What do I pay when my Medicare Part D plan excludes Tier 1 and Tier 2 drugs from the plan's initial deductible?

You will only pay the Tier 1 or Tier 2 copayment for your medications, if these two formulary tiers are excluded from the initial deductible - even when the plan's initial deductible is not yet met.

An increasing number of Medicare Part D drug plans now exclude low-cost formulary Tier 1 and Tier 2 drugs from the plan's initial deductible and you have immediate coverage for most low-costing drugs. Meaning that, from the very start of the plan year, you will pay just Tier 1 and 2 copays for these drugs (unless the retail price is less than the copay and then you will pay no more than the retail price) - and your initial deductible will only be applied to more-expensive brand-name drugs or drugs on higher formulary tiers that are not excluded from the deductible.

Reminder: Not all Medicare drug plans provide immediate coverage for your generic drugs.

If your Medicare Part D plan does not exclude any tiers from the initial deductible, then you must pay your Medicare Part D plan's initial deductible before you receive any coverage from your Medicare Part D plan. For example, the standard 2024 Medicare Part D deductible is $545 and you must pay the full retail price for your formulary drugs until you have spent $545 out of pocket. When the initial deductible is met, then the Medicare plan coverage begins and you will only pay a portion of the retail drug cost, sharing the cost with your Medicare drug plan.

Example Purchase #1: What will I pay when my first purchase of the year is a $22 Tier 2 drug excluded from my deductible?

So, if you have a $545 standard deductible with Tier 1 and Tier 2 drugs excluded from the deductible, and you purchase a Tier 2 generic drug that has a retail price of $22 (with a copay of $3) – you pay only the $3 copay and your $545 deductible is not affected by your purchase.

Example Purchase #2: Up to this point in the year, you have only purchased Tier 1 and Tier 2 drugs that are excluded from the Initial Deductible and you now have a newly-prescribed Tier 3 drug with a retail cost of $520 and a $47 Tier 3 copay.

Example Purchase #3: Up to this point in the year, you have only purchased Tier 1 and Tier 2 drugs that are excluded from the Initial Deductible and you now have a newly-prescribed Tier 3 drug with a retail cost of $560 and a $47 Tier 3 copay.

(Note: this a straddle claim).

(1) You would first pay $545 of the $560 retail drug cost to satisfy your $545 Initial Deductible and (2) the remaining $15 portion of the retail cost ($560 - $545) would carry over (straddle) into your Initial Coverage phase where you have a $47 copay.

But, since you never pay more than the drug plan’s retail cost, you are not charged the full $47 copay, but instead, you pay the remaining $15 retail balance, so your total cost-sharing would be $560 ($545 + $15).

And the full $560 retail value of the formulary drug would count toward reaching your plan's Initial Coverage Limit and entering the 2024 Donut Hole or Coverage Gap.

Question: But what happens if I only buy Tier 1 and Tier 2 formulary drugs excluded from the plan's deductible, will I ever enter the Donut Hole?

Yes. In the examples above (with Tier 1 and Tier 2 drugs excluded from the deductible), if you were to only purchase Tier 1 and Tier 2 drugs all year, your $545 initial deductible would never be met. However, you enter the Donut Hole (or leave the Initial Coverage Phase) based on the retail value of the formulary drugs you purchase.

An increasing number of Medicare Part D drug plans now exclude low-cost formulary Tier 1 and Tier 2 drugs from the plan's initial deductible and you have immediate coverage for most low-costing drugs. Meaning that, from the very start of the plan year, you will pay just Tier 1 and 2 copays for these drugs (unless the retail price is less than the copay and then you will pay no more than the retail price) - and your initial deductible will only be applied to more-expensive brand-name drugs or drugs on higher formulary tiers that are not excluded from the deductible.

Reminder: Not all Medicare drug plans provide immediate coverage for your generic drugs.

If your Medicare Part D plan does not exclude any tiers from the initial deductible, then you must pay your Medicare Part D plan's initial deductible before you receive any coverage from your Medicare Part D plan. For example, the standard 2024 Medicare Part D deductible is $545 and you must pay the full retail price for your formulary drugs until you have spent $545 out of pocket. When the initial deductible is met, then the Medicare plan coverage begins and you will only pay a portion of the retail drug cost, sharing the cost with your Medicare drug plan.

