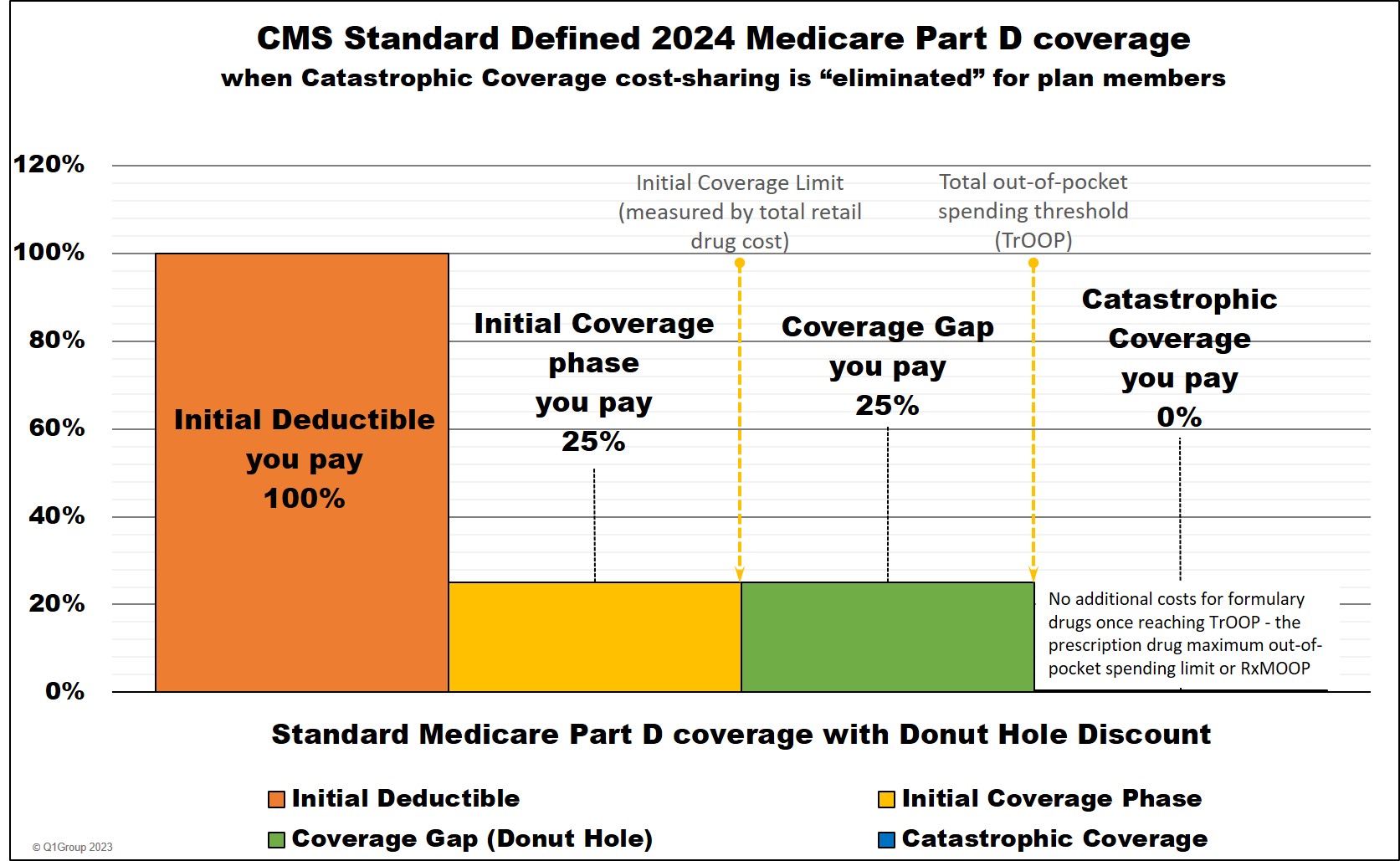

For plan year 2024 and beyond, the Inflation Reduction Act eliminates beneficiary cost-sharing in the Catastrophic Coverage phase, so plan members will not have any out-of-pocket costs for formulary drugs after reaching the plan's 2024 $8,000 total out-of-pocket threshold (TrOOP); therefore, TrOOP becomes the RxMOOP or the maximum out-of-pocket spending limit for formulary drugs.

Entering the 2024 Donut Hole or Coverage Gap

As noted above, a Medicare Part D beneficiary enters the 2024 Donut Hole or Coverage Gap when their retail medication costs reach a certain amount or the Initial Coverage Limit. The Initial Coverage Limit can change every year and in 2024, the Initial Coverage Limit for most Medicare drug plans is reached when a person's retail drug costs total $5,030.

