Why is the Medicare Part D Coverage Gap called the Donut Hole?

The Donut Hole (or Coverage Gap) is the third part of your Medicare Part D plan coverage and is a

term used to describe a "gap" or pause in your Medicare Part D prescription drug coverage where - prior to 2011 - you were 100% responsible for the cost of your prescription drugs -

unless your Medicare Part D plan provided additional coverage while in the Donut Hole.

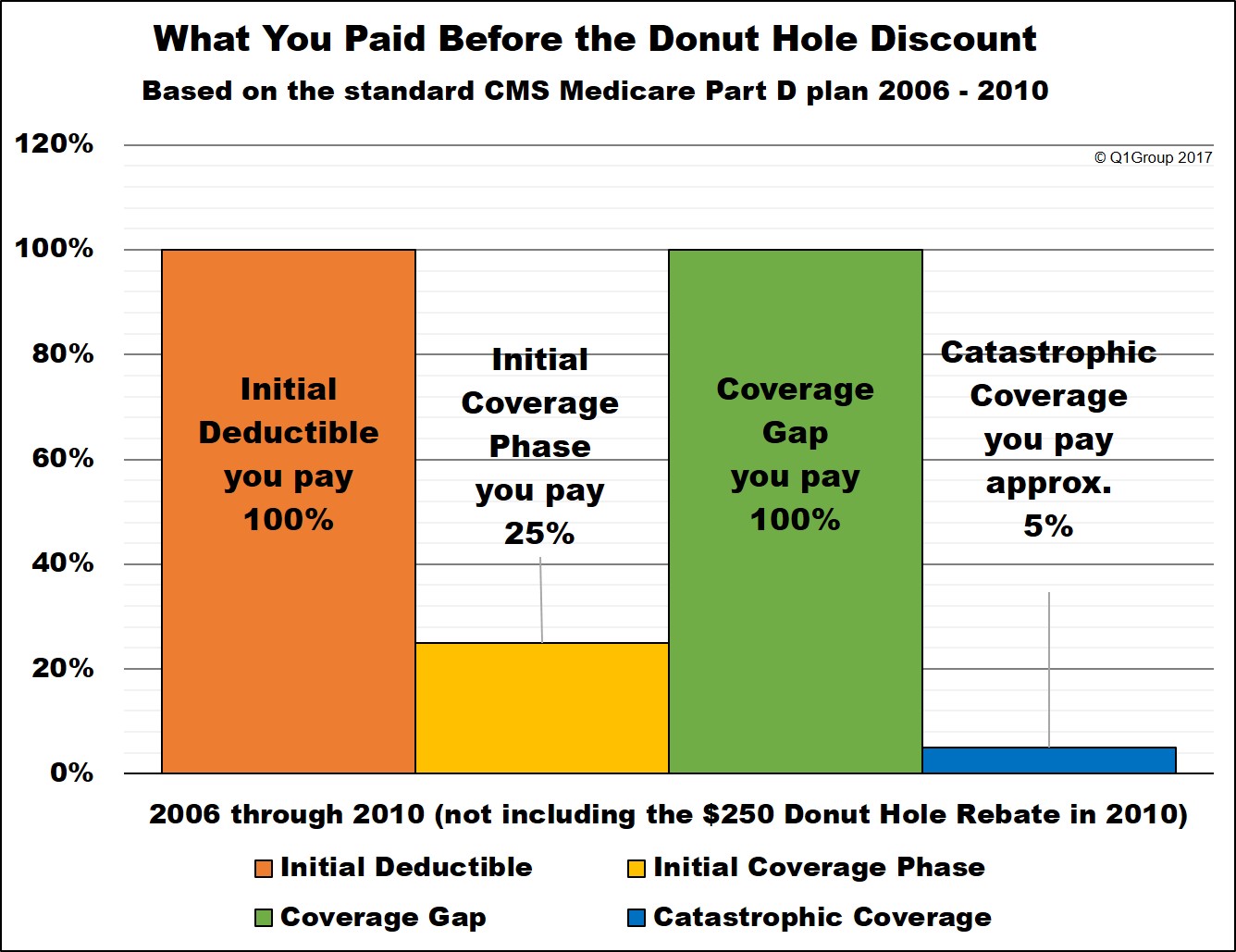

