Do you provide a system where we can enter a list of drugs, save them, and then compare the annual costs for each Medicare Part D plan?

No. We designed our Q1Medicare drug search tools for people who wish to quickly check the coverage of a single formulary medication across all Medicare Part D prescription drug plans (PDP) or Medicare Advantage plans that include prescription drug coverage (MAPD). Our Drug Finder is located at Q1Rx.com.

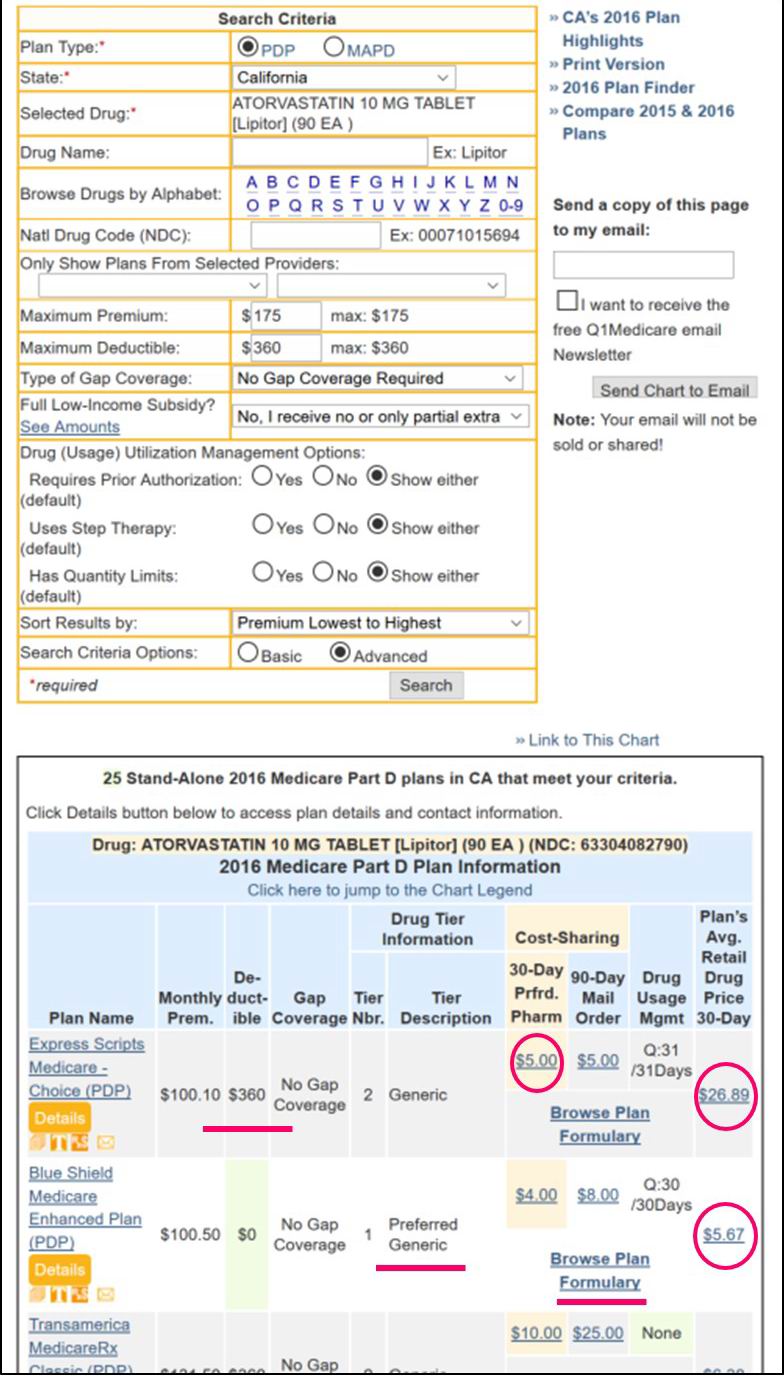

