Can I compare my Medicare Part D retail drug costs to the estimated cost using a non-Part D Drug Discount card?

Yes. You can use our Q1Rx® Medicare Part D Drug Finder (Q1Rx.com)

to see how all Medicare Part D prescription drug plans (PDPs) or Medicare Advantage plans that include drug coverage (MAPDs) in your area (State or ZIP Code) cover a specific drug - and you can see the estimated cost for the same drug using a drug discount card.

As you will note in the following examples, there may be times when your Medicare Part D plan's cost sharing for a formulary drug is higher (Example #1) - or lower (Example #2) than the cost associated with using a drug discount card - and you will need to check prices carefully to ensure that you are paying the lowest price.

Drug Discount Cards and Medicare Part D Coverage

Please note, a drug discount card will not work together with your Medicare Part D plan coverage. And, if you decide to use a drug discount card, we suggest that you submit the receipts to your Medicare drug plan so that your drug usage can be monitored (to guard against possible drug interactions or over-usage). You can contact your Medicare plan's Member Services department using the toll-free number found on your Member ID card to learn more about submitting your drug purchases to your Medicare Part D plan.

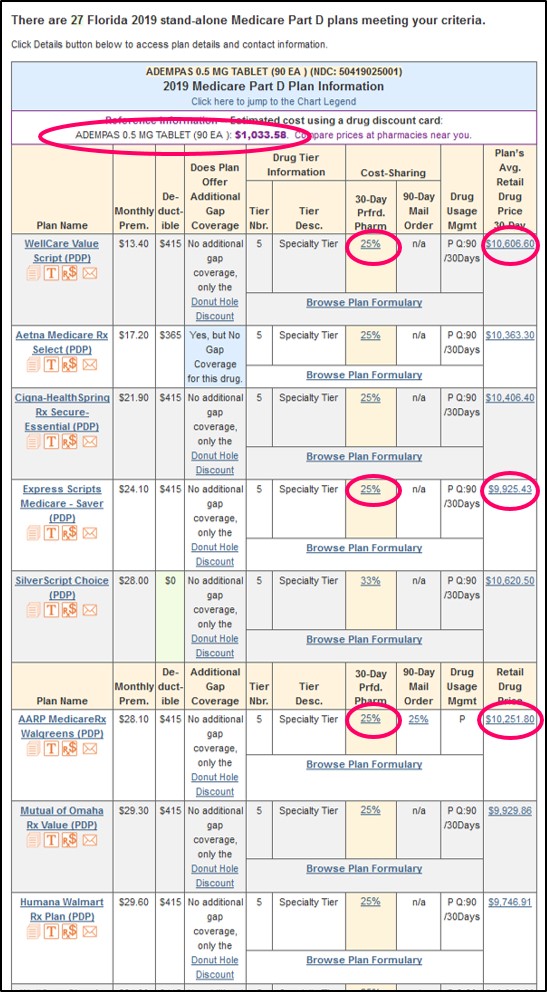

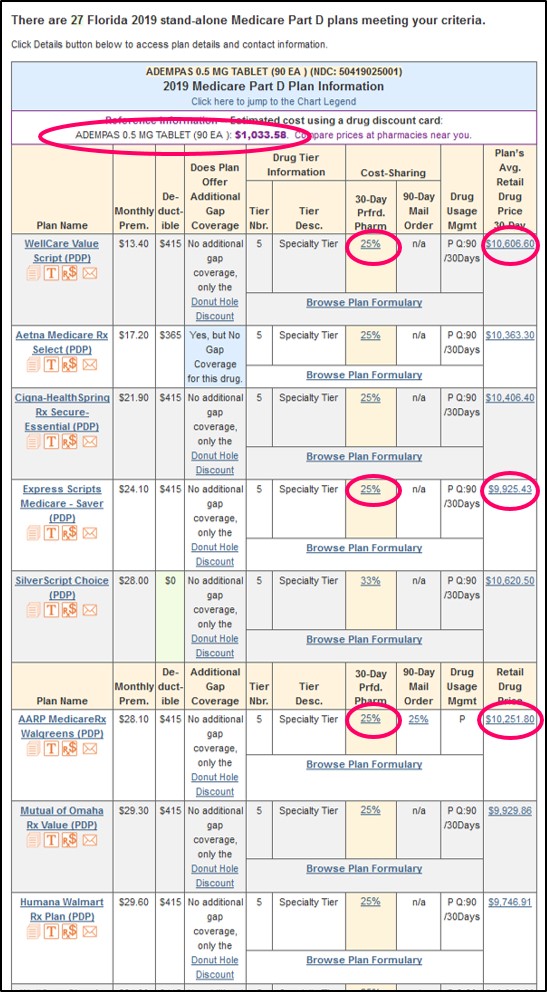

Example #1: Adempas® coverage by Florida Medicare Part D plans.

