How do I calculate my Medicare Part D Late-Enrollment Penalty?

A person enrolled in a Medicare drug plan may owe a late enrollment penalty (LEP) if they are without Part D drug coverage - or some other form of creditable prescription drug coverage - for any continuous period of 63 days

or more after the end of their Medicare Initial Enrollment Period

(IEP). For example, if you turn 65 and become eligible for

Medicare but decide to wait an entire year before enrolling in a Medicare Part D drug plan

(and do not have some other form of credible drug coverage, such as employer drug

coverage or VA coverage), you will incur a penalty for the 12 months

that you were without drug coverage - assuming you are not eligible for Medicare Extra Help. The late enrollment penalty applies to both stand-alone Medicare Part D prescription drug plans (PDP) and Medicare Advantage plans that include drug coverage (MAPD).

Your Medicare Part D late-enrollment penalty is calculated by multiplying the number of months you were without some form of "creditable" prescription drug coverage by 1% of the annual base Medicare Part D premium ($34.70 in 2024).

Example (for 2024 penalty): Calculating a five-year late-enrollment penalty

As shown in the table below, the 2024 national base Medicare Part D premium is ($34.70. So, if you were previously without some form of creditable prescription drug coverage for five years (or 60 months), you would pay, in addition to your monthly Medicare plan premium, a 2024 monthly penalty of $20.80 (60 months x (1% x ($34.70)) - or an additional $250 per year.

As reference, here are the average national base Medicare Part D premium values used by Medicare to calculate the late-enrollment penalties for past years:

Question: Can my late-enrollment penalty can change year-to-year?