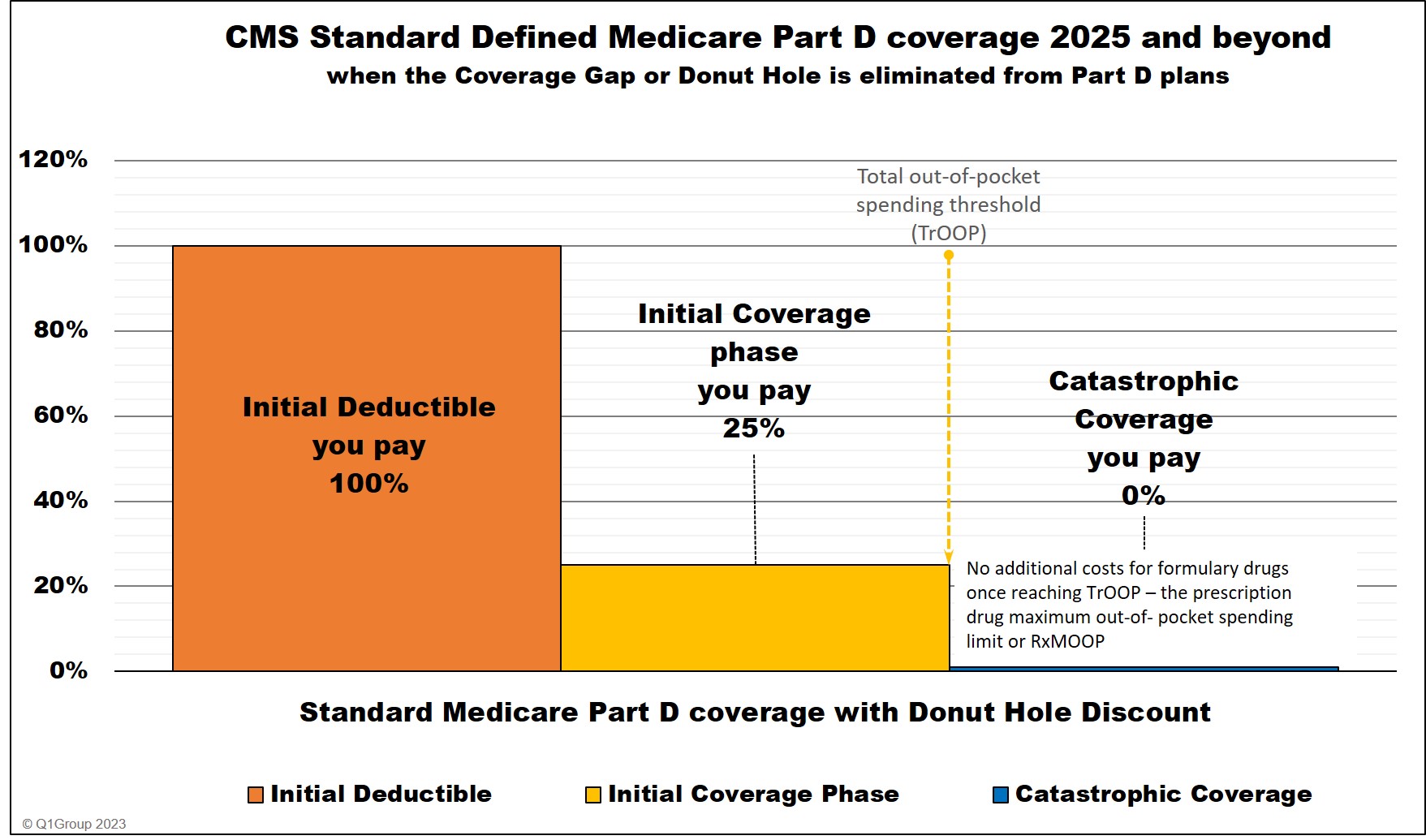

In 2025, there will be no Donut Hole, so the Initial Coverage phase will end when a person reaches the $2,000 TrOOP or RxMOOP threshold.

Question: I thought the Donut Hole was "closed?

Not exactly. Although we say that the Donut Hole "closed" in 2020 -- since you receive a 75% discount on all formulary drugs -- you will still leave your Medicare Part D plan's Initial Coverage Phase once your retail drug costs exceed the Initial Coverage Limit. And when you leave your Initial Coverage Phase, you will enter the Coverage Gap (Donut Hole) where the cost of your formulary medications can increase, decrease, or stay the same - depending on your Medicare drug plan, your cost-sharing, and the drug's retail price. You can click on our FAQ "Did the Coverage Gap or Donut Hole just close up and go away?" to read more.

Important Fact: In 2025, the Donut Hole phase will no longer exist.

In 2025, the Inflation Reduction Act eliminates the Coverage Gap (Donut Hole) phase. Medicare Part D beneficiaries will stay in the Initial Coverage phase until they reach the maximum cap on out-of-pocket spending for Part D formulary drugs - RxMOOP or TrOOP - which is set at $2,000 for 2025. After reaching RxMOOP Medicare Part D beneficiaries will enter the Catastrophic Coverage phase.

Question: Can you enter the 2024 Donut Hole with a single drug purchase?

