What is my Medicare Advantage plan's maximum out-of-pocket limit (MOOP)?

Your Medicare Advantage plan’s Maximum Out-of-Pocket Limit (MOOP) is the total amount you will spend this year on in-network copayments and coinsurance

for covered or eligible Medicare Part A and Medicare Part B medical services.

As a reminder: your Medicare Part A or hospital insurance covers in-patient care and Medicare Part B covers doctor visits or out-patient care

When you have reached your plan's annual MOOP limit, your Medicare Advantage plan's eligible Part A and Part B medical services are covered for the remainder of the year at no cost to you.

What is my Medicare Advantage plan's MOOP limit?

Maximum out-of-pocket limits will vary from plan-to-plan and your Medicare Advantage plan's maximum out-of-pocket limits can be as little as $0 (for D-SNPs and MMPs) up to the Medicare-established in-network annual maximum of $8,850 for 2024.

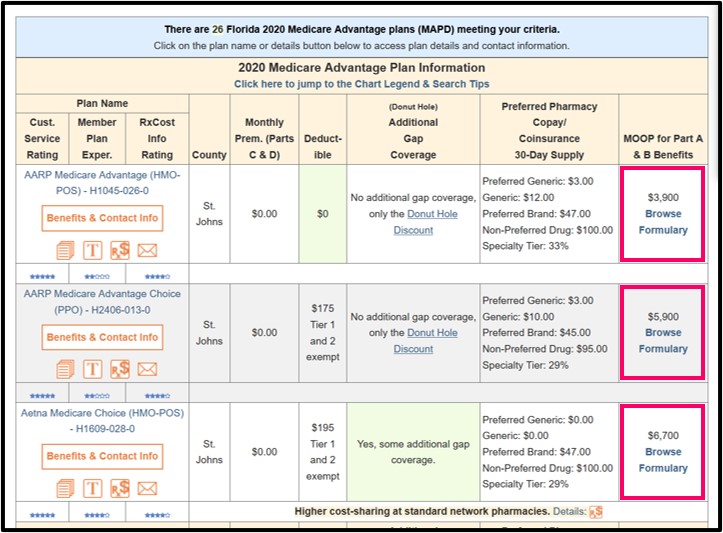

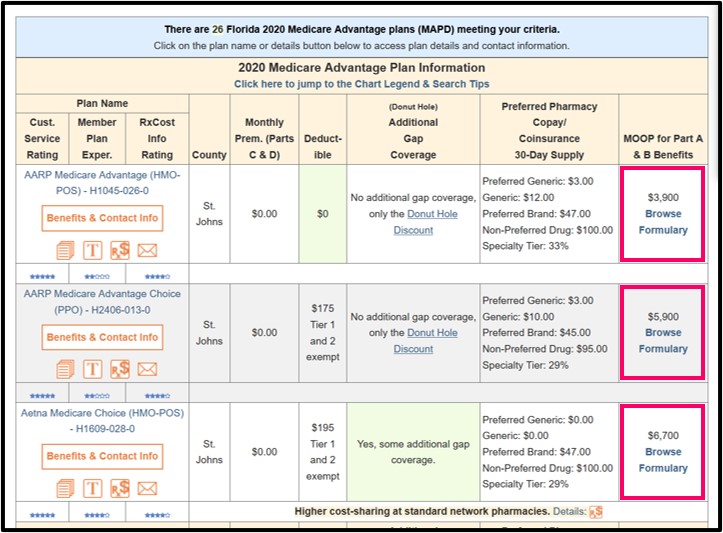

We show the MOOP levels for all Medicare Advantage plans in our MA-Finder tool.

For more information, you can also call your plan's Member Services department to learn more about your plan's MOOP (the toll-free telephone number is found on your Member ID card) or you can look in your Medicare plan's Evidence of Coverage (EOC) document for text that may say something such as:

For more information, you can also call your plan's Member Services department to learn more about your plan's MOOP (the toll-free telephone number is found on your Member ID card) or you can look in your Medicare plan's Evidence of Coverage (EOC) document for text that may say something such as:

As a reminder: your Medicare Part A or hospital insurance covers in-patient care and Medicare Part B covers doctor visits or out-patient care

When you have reached your plan's annual MOOP limit, your Medicare Advantage plan's eligible Part A and Part B medical services are covered for the remainder of the year at no cost to you.

What is my Medicare Advantage plan's MOOP limit?

Maximum out-of-pocket limits will vary from plan-to-plan and your Medicare Advantage plan's maximum out-of-pocket limits can be as little as $0 (for D-SNPs and MMPs) up to the Medicare-established in-network annual maximum of $8,850 for 2024.

We show the MOOP levels for all Medicare Advantage plans in our MA-Finder tool.

