health care services.

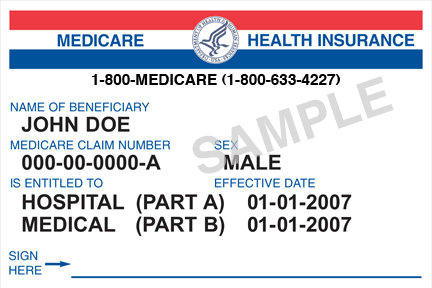

As noted by CMS, "[t]he new [Medicare] cards will use a unique, randomly-assigned 11-[character] number called a Medicare Beneficiary Identifier (MBI), to replace the Social Security-based Health Insurance Claim Number (HICN) currently used on the Medicare card." CMS also noted that the new Medicare card initiative "will prevent fraud, fight identity theft and protect essential program funding and the private healthcare and financial information of our Medicare beneficiaries."

Here is an example of the original Medicare card with Social Security-based Health Insurance Claim Number (HICN) (source: CMS)

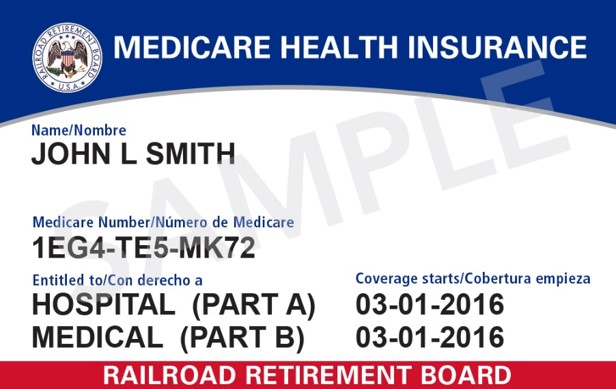

And here is an example of the new Medicare card (starting April 2018) with unique and randomly-assigned Medicare Beneficiary Identifier (MBI) (source: CMS)

Here are a few key points about your new Medicare card from CMS:

- New Medicare Card, Same Medicare Benefits.

Your new Medicare card will not affect or change your Medicare Part A or Medicare Part B benefits. Your Medicare Part A and Part B effective dates printed on the new Medicare card ("Coverage Starts") will not change.

- The 11-charecter Medicare Beneficiary Identifier (MBI).

Your new Medicare card is printed on paper, the size of a credit card, and will have a new 11-character Medicare "Number" or Medicare Beneficiary Identifier (MBI). You will notice that your new MBI "number" is actually alphanumeric or having both upper-case letters and numbers (from the sample graphic above you can see "1EG4-TE5-MK72") - to avoid confusion, the MBI will exclude the letters:"S, L, O, I, B, Z" (since these letters are easily mistaken for numbers).

- Your Unique and Random Number.

Your new Medicare card will have a number that is unique to you - but, there is no meaning to the number. Remember, you will have a different number than your spouse.

- New Medicare Cards May Have QR Codes

New Medicare cards may have a square code, also referred to as a QR code (a type of machine-readable code). The QR codes on Medicare cards allow the contractor who prints the cards to ensure the right card goes to the right person with Medicare or Railroad Retirement Board (RRB) benefits. Providers cannot use it for any other purpose. The RRB issued cards may have a QR code on the front of the card while all other Medicare patients may get a new card with a QR code on the back of the cards. These are legitimate (official) Medicare cards. (updated: 2018-06-21)

- No more Social Security numbers.

Medicare is removing the 9-digit Social Security Number from these new Medicare cards (from the sample original Medicare card graphic above we had the Social Security Number "000-00-0000").

- No more gender, no more signature.

The new Medicare cards will no longer include your gender and your new Medicare cards will not have a signature line.

- Helping you to fight against identity theft and more.

The new Medicare card will help protect your identity (prevent identity theft) and, as noted above, fights fraud, protects "essential program funding and the private healthcare and financial information of our Medicare beneficiaries".

- Important: Confirm your mailing address.

Please make sure that your mailing address is up-to-date by calling the Social Security Administration at 1-800-772-1213 (TTY users 1-800-325-0778) (Monday through Friday, from 7 a.m. to 7 p.m.) or visit https://ssa.gov/myaccount.

- Look for your new Medicare card in the mail.

CMS will automatically mail you a new Medicare card - you do not need to take any action. Below is the CMS Medicare card mailing schedule and, as you can imagine, mailing new Medicare cards to 57.7 million people will take some time, so be sure to have some patience. CMS will begin mailing new Medicare cards April 2018 and continue through April 2019.

Update 07/25/2018 - If you live in Alaska, American Samoa, California, Delaware, the District of Columbia, Guam, Hawaii, Maryland, Northern Mariana Islands, Pennsylvania, Oregon, Virginia, and West Virginia - you should have received your new Medicare card. (If you did not receive your new card, please call Medicare at 1-800-633-4227.)

