If I am Dual Eligible and qualify for Extra Help, will my Medicare Part D drug plan premium always be $0?

Not always. If you are "Dual Eligible", qualifying for

both Medicare and Medicaid, you will automatically qualify for the Medicare Part

D Low-Income Subsidy (LIS) or Extra Help program.

If you have LIS benefits and you enroll in a stand-alone Medicare Part D plan that qualifies as one of your state's $0 premium LIS plans, you will pay a $0 monthly premium.

However, if you qualify for LIS benefits and enroll in a Medicare Part D plan that does not qualify for your state's $0 LIS premium, you will pay a small monthly premium that is roughly calculated as the difference between your state's benchmark premium and the Medicare plan's premium.

The good news is that, if you qualify for Medicare Part D Extra Help, you are granted a Special Enrollment Period (SEP) that allows you to change your Medicare Part D or Medicare Advantage plan enrollment once per quarter, during the first nine months of the plan year. Your newly chosen plan becoming effective the first day of the month after enrollment.

If you have LIS benefits and you enroll in a stand-alone Medicare Part D plan that qualifies as one of your state's $0 premium LIS plans, you will pay a $0 monthly premium.

However, if you qualify for LIS benefits and enroll in a Medicare Part D plan that does not qualify for your state's $0 LIS premium, you will pay a small monthly premium that is roughly calculated as the difference between your state's benchmark premium and the Medicare plan's premium.

The good news is that, if you qualify for Medicare Part D Extra Help, you are granted a Special Enrollment Period (SEP) that allows you to change your Medicare Part D or Medicare Advantage plan enrollment once per quarter, during the first nine months of the plan year. Your newly chosen plan becoming effective the first day of the month after enrollment.