"As a member of the plan, the most you will have to pay out-of-pocket for in-network covered Part A and Part B services in 202[x] is $1,500. The amounts you pay for copayments and coinsurance for in-network covered services count toward this maximum out-of-pocket amount. . . . If you reach the maximum out-of-pocket amount of $1,500, you will not have to pay any out-of-pocket costs for the rest of the year for in-network covered Part A and Part B services."In this example, if your Medicare Advantage plan has an annual MOOP limit of $1,500 - and you have already spent $1,500 out-of-pocket for in-network, eligible medical expenses - you will spend $0 for the remainder of the year for your in-network, covered Part A and Part B medical costs.

As a note, the most common 2024 Medicare Advantage plan MOOP limits are $6,700 and $4,900 (and, as a comparison, the most common 2020 Medicare Advantage plan MOOP limits were $6,700 and $3,400).

| Percentage of Medicare Advantage Plans Using Popular MOOP Limits* |

|||||

| Plan Year | $7,550 | $6,700 | $3,450 | $3,400 | $0 |

| 2024 | 3.3% | 3.9% | 0.9% | 3.2% | 0.9% |

| 2023 | 5.5% | 7.3% | 2.1% | 3.6% | 1.6% |

| 2022 | 9.5% | 9.6% | 3.4% | 5% | 1.4% |

| 2021 | 12% | 12% | 4% | 7% | 1% |

| 2020 | n/a | 24% | n/a | 10% | 2% |

| 2019 | n/a | 34% | n/a | 13% | 3% |

| 2018 | n/a | 39% | n/a | 14% | 3% |

| 2017 | n/a | 36% | n/a | 14% | 6% |

| 2016 | n/a | 35% | n/a | 17% | 7% |

| 2015 | n/a | 38% | n/a | 23% | 4% |

| 2014 | n/a | 25% | n/a | 26% | 10% |

* Medicare Advantage plans can be defined by three numbers: (Contract_ID, Plan_ID, Segment_ID) and may appear on your plan documents as "H1234-001-001". This table takes into account the total number of Medicare Advantage plans on a Segment ID level (or regional level). This means that the number of plans is slightly higher than used in other parts of our analysis. For example, in 2024, we calculate the total number of unique plans down to a Plan ID level as 5,369. However, in this table, we calculate the number of plans as 5,806 for the total number of 2024 Medicare Advantage at a Segment ID level.

n/a - not available - the $7,550 and $3,450 MOOP limits were introduced in 2021.

Note: *Some Medicare Advantage plans do not have a MOOP limit. These plans are Medicare-Medicaid Plans (MMP) and D-SNPs (Medicare Advantage Special Needs Plans for dual eligible Medicare/Medicaid beneficiaries) and are not included in the chart above.

You can click on the links in the chart above to see how MOOP limits can vary between Medicare Advantage plans each year.

Important: Some Medicare Part A and Part B healthcare costs may

be excluded from your maximum out-of-pocket limit - so some medical costs will not count toward reaching your MOOP - and after reaching MOOP, you may still have additional healthcare costs for the remainder of the year.

Please look for language in your Medicare Advantage plan's (MA or MAPD) Summary of Benefits or Evidence of Coverage document that may read something like:

Important: Out-of-network Part A and Part B medical costs may be excluded from MOOP or your plan may have a separate higher out-of-network MOOP limit.

Please look for language in your Medicare Advantage plan's (MA or MAPD) Summary of Benefits or Evidence of Coverage document that may read something like:

Remember: When you reach your MOOP, keep paying your Medicare plan premiums.

Once you reach your MOOP limit, your Medicare Advantage plan will contact you and also remind you that you will need to continue paying your Medicare Part B premiums (if paid by you) and your Medicare Advantage plan premiums.

Please also remember that MOOP is only for medical services and reaching your MOOP limit does not affect your Medicare Advantage plan’s prescription drug coverage. In other words, you will need to continue paying your prescription drug costs - even after you meet your Medicare Advantage plan's MOOP, until you reach your Medicare Part D out of pocket limit or TrOOP, which determines when you enter your plan's Catastrophic Coverage phase. And beginning in 2024, you will not have any out-of-pocket costs for formulary drug purchases after reaching your plan's 2024 $8,000 Part D total out-of-pocket threshold (TrOOP); therefore, TrOOP becomes the RxMOOP in 2024.

Important: Part A & Part B MOOP is not Part D TrOOP!

To learn more, please read: "How are MOOP and TrOOP related? Does your TrOOP go towards meeting your MOOP?"

Reminder: Your Medicare Advantage plan's MOOP can change every year.