The following graphic shows Medicare Part D plan coverage for the medication Adempas® across all 27 Medicare Part D plans in Florida (2019). You can see in the screen shot below that the example Florida Part D plans all have coinsurance of 25% of retail - with the estimated average retail cost ranging from $9,746.91 to $10,606.60** (averaged across all network pharmacies in the state).

So, the coverage cost for this mediation would be around 25% of $10,000 or around $2,500 (with the actual cost varying between Medicare Part D plans and at different pharmacies).

You can repeat the search using Q1Rx.com/FL/50419025001 for the current data. You can then see changes in average retail drug cost that would affect the cost-sharing or coverage cost.

The estimated cost for Adempas® using a drug discount card instead of your Medicare Part D coverage

For your reference, the estimated cost using a drug discount card is shown at the top of the Q1Rx.com Drug Finder results chart. In this example, the estimated cost for the Adempas 0.5MG using a drug discount card (instead of your Medicare Part D plan coverage) would be $1,033.58**.

Please remember, the estimated cost using a drug discount card can vary depending on your chosen pharmacy - and can change over time.

** Using the estimated retail drug costs as of 02/11/2019

As you will note in the following examples, there may be times when your Medicare Part D plan's cost sharing for a formulary drug is higher (Example #1) - or lower (Example #2) than the cost associated with using a drug discount card - and you will need to check prices carefully to ensure that you are paying the lowest price.

Drug Discount Cards and Medicare Part D Coverage

Please note, a drug discount card will not work together with your Medicare Part D plan coverage. And, if you decide to use a drug discount card, we suggest that you submit the receipts to your Medicare drug plan so that your drug usage can be monitored (to guard against possible drug interactions or over-usage). You can contact your Medicare plan's Member Services department using the toll-free number found on your Member ID card to learn more about submitting your drug purchases to your Medicare Part D plan.

Example #1: Adempas® coverage by Florida Medicare Part D plans.

The following graphic shows Medicare Part D plan coverage for the medication Adempas® across all 27 Medicare Part D plans in Florida (2019). You can see in the screen shot below that the example Florida Part D plans all have coinsurance of 25% of retail - with the estimated average retail cost ranging from $9,746.91 to $10,606.60** (averaged across all network pharmacies in the state).

So, the coverage cost for this mediation would be around 25% of $10,000 or around $2,500 (with the actual cost varying between Medicare Part D plans and at different pharmacies).

You can repeat the search using Q1Rx.com/FL/50419025001 for the current data. You can then see changes in average retail drug cost that would affect the cost-sharing or coverage cost.

The estimated cost for Adempas® using a drug discount card instead of your Medicare Part D coverage

For your reference, the estimated cost using a drug discount card is shown at the top of the Q1Rx.com Drug Finder results chart. In this example, the estimated cost for the Adempas 0.5MG using a drug discount card (instead of your Medicare Part D plan coverage) would be $1,033.58**.

Please remember, the estimated cost using a drug discount card can vary depending on your chosen pharmacy - and can change over time.