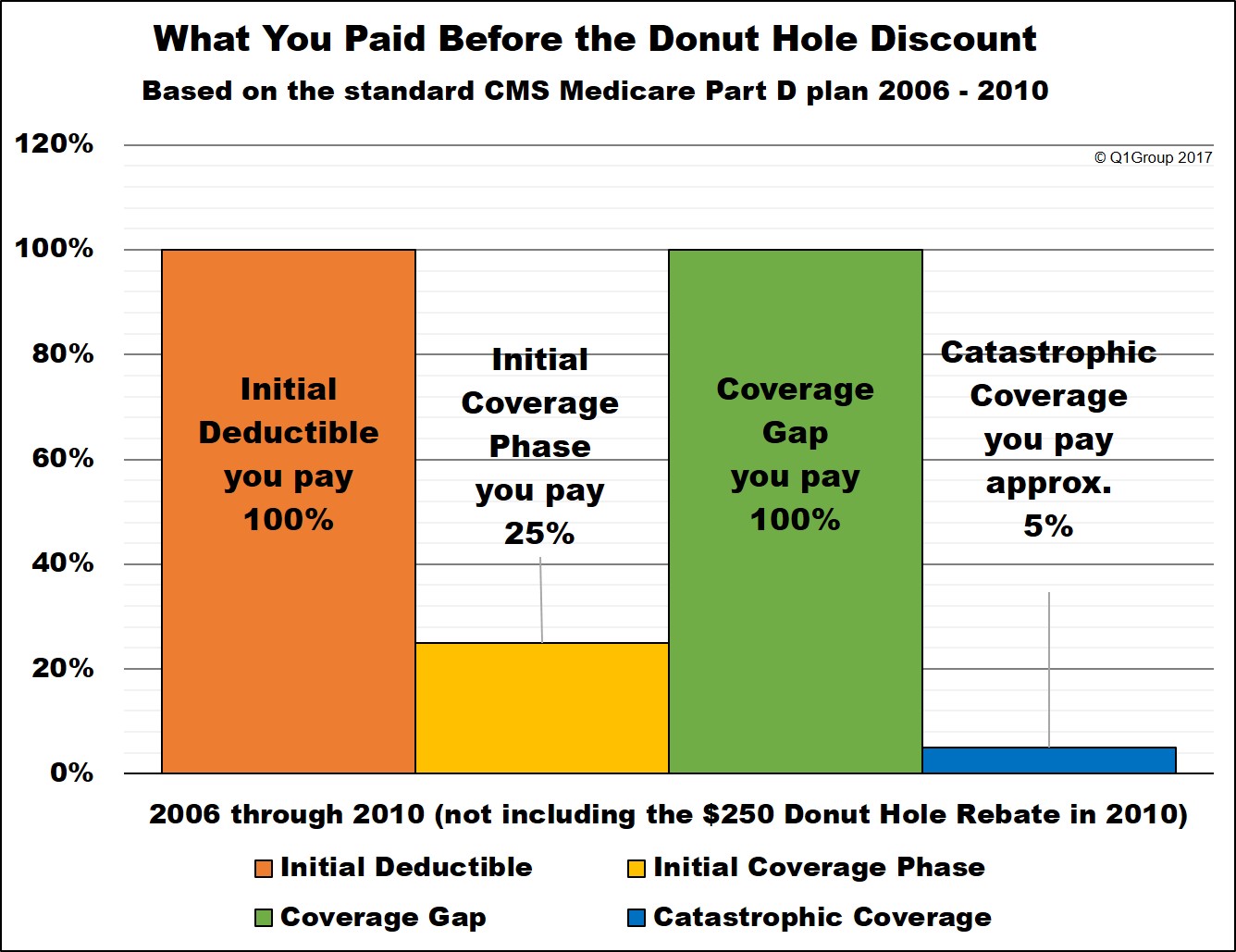

So between 2006 and 2010, the Medicare Part D Coverage Gap or Donut Hole was actually similar to a second deductible in an insurance policy where, after receiving a certain level of drug coverage (your Initial Coverage Phase), you were, once again, responsible for paying your own drug coverage until you reached the Catastrophic Coverage portion of your Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan that included drug coverage (MAPD).