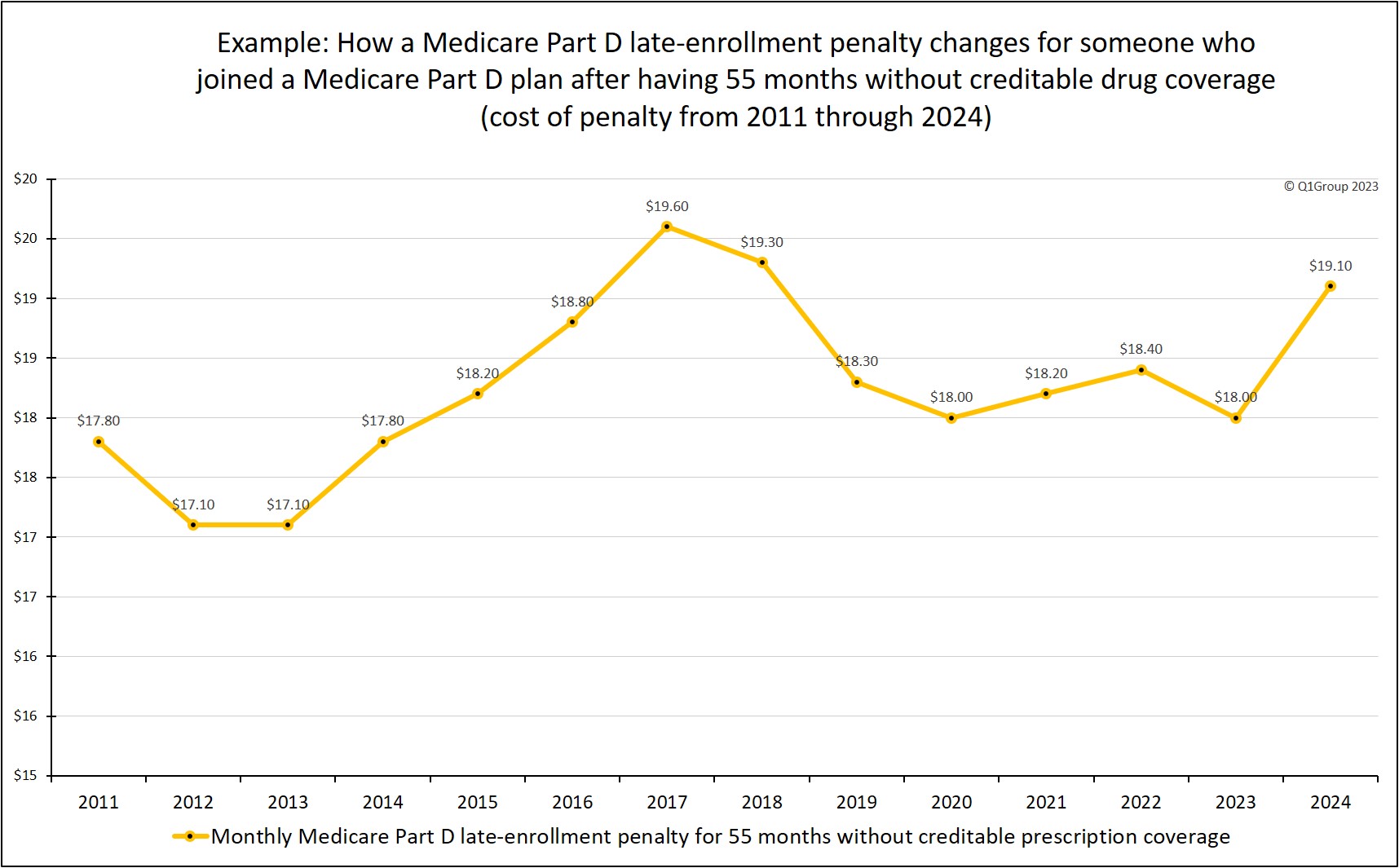

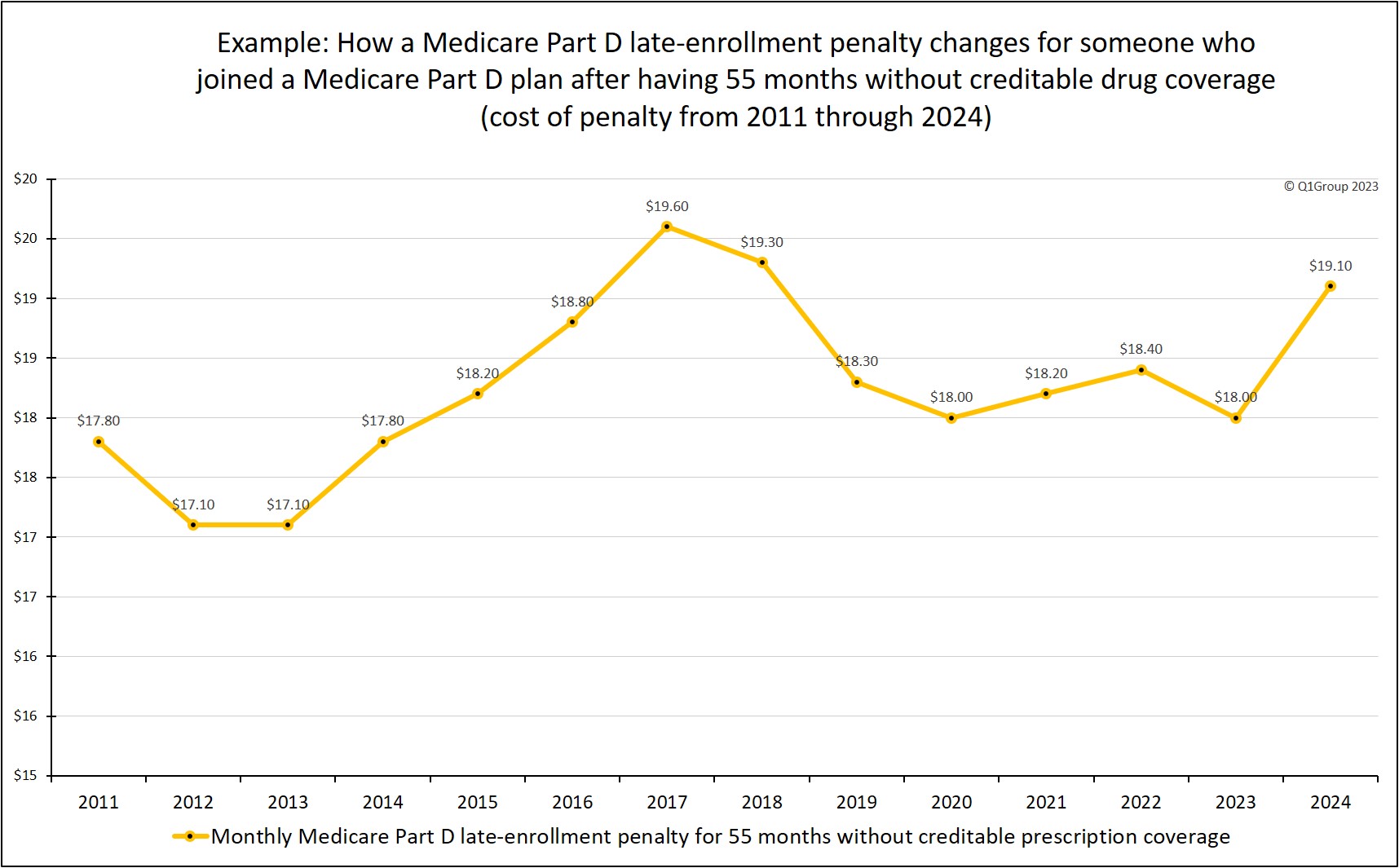

Yes. The late-enrollment penalty is permanent and can fluctuate every year based on the national average base Medicare Part D premium. As another example, if you were eligible for Medicare, but without creditable prescription drug coverage from 2006 through 2010 (55 months without drug coverage) and then joined a Medicare Part D plan in 2011, you would pay a monthly penalty of $17.80 (55 months without drug coverage * 1% of $32.34 (the national base premium for 2011) - rounded to the nearest $0.10) or around an additional $214 over the year for your drug coverage.

In comparison, your 2024 penalty would be slightly higher or $19.10 per month (55 months without drug coverage * 1% of $34.70 (the national base premium for 2024) - rounded to the nearest $0.10) or around an additional $229 for the year.

If you stayed in a Medicare Part D plan since 2011, here is a chart showing how your 55-month late-enrollment penalty would have changed over the years (2011 to 2024).

Your Medicare Part D late-enrollment penalty is calculated by multiplying the number of months you were without some form of "creditable" prescription drug coverage by 1% of the annual base Medicare Part D premium ($34.70 in 2024).

Example (for 2024 penalty): Calculating a five-year late-enrollment penalty

