Will I save money with a low premium $0 deductible Medicare Part D plan?

The answer depends on your medication and healthcare needs. Although many media sources still advise people to look at Medicare plans with low premiums and low deductibles, we suggest that people

enroll in the Medicare Part D prescription drug plan (PDP) or Medicare Advantage plan (MA, MAPD, or SNP) that most economically covers their prescription and healthcare needs - based on annual cost estimates (monthly premiums + covered health and drug costs including any deductible).

In the past, we have found that some people have mistakenly thought that Medicare plans with no (or a $0) initial deductible or a low monthly premium were always less expensive on an annual basis - without considering prescriptions or healthcare. But, as our examples show below, this is often not the case.

Example 1: You use no prescription medications . . .

Consider the lowest premium Medicare Part D or a $0 premium Medicare Advantage plan.

If you are using no medications, then the Medicare prescription drug plan (or Medicare Advantage plan) with the lowest premium may be your most economical solution. Although some people would prefer to enroll in the lowest premium plan that has a $0 deductible (or exclude Tier 1 and Tier 2 drugs from the deductible), just in case they do need to purchase a few prescriptions during the year. You might also consider paying a slightly higher monthly premium for a Medicare drug plan with a lower premium, $0 deductible, and a large drug list or formulary.

Example 2: You use only a few low-costing generic medications . . .

Consider a low premium Medicare drug plan (PDP or MAPD) that has Tier 1 and Tier 2 drugs excluded from the formulary.

If you use only low-cost Tier 1 or Tier 2 generic medications, and you choose a Medicare Part D plan with a low monthly premium and standard initial deductible, you may find that the plan excluded Tier 1 and Tier 2 drugs from the deductible and you have immediate coverage as if you had a plan with a $0 deductible. For example, the 2023 Wellcare Value Script plan has a standard $505 Initial Deductible, but the deductible does not apply to Tier 1 and Tier 2 generic medications. So this 2023 Medicare Part D plan has a low monthly premium, a generous formulary, and also provides coverage for Tier 1 and Tier 2 generics from the very start of the plan year.

In the past, we have found that some people have mistakenly thought that Medicare plans with no (or a $0) initial deductible or a low monthly premium were always less expensive on an annual basis - without considering prescriptions or healthcare. But, as our examples show below, this is often not the case.

Example 1: You use no prescription medications . . .

Consider the lowest premium Medicare Part D or a $0 premium Medicare Advantage plan.

If you are using no medications, then the Medicare prescription drug plan (or Medicare Advantage plan) with the lowest premium may be your most economical solution. Although some people would prefer to enroll in the lowest premium plan that has a $0 deductible (or exclude Tier 1 and Tier 2 drugs from the deductible), just in case they do need to purchase a few prescriptions during the year. You might also consider paying a slightly higher monthly premium for a Medicare drug plan with a lower premium, $0 deductible, and a large drug list or formulary.

Example 2: You use only a few low-costing generic medications . . .

Consider a low premium Medicare drug plan (PDP or MAPD) that has Tier 1 and Tier 2 drugs excluded from the formulary.

If you use only low-cost Tier 1 or Tier 2 generic medications, and you choose a Medicare Part D plan with a low monthly premium and standard initial deductible, you may find that the plan excluded Tier 1 and Tier 2 drugs from the deductible and you have immediate coverage as if you had a plan with a $0 deductible. For example, the 2023 Wellcare Value Script plan has a standard $505 Initial Deductible, but the deductible does not apply to Tier 1 and Tier 2 generic medications. So this 2023 Medicare Part D plan has a low monthly premium, a generous formulary, and also provides coverage for Tier 1 and Tier 2 generics from the very start of the plan year.

