Am I allowed to use a Drug Discount Program instead of my Medicare Part D plan?

Yes. Medicare Part D prescription drug coverage is voluntary and you can use a Drug Discount Coupon or Drug Discount Card to purchase your medications instead of your Medicare Part D plan coverage. Likewise, if

you find a pharmacy offering discounted prices or prices less than your Part D coverage, then you are permitted buy your medications without using your Medicare Part D prescription drug plan (but, you may need to specifically ask the pharmacist to use the pharmacy's discounted price rather than your Medicare Part D plan coverage).

However, there are a few things to consider when purchasing your medications outside of your Medicare Part D plan:

However, there are a few things to consider when purchasing your medications outside of your Medicare Part D plan:

- You cannot combine drug discounts with your Medicare Part D coverage.

A drug discount program (discount card or discount coupon) will not work together with a Medicare Part D plan, so you cannot use a drug discount program together with your Medicare Part D coverage for added savings.

- Drug Manufacturer Coupons are not the same as Drug Discount Coupons --- and you CANNOT use a Drug Manufacturer Coupon if you are eligible for Medicare.

Often you will hear a television commercial for a new brand-name drug offering a short-term discount coupon for the new drug. However, if you are eligible for Medicare you CANNOT use a Drug Manufacturer's Coupon based on federal anti-kickback laws.

You may even notice the "fine print" on the coupon stating something such as: "This Card is not valid for prescriptions that are eligible to be reimbursed, in whole or in part, by Medicaid, Medicare or other federal or state healthcare programs (including any state prescription drug assistance programs and the Government Health Insurance Plan available in Puerto Rico [formerly known as “La Reforma de Salud”])."

As noted in a government report: “Pharmaceutical manufacturers offer copayment coupons to reduce or eliminate the cost of patients’ out-of-pocket copayments for specific brand-name drugs. The anti-kickback statute prohibits the knowing and willful offer or payment of remuneration to a person to induce the purchase of any item or service for which payment may be made by a Federal health care program [i.e., Medicare]. Manufacturers may be liable under the anti-kickback statute if they offer coupons to induce the purchase of drugs paid for by Federal health care programs, including Medicare Part D.”

In addition, you may notice that a pharmaceutical company's website will provide a Pharmaceutical Assistance Program (PAP) offering drug discounts to people in economic need. However, you will usually see the PAP's disclaimer that the discount is not available for people who are eligible for Medicare or people who already have drug coverage. For instance, you might read: "Patient must [n]ot have private or public prescription coverage [in order to be eligible for the program]."

- You can see the approximate cost of using a drug discount card in our Q1Rx.com Drug Finder.

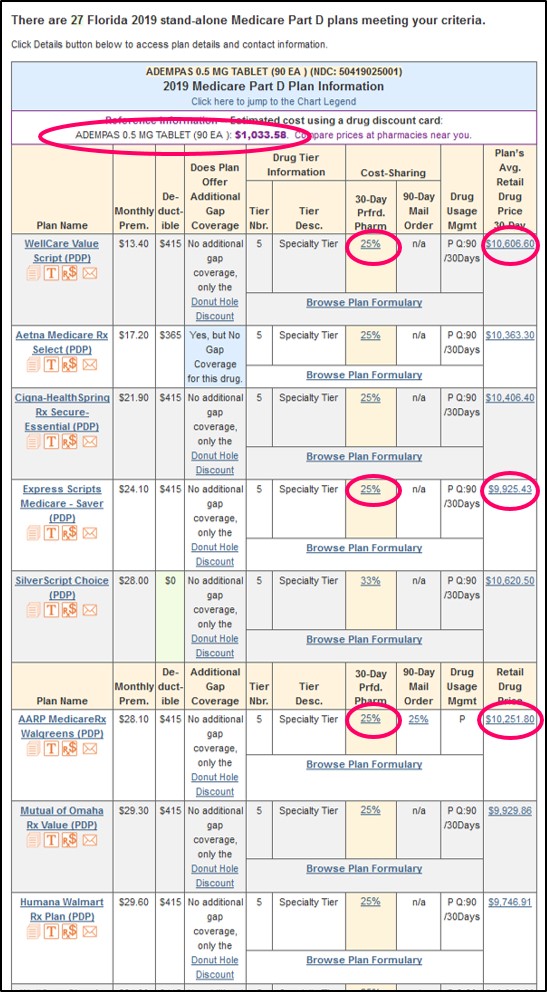

When you search for the average cost of a Part D drug using our Q1Rx.com Drug Finder, we show the average negotiated retail price for a drug across all Medicare Part D plans in a Service Area - and we show the average discounted retail drug price using a drug discount card.