As shown in the table below, the 2024 national base Medicare Part D premium is ($34.70. So, if you were previously without some form of creditable prescription drug coverage for five years (or 60 months), you would pay, in addition to your monthly Medicare plan premium, a 2024 monthly penalty of $20.80 (60 months x (1% x ($34.70)) - or an additional $250 per year.

As reference, here are the average national base Medicare Part D premium values used by Medicare to calculate the late-enrollment penalties for past years:

|

|

Question: Can my late-enrollment penalty can change year-to-year?

Yes. The late-enrollment penalty is permanent and can fluctuate every year based on the national average base Medicare Part D premium. As another example, if you were eligible for Medicare, but without creditable prescription drug coverage from 2006 through 2010 (55 months without drug coverage) and then joined a Medicare Part D plan in 2011, you would pay a monthly penalty of $17.80 (55 months without drug coverage * 1% of $32.34 (the national base premium for 2011) - rounded to the nearest $0.10) or around an additional $214 over the year for your drug coverage.

In comparison, your 2024 penalty would be slightly higher or $19.10 per month (55 months without drug coverage * 1% of $34.70 (the national base premium for 2024) - rounded to the nearest $0.10) or around an additional $229 for the year.

If you stayed in a Medicare Part D plan since 2011, here is a chart showing how your 55-month late-enrollment penalty would have changed over the years (2011 to 2024).