Example Purchase #1: What will I pay when my first purchase of the year is a $22 Tier 2 drug excluded from my deductible?

- Your Medicare Part D plan's initial deductible: $545 (still unchanged)

- Your plan's Tier 2 drug copay: $3

- Your Tier 2 drug's retail price: $22

- After the Tier 2 drug purchase your Medicare Part D plan's initial deductible: $545

So, if you have a $545 standard deductible with Tier 1 and Tier 2 drugs excluded from the deductible, and you purchase a Tier 2 generic drug that has a retail price of $22 (with a copay of $3) – you pay only the $3 copay and your $545 deductible is not affected by your purchase.

Example Purchase #2: Up to this point in the year, you have only purchased Tier 1 and Tier 2 drugs that are excluded from the Initial Deductible and you now have a newly-prescribed Tier 3 drug with a retail cost of $520 and a $47 Tier 3 copay.

- Your Medicare Part D plan's initial deductible: $545 (still unchanged)

- Your plan's Tier 3 drug copay: $47

- Your Tier 3 drug's retail price: $520

- After the Tier 3 drug purchase your Medicare Part D plan's initial deductible: $25

Example Purchase #3: Up to this point in the year, you have only purchased Tier 1 and Tier 2 drugs that are excluded from the Initial Deductible and you now have a newly-prescribed Tier 3 drug with a retail cost of $560 and a $47 Tier 3 copay.

(Note: this a straddle claim).

- Your Medicare Part D plan's initial deductible: $545 (still unchanged)

- Your plan's Tier 3 drug copay: $47

- Your Tier 3 drug's retail price: $560

- After the Tier 3 drug purchase your Medicare Part D plan's initial deductible: $0 (you are now in into Initial Coverage Phase)

(1) You would first pay $545 of the $560 retail drug cost to satisfy your $545 Initial Deductible and (2) the remaining $15 portion of the retail cost ($560 - $545) would carry over (straddle) into your Initial Coverage phase where you have a $47 copay.

But, since you never pay more than the drug plan’s retail cost, you are not charged the full $47 copay, but instead, you pay the remaining $15 retail balance, so your total cost-sharing would be $560 ($545 + $15).

And the full $560 retail value of the formulary drug would count toward reaching your plan's Initial Coverage Limit and entering the 2024 Donut Hole or Coverage Gap.

Question: But what happens if I only buy Tier 1 and Tier 2 formulary drugs excluded from the plan's deductible, will I ever enter the Donut Hole?

Yes. In the examples above (with Tier 1 and Tier 2 drugs excluded from the deductible), if you were to only purchase Tier 1 and Tier 2 drugs all year, your $545 initial deductible would never be met. However, you enter the Donut Hole (or leave the Initial Coverage Phase) based on the retail value of the formulary drugs you purchase.

So, if your total retail drug cost

exceeds your Initial Coverage Limit ($5,030 in 2024), you would still enter your plan's Coverage Gap or Donut Hole - and continue to move through your plan's coverage - and the plan's initial deductible is no longer an issue.

As noted by Medicare in the September 10, 2010 memorandum, "Additional Guidance Concerning Closing the Coverage Gap in 2011",

"With the implementation of the [Medicare Coverage Gap Discount Program], however, CMS finds it necessary to clarify that for purposes of the [Medicare Coverage Gap Discount Program] only beginning in 2011, a Part D deductible ceases to apply once a beneficiary’s total gross covered drug costs exceed the [Initial Coverage Limit]. This means that for a beneficiary enrolled in a Part D plan with a brand-only deductible, applicable (i.e. brand) drugs that would otherwise be subject to the deductible will be eligible for a coverage gap discount once the beneficiary’s total gross covered drug costs exceed the [Initial Coverage Limit] even if the beneficiary has not satisfied the deductible."

Example Purchase #4: Up to this point you have only purchased Tier 1 and Tier 2 drugs that are excluded from the Initial Deductible and you now purchase a Tier 3 (or Tier 6) insulin drug with a retail cost of $300.