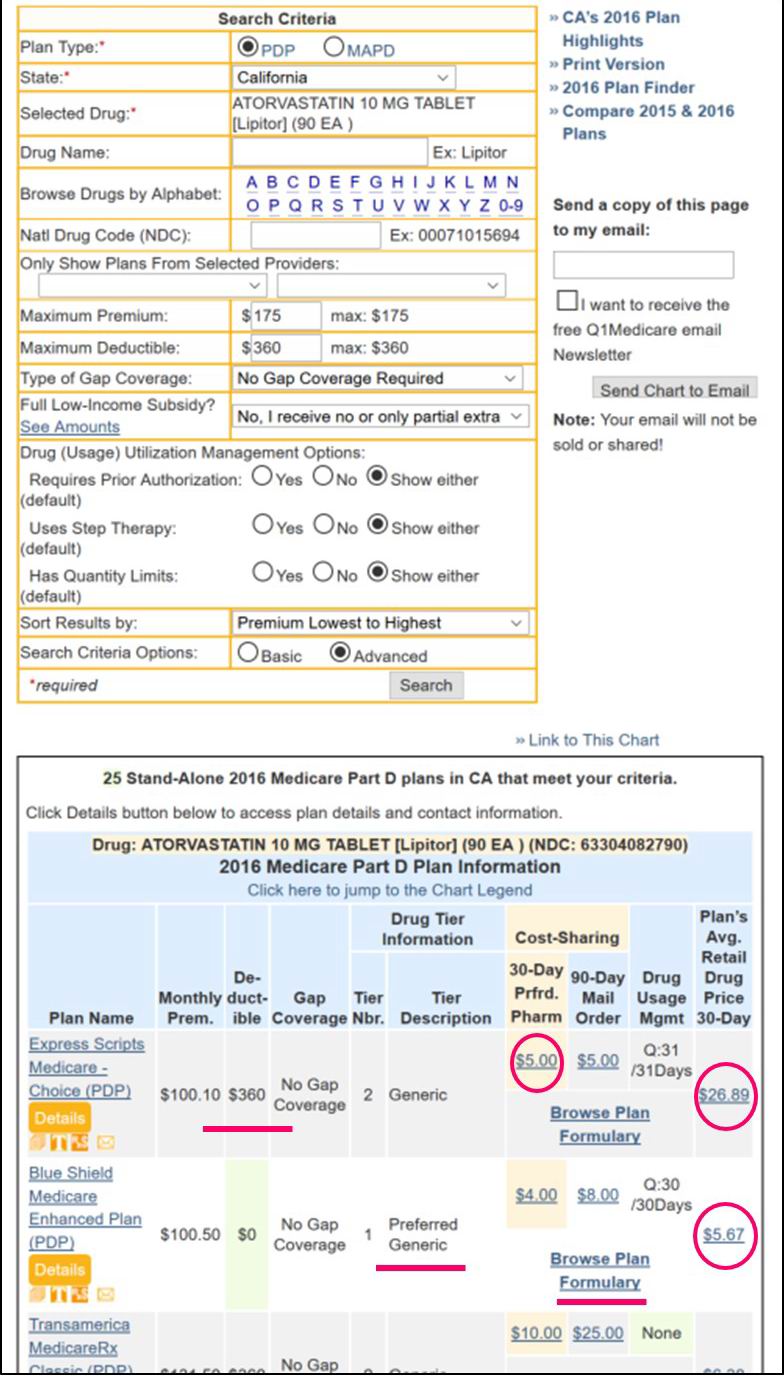

Here is a screenshot of our Drug Finder showing coverage for the drug 10 mg Atorvastatin on all 2016 California Medicare Part D plans (PDPs).

We also provide a Formulary Browser that allows people to see all the drugs covered by a specific Medicare prescription drug plan. Our Formulary Browser can be found at Formulary-Browser.com or using the "Browse Formulary" link on our Medicare Part D Plan Finder or Medicare Advantage Plan Finder.