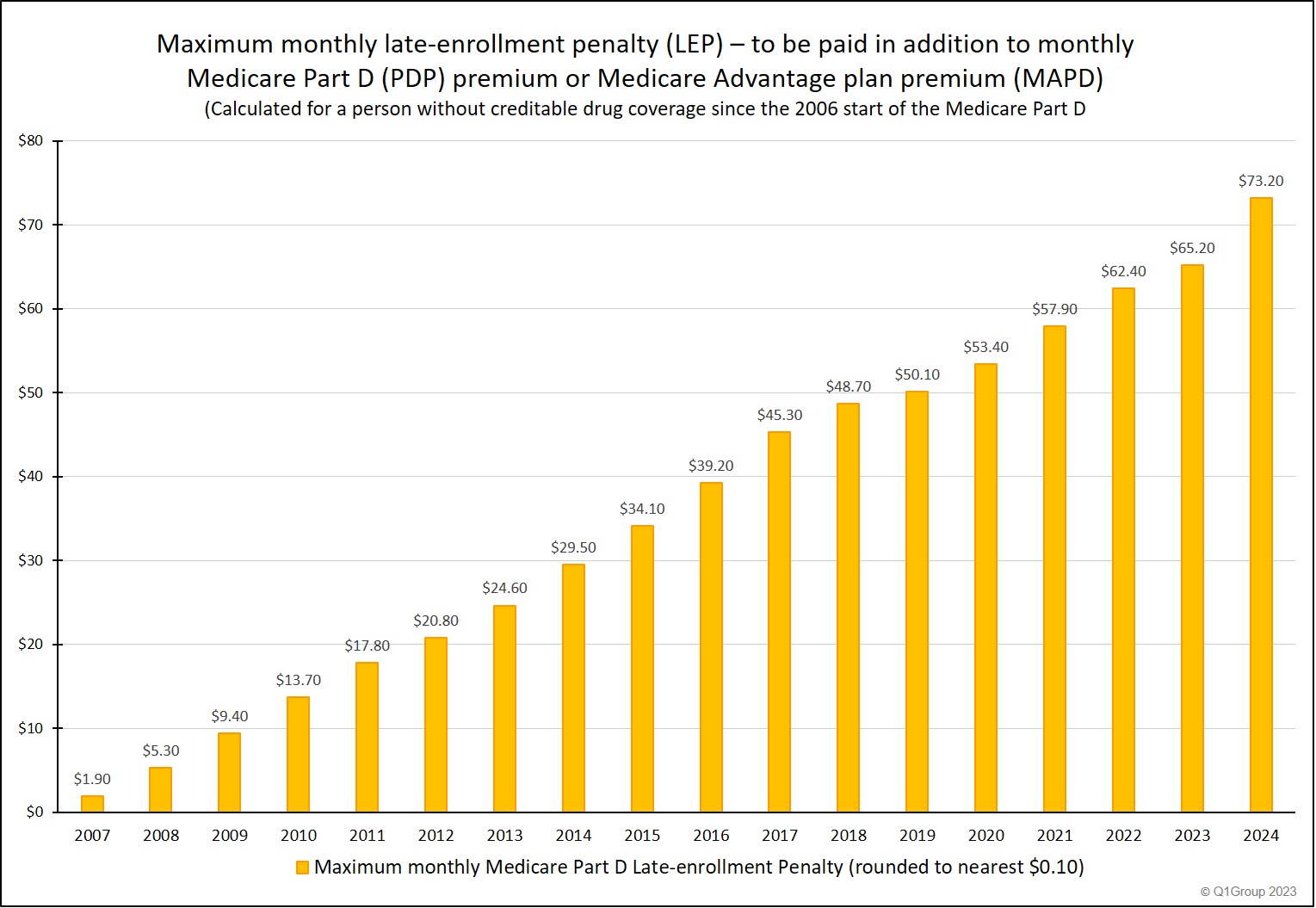

Question: If I never joined a Medicare drug plan, can my late-enrollment penalty increase over time?

Yes. In 2024, the maximum late-enrollment penalty can reach as high as $878.40 per year - paid in addition to your Medicare plan premium and coverage. Here is an example chart showing how a Medicare Part D late-enrollment penalty can increase over the years - and the cost of waiting to enroll in a Part D plan.