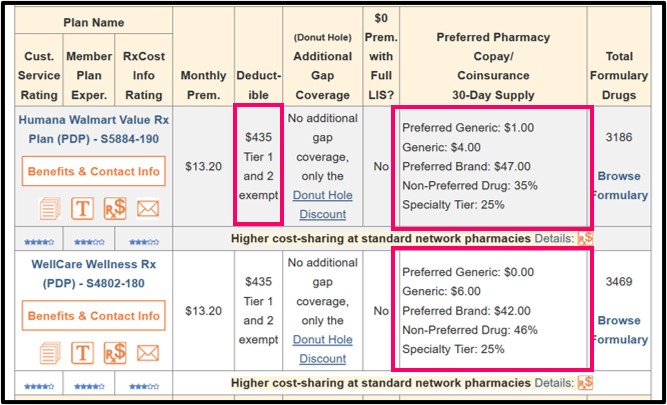

If you anticipate that your prescription needs could change during the plan year, you can also consider a Medicare drug plan with lower cost-sharing for drug tiers above Tier 1 and Tier 2. In this example from our 2020 Medicare Part D Plan Finder below, there are two plans with the same premium, the same initial deductible ($435), and both plans exclude Tier 1 and Tier 2 drugs from deductible, but the plan with the larger formulary (3,469 drugs vs. 3,186 drugs) has higher cost sharing for Tier 4. So, if you are unexpectedly prescribed a Tier 4 Non-Preferred Brand Drug, you would pay 48% of the retail drug price.

Example 3: You use very expensive brand-name medications.

If you use higher-cost brand-name medications - for example, with a retail cost of over $11,000 per month - you may, in your first month, go through your initial deductible, through the Initial Coverage Phase, through the Coverage Gap, and into Catastrophic Coverage. In such a situation, you may simply benefit from a Medicare Part D plan with the lowest premium, but most importantly, you must ensure that your medications are on the plan’s formulary or drug list. Otherwise, you will pay 100% out-of-pocket for any non-formulary drugs (as seen in the example below).

Example 4: You use a few brand-name medications.

As an example, let us look at the plan coverage for three popular brand-name drugs, Lipitor®, Plavix®, and Nexium®. In Texas, the Medicare Part D plan with the lowest monthly premium is the $18.40 Humana Walmart Rx Plan that has a $360 deductible. The lowest premium Texas Medicare Part D plan with a $0 initial deductible is the SilverScript Choice plan, having a $22.90 monthly premium. The chart below compares how these plans cover the three brand-name drugs, Lipitor®, Plavix®, and Nexium®. Notice that the Express Scripts Medicare - Choice plan with a significantly higher monthly premium ($104.30) and a $360 deductible has the lowest estimated total annual costs because it covers most of the medications that are otherwise not covered by some the lower premium drug plans.

* Total annual costs include the monthly premiums and the medication cost-sharing, including deductible. Total annual cost estimates using Medicare.gov Plan Finder on 10/25/2015 with CVS as pharmacy.

** Low value is cost-sharing at preferred network pharmacies and high value is cost-sharing at regular network pharmacies.

Example 5: You use generic equivalents for your brand-name medications.

As we continue our example, we switch to the generic form of Lipitor®, Plavix®, and Nexium®. As you might guess, our most economical Medicare plan choice changes.

Using Texas in our example, the Blue Cross MedicareRx Value is the most economical stand-alone prescription drug plan for this basket of medications, even though this plan has a $360 deductible. AARP MedicareRx Preferred (PDP) is the most economical plan with a $0 deductible. The chart below compares the annual costs for the lowest premium Texas plan, the lowest premium $0 deductible Texas plan and the plan with the lowest annual costs for this basket of medications.

* Total annual costs include the monthly premiums and the medication cost-sharing, including deductible. Total annual cost estimates using Medicare.gov Plan Finder on 10/25/2015 with CVS as pharmacy.

** Low value is cost-sharing at preferred network pharmacies and high value is cost-sharing at regular network pharmacies.

Bottom Line: Be sure to look at your total annual medication costs and consider monthly premiums, drug coverage, drug cost-sharing, and initial deductibles. And when in doubt, telephone a Medicare representative at 1-800-633-4227 and ask for assistance.

