Do some Medicare Part D plans offer coverage beyond the Donut Hole discount?

Yes. All Medicare Part D prescription plan offer the 75% Donut Hole discount - but, a few Part D plans (PDPs) and Medicare Advantage plans (MAPDs) also offer some

form of additional supplemental gap coverage (in addition to the standard Donut Hole discount). Often, this supplemental Donut Hole coverage is rather limited and is not extended to all formulary drugs.

Question: How can I see if any plans in my area provide any additional gap coverage?

You can use our Q1Medicare® Medicare Part D Plan Finder (PDP-Finder.com) or Medicare Advantage Plan Finder (MA-Finder.com) to check your state (or county) to see if any Medicare drug plans in your area offer partial drug coverage in the Donut Hole.

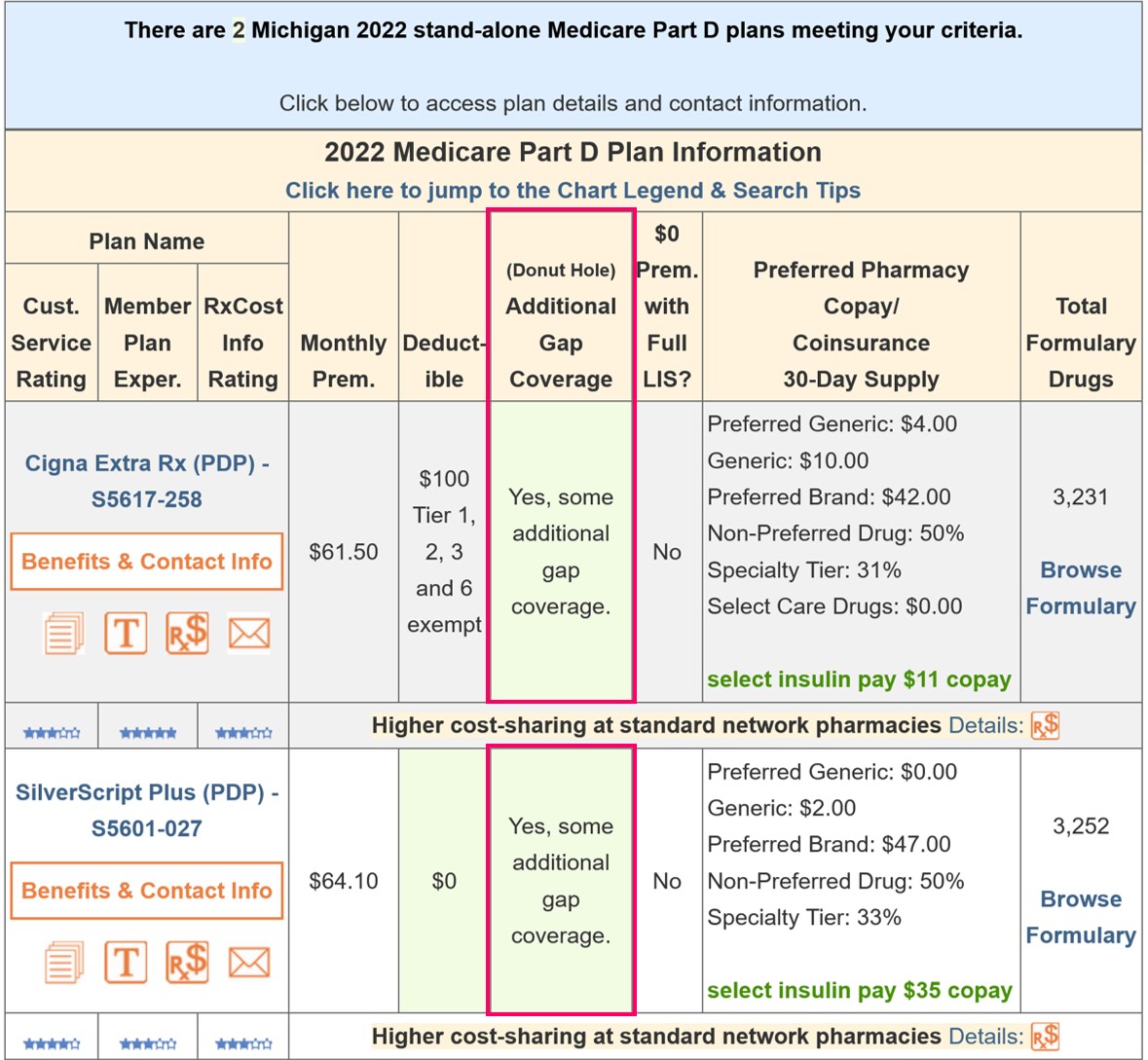

For example, here is a link to Michigan stand-alone Part D drug plans that offer some additional Gap Coverage:

https://q1medicare.com/PDPFinder/MI/?gap=SomeGapCov

From the example results, you can see two Michigan Medicare Part D plans include additional coverage (beyond the Donut Hole discount) for some formulary drugs purchased in the Coverage Gap.

Question: How can I see if any plans in my area provide any additional gap coverage?

You can use our Q1Medicare® Medicare Part D Plan Finder (PDP-Finder.com) or Medicare Advantage Plan Finder (MA-Finder.com) to check your state (or county) to see if any Medicare drug plans in your area offer partial drug coverage in the Donut Hole.