In other words, you had a "hole" in the center of your Medicare Part D drug coverage as is shown in the following chart.

The Donut Hole 2006 to 2010

However, since the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage during the Coverage Gap.

However, since the introduction of the Donut Hole discount in 2011, you are now responsible for only a portion of your own drug coverage during the Coverage Gap.

2020 and beyond: Closing the Donut Hole

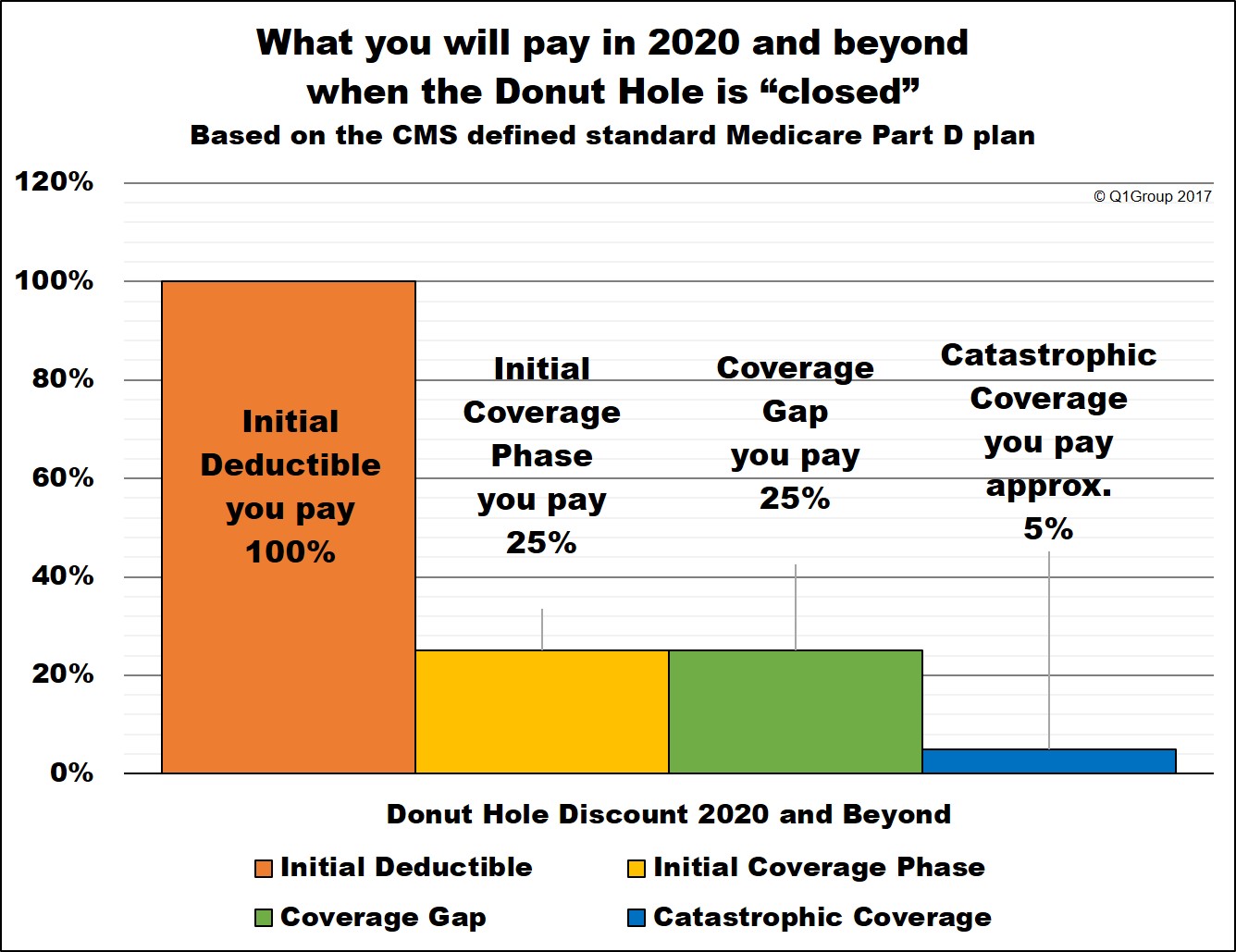

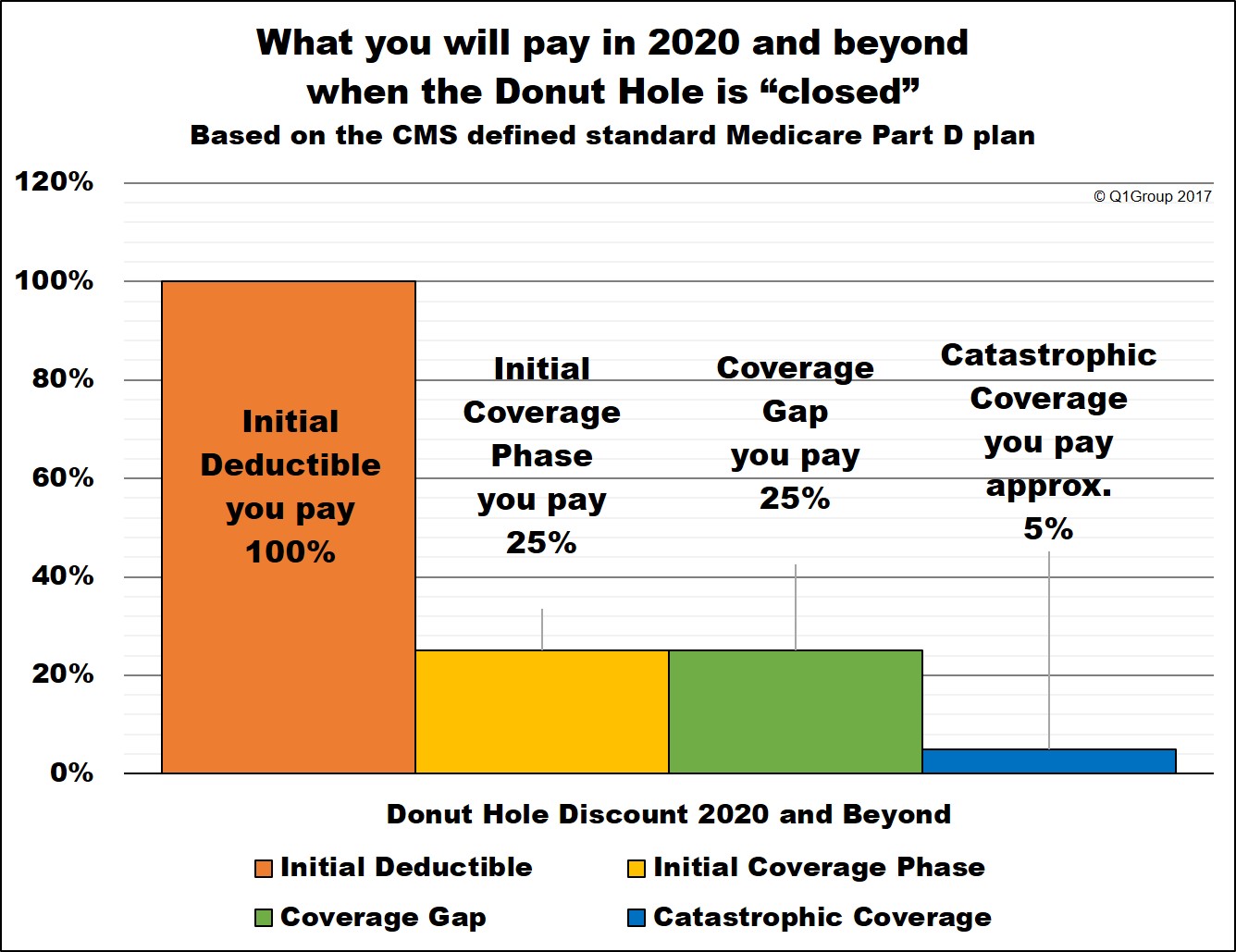

In 2020, the Coverage Gap was considered "closed" when both formulary generic and brand-name drugs cost Medicare Part D plan members 25% of the retail drug price (so you will pay $250 for a medication with a $1,000 retail cost) until reaching Catastrophic Coverage where you will pay around 5% of retail.

For example, if your Medicare Part D plan follows the standard Medicare Part D prescription drug plan, you will pay a fixed 25% cost-sharing in the Initial