What is the Medicare Part D late enrollment penalty (LEP)?

The Medicare Part D late enrollment premium penalty (LEP) is an additional cost you will pay every month because you did not enroll into a Medicare Part D prescription drug plan when you were initially eligible for Medicare coverage - or you were without Medicare drug coverage for a period of more than 63 days - and you did not have any other creditable prescription coverage (drug coverage that was at least as comprehensive as Medicare Part D drug coverage, such as VA drug coverage, TRICARE, or

employer healthcare benefits).

Calculating your Late Enrollment Penalty (LEP)

The Late Enrollment Penalty is calculated as an additional 1% of the average annual base Medicare Part D premium (for example, $34.70 in 2024 up from $32.74 in 2023) for every month that you were without creditable coverage (in other words, you will pay roughly, a $0.35 penalty for every month without drug coverage).

The Centers for Medicare and Medicaid Services (CMS) will calculate your Part D Late Enrollment Penalty by totaling the number of months you have been without "creditable" prescription drug coverage and multiplying the total months by 1% of the national base average Medicare Part D premium (this changes each year).

For example, if you were without drug coverage for 10 months, in 2024 you would pay 10 months * 1% * $34.70 = around $3.50 per month that is paid in addition to your Medicare Part D premium.

The good news is that you do not need to calculate your Medicare Part D late enrollment premium penalty each year. Your penalty is calculated for you by Medicare each year and then reported to your Medicare Part D plan or Medicare Advantage plan. Your Medicare Part D plan will then send you a letter regarding the amount of your penalty.

Please note, your Medicare Part D LEP is permanent.

As reference, here are the national base average Medicare Part D premium values used by CMS to calculate the late enrollment penalties for past years:

Calculating your Late Enrollment Penalty (LEP)

The Late Enrollment Penalty is calculated as an additional 1% of the average annual base Medicare Part D premium (for example, $34.70 in 2024 up from $32.74 in 2023) for every month that you were without creditable coverage (in other words, you will pay roughly, a $0.35 penalty for every month without drug coverage).

The Centers for Medicare and Medicaid Services (CMS) will calculate your Part D Late Enrollment Penalty by totaling the number of months you have been without "creditable" prescription drug coverage and multiplying the total months by 1% of the national base average Medicare Part D premium (this changes each year).

For example, if you were without drug coverage for 10 months, in 2024 you would pay 10 months * 1% * $34.70 = around $3.50 per month that is paid in addition to your Medicare Part D premium.

The good news is that you do not need to calculate your Medicare Part D late enrollment premium penalty each year. Your penalty is calculated for you by Medicare each year and then reported to your Medicare Part D plan or Medicare Advantage plan. Your Medicare Part D plan will then send you a letter regarding the amount of your penalty.

Please note, your Medicare Part D LEP is permanent.

As reference, here are the national base average Medicare Part D premium values used by CMS to calculate the late enrollment penalties for past years:

|

|

And here are a few articles detailing how the late enrollment penalty changes each year.

- 2024 Medicare Part D Late-Enrollment Penalty rate will increase 6% - with maximum penalties reaching up to $878 for the year.

- 2023 Medicare Part D Late-Enrollment Penalty rate will decrease - but maximum penalties can reach up to $783 for the year.

- 2022 Medicare Part D Late-Enrollment Penalties will increase slightly - maximum penalties can reach up to $749 for the year.

- 2021 Medicare Part D Late-Enrollment Penalties will increase slightly - maximum penalties can reach up to $695 for the year.

- 2020 Medicare Part D Late-Enrollment Penalties decrease for a third year in a row

- 2019 Medicare Part D Late-Enrollment Penalties (5.23% decrease) - with max annual penalties reaching $601

- 2018 Medicare Part D Late-Enrollment Premium Penalties will Decrease by 1.71%

- 2017 Medicare Part D Late Enrollment Premium Penalty example (4.5% increase)

-

2016 Late Enrollment Premium Penalty example (3% increase)

-

2015 Late Enrollment Premium Penalty example (2% increase)

-

2014 Late Enrollment Premium Penalty example (4% increase)

-

2013 Late Enrollment Premium Penalty example

Exception to the LEP: The Medicare Part D Extra Help program

Please note, if you are eligible for Medicare Part D Extra Help (also known as the Low-Income Subsidy (LIS) program), you will not be subject to a late enrollment penalty - if you qualify for Medicare and Medicaid, you automatically qualify for the Medicare Part D Extra Help program.