Medicare Advantage plans can change maximum out-of-pocket limits (MOOP) every year and the higher the MOOP, the more you will pay before your medical costs are covered by your plan. Medicare Advantage plans may also change the MOOP limits for in-network and out-of-network Part A and Part B coverage.

The good news is that Medicare annually sets the maximum MOOP limit for all Medicare Advantage plans - and your Medicare plan's Annual Notice of Change letter (ANOC) will notify you about upcoming changes to your MOOP.

Please look for language in your Medicare Advantage plan's (MA or MAPD) Summary of Benefits or Evidence of Coverage document that may read something like:

"For covered services that have a benefit limitation, you pay the full cost of any services you get after you have used up your benefit for that type of covered service. If the covered service exceeds the benefit limit, the amount you pay will not count towards your out-of-pocket maximum [for example, Skilled Nursing: $20 copay days 1-20, and $196 per day copay for days 21-100]. "

or

"In addition, generally amounts you pay for non-authorized and/or non-plan directed out of network services, Non Medicare Covered Services and supplemental benefits such as, but not limited to: Dental, Hearing, Outpatient Blood Services, Over the Counter medications, Transportation and Vision do not count toward your maximum out-of-pocket amount." [emphasis added]

Important: Out-of-network Part A and Part B medical costs may be excluded from MOOP or your plan may have a separate higher out-of-network MOOP limit.

Please look for language in your Medicare Advantage plan's (MA or MAPD) Summary of Benefits or Evidence of Coverage document that may read something like:

"Your yearly limit(s) in this plan: $6,700 for services you receive from in-network providers. If you reach the limit on out-of-pocket costs [MOOP], you keep getting covered hospital [Medicare Part A] and medical [Medicare Part B] services and we will pay the full cost for the rest of the year. Please note that you will still need to pay your monthly premiums and cost-sharing for your Part D prescription drugs."

or

As a member of our plan, the most you will have to pay out-of-pocket for in-network covered services in 202[x] is $6,700. . . . Your plan also has a combined maximum out-of-pocket amount of $10,000. This is the most you pay during the calendar year for covered plan services received from both in-network and out-of-network providers. The amounts you pay for deductibles, copayments and coinsurance for covered services count toward this combined maximum out-of-pocket amount. . . . If you have paid $10,000 for covered services, you will have 100% coverage and will not have any out-of-pocket costs for the rest of the year for covered services. [The Medicare-established annual maximum combined (in-network / out-of-network) MOOP limit will increase to $13,300 in 2024.]

orAlthough some types of Medicare Advantage plans (such as HMOs) may not include out-of-network coverage as part of the plan's MOOP limit - you may find other Medicare Advantage plans (such as HMO-POS plans) include out-of-network coverage as part of the plan's higher MOOP limit.

"Your in-network maximum out-of-pocket amount is $4,000. This is the most you pay during the calendar year for covered Medicare Part A and Part B services received from in-network providers. The amounts you pay for copayments and coinsurance for covered services from in-network providers count toward this in-network maximum out-of-pocket

amount. (The amounts you pay for plan premiums, Part D prescription drugs, and services from out-of-network providers do not count toward your in-network maximum out-of-pocket amount.)" [emphasis added]

Remember: When you reach your MOOP, keep paying your Medicare plan premiums.

Once you reach your MOOP limit, your Medicare Advantage plan will contact you and also remind you that you will need to continue paying your Medicare Part B premiums (if paid by you) and your Medicare Advantage plan premiums.

Please also remember that MOOP is only for medical services and reaching your MOOP limit does not affect your Medicare Advantage plan’s prescription drug coverage. In other words, you will need to continue paying your prescription drug costs - even after you meet your Medicare Advantage plan's MOOP, until you reach your Medicare Part D out of pocket limit or TrOOP, which determines when you enter your plan's Catastrophic Coverage phase. And beginning in 2024, you will not have any out-of-pocket costs for formulary drug purchases after reaching your plan's 2024 $8,000 Part D total out-of-pocket threshold (TrOOP); therefore, TrOOP becomes the RxMOOP in 2024.

Important: Part A & Part B MOOP is not Part D TrOOP!

To learn more, please read: "How are MOOP and TrOOP related? Does your TrOOP go towards meeting your MOOP?"

Reminder: Your Medicare Advantage plan's MOOP can change every year.

Medicare Advantage plans can change maximum out-of-pocket limits (MOOP) every year and the higher the MOOP, the more you will pay before your medical costs are covered by your plan. Medicare Advantage plans may also change the MOOP limits for in-network and out-of-network Part A and Part B coverage.

The good news is that Medicare annually sets the maximum MOOP limit for all Medicare Advantage plans - and your Medicare plan's Annual Notice of Change letter (ANOC) will notify you about upcoming changes to your MOOP.

Browse FAQ Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service