Important changes coming January 1, 2025:

In 2025, the Inflation Reduction Act (IRA) of 2022 will eliminate the Coverage Gap (Donut Hole) and since there is no cost-sharing for Medicare beneficiaries who reach the Catastrophic Coverage phase starting in 2024, a person will have no additional costs for formulary Medicare Part D drugs once they reach the plan's TrOOP threshold ($8,000 in 2024) and ($2,000 in 2025).

Starting in 2025, Medicare Part D drug plan coverage will simply include (1) the Initial Deductible (if any) and (2) the Initial Coverage phase. The 2025 Initial Coverage Limit is reached when a person has spent $2,000 out-of-pocket on Part D formulary drugs. And after meeting the $2,000 prescription drug maximum out-of-pocket spending limit (RxMOOP), the Part D plan member will not pay anything for formulary drugs throughout the remainder of the year.

_____________________________________

Meanwhile, the Donut Hole will still exist in 2023 and 2024.

As a reminder, you enter the 2023 Coverage Gap or Donut Hole after exceeding your Medicare drug plan's 2023 Initial Coverage Limit of $4,660 ($5,030 in 2024). And when you spend over your out-of-pocket limit (TrOOP) ($7,400 in 2023 and $8,000 in 2024), you will leave the Donut Hole and enter the Catastrophic Coverage phase of your Medicare Part D plan (the fourth phase of Part D coverage).

Therefore, you will leave your Medicare Part D plan's Second Phase or Initial Coverage Phase once your retail drug costs exceed the drug plan's Initial Coverage Limit - and then you will enter the Coverage Gap (Donut Hole), receive a 75% discount on all formulary drugs. But the cost of your formulary medications can actually increase, decrease, or stay the same in the Donut Hole depending on your Medicare plan's previous cost-sharing and the drug's retail price (see the examples below for more information).

Question: Since the Donut Hole is "closed", will I always pay less in the Gap as compared to what I paid during my Initial Coverage phase?

No. Your cost savings (or additional costs) in the Donut Hole will depend on your Extra Help status, the retail price of your formulary drugs, and your Medicare Part D plan's cost-sharing or what your plan charges for a copayment during your Initial Coverage Phase (before entering the Donut Hole). The next few examples illustrate how your drug costs can remain the same, increase, or decrease when you enter the Donut Hole.

Example 1 - You are qualified for Medicare Part D Extra Help - so you have no Donut Hole

Your drug costs stay the same in the Donut Hole. If you are eligible for the Medicare Part D Extra Help program

(Low-Income Subsidy), then you will not have a Donut Hole in your

Medicare Part D prescription drug coverage. Your coverage will remain

unchanged with fixed copayments for brand and generic formulary drugs

(and your plan coverage will change only if you reach the Catastrophic

Coverage phase where you will only pay a maximum of 5% of the retail

drug price).