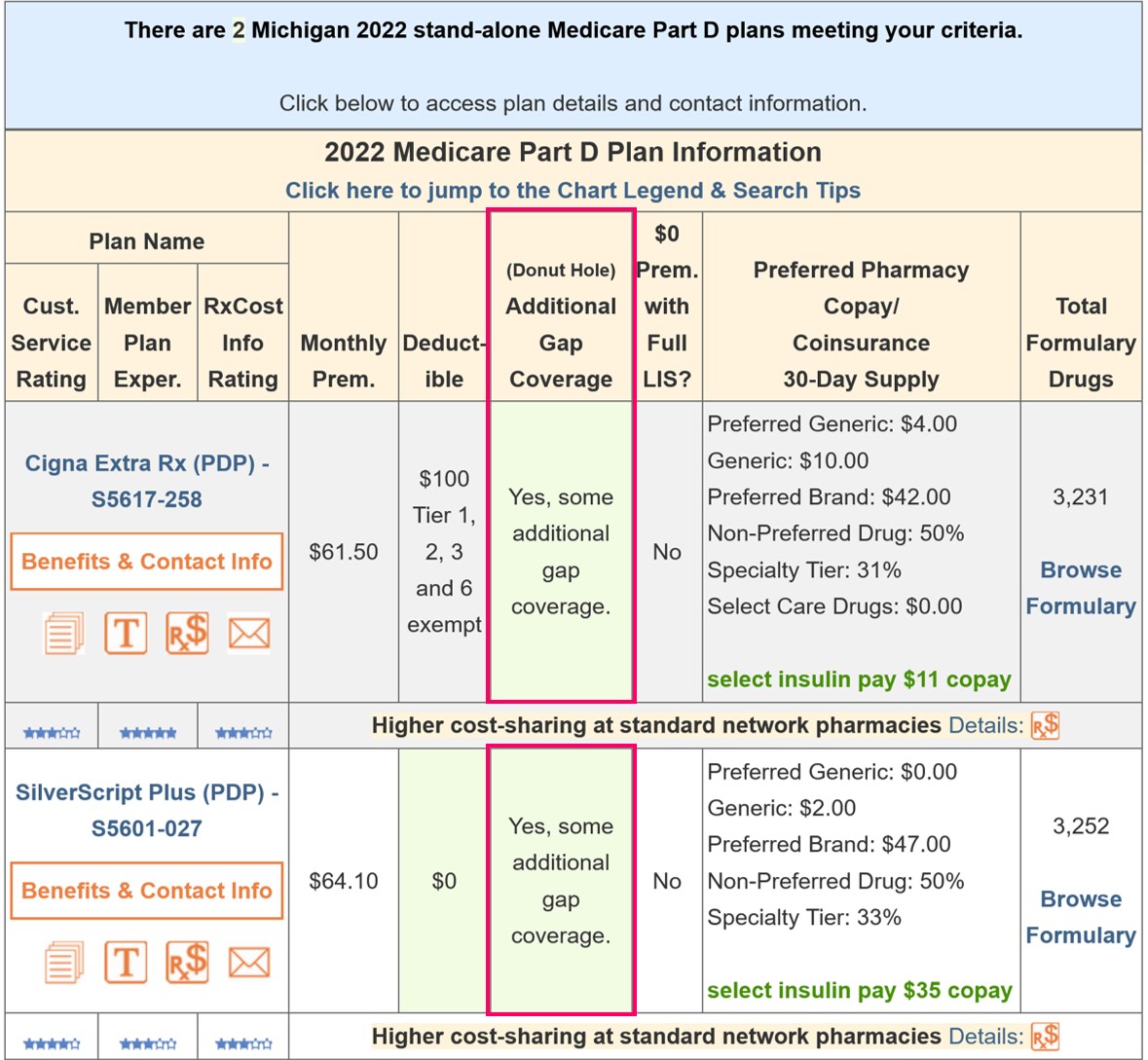

For example, here is a link to Michigan stand-alone Part D drug plans that offer some additional Gap Coverage:

https://q1medicare.com/PDPFinder/MI/?gap=SomeGapCov

From the example results, you can see two Michigan Medicare Part D plans include additional coverage (beyond the Donut Hole discount) for some formulary drugs purchased in the Coverage Gap.

Question: Does any Medicare drug plan offer complete Donut Hole coverage?

Unfortunately, no. In the early days of the Medicare Part D program (2006-2007), a few Medicare plans offered complete coverage of all formulary drugs through the Donut Hole (for example, the Humana Complete PDP offered continuous coverage of all formulary drugs through the Donut Hole).

But according to press reports at the time, the cost and risk exposure of offering a Part D plan with complete Donut Hole coverage was simply too high for many Part D providers. So currently, no Medicare Part D plan offers complete brand-name and generic prescription drug coverage through the Coverage Gap (beyond what is provided by the 75% Donut Hole discount).

Question: How does Supplemental Donut Hole Coverage work with the Donut Hole discount?

You receive the pharmaceutical manufacture's portion of the Donut Hole discount on brand-name drugs after applying the plan's gap coverage.

As noted in an example from Medicare,

"[i]f your Medicare Part D plan offers 60% coverage on brand-name drugs in the coverage gap (you pay 40% co-insurance) and you purchase a brand-name formulary prescription that has a retail price of $100, the cost of your prescription after your plan’s savings is $40.

The 70% pharmaceutical manufacturer discount is then applied to your $40 portion so that you only pay $12. [Please notice that only the pharmaceutical industry's portion of the Donut Hole Discount is applied since the Medicare Part D plan is already providing additional Gap coverage.]

However, the entire $40 co-insurance paid by you and the pharmaceutical manufacturer will count toward your total out-of-pocket spending (TrOOP) limit and help you get out of the Coverage Gap a little faster."

(source: https://www.medicare.gov/ Pubs/pdf/11493.pdf - "Closing the Coverage Gap - Medicare Prescription Drugs Are Becoming More Affordable")

Question: What if I cannot find any plan that offers supplemental Gap Coverage in my area?

Medicare drug plans with supplemental Donut Hole coverage are becoming less common, but even if no plans are offered in your state, you will still automatically receive the Donut Hole discount (that provides a 75% discount on all formulary drugs).

Remember: If you still are having trouble paying for your medications, you can contact your state Medicaid office and ask whether you qualify for the Medicare Part D Extra Help program (if you are eligible for financial Extra Help, you completely avoid the Donut Hole). You can also contact your local SHIP or State Health Insurance Assistance Program and ask about alternative ways to help pay for medications.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service