- Drug discount cards and coupons do not always have the lowest price.

As always, please calculate your drug savings before using a drug discount program. As can be seen in the graphic above, depending on your Medicare plan and drug, you may be paying more for your medications with your Medicare Part D plan coverage as compared to a drug discount card (but, this is not always the case). Some drug discount plans mention an average cost savings of 50% - however, the standard Medicare Part D plan design offers medications at a 75% savings (25% of the retail price).

Even if your Medicare plan has a fixed copay that is more than 25% of retail, if you have high monthly retail drugs costs (for example, you buy drugs with an average monthly retail value of over $420 in 2024, you will reach your Medicare plan's Coverage Gap and may be able to take advantage of the Donut Hole discounts where you will receive a fixed 75% discount on all formulary medications purchased (you only pay 25% of retail).

Read more in our FAQ: Is a Drug Discount Card always cheaper than my Part D coverage?

- You can still submit receipts to your Medicare plan for drug purchases.

If you purchase medications using a drug discount coupon, drug discount card, or the pharmacy's discount program, you can submit the receipts for your formulary drug purchases to your Medicare Part D plan so that your Medicare plan can track your overall drug spending - and the amount of the formulary drug purchase is added to your total out-of-pocket expenses (TrOOP) - and monitor your drug usage for any negative drug interactions. (You can only get credit for formulary drug purchases made at network pharmacies and only during the Initial Deductible or Coverage Gap phases of coverage.) You can contact your Member Services department about the procedure for submitting receipts). You can read more in our Frequently Asked Question (FAQ) on the Lower Cash Price policy.

- Drug discount programs are not a substitute for Medicare Part D drug coverage.

A Medicare Part D program often offers the lowest prices available for many popular medications - and provides the added benefit of insurance against unexpected changes in your prescription needs. A Medicare Part D program can also monitor your drug usage and identify possible over-usage (such as with pain medication or opioids) and negative interactions between prescriptions. If you are using a drug discount card, and decide to stop paying your Medicare Part D premiums in an effort to leave or cancel your Medicare Part D plan, and do not have any other form of creditable prescription drug coverage (VA, TRICARE, Employer coverage), you will be subject to the permanent late-enrollment premium penalty should you ever decide to re-enroll in a Medicare prescription drug plan (and your unpaid premiums may be reported to a collection agency or you may be required to pay unpaid-premiums should you ever try to rejoin the same Medicare drug plan).

- Drug discount cards vs. the Donut Hole discount.

As noted above, if your 2024 average monthly retail drug costs are more than $420 but less than $1,038, you will enter the 2024 Coverage Gap (where you can receive a 75% discount on the retail cost of your medications), but may not have high enough out-of-pocket drug spending exit the Coverage Gap and enter your Medicare Part D plan’s Catastrophic Coverage phase (where you will have a $0 copay for formulary medications until the end-of-the-year).

If your monthly retail drug costs are high enough for you to enter the Donut Hole, but too low to exit into Catastrophic Coverage, then you can consider using a drug discount program for drug purchases made in the Donut Hole, assuming that the drug discount card or coupon provides more saving than the Donut Hole discount (a discount of 75% of retail for all formulary drugs).

- Ask about the pharmacy's everyday retail drug pricing.

As an alternative to a drug discount program or coupon, you can seek out retail pharmacies with "everyday" or "usual and customary" low retail drug prices. Purchases from retailers with everyday low drug prices are not considered a one-time discount or a discount program, so your Medicare Part D coverage can be used together with the pharmacy's every-day low drug price. You can click here to learn more about network pharmacies with lower, everyday retail prices.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service