- Your Medicare Part D plan's initial deductible: $545 (still unchanged)

- Your plan's Tier 3 insulin copay: $35

- Your Tier 3 or Tier 6 insulin retail price: $300

- After the Tier 3 drug purchase your Medicare Part D plan's initial deductible: $545

As background, beginning in 2023, all Medicare drug plans will offer all insulin on the plan's formulary at a copay of no more than $35 (per month) based on the Inflation Reduction Act (IRA). The IRA stipulates that Medicare Part D drug plans must offer various types and forms of insulin for a 30-day copay of $35 (or less) and will keep this low cost-sharing throughout all phases of coverage including: the plan's Initial Deductible, Initial Coverage phase, and the Coverage Gap (or Donut Hole). If you have high prescription costs and reach the 2024 Catastrophic Coverage phase, you will have no additional costs for formulary drugs for the remainder of the year.

Important note from 2023: Unlike a Tier excluded from the deductible (such as in the example above), the 2023 purchase of a plan's covered insulin product will reduce a person's initial deductible by the total retail cost of the insulin product - so not just the $35 or less copay paid by the person, but the retail price of the insulin.

For example, if a plan's negotiated retail cost for insulin was $200 and a person had not yet met the 2023 deductible of $505, the person will pay no more than $35 for the formulary insulin product, but the deductible will be reduced by the $200 retail insulin cost - and so the remaining 2023 deductible would now be $305.

- Your 2023 Medicare Part D plan's initial deductible: $505 (still unchanged)

- Your plan's Tier 3 insulin copay: $35

- Your Tier 3 insulin retail price: $300

- After the Tier 3 insulin purchase your 2023 Medicare Part D plan's initial deductible: $205

Note for 2024: As per Medicare guidance: "The [2024] deductible does not apply to the covered insulin product, therefore, none of the cost of the insulin product . . . would count towards satisfying the deductible that otherwise applies under the plan for other products." So an insulin purchase would be similar to the purchase of a Tier 1 or Tier 2 drug excluded from the deductible.

Question: How do you know whether a Medicare plan excludes Tier 1 and Tier 2 drugs from the initial deductible?

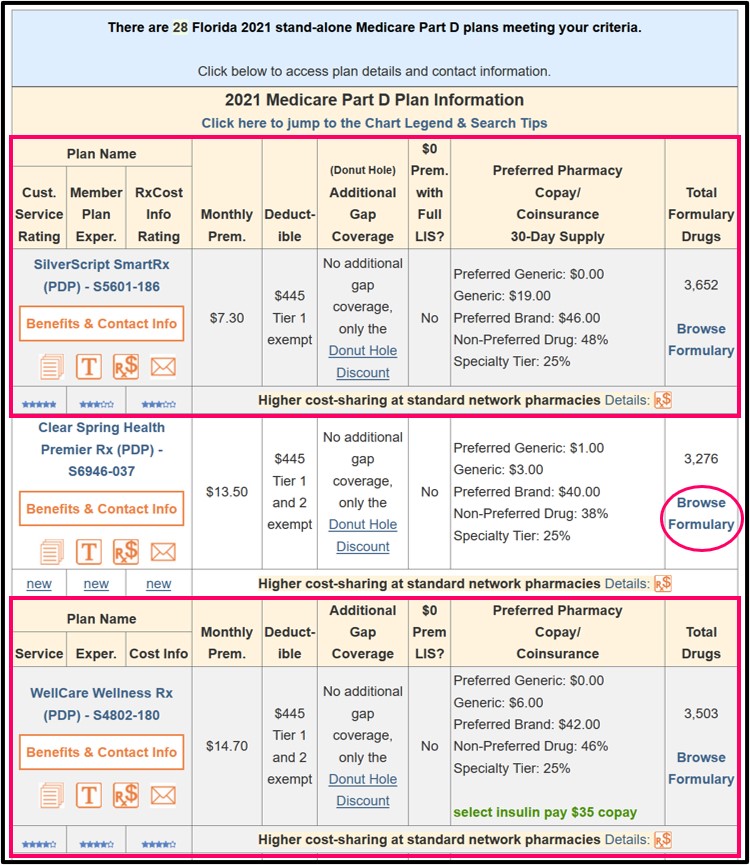

You will notice when you visit our Q1Medicare Medicare Part D Plan Finder (PDP-Finder.com) that Medicare Part D plans will be marked under the "Deductible" section with the text "Tier 1 exempt" or "Tier 1 and 2 exempt".

Here is an example of 2021 Florida Medicare Part D plans having lower-costing generics excluded from the standard deductible.