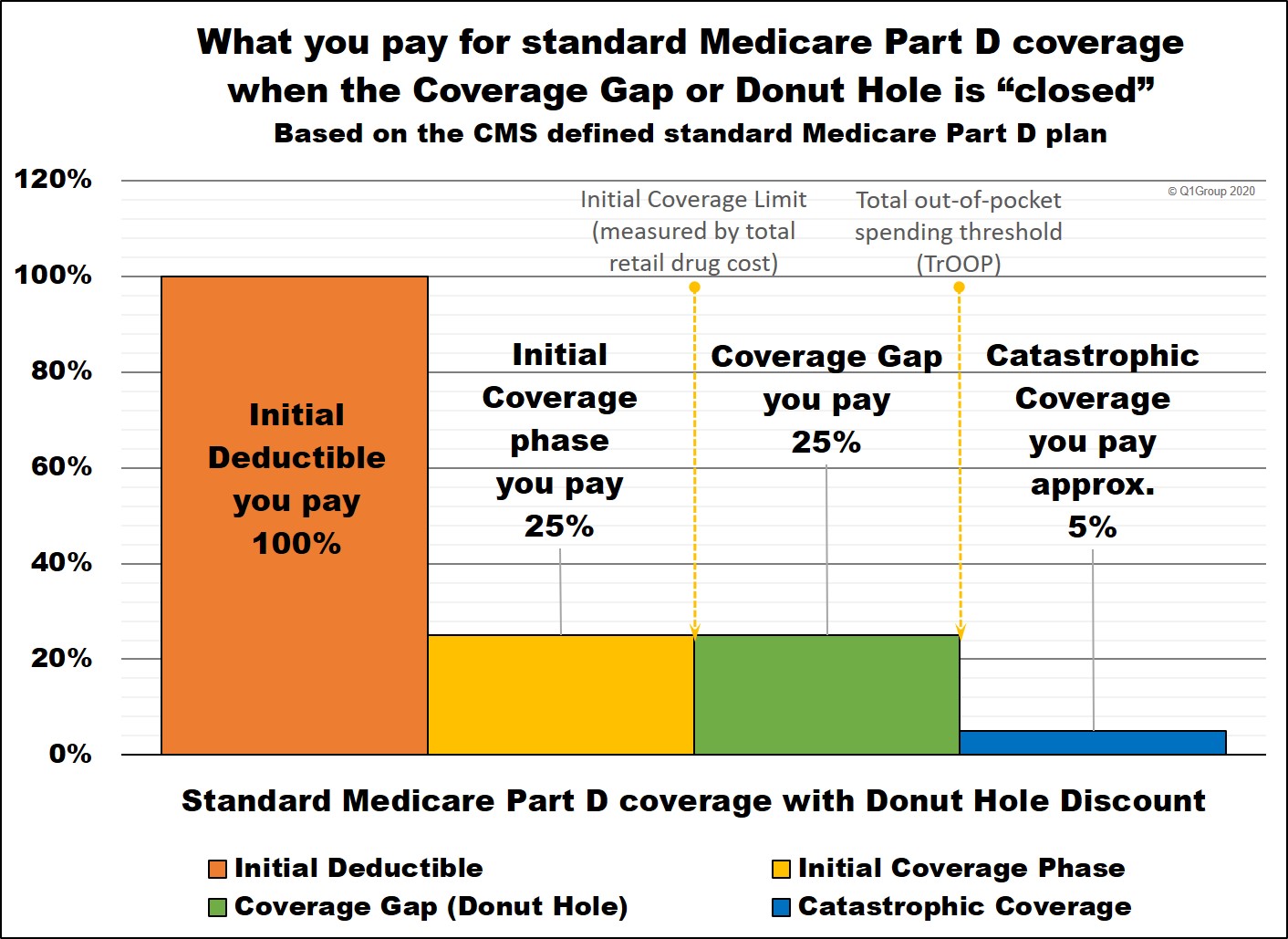

Example 2 - Your Medicare Part D plan has a fixed 25% cost-sharing - so you will not notice entering the Donut Hole

Your drug costs stay the same in the Donut Hole.

If you are enrolled in a Medicare Part D plan that follows the Medicare

defined standard plan you will pay a standard deductible ($505 in 2023 and $545 in 2024)

, then you will pay 25% coinsurance in the initial coverage phase (you

pay 25% of the retail cost for formulary drugs), then you will pay the

same 25% coinsurance in the Donut Hole.

Medicare notes that, “the coverage gap will effectively be

closed for generics [and brand drugs]; beneficiary cost-sharing for

generics [and brand drugs] in the gap will be 25% which is equivalent to

[standard] initial coverage period cost-sharing”.

Therefore, in this Example 2, the Coverage Gap seems to have gone away -- but, in reality, you are paying the same 25% of retail in the Donut Hole as you would pay during the Initial Coverage Phase.

Question: How many stand-alone 2024 Medicare Part D

prescription drug plans (PDPs) actually follow this standard Medicare

Part D plan design with fixed 25% cost-sharing?

Not many. For example, in 2024, only two stand-alone Medicare

Part D plans (PDP) follow the standard Medicare Part D plan with a fixed

25% cost-sharing and only a few 2024 Medicare Advantage plans that include drug coverage (MAPDs) provide fixed 25% cost-sharing.

Your drug cost increases when you enter the Donut Hole. If you are using a Tier 3 medication

with a negotiated retail cost of $372 and your Medicare Part D plan has

a $43 copay for the Tier 3 drug, your drug costs will increase when you

reach the Donut Hole. In the Donut Hole you will pay 25% of the $372

retail drug price - or $93 per prescription instead of your previous $43 copay.

Your drug cost decreases when you enter the Donut Hole. However, if your Tier 3 medication has a negotiated retail cost of $8.40 and your Medicare Part D plan has a $44 copay for the Tier 3 drug, you will pay the "lessor of" the plan's copay or the drug's retail price. And since you never pay more than

the drug's retail price, you will pay $8.40 for the drug (not the $44

copay) and, if you enter the Donut Hole, you would pay 25% of the $8.40

retail drug price or $2.10 instead of the $44 copay.

No. The 2024 Medicare & You Handbook does not include any information about the 2024 Coverage Gap or Donut Hole, perhaps since the Donut Hole is considered "closed" for people who have standard Medicare Part D plan coverage with a fixed 25% coinsurance rate for all formulary drugs. As our Example 2 above shows, members of these Medicare drug plans will not even notice when they move into the Coverage Gap. But, as is also noted above, only two stand-alone 2024 Medicare Part D prescription drug plan (PDP) (and very few Medicare Advantage plans) offered this fixed 25% cost-sharing for all formulary drugs.

On the positive side, Medicare.gov still provides the following information on the 2024 Coverage Gap:

"Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs.The Centers for Medicare and Medicaid Services (CMS) also notes in their 2019 "Your Guide to Medicare Prescription Drug Coverage":

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,660 on covered drugs in 2023 ($5,030 in 2024), you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap." (1)

"Coverage gap (also called the “donut hole”)Review: More about the 75% brand-name and generic Donut Hole discount

A gradual closing of the coverage gap has made Medicare drug coverage more reasonably priced for people with Medicare. You reach the coverage gap after you and your plan have spent a certain amount of money for covered drugs. When you’re in the coverage gap, you may pay more costs for your drugs out-of-pocket, up to a limit. Not everyone will reach the coverage gap. . . .