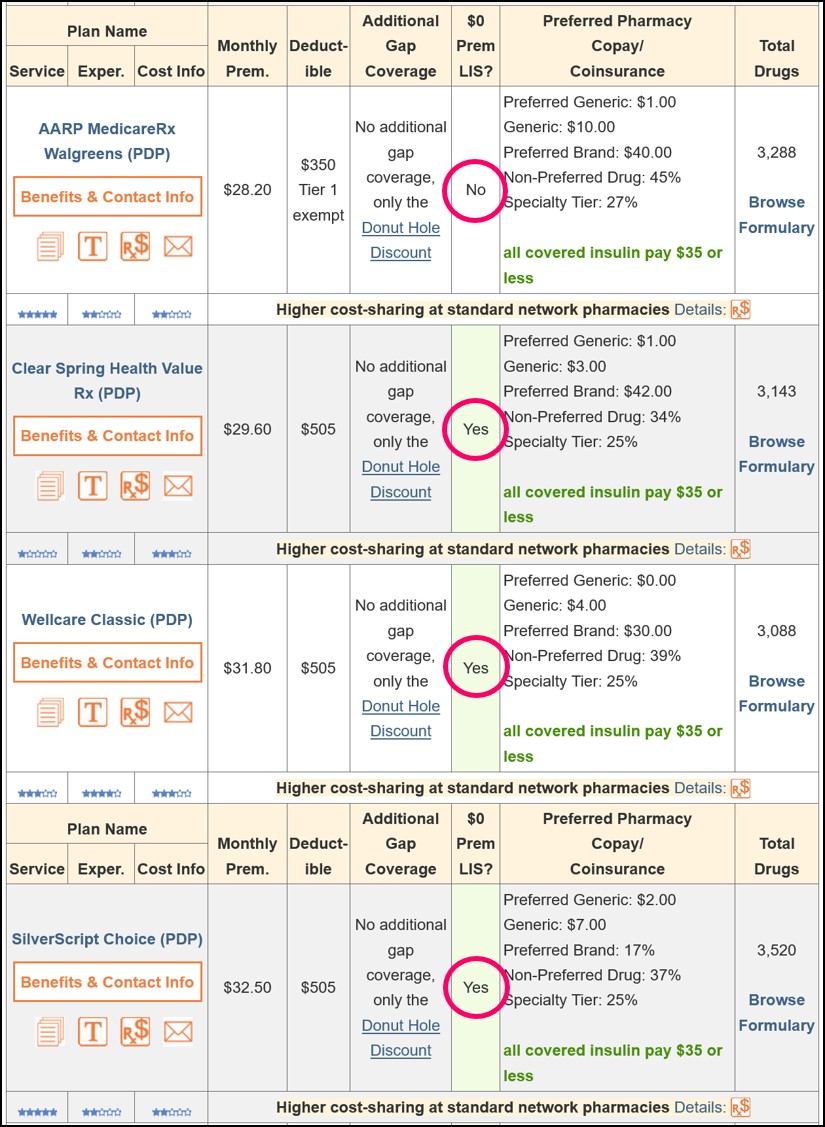

Question: Which Medicare Part D plans qualify for the $0 premium?

You can quickly see the Medicare Part D plans (PDPs) in your state that qualify for the $0 premium (that is, the PDPs that meet your state's $0 LIS benchmark premium and offering a basic or standard Medicare Part D plan design (DS, AE, BA)) at PDP-Finder.com/FL.

Please note: you will notice that a low-costing Medicare Part D plan in the 2023 example graphic below (see current plans here) does not qualify for the $0 premium -- even though its premium is less than the Florida $0 benchmark premium ($35.92) -- because the plan offers enhanced (EA) Medicare Part D coverage rather than basic coverage. You will also notice that a Medicare Part D plan may meet the state $0 benchmark premium in one state and not qualify for the $0 premium in another state.