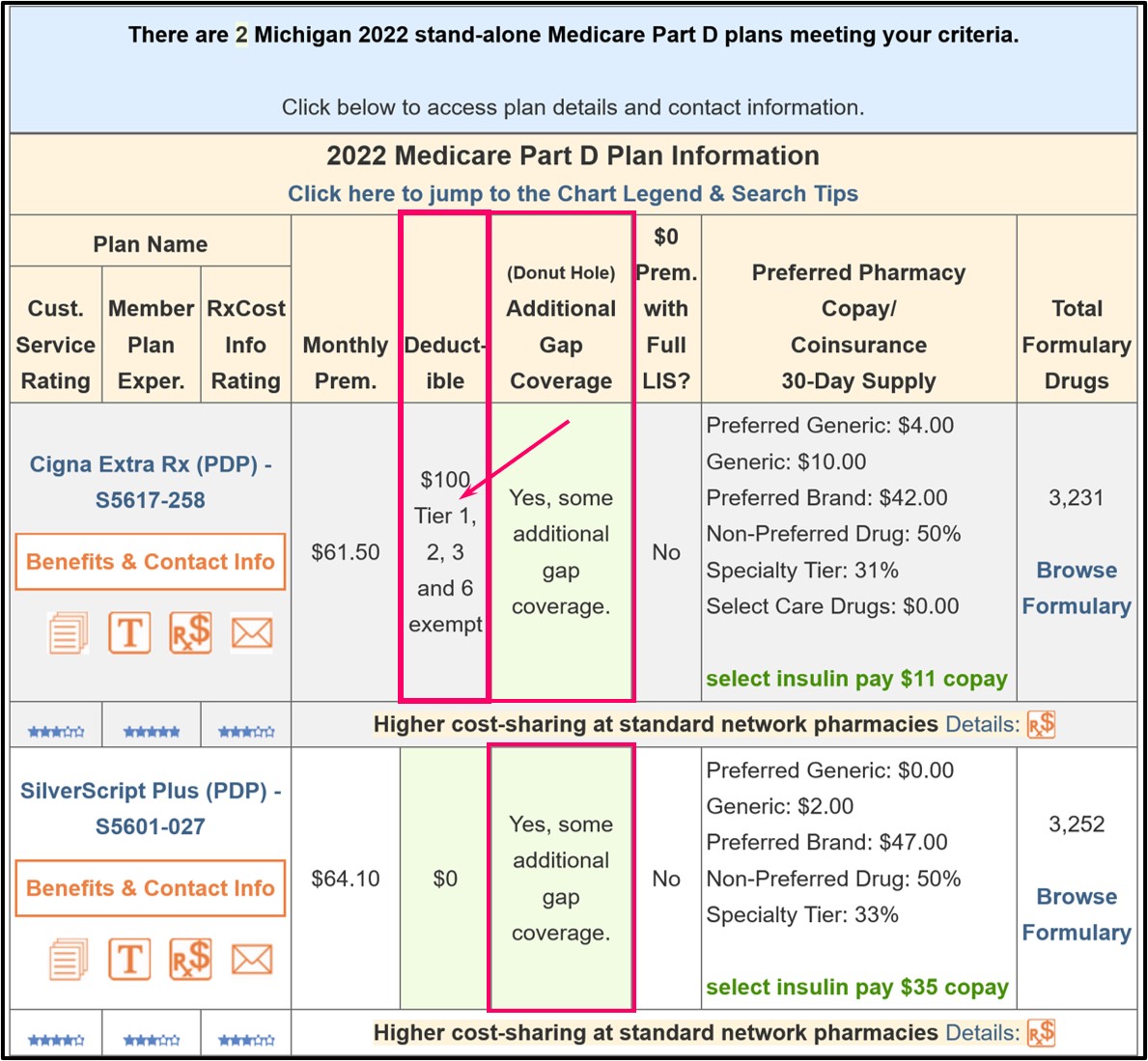

And here is an example of a 2022 Medicare Part D plan having Tier 1, Tier 2, Tier 3, and Tier 6 drugs excluded from the plan's initial $100 deductible.

In addition, when you view the Medicare plan details (by clicking on the

Medicare plan name), you can see in the plan details that Tier 1 and

Tier 2 drugs may be excluded from the plan's initial deductible.