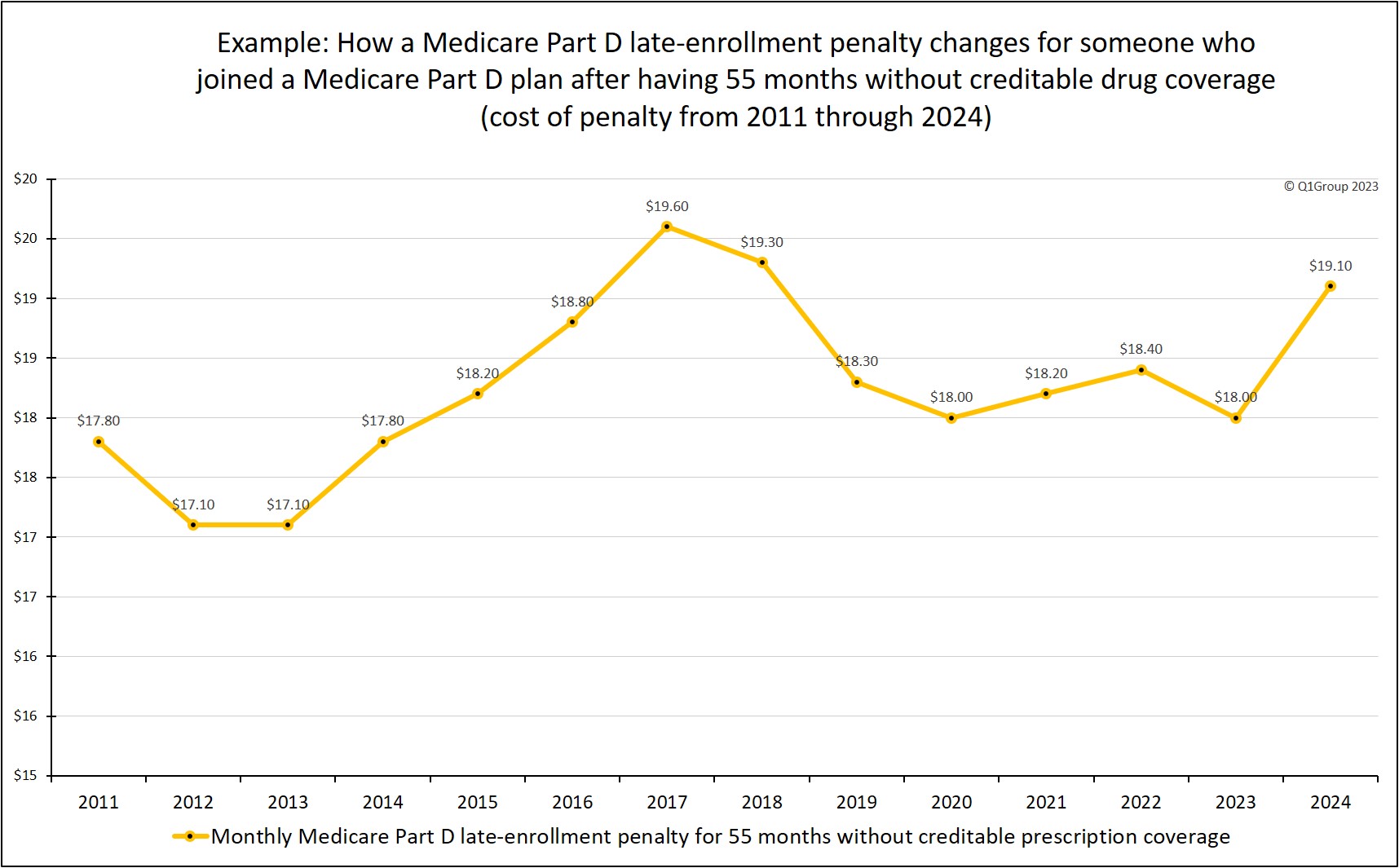

Example: How do I estimate my 55 month late-enrollment penalty?

As shown in the table above, the 2024 national base Medicare Part D premium is $34.70. So, if you were previously without creditable prescription drug coverage for 55 months, you would pay your monthly Medicare plan premium, plus you would pay a 2024 monthly penalty of $19.10 (55 months without drug coverage * 1% of $34.70 - rounded to the nearest $0.10) or around an additional $229 per year for your drug coverage.

If you stayed in a Medicare Part D plan, here is a chart of how your 55-month late-enrollment penalty would have changed over the years.