Coverage phase and then, if you enter the Donut Hole, you will continue to pay the same 25% co-insurance for all formulary drugs purchased - and since there is no change in coverage between being your Initial Coverage phase and Coverage Gap - the Donut Hole appears to be closed (see the diagram below).

In fact, the Donut Hole actually closed a little earlier than planned.

In 2018, President Trump signed the Bipartisan Budget Act of 2019 (Pub.L. 115-123) that effectively "closes" the Coverage Gap for brand-name drugs, with the brand-name Donut Hole discount increasing to 75% in 2019 (one year earlier than planned). The Coverage Gap for generic drugs was not affected by the Act and "closed" as planned in 2020 when all generic formulary drugs also receive a 75% discount.

The Donut Hole 2020 and Beyond

Question: So did the Donut Hole just go away from our Medicare Part D plans?

Question: So did the Donut Hole just go away from our Medicare Part D plans?

Not exactly. Although we say that the Donut Hole is now "closed" since you receive a 75% discount on all formulary drugs if you enter the Donut Hole - it is possible that the cost of your formulary medications can increase, decrease, or stay the same once you are in the Donut Hole (Coverage Gap) - depending on your Medicare drug plan, your initial cost-sharing, and the drug's retail price.

For example, if you usually pay a fixed co-pay for your drugs (for example, $47 for a $300 drug) during your Initial Coverage phase, you will pay 25% of $300 if you enter the Donut Hole or $75. So, you would pay more in the Donut Hole ($75) than you did in your Initial Coverage phase ($47).

You can click on our FAQ "Did the Coverage Gap or Donut Hole just close up and go away?" to read more.

Help with planning for your Donut Hole

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or PDP-Planner online illustrating the changes in your monthly estimated costs based on the established standard Medicare Part D plan limits mentioned above.