As an example, let us look at the plan coverage for three popular brand-name drugs, Lipitor®, Plavix®, and Nexium®. In Texas, the Medicare Part D plan with the lowest monthly premium is the $18.40 Humana Walmart Rx Plan that has a $360 deductible. The lowest premium Texas Medicare Part D plan with a $0 initial deductible is the SilverScript Choice plan, having a $22.90 monthly premium. The chart below compares how these plans cover the three brand-name drugs, Lipitor®, Plavix®, and Nexium®. Notice that the Express Scripts Medicare - Choice plan with a significantly higher monthly premium ($104.30) and a $360 deductible has the lowest estimated total annual costs because it covers most of the medications that are otherwise not covered by some the lower premium drug plans.

| Medicare Part D Plan Name | Monthly Premium | Initial Deductible | Total Annual Cost* | Number of Drugs on Formulary | Cost-Sharing 30 Day Supply | ||

| Lipitor® | Plavix® | Nexium® | |||||

| Humana Walmart Rx Plan | $18.40 | $360 Tiers 1&2 excluded |

$9,064 | 3,271 | Not on Formulary ($224) | Not on Formulary ($223) | Not on Formulary ($290) |

| SilverScript Choice | $22.90 | $0 | $6,183 | 2,971 | Not on Formulary ($223) | Not on Formulary ($223) | $46 |

| Express Scripts Medicare - Choice | $104.30 | $360 Tiers 1&2 excluded |

$6,149 | 3,453 | Not on Formulary ($224) | $81-$85** (41%-43% co-ins) | $42-$47** |

* Total annual costs include the monthly premiums and the medication cost-sharing, including deductible. Total annual cost estimates using Medicare.gov Plan Finder on 10/25/2015 with CVS as pharmacy.

** Low value is cost-sharing at preferred network pharmacies and high value is cost-sharing at regular network pharmacies.

Example 5: You use generic equivalents for your brand-name medications.

As we continue our example, we switch to the generic form of Lipitor®, Plavix®, and Nexium®. As you might guess, our most economical Medicare plan choice changes.

Using Texas in our example, the Blue Cross MedicareRx Value is the most economical stand-alone prescription drug plan for this basket of medications, even though this plan has a $360 deductible. AARP MedicareRx Preferred (PDP) is the most economical plan with a $0 deductible. The chart below compares the annual costs for the lowest premium Texas plan, the lowest premium $0 deductible Texas plan and the plan with the lowest annual costs for this basket of medications.

| Medicare Part D Plan Name | Monthly Premium | Initial Deductible | Total Annual Cost* | Number of Drugs on Formulary | Cost-Sharing 30 Day Supply | ||

| Atorvastatin Calcium | Clopidogrel | Esomeprazole Magnesium |

|||||

| Humana Walmart Rx Plan | $18.40 | $360 Tiers 1&2 excluded |

$3,426 | 3,271 | $4-$6.80** | $4-$6.50** | Not on Formulary ($254) |

| SilverScript Choice | $22.90 | $0 | $3,385 | 2,971 | $3.00 | $3.00 | Not on Formulary ($253) |

| Blue Cross MedicareRx Value | $63.20 | $360 Tiers 1&2 excluded |

$933 | 3,108 | $0-$5** | $4.54 | $0-$15** |

* Total annual costs include the monthly premiums and the medication cost-sharing, including deductible. Total annual cost estimates using Medicare.gov Plan Finder on 10/25/2015 with CVS as pharmacy.

** Low value is cost-sharing at preferred network pharmacies and high value is cost-sharing at regular network pharmacies.

Bottom Line: Be sure to look at your total annual medication costs and consider monthly premiums, drug coverage, drug cost-sharing, and initial deductibles. And when in doubt, telephone a Medicare representative at 1-800-633-4227 and ask for assistance.

Browse FAQ Categories

Find Prescription Discounts

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service