-- New Medicare ID cards are currently being sent to Medicare beneficiaries in "Wave 3": Arkansas, Illinois, Indiana, Iowa, Kansas, Minnesota, Nebraska, North Dakota, Oklahoma, South Dakota, Wisconsin.

-- Medicare has also begun to send Medicare ID cards to residents of "Wave 4": Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, and Vermont.

Update 07/15/2018 - If you live in Delaware, the District Of Columbia, Maryland, Pennsylvania, Virginia, or West Virginia, you should have received your new Medicare card. (If you did not receive your new card, please call Medicare at 1-800-633-4227.)

Update 04/05/2018 - New Medicare cards will be sent to people who are newly eligible for Medicare starting April 2018. New Medicare cards will be sent to existing Medicare beneficiaries starting May 2018 - instead of April 2018.

| Group | States included in the card mailing |

Date of card mailing |

| Newly eligible Medicare Beneficiaries | All - Nationwide |

ongoing |

| 1 | Delaware, District of Columbia, Maryland, Pennsylvania, Virginia, West Virginia |

completed |

| 2 | Alaska, American Samoa, California, Guam, Hawaii, Northern Mariana Islands, Oregon |

completed |

| 3 | Arkansas, Illinois, Indiana, Iowa, Kansas, Minnesota, Nebraska, North Dakota, Oklahoma, South Dakota, Wisconsin | completed |

| 4 | Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont |

completed |

| 5 | Alabama, Florida, Georgia, North Carolina, South Carolina |

completed |

| 6 | Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Texas, Utah, Washington, Wyoming |

completed |

| 7 | Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Puerto Rico, Tennessee, Virgin Islands |

completed |

- Begin using your new Medicare card at once.

Once you receive your new Medicare card, CMS recommends that you destroy your old Medicare card, and immediately begin using your new Medicare card.

- Important: Keep your personal information secure.

Again, be sure to protect yourself by destroying your old Medicare card in a way that no one can get your personal information.

- Medicare Advantage plan Members.

If you are enrolled in a Medicare Advantage plan (MA or MAPD) like an HMO or PPO, you will continue using your Medicare plan's Member ID card just as you do now. Keep your new Medicare card safe, but carry the new Medicare card with you in case a healthcare provider asks to see it.

- Members of stand-alone Medicare Part D plans.

If you are enrolled in a stand-alone Medicare Part D prescription drug plan (PDP), you will continue using your Medicare Part D plan's Member ID card for your prescription drug coverage. Please also carry your new Medicare card with you for evidence of your Medicare Part A and Medicare Part B coverage.

- CMS Cautions and Fraud Alerts:

-- As emphasized by CMS: "Guard your Card". Protect your new Medicare card the same way you protect a credit card.

-- "Beware of anyone who contacts you about your new Medicare card. [CMS] will never ask you to give us personal or private information to get your new Medicare number and card." (emphasis added)

-- "Only give your new Medicare Number [MBI] to doctors, pharmacists, other health care providers, your insurers, or people you trust to work with Medicare on your behalf."

-- You do not need to pay for your new Medicare card. "If someone asks you for your information, for money, or threatens to cancel your health benefits if you don’t share your personal information, hang up and call [a Medicare representative] at 1-800-MEDICARE (1-800-633-4227)." (emphasis added)

-- "If someone calls you unexpectedly saying they “work with” or represent Medicare and need your card Number or other personal information, hang up! Medicare will only call you if you’ve called and left a message or if a representative said that someone will call you back." (emphasis added)

-- Important: Remember, your Medicare card will be sent to you automatically and you do not need to pay for your new Medicare card.

- New cards RRB beneficiaries.

Railroad Retirement Board (RRB) beneficiaries will also have a new card with the RRB logo.

An example of the new RRB card with Medicare Beneficiary Identifier (MBI) (source: CMS)

* The Medicare Access and CHIP

(Children’s Health Insurance Program) Reauthorization Act (MACRA) of 2015

requires CMS to remove Social Security Numbers (SSNs) from all Medicare cards

by April 2019. A new Medicare Beneficiary Identifier (MBI) will replace the

SSN-based Health Insurance Claim Number (HICN) as the identifier on all

Medicare cards.

Sources:

Related questions

Sources:

https://www.cms.gov/newcard,

https://www.medicare.gov/forms-help-and-resources/your-medicare-card.html

https://www.cms.gov/Medicare/New-Medicare-Card/Partners-and-Employers/Partners-and-employers.html

https://www.medicare.gov/forms-help-and-resources/your-medicare-card.html

https://www.cms.gov/Medicare/New-Medicare-Card/Partners-and-Employers/Partners-and-employers.html

Related questions

- How do I replace a lost or damaged Medicare card? Q1FAQ.com/710

- I am new to Medicare, will I receive an old or a new Medicare Card? Q1FAQ.com/711

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service