Yes. It is possible that one large drug purchase (or a multiple month drug purchase, such as a 90-day supply of an expensive drug) can actually move you from the Initial Coverage Phase into the Donut Hole and the cost of your medication may actually be spread over two or more phases of your Medicare drug plan as a "straddle claim".

For example, back in 2023, if you purchased a formulary drug with a retail cost of over $4,660, you would immediately be in the Coverage Gap. In fact, if you purchase a 2023 formulary drug with a retail drug price of over $12,448, you would actually enter -- and exit your Coverage Gap with a single drug purchase and then be in Catastrophic Coverage for the remainder of the year.

What you pay and what your plan pays: Comparing retail drug prices to your formulary drug costs

As explained by the Medicare Part D plan provider United HealthCare, when you are enrolled in a Medicare Part D plan, there are actually two payments being made when you purchase a medication covered by your Medicare Part D plan:

(1) What you pay for a formulary drug or your discounted payment under the Part D plan (also known as the co-payment or co-insurance) and (2) What your plan pays for the formulary drug or the balance of the retail cost being paid by your Part D insurance carrier. Together, (1) your portion and (2) the insurance company portion add up to the total retail cost of the prescription.

Here is how example formulary drug purchases are calculated throughout your Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide).

|

When you purchase a formulary medication |

|||||||

|

Example |

You Pay |

Your |

Drug Mfg. Pays |

U.S. |

Amount counting toward your ICL |

Amount counting toward your TrOOP |

|

|

Part 1 |

$100 |

$100 |

$0 |

$0 |

$0 |

$100 |

$100 |

|

Part 2 |

$100 |

$25 |

$75 |

$0 |

$0 |

$100 |

$25 |

|

Part 3 |

$100 |

$25 |

$5 |

$70 |

$0 |

n/a |

$25+$70 |

|

Coverage Gap - generic drugs *** |

$100 |

$25 |

$75 |

$0 |

$0 |

n/a |

$25 |

|

Part 4 |

$100 |

$0 |

$20 |

$0 |

$80 |

n/a |

n/a |

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** you pay nothing for all formulary medications for the remainder of the year. (80% paid by Medicare, 20% paid by Medicare plan, and 0% by plan member)

"n/a" - "not applicable" to this phase or part of your Medicare Part D plan coverage

You leave the Donut Hole when your total out-of-pocket sending (also

called TrOOP) reaches a certain level. Your TrOOP threshold (like your

Initial Coverage Limit) can change every year and here are a few examples (as reference, the TrOOP threshold for 2006 was $3,600):

|

|

After you spend over your 2024 TrOOP threshold of $8,000, you enter the Catastrophic Coverage phase of your Part D coverage where the cost of your formulary prescription medications is reduced to $0 - you will have no cost-sharing for formulary prescriptions for the remainder of the year.

What you spend in formulary drugs counts toward TrOOP.

As noted above, TrOOP is made up of what you pay during the initial deductible (if you have one) plus what you personally pay in the initial coverage phase, before the Donut Hole plus what you pay in the Donut Hole (and 70% of the brand-name drug discount paid by the drug manufacturer).

What you spend on monthly Medicare plan premiums does not count toward TrOOP.

Your monthly Medicare Part D premiums are not included in TrOOP- nor are any medications that you purchase outside of your Medicare Part D plan (for instance, from a non-US pharmacy) - nor any medications that are not covered by your Medicare Part D plan.

Keeping track of your Expenses

The good news: You do not need to keep track of the retail cost of your medications or what you actually spend on drugs. Your Medicare Part D plan will account for all of your formulary drug purchases and then your plan will send you a monthly statement (the Explanation of Benefits (EOB)) detailing your purchases and how close you are to the coverage gap. Also, you may find that some pharmacies print receipts showing your drug purchase and where you are in comparison to the coverage gap.

The reality: Most people do not pay attention to their monthly EOB letter that they receive from their Medicare Part D drug plan. Instead, we find that most people know they are in the Donut Hole when they purchase their medications and suddenly pay a different price for their drugs - and that is why we built our Q1Medicare.com PDP-Planner or Donut Hole calculator. You can use the Donut Hole calculator to enter your monthly retail drug costs and see when (or if) you will enter (or exit) the Donut Hole.

Question: Will you pay more for your formulary drugs when you enter the Donut Hole?

Maybe. The change of your drug coverage costs (increase or decrease) when entering the Donut Hole depends on what drugs you use and your plan's coverage costs before entering the Donut Hole. You can read more in our Frequently Asked Question (FAQ) that shows examples of how drug costs can go decrease or increase when you enter the Donut Hole: Q1FAQ.com/719

Would you like more information?

We have more information online about the Donut Hole or Coverage Gap here:

PDP-Planner.com

Still not sure how the Donut Hole or Coverage Gap fits into your Medicare prescription drug plan? Click on the following link and send us your question: q1medicare.com/Helpdesk.php.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service