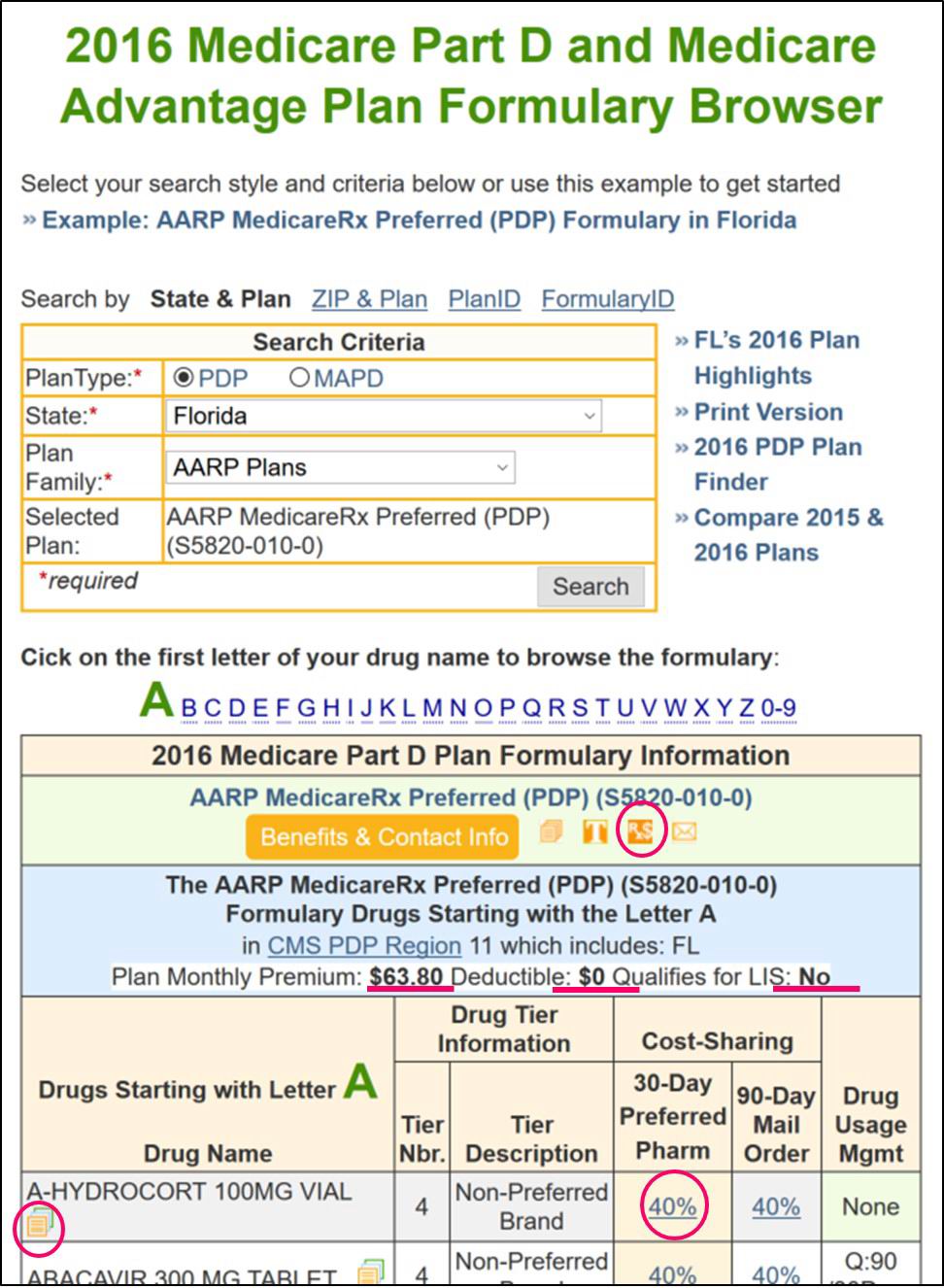

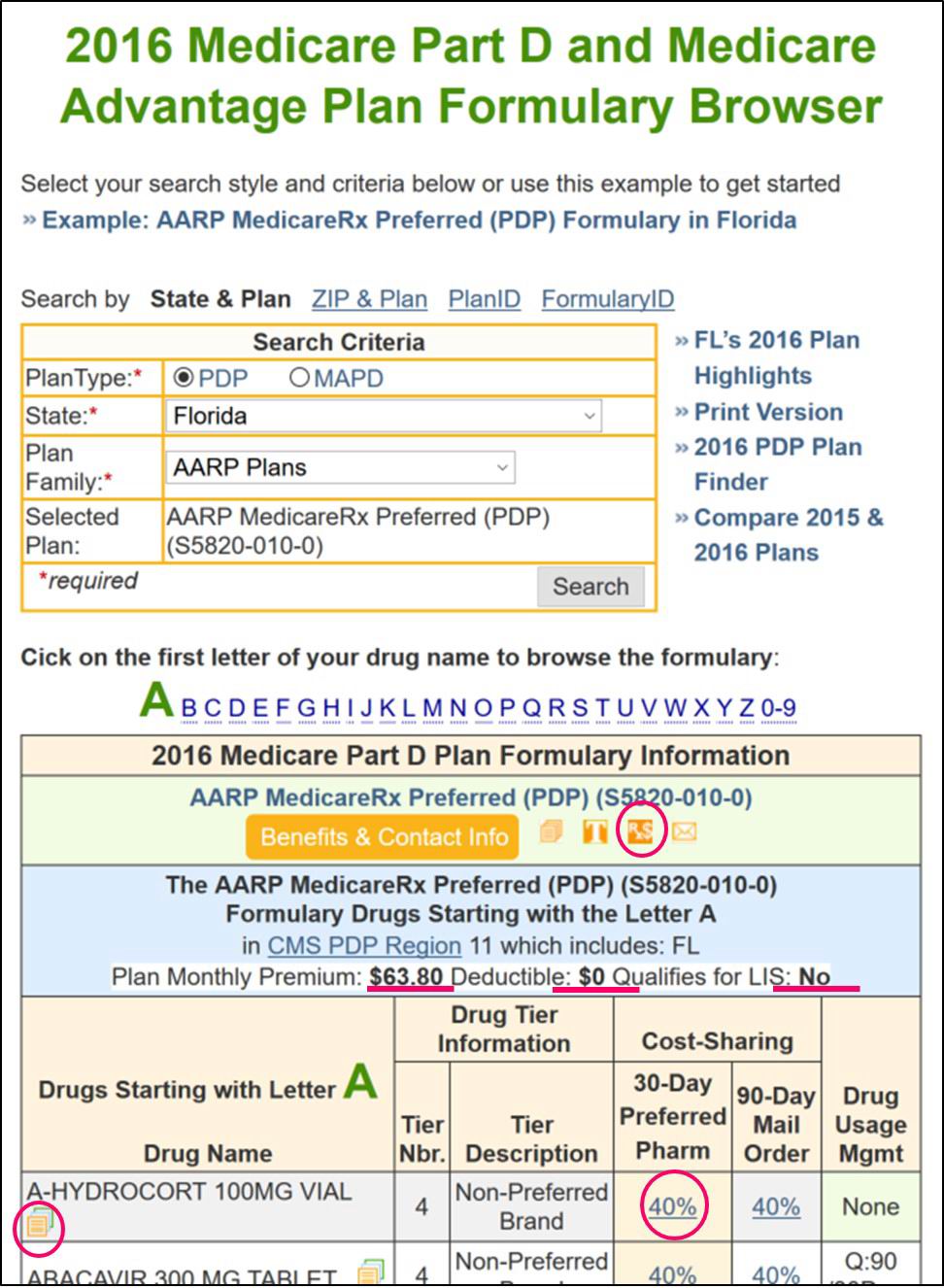

Here is a screenshot of our Formulary Browser listing all drugs covered by the 2016 Florida AARP MedicareRx Preferred Medicare Part D plan (PDP).

Here is a screenshot of our Drug Finder showing coverage for the drug 10 mg Atorvastatin on all 2016 California Medicare Part D plans (PDPs).