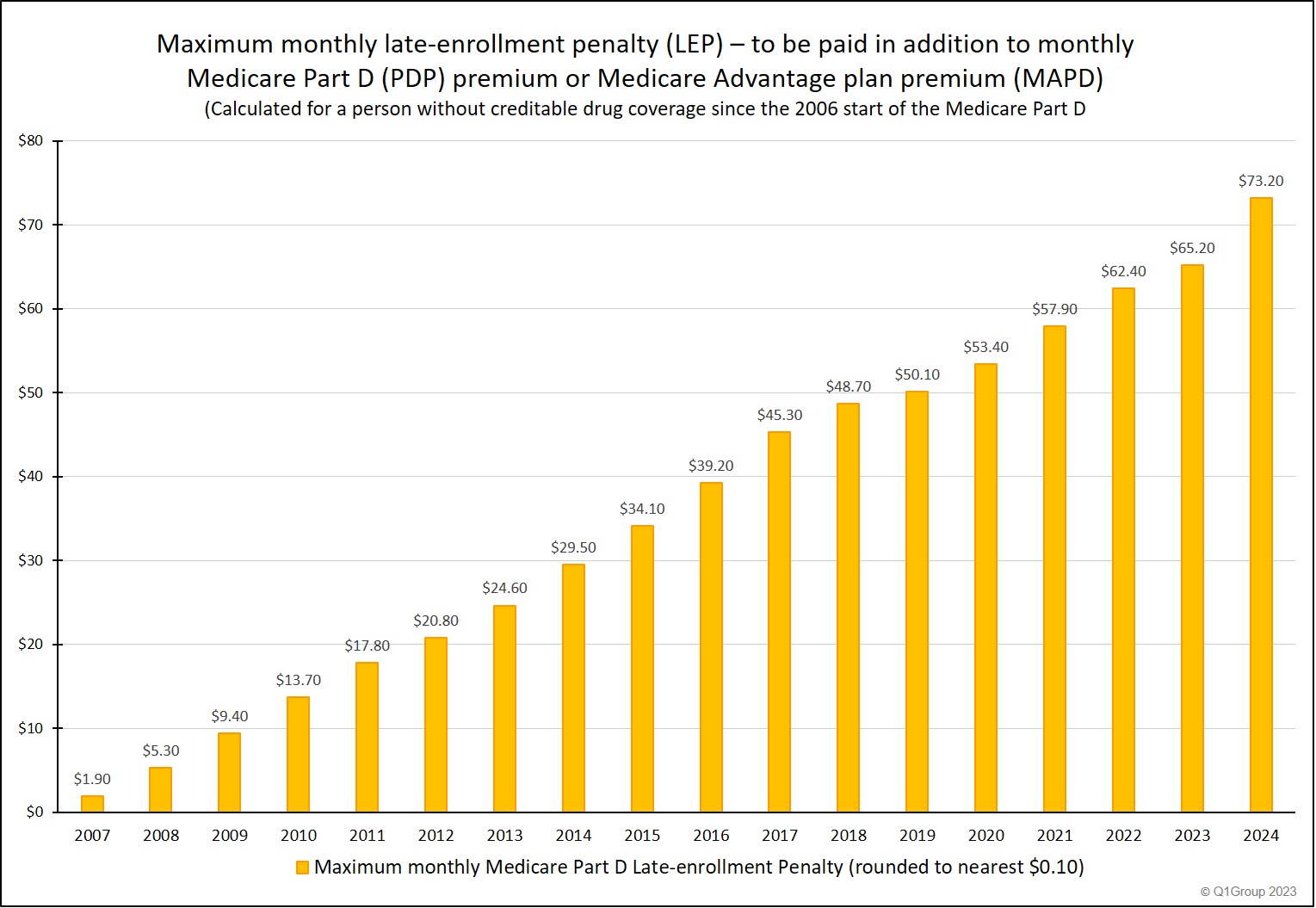

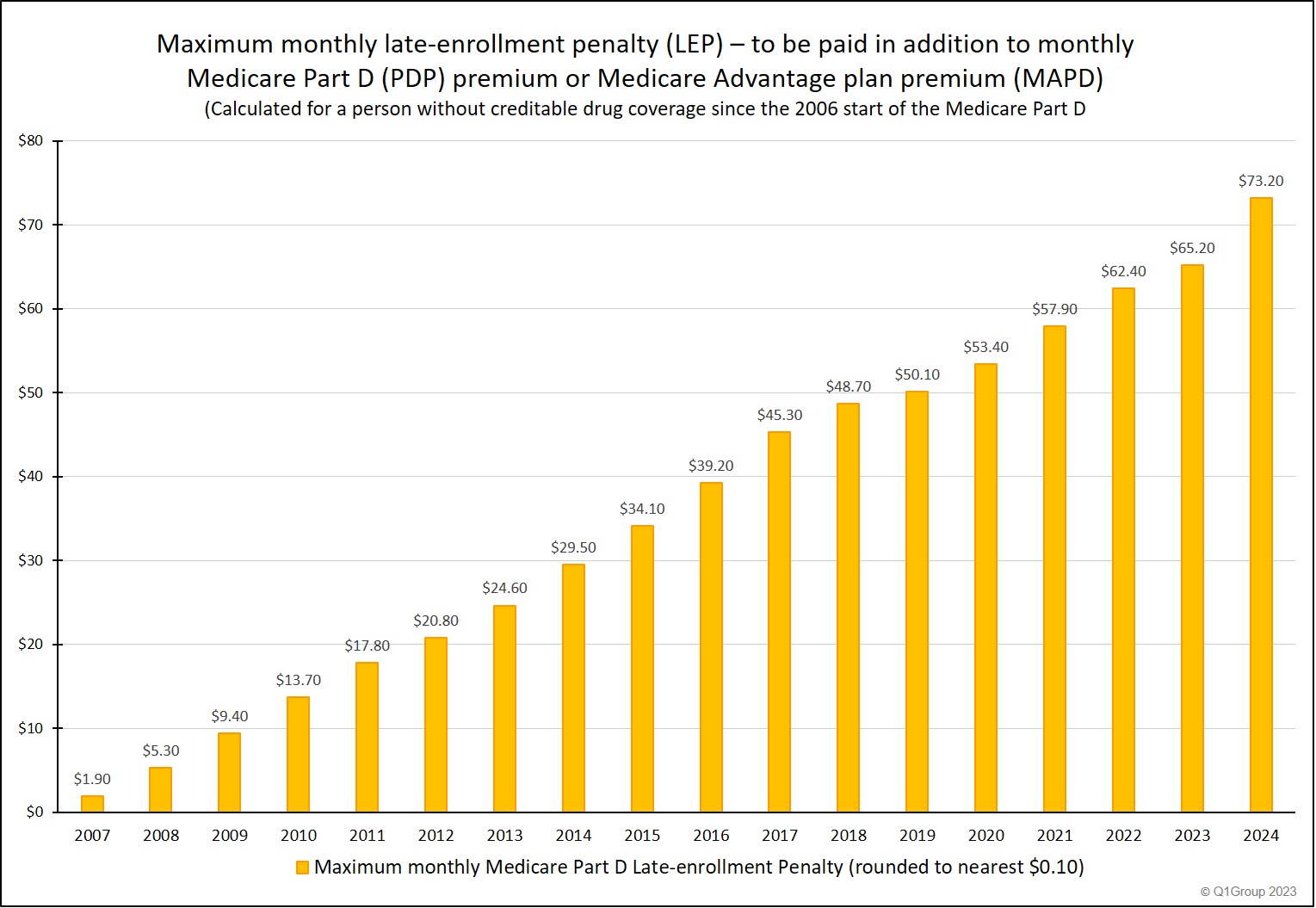

The ever-increasing "cost of waiting" to enroll in a Medicare Part D plan.

The following "maximum penalty" chart emphasizes the possible costs you may incur if you do not have any other prescription drug coverage and delay enrollment your Medicare Part D plan.

Aside from the late-enrollment penalty, if you decide to postpone Medicare Part D enrollment and then find that you suddenly have prescription needs, you may need to wait until the annual Open Enrollment Period (starting October 15th and continuing through December 7th) to join a plan with coverage starting the next January 1st - and you will need to pay all of your prescription costs out-of-pocket until your Part D plan coverage starts.

Our suggestion - avoid the penalty: Even if you currently use no

prescription medications and are in good health, look at the monthly

costs on our chart and consider enrolling in a Medicare Part D plan or

Medicare Advantage plan with the lowest monthly premium (perhaps a

Medicare Advantage plan that offers prescription drug coverage (MAPD)

with a $0 premium). And then just consider your Medicare Part D plan as

other type of "insurance" that is available should you need it.

Appealing your late enrollment penalty

If you do not agree with your late enrollment penalty, you have the right to appeal your LEP. When your Medicare Part D plan informs you about your penalty, you will also be told how you can appeal the penalty if it was wrongly assessed. You can also learn more about LEP appeals by calling the Member Services department of your Medicare Part D plan or you can read more here: q1medicare.com/PartD-AppealMedicaresEnrollmentPenalty.php

And to learn more about the Late-Enrollment Penalty

For more information, you can click here if you would like to read more on the Medicare Part D late-enrollment penalty.

Also, you can learn more in our articles about the Late Enrollment Penalty (LEP).

Appealing your late enrollment penalty

If you do not agree with your late enrollment penalty, you have the right to appeal your LEP. When your Medicare Part D plan informs you about your penalty, you will also be told how you can appeal the penalty if it was wrongly assessed. You can also learn more about LEP appeals by calling the Member Services department of your Medicare Part D plan or you can read more here: q1medicare.com/PartD-AppealMedicaresEnrollmentPenalty.php

And to learn more about the Late-Enrollment Penalty

For more information, you can click here if you would like to read more on the Medicare Part D late-enrollment penalty.

Also, you can learn more in our articles about the Late Enrollment Penalty (LEP).

Browse FAQ Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service