You won’t need to pay all out-of-pocket costs when you’re in the coverage gap. In 2020, your plan will cover at least 5% of the cost of covered brand-name drugs, and the drug manufacturer will give a 70% discount, for a combined savings of at least 75% on these brand-name drugs. The amount you pay (25%) and the 70% discount you get from the manufacturer both count as out-of-pocket spending that will help you get out of the coverage gap. Also, in 2020, Medicare will cover 75% of the price for generic drugs when you’re in the coverage gap."(2)

Since the Bipartisan Budget Act of 2018 (BBA)(3) that President Trump signed into law on Friday, February 9, 2018 - you receive a 75% discount for all formulary brand-name and generic drugs purchased in the Donut Hole. And you will receive credit toward leaving the Donut Hole for the portion of the brand name discount provided by the pharmaceutical manufacturer.

Perhaps more importantly, before, the BBA, the drug manufacturer was set to pay only 50% of the brand-name retail cost, the Medicare Part D plan would pay 25%, and you would pay the remaining 25% of the brand-name drug's retail cost. For example, previous to the BBA, if you purchased a brand-name drug with a $100 retail cost while in the Donut Hole, you would pay $25 and get $75 credit toward your TrOOP limit. (TrOOP is your total out-of-pocket spending limit before you exit the Donut Hole and enter Catastrophic Coverage where you will pay around 5% for your formulary drugs for the remainder of the year.)

The BBA now shifts more of the Donut Hole discount onto the pharmaceutical suppliers (instead of the Medicare Part D plans) and this, in turn, will effectively move people with higher drug costs through the Donut Hole at a faster rate - and into Catastrophic Coverage. Specifically, a 70% portion of the brand-name discount is paid by the pharmaceutical Industry and only the 5% portion of the total 75% discount will be paid by your Medicare Part D plan - and this means that, during the Donut Hole, you will pay 25% of retail brand-name drug costs and received 95% of the retail drug cost as credit toward meeting your total out-of-pocket costs (in 2023 TrOOP is $7,400 and $8,000 in 2024).

For example, if you purchased a brand-name drug with a $100 retail cost while in the Donut Hole, you would pay $25 and get $95 credit toward your TrOOP limit (Donut Hole exit point).

Please also note, this 95% of retail that counts toward TrOOP only applies to formulary brand-name drug purchases. When you purchase generic formulary drugs in the Donut Hole you still receive the 75% discount, but only the 25% of retail costs that you actually spend count toward meeting your TrOOP.

Bottom Line: The Donut Hole did not really go away - you still pay 25% of retail prices for your formulary prescriptions if you reach the Coverage Gap - and the 25% of retail prices may be more, less, or the same as you have previously paid for the same formulary drug. For more information about the changes in the Donut Hole discount, you can click here to see a chart of how the Donut Hole discounts changed from 2011 through 2020.

Proposed Donut Hole change that never was implemented

How the 70% Pharmaceutical Industry's discount is counted toward exiting the Donut Hole.

Medicare proposed changes to the Medicare Part D program "which includes the exclusion of [the pharmaceutical] manufacturer discounts from the calculation of beneficiary out-of-pocket costs [TrOOP] in the Medicare Part D coverage gap". [emphasis added](4)

This proposed change would mean people would not be able to count the large portion of the Donut Hole discount paid by drug manufacturers toward reaching their TrOOP and leaving the Donut Hole - and this means, people would pay more to exit the Donut Hole - and fewer people would reach Catastrophic Coverage if this proposal is implemented. (5)

In other words, if a person bought a brand-name drug in the 2023 Donut Hole, they would pay 25% of the retail price and only the $25 actually spent would count toward their out-of-pocket spending or TrOOP (as compared to getting credit for $95 as was originally written in the BBA (see above)). The justification behind this proposal is that, with the 70% manufacturer discount credited to a person's TrOOP, many more people would reach Catastrophic Coverage costing the country a great deal of additional money.(6)

References

(2) https://www.medicare.gov/Pubs/pdf/11109-Your-Guide-to-Medicare-Prescrip-Drug-Cov.pdf (as of September 9, 2020)

(3) https://www.congress.gov/bill/115th-congress/house-bill/1892/ - Pub.L. 115-123

(4) https://www.federalregister.gov/documents/2018/05/16/2018-10435/hhs-blueprint-to-lower-drug-prices-and-reduce-out-of-pocket-costs

(5) https://avalere.com/expertise/managed-care/insights/proposed-changes-to-part-d-would-increase-beneficiary-costs

(6) https://files.kff.org/attachment/Issue-Brief-Summary-of-Recent-and-Proposed-Changes-to-Medicare-Prescription-Drug-Coverage-and-Reimbursement-Policy

Also see the May 11, 2018 document: https://www.hhs.gov/sites/default/files/AmericanPatientsFirst.pdf and the May 16, 2018 Fed Reg: https://www.gpo.gov/fdsys/pkg/FR-2018-05-16/pdf/2018-10435.pdf

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service