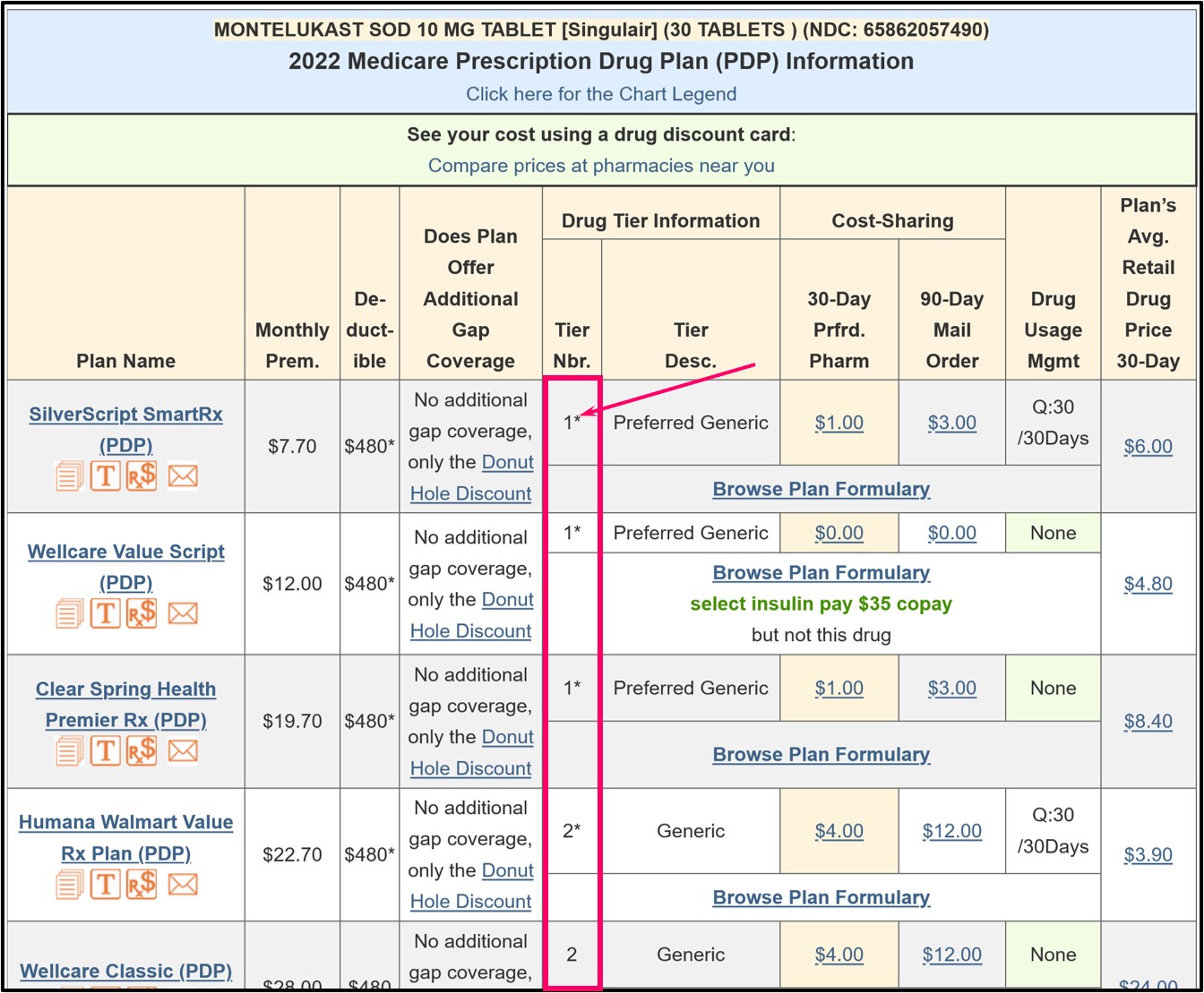

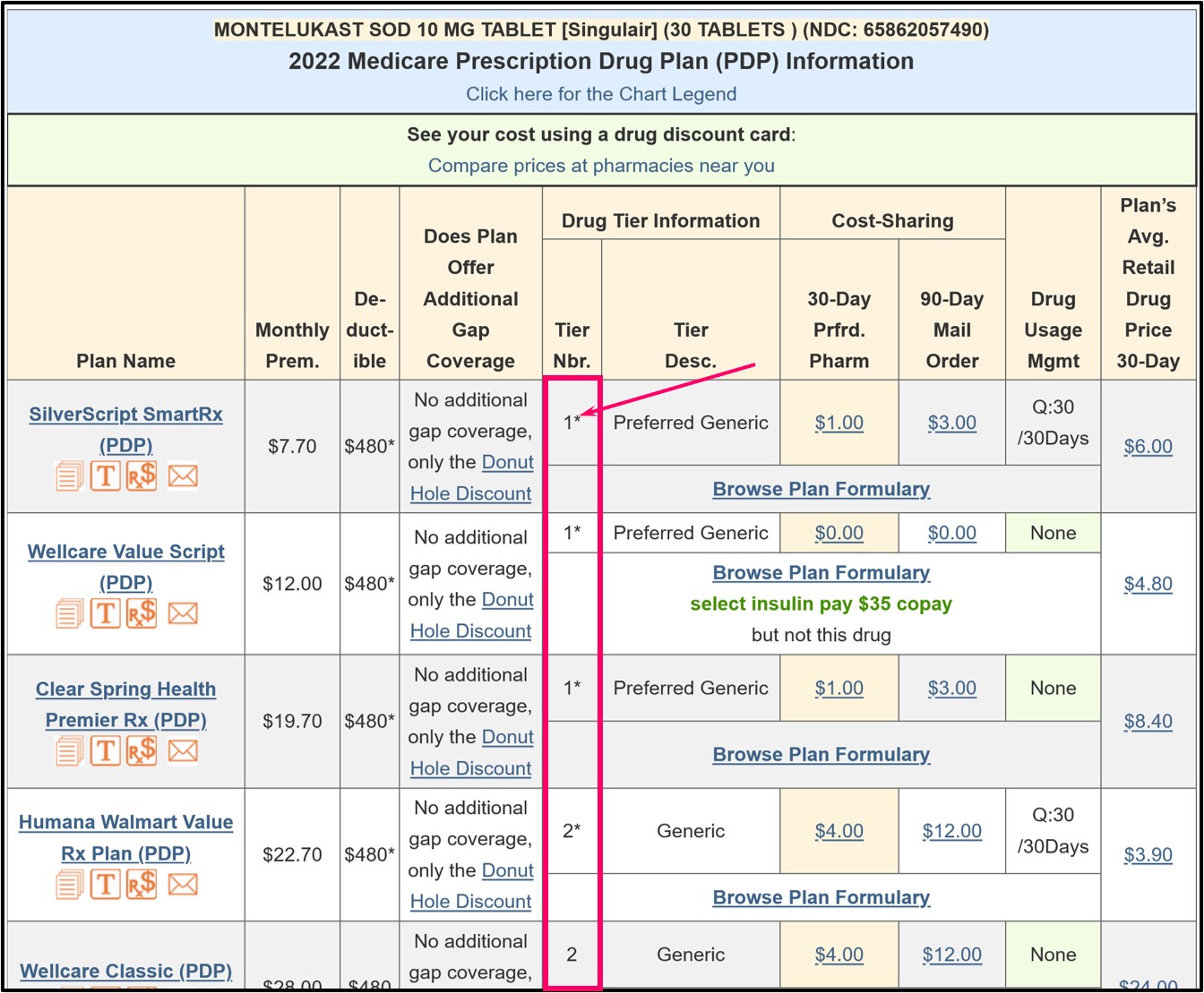

As an example using the Q1Rx Drug Finder, in 2023, Florida has 23 stand-alone Medicare Part D plans that cover “MONTELUKAST SOD 10 MG TABLET [Singulair] (30 TABLETS) (NDC: 65862057490)” and you can click on the Medicare plan name to see more details of the coverage for a particular plan.

In the Q1Rx Drug Finder, you can see that some drugs are marked as (1* or 2*) and this means that the Tier 1 or Tier 2 drug has is excluded from the plan's initial deductible - and receives coverage according to the cost-sharing.

Need more help? Contact your plan and review your plan's documentation.

You can learn more by contacting your Medicare Part D prescription drug plan by calling the toll-free number for Member Services found on your Member ID card.