This chart is assuming that the Medicare beneficiary was eligible for a Medicare Part D plan back in 2006, but decided not to join a Medicare prescription drug plan until 2024.

Not a big fan of math? No problem.

The amount of your Medicare Part D late-enrollment premium penalty is calculated each year by the Centers for Medicare and Medicaid Services (CMS) and then reported by CMS to your Medicare Part D plan or Medicare Advantage plan.

Your Medicare Part D plan will then send you a letter regarding the amount of your penalty. So, CMS or Medicare will calculate your Part D Late Enrollment Penalty by totaling the number of months you have been without "creditable" prescription drug coverage and multiplying the total months by 1% of the national base average Medicare Part D premium which can change each year.

The letter from your Part D plan will also detail how CMS calculated the penalty and explain how you can ask for a review of your the Late-Enrollment Penalty (or LEP).

You can click here to read more about how CMS calculates Medicare Part D late-enrollment penalties.

Question: Is everyone subject to the Part D late-enrollment penalty?

No. In general, if you did not enroll into a Medicare Part D prescription drug plan during your Initial Enrollment Period (IEP) and you did not have other creditable prescription coverage (like VA or employer or union drug coverage), you could be subject to a penalty that is added to your monthly Medicare Part D premiums. In addition, if you canceled your Medicare Part D plan or were without creditable prescription drug coverage for more than 63 days, you will also be subject to the premium penalty.

However, you will not be subject to a late-enrollment penalty if you are eligible for the Low-Income Subsidy (LIS) or Medicare Part D Extra Help program.

Question: Will I pay a Part D late-enrollment penalty if I join a Medicare Advantage plan that includes drug coverage (MAPD)?

Yes. You will pay a Medicare Part D late-enrollment penalty if you join a Medicare Advantage plan that includes drug coverage (MAPD). However, if you join a Medicare Advantage plan without drug coverage (MA), you will not pay a Part D late-enrollment penalty since you do not have drug coverage.

Question: What is "creditable" drug coverage?

"Creditable" prescription drug coverage means drug coverage that is at-least-as-good-as basic drug coverage provided by a Medicare Part D plan. Some examples of creditable coverage are, VA coverage, TRICARE coverage, coverage from your Union healthcare, or employer health plan. If you have employer drug coverage, your employer health plan administrator will have sent you a letter telling whether your drug coverage is "creditable".

Question: What should I do if I don't believe that I should be paying a late-enrollment penalty?

You have the right to appeal your Medicare Part D late-enrollment penalty if you think that the penalty was wrongly assessed or miscalculated. To learn more, we have detailed instructions online for appealing your late-enrollment penalty: q1medicare.com/PartD-AppealMedicaresEnrollmentPenalty.php

You can begin by contacting your Medicare Part D plan using the toll-free number on your Member ID card and asking that the plan sends you a “Reconsideration Request Form” so that you can appeal your late-enrollment penalty.

You can also learn more from the federal contractor that handles Part D late-enrollment penalty appeals. You can contact “C2C Innovative Solutions, Inc.” using the toll-free number (1-833-919-0198) or visit the website:

partdappeals.c2cinc.com/Part-D-Enrollees-Representatives/Appeal-Instructions

Late-enrollment Penalty articles

For more information, you can click here to review our recent articles detailing the late-enrollment penalty.

Late-enrollment Penalty Frequently Asked Questions (FAQs)

You can also click here if you would like to review more of our Frequently Asked Question (FAQ) regarding the Medicare Part D late-enrollment penalty.

Examples from CMS late-enrollment penalty tip-sheets.

To see a few examples of how to calculate a late enrollment penalty see our article Examples Calculating the Late Enrollment Penalty.

See more example calculations and CMS examples from past years:

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2020 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2018 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2016 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2014 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2011 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2009 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2006)

To see a few examples of how to calculate a late enrollment penalty see our article Examples Calculating the Late Enrollment Penalty.

See more example calculations and CMS examples from past years:

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2020 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2018 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2016 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2014 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2011 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2009 Revision)

CMS Tip Sheet - Calculating the Late Enrollment Penalty (2006)

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service