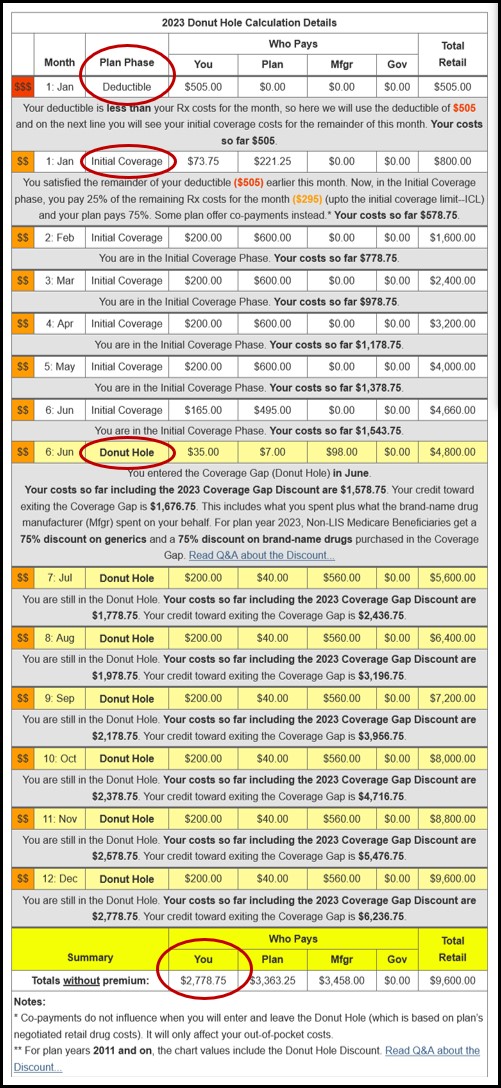

We also have several examples online to help you get started with PDP-Planner. You can click here for a 2023 example of a Medicare beneficiary with relatively high monthly prescription drug costs of $800 per month resulting in estimated annual out-of-pocket costs of $2,779 - you can then change the monthly drug cost to whatever you wish to estimate your annual out-of-pocket cost.

So between 2006 and 2010, the Medicare Part D Coverage Gap or Donut Hole was actually similar to a second deductible in an insurance policy where, after receiving a certain level of drug coverage (your Initial Coverage Phase), you were, once again, responsible for paying your own drug coverage until you reached the Catastrophic Coverage portion of your Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan that included drug coverage (MAPD).

In other words, you had a "hole" in the center of your Medicare Part D drug coverage as is shown in the following chart.

The Donut Hole 2006 to 2010

2020 and beyond: Closing the Donut Hole

In 2020, the Coverage Gap was considered "closed" when both formulary generic and brand-name drugs cost Medicare Part D plan members 25% of the retail drug price (so you will pay $250 for a medication with a $1,000 retail cost) until reaching Catastrophic Coverage where you will pay around 5% of retail.

For example, if your Medicare Part D plan follows the standard Medicare Part D prescription drug plan, you will pay a fixed 25% cost-sharing in the Initial Coverage phase and then, if you enter the Donut Hole, you will continue to pay the same 25% co-insurance for all formulary drugs purchased - and since there is no change in coverage between being your Initial Coverage phase and Coverage Gap - the Donut Hole appears to be closed (see the diagram below).

In fact, the Donut Hole actually closed a little earlier than planned.

In 2018, President Trump signed the Bipartisan Budget Act of 2019 (Pub.L. 115-123) that effectively "closes" the Coverage Gap for brand-name drugs, with the brand-name Donut Hole discount increasing to 75% in 2019 (one year earlier than planned). The Coverage Gap for generic drugs was not affected by the Act and "closed" as planned in 2020 when all generic formulary drugs also receive a 75% discount.

The Donut Hole 2020 and Beyond

Not exactly. Although we say that the Donut Hole is now "closed" since you receive a 75% discount on all formulary drugs if you enter the Donut Hole - it is possible that the cost of your formulary medications can increase, decrease, or stay the same once you are in the Donut Hole (Coverage Gap) - depending on your Medicare drug plan, your initial cost-sharing, and the drug's retail price.

For example, if you usually pay a fixed co-pay for your drugs (for example, $47 for a $300 drug) during your Initial Coverage phase, you will pay 25% of $300 if you enter the Donut Hole or $75. So, you would pay more in the Donut Hole ($75) than you did in your Initial Coverage phase ($47).

You can click on our FAQ "Did the Coverage Gap or Donut Hole just close up and go away?" to read more.

Help with planning for your Donut Hole

To help you visualize the phases of your Medicare Part D prescription drug plan coverage, we have a Donut Hole Calculator or PDP-Planner online illustrating the changes in your monthly estimated costs based on the established standard Medicare Part D plan limits mentioned above.

We also have several examples online to help you get started with PDP-Planner. You can click here for a 2023 example of a Medicare beneficiary with relatively high monthly prescription drug costs of $800 per month resulting in estimated annual out-of-pocket costs of $2,779 - you can then change the monthly drug cost to whatever you wish to estimate your annual out-of-pocket cost.

Below is an example graphic of the Q1Medicare PDP-Planner or Donut Hole calculator showing the possible spending throughout the phases of your Medicare Part D plan - and how your drug costs can change before, during, and after the Donut Hole.

Browse FAQ Categories

Compare Prices Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service