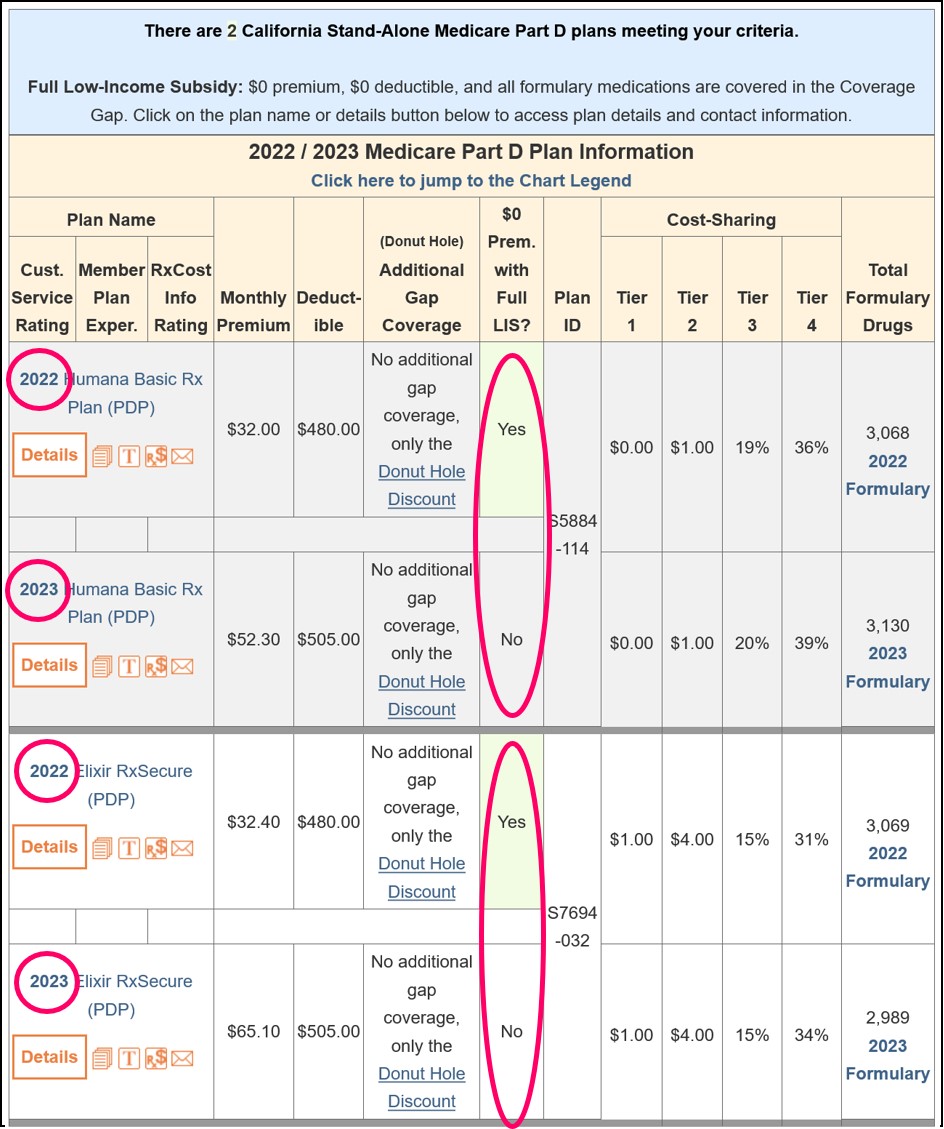

But, state LIS benchmark premiums and Medicare Part D plans change each year - and the Medicare plans that qualify for the state's $0 benchmark premium also change each year. You can see how Medicare Part D plans change each year using our Medicare Part D compare tool (PDP-Compare.com/CA).

So as you can see in the 2022/2023 example below using PDP-Compare, it is possible that your Medicare Part D plan might qualify as a $0 premium plan one year and then next year the same Medicare plan does not qualify for the $0 premium.

A bit of history...

Plan year 2023 was the last year for partial-LIS benefits. Starting with plan year 2024, the Inflation Reduction Act (IRA) increased full-Extra Help benefits to people at or below 150% of FPL and consequently, the current partial Extra Help (135% to 150% of FPL) designation will be eliminated.