You can also read more about your drug plan coverage in your Medicare plan's Evidence of Coverage document where you might find in Chapter 4, "What you pay for your Part D prescription drugs":

Remember, your Medicare Part D plan's Initial Deductible does not affect when you enter the Donut Hole or Coverage Gap. You enter the Donut Hole based on the retail value of the prescriptions you purchase - not the coverage cost (what you pay).

However, your Initial Deductible (your out-of-pocket spending) will impact how quickly you exit the Donut Hole. You can click here to read more about the impact of your Initial Deductible.

References include:

https://www.csscoperations.com/internet/Cssc.nsf/ files/PDEParticipantGuide%20cameraready%20081811.pdf/ $FIle/PDEParticipantGuide%20cameraready%20081811.pdf

https://www.hhs.gov/guidance/document/additional-guidance-concerning-closing-coverage-gap-2011

https://www.cms.gov/files/document/frequently-asked-questions-medicare-part-d-insulin-benefit.pdf

https://www.cms.gov/files/document/ira-2024-pdeguidance-final508g.pdf

As an example using the Q1Rx Drug Finder, in 2023, Florida has 23 stand-alone Medicare Part D plans that cover “MONTELUKAST SOD 10 MG TABLET [Singulair] (30 TABLETS) (NDC: 65862057490)” and you can click on the Medicare plan name to see more details of the coverage for a particular plan.

In the Q1Rx Drug Finder, you can see that some drugs are marked as (1* or 2*) and this means that the Tier 1 or Tier 2 drug has is excluded from the plan's initial deductible - and receives coverage according to the cost-sharing.

Need more help? Contact your plan and review your plan's documentation.

You can learn more by contacting your Medicare Part D prescription drug plan by calling the toll-free number for Member Services found on your Member ID card.

You can also read more about your drug plan coverage in your Medicare plan's Evidence of Coverage document where you might find in Chapter 4, "What you pay for your Part D prescription drugs":

"During the Deductible Stage, you pay the full cost of your Cost-Sharing Tier 3, Cost-Sharing Tier 4, and Cost-Sharing Tier 5 drugs" and then, "You stay in the Deductible Stage until you have paid [annual deductible amount] for your Cost-Sharing Tier 3, Cost-Sharing Tier 4, and Cost-Sharing Tier 5 drugs".Further on in the Evidence of Coverage Chapter 4 you may read:

"The Deductible Stage is the first payment stage for your drug coverage. You will pay a yearly deductible of [annual deductible amount] on Cost-Sharing Tier 3, Cost-Sharing Tier 4, and Cost-Sharing Tier 5 drugs. You must pay the full cost of your Cost-Sharing Tier 3, Cost-Sharing Tier 4, and Cost-Sharing Tier 5 drugs until you reach the plan's deductible amount. For all other drugs you will not have to pay any deductible and will start receiving coverage immediately.The Initial Deductible and the Donut Hole.

• Your "full cost" is usually lower than the normal full price of the drug, since our plan has negotiated lower costs for most drugs.

• The "deductible" is the amount you must pay for your Part D prescription drugs before the plan begins to pay its share.

Once you have paid [the annual deductible amount] for your Cost-Sharing Tier 3, Cost-Sharing Tier 4, and Cost-Sharing Tier 5 drugs, you leave the Deductible Stage and move on to the next drug payment stage, which is the Initial Coverage Stage."

Remember, your Medicare Part D plan's Initial Deductible does not affect when you enter the Donut Hole or Coverage Gap. You enter the Donut Hole based on the retail value of the prescriptions you purchase - not the coverage cost (what you pay).

However, your Initial Deductible (your out-of-pocket spending) will impact how quickly you exit the Donut Hole. You can click here to read more about the impact of your Initial Deductible.

References include:

https://www.csscoperations.com/internet/Cssc.nsf/ files/PDEParticipantGuide%20cameraready%20081811.pdf/ $FIle/PDEParticipantGuide%20cameraready%20081811.pdf

https://www.hhs.gov/guidance/document/additional-guidance-concerning-closing-coverage-gap-2011

https://www.cms.gov/files/document/frequently-asked-questions-medicare-part-d-insulin-benefit.pdf

https://www.cms.gov/files/document/ira-2024-pdeguidance-final508g.pdf

Browse FAQ Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service