How do increases in retail drug prices affect my Medicare Part D drug plan coverage?

The retail prices of your formulary drugs determine how fast you move through your Part D coverage and what you may pay for covered drugs as you move through the different phases of your coverage.

In short, higher retail drug prices mean you may pay more for your drug coverage and move faster through the phases of your Medicare drug coverage.

And yes, retail prices for your formulary drugs can change throughout the plan year (usually increasing) - and can vary pharmacy-to-pharmacy.

And the bad news: As retail prices increase for your drugs, your Part D coverage and out-of-pocket costs can change from what you predicted when you chose your Medicare Part D drug plan last November or December - meaning, with mid-year drug price increases, you may no longer be enrolled in the most economical Medicare prescription drug plan.

More about Retail Drug Prices:

In short, higher retail drug prices mean you may pay more for your drug coverage and move faster through the phases of your Medicare drug coverage.

And yes, retail prices for your formulary drugs can change throughout the plan year (usually increasing) - and can vary pharmacy-to-pharmacy.

And the bad news: As retail prices increase for your drugs, your Part D coverage and out-of-pocket costs can change from what you predicted when you chose your Medicare Part D drug plan last November or December - meaning, with mid-year drug price increases, you may no longer be enrolled in the most economical Medicare prescription drug plan.

More about Retail Drug Prices:

- Retail drug prices determine how much time you spend in the Initial Deductible.

If your Medicare prescription drug plan has an initial deductible, retail drug prices will affect how long you stay in the deductible.

- Retail drug prices determine how much time you spend in the Initial Coverage Phase before reaching the Coverage Gap.

Your Medicare Part D plan provides initial drug coverage until you reach your plan's Initial Coverage Limit (ICL) and your plan's negotiated retail cost for your medication is used to determined when you reach your ICL. For example, if you purchase a medication with a retail cost of $500 and you have a copay of $60, the $500 retail value is counted toward meeting your Initial Coverage Limit.

When you exceed your plan's Initial Coverage Limit, you enter the Coverage Gap or Donut Hole - and pay 75% of the plan's retail drug price (as noted below).

- Retail drug costs can determine what you pay in the Initial Coverage phase.

If your Medicare prescription drug plan uses coinsurance cost-sharing, you will pay a percentage of the retail drug cost for your formulary drug.

For example, if you pay a 25% coinsurance for a medication that has a negotiated retail drug price of $100, your cost-sharing is $25 - and the $100 retail cost is counted toward the Initial Coverage Limit. If the retail drug price increases to $200 during the plan year, you will pay $50 for the same medication - even though the coverage cost was $25 for the same drug back when you enrolled in the plan.

- Retail drug costs determine what you pay in the Donut Hole.

Once you exceed your Initial Coverage Limit, you move into your plan's Donut Hole or Coverage Gap where you will receive the 75% Donut Hole discount for all formulary drugs. In other words, you pay 25% of the retail drug price for your formulary prescriptions.

- Retail drug costs determine what you pay in the Catastrophic Coverage phase.

If you have high drug costs and exit the Coverage Gap, you will enter the Catastrophic Coverage phase. Your cost-sharing while in the Catastrophic Coverage phase (after leaving the Donut Hole) can vary depending on the retail price of your drugs.

For example, in 2023, you pay the greater of $4.15 or 5% of your plan’s negotiated retail drug price for generics or the higher of $10.35 or 5% of the retail cost of your brand-name drugs.

Keep in mind that 2023 is the last year that Medicare Part D beneficiaries will pay cost-sharing in the Catastrophic Coverage phase. For plan year 2024, the Inflation Reduction Act (IRA) of 2022 eliminates beneficiary cost-sharing in the Catastrophic Coverage phase.

Getting an idea of your plan's retail drug prices.

To give you an overview of pricing, we show the average negotiated retail drug price in the far right column of our Q1Rx Drug Finder comparison chart. Again, these average negotiated retail drug prices can vary pharmacy-to-pharmacy (so CVS retail prices may not be the same as prices at WalMart or Walgreens) and prices can change week-to-week. Also, please note that the average negotiated retail drug price can vary state-to-state as you travel with your Medicare Part D plan.

Here is an example of our Q1Rx.com Drug Finder showing how the retail price of a popular generic medication can vary between Medicare Part D plans (the estimated cost using a Drug Discount Card is shown at the top of the Q1Rx table).

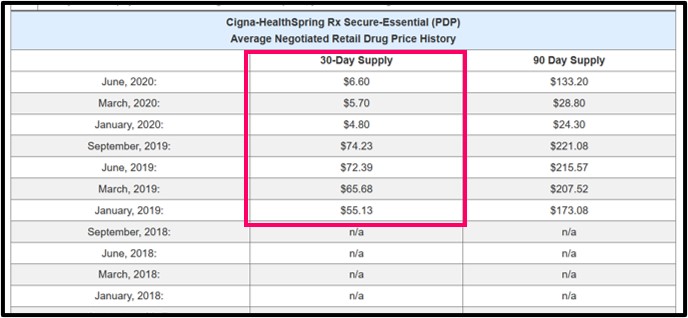

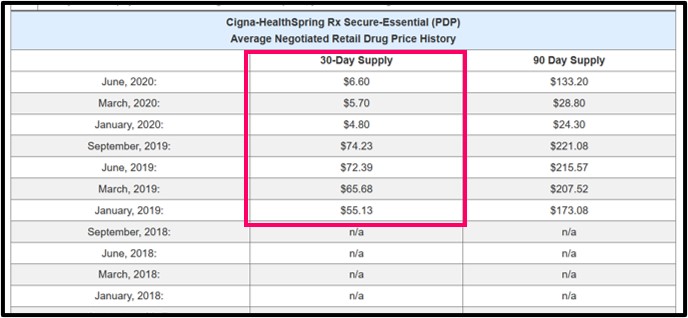

Seeing how retail drug prices can change over time.

To see how a retail price can change with a certain Medicare Part D plan, you can click on the average negotiated retail drug price (in this example, $6.60) to view the pricing history for a particular plan and drug. The same average retail drug pricing information is also available when using our Formulary

Browser and clicking on the 30-day supply or 90-day supply cost-sharing figures.

See the 2024 Rosuvastatin data.

See the 2024 Rosuvastatin data.

Browse FAQ Categories

Ask a Pharmacist*

Have questions about your medication?

» Answers to Your Medication Questions, Free!

Available Monday - Friday

8am to 5pm MST

8am to 5pm MST

*A free service included with your no cost drug discount card.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service