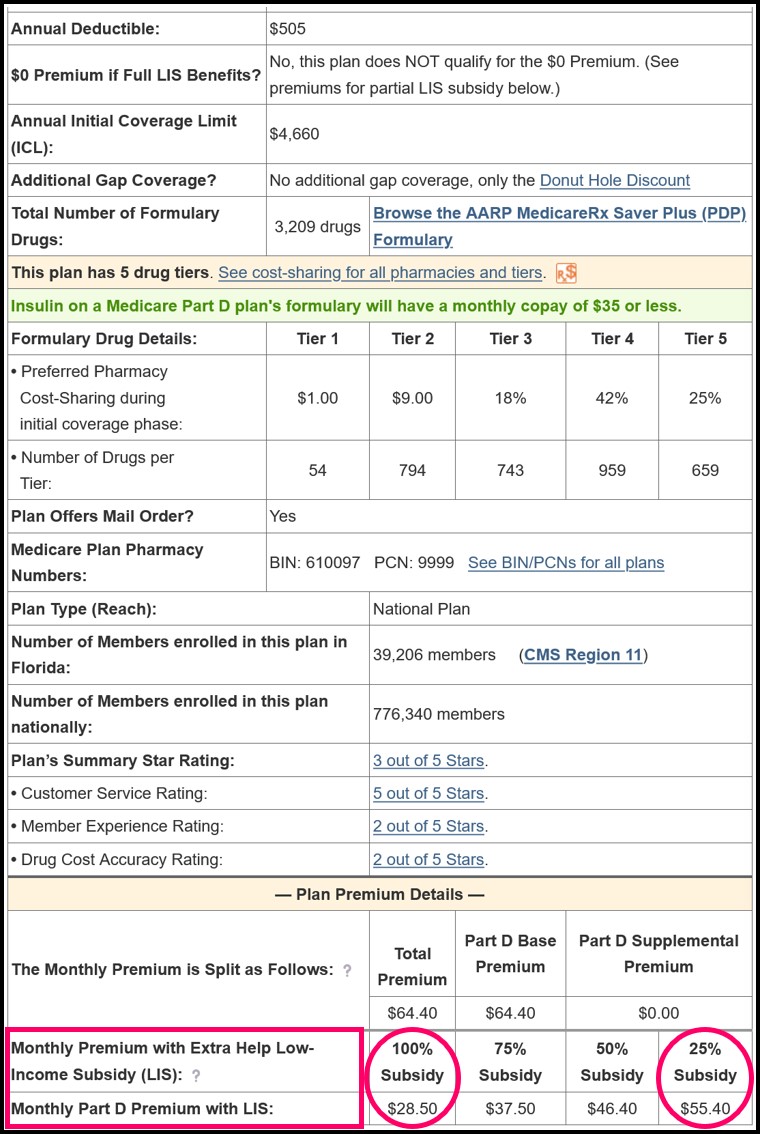

Question: Where can I see the 2023 plan premium if I had partial-LIS benefits?

In the past, you may have only qualified for partial-LIS benefits (instead of full-LIS benefits); however, beginning in plan year 2024, full-LIS benefits have been expanded to 150% of FPL and therefore full-LIS benefits are extended to beneficiaries who formerly received only partial-LIS benefits. See more about Medicare Part D changes made through the Inflation Reduction Act (IRA).

For plan years prior to 2024, you can click on the Medicare Part D plan name while using PDP-Finder or PDP-Compare, and scroll through the plan's coverage details to see the premium you would pay with full-LIS status or partial-LIS status (see 2023 example below).

More Information:

Please see our FAQ: "I am qualified for Medicaid and Medicare, so why am I still paying a premium for my Medicare Part D prescription drug plan?"

To learn more and apply for Extra Help, you can call Social Security at 1-800-772-1213 (TTY 1-800-325-0778) or visiting www.socialsecurity.gov or contact your local state Medicaid office. For more assistance with choosing a Medicare Part D or Medicare Advantage plan call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

Or you can visit the Medicare.gov Medicare Prescription Drug Plan Finder for a list of the Medicare drug plans available in your area.

Again, to help with your plan search, we also offer our Medicare Part D Plan Finder and Plan Overview by State.

(Primary source: U.S. Department of Health & Human Services)

Plan year 2023 was the last year for partial-LIS benefits. Starting with plan year 2024, the Inflation Reduction Act (IRA) increased full-Extra Help benefits to people at or below 150% of FPL and consequently, the current partial Extra Help (135% to 150% of FPL) designation will be eliminated.

Question: Where can I see the 2023 plan premium if I had partial-LIS benefits?

In the past, you may have only qualified for partial-LIS benefits (instead of full-LIS benefits); however, beginning in plan year 2024, full-LIS benefits have been expanded to 150% of FPL and therefore full-LIS benefits are extended to beneficiaries who formerly received only partial-LIS benefits. See more about Medicare Part D changes made through the Inflation Reduction Act (IRA).

For plan years prior to 2024, you can click on the Medicare Part D plan name while using PDP-Finder or PDP-Compare, and scroll through the plan's coverage details to see the premium you would pay with full-LIS status or partial-LIS status (see 2023 example below).

More Information:

Please see our FAQ: "I am qualified for Medicaid and Medicare, so why am I still paying a premium for my Medicare Part D prescription drug plan?"

To learn more and apply for Extra Help, you can call Social Security at 1-800-772-1213 (TTY 1-800-325-0778) or visiting www.socialsecurity.gov or contact your local state Medicaid office. For more assistance with choosing a Medicare Part D or Medicare Advantage plan call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048.

Or you can visit the Medicare.gov Medicare Prescription Drug Plan Finder for a list of the Medicare drug plans available in your area.

Again, to help with your plan search, we also offer our Medicare Part D Plan Finder and Plan Overview by State.

(Primary source: U.S. Department of Health & Human Services)

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service