** Using the estimated retail drug costs as of 02/11/2019

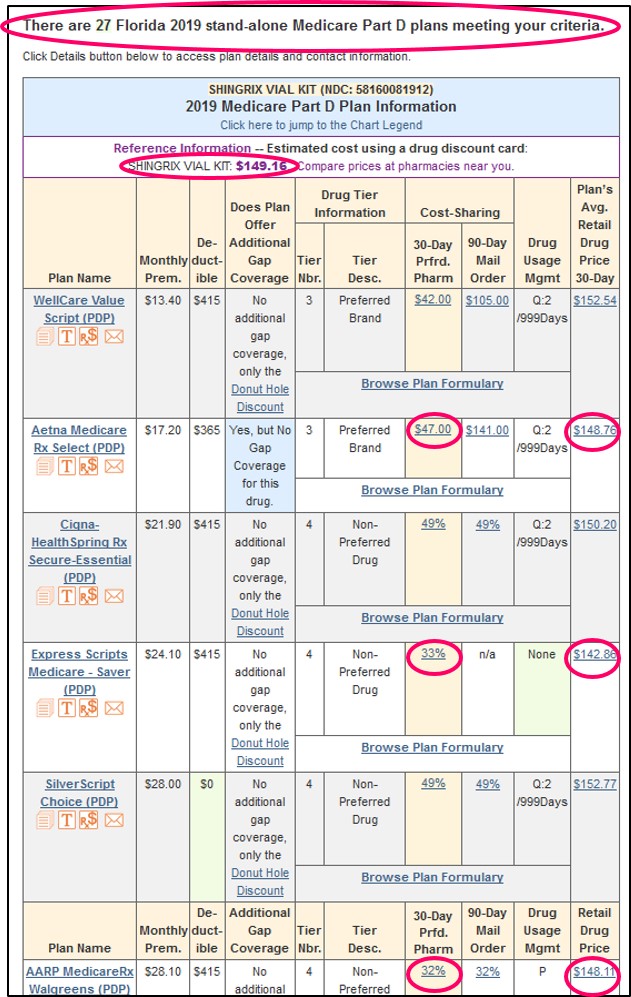

Example #2: SHINGRIX® shingles vaccine coverage by Florida Medicare Part D plans.

In the following example, we are showing coverage of the shingles vaccine, SHINGRIX across all 27 Medicare Part D plans in Florida (2019). You can see in the screen shot below that one Florida Part D plan has a copay of $47 and the next-highlighted Part D plan covers the drug with coinsurance of 33% of retail.

Since the estimated average retail cost at this specific time is $142.82* (averaged across all network pharmacies in the state), the coverage for this vaccine would be 33% of $142.86 or around $47 (with the actual cost possibly varying at different pharmacies) - or the same as the fixed $47 copay.

And to see the estimated cost of SHINGRIX using a drug discount card instead of your Medicare Part D coverage

The estimated cost for the SHINGRIX vaccine using a drug discount card shown at the top of Q1Rx.com Drug Finder results chart $149.16*.

* Using the estimated retail drug costs as of 02/01/2019

You can repeat the search using Q1Rx.com/FL/58160082311 to see Florida plans currently covering Shingrix. And keep in mind that since January 1, 2023, the 2022 Inflation Reduction Act stipulates that Medicare Part D beneficiaries will have no cost sharing for vaccines that are recommended by the Advisory Committee on Immunization Practices (ACIP), such as Shingles and Pneumonia vaccines.

As a note: To learn more about your Medicare Part D plan's cost sharing and retail drug information . . .

(1) You can telephone your Medicare Part D plan's Member Services department using the toll-free telephone number found on your Member ID card.

(2) You can telephone a Medicare representative at 1-800-Medicare (1-800-633-4227) and ask for an estimated retail drug price at your chosen pharmacy.

Reminder: Coinsurance costs (coverage based on a percent of retail drug cost) can change

If your Medicare Part D prescription drug plan cost-sharing is based on a percentage of retail price (such as 25% coinsurance), you will find your coverage cost increases (or decreases) due to the changes in your drug’s retail price – even if you always use the same pharmacy.

If the retail drug price increases to $667 in March, you would pay $100 for the same prescription (15% of $667).

Please remember that your plan's negotiated retail drug prices can vary over time, between network pharmacies (preferred and standard pharmacies) -- and even between preferred network pharmacies.

(1) You can telephone your Medicare Part D plan's Member Services department using the toll-free telephone number found on your Member ID card.

(2) You can telephone a Medicare representative at 1-800-Medicare (1-800-633-4227) and ask for an estimated retail drug price at your chosen pharmacy.

Reminder: Coinsurance costs (coverage based on a percent of retail drug cost) can change

If your Medicare Part D prescription drug plan cost-sharing is based on a percentage of retail price (such as 25% coinsurance), you will find your coverage cost increases (or decreases) due to the changes in your drug’s retail price – even if you always use the same pharmacy.

For example, if you are in your plan's Initial Coverage Phase

- and your cost-sharing is 15% coinsurance - and your formulary

medication has a retail price of $600 in January, then you will pay $90

for cost-sharing when purchasing your medication (15% of $600).

If the retail drug price increases to $667 in March, you would pay $100 for the same prescription (15% of $667).

Please remember that your plan's negotiated retail drug prices can vary over time, between network pharmacies (preferred and standard pharmacies) -- and even between preferred network pharmacies.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service