We also provide a Formulary Browser that allows people to see all the drugs covered by a specific Medicare prescription drug plan. Our Formulary Browser can be found at Formulary-Browser.com or using the "Browse Formulary" link on our Medicare Part D Plan Finder or Medicare Advantage Plan Finder.

Here is a screenshot of our Formulary Browser listing all drugs covered by the 2016 Florida AARP MedicareRx Preferred Medicare Part D plan (PDP).

Remember: No online tool can guarantee an accurate estimate of your annual Medicare Part D costs.

- Drug List Changes: Medicare Part D plans are allowed to

change their formularies or drug lists throughout the plan year and can

substitute generic medications for brand name drugs as the generics

become available. To clarify, Medicare Part D plans are not allowed to

drop a medication that you are using, but they are allowed to substitute

a generic equivalent for your brand name drug.

- Retail Price Changes: Drug prices can change throughout

the plan year and even though you are "locked in" to your plan through

December 31, your plan can raise the price of your medications. If you

have a fixed co-pay ($30 per 30 pills), you may not notice the changes

immediately. If you have cost-sharing in the form of co-insurance (25%

of retail) you may notice that your cost-sharing will increase during

the year and not resemble the drug cost estimate you had in October of

the previous year.

- Purchasing your drugs. Even the order in which you purchase your medications (or the order in which your drug claims are processed) will affect your total annual drug spending. If you purchase an expensive medication as the first drug purchase of the plan year, you may go though your entire coverage and into the Donut Hole or Coverage Gap before you can purchase other medications. You can read more in our section on Straddle Claims: q1medicare.com/faq/category/straddle-claims/121/

Using the Medicare.gov site to "estimate" annual prescription drug cost

Since drug prices and drug availability can change throughout the plan year, only Medicare (the Centers for Medicare and Medicaid Services or CMS) maintains the most current drug and pricing data. This means only Medicare can provides the most accurate estimate of your annual drug costs (and again, your estimate in October may not reflect what you actually spend in May of the next year).

To get started, you can enter and save your medication list on the www.Medicare.gov plan finder website found at https://www.medicare.gov/find-a-plan/questions/home.aspx where you are able to enter multiple medications, see generic alternatives, and view an annual cost estimate at different area pharmacies.

If you have any difficulty, we also provide an online tutorial to help you use the Medicare.gov Plan Finder:

q1medicare.com/PartD-Medicare_PartDPlanFinderTutorial.php

To make life easier, you can also speak with a Medicare representative to get information on all Medicare Part D or Medicare Advantage plan options. To contact Medicare directly please call toll-free 1-800-633-4227, select the prescription drug option, and then choose the option to speak with a Medicare representative or say "representative" several times during the automated menu options.

Once connected, please explain your situation to a Medicare representative and ask the Medicare representative to help you find a Medicare Advantage plan or a Medicare Part D prescription drug plan that most economically covers your health and medication needs - or you can ask specific questions about a particular Medicare plan.

As you review plan options, you can ask the representative to provide you with an estimated annual cost based on your health and medication needs for any particular Medicare plan.

Preferred Pharmacy Pricing

You can also make sure that the Medicare representative knows about the pharmacies you use or have available (and explains to you about the possible cost differences between preferred and non-preferred or standard network pharmacies).

Healthcare Providers

If you are enrolling into a Medicare Advantage plan, please be sure that your healthcare providers are included in the plan's network (you can contact the Medicare Advantage plan directly for more details). Remember, Medicare Advantage plans are allowed to drop providers from their network during the plan year. Please see: "Can I get a Special Enrollment Period if my Medicare Advantage plan drops my doctor from the plan's network?"

Enrolling in your chosen plan

If you have found an acceptable Medicare plan, and you are eligible for enrollment, the Medicare representative can also process your enrollment into any Medicare Part D or Medicare Advantage plan directly over the telephone - and the process only takes a few minutes (with an enrollment confirmation code provided - that you should write down and store in a safe place until your Medicare plan information arrives).

Medicare.gov provides unbiased information

Please note that a Medicare representative is not compensated for a Medicare plan enrollment and provides you with an unbiased view of all available Medicare Part D plans or Medicare Advantage plans.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service