In theory, you should pay less for your prescription drugs when you use the coverage provided by your Medicare Part D plan.

The Medicare Part D program is voluntary and the federal government provides approval and oversight to the Medicare Part D plans through the Centers for Medicare and Medicaid Services (CMS).

Question: How do I actually get Medicare drug coverage?

Your prescription drug coverage can be provided in different ways:

(1) A "stand-alone" Medicare Part D prescription drug plan (PDP) - a Medicare PDP only provides drug coverage and no other health care coverage. You may want to enroll in a PDP if you just use original Medicare Part A and Medicare Part B coverage or are enrolled in a Medicare Supplement (Medigap plan).

(2) A Medicare Advantage plan that includes prescription coverage (MAPD) - a Medicare Advantage plan will include Medicare Part A (in-patient and hospital coverage), Medicare Part B (out-patient and physician coverage), Medicare Part D prescription drug coverage, and often some supplemental benefits such as wellness programs, dental, or optical - all for one monthly premium.

(3) Employer, Union, VA drug coverage. You can also receive drug coverage from other sources such as your employer health plan or union health benefits or the VA. The key is to ensure that any Employer Health Plan provides "creditable" prescription drug coverage so that you avoid any Late-Enrollment Premium Penalties. Late-Enrollment Penalties are assessed when you eligible for Medicare Part D coverage, but are without some form of creditable drug coverage for more than 63 days.

(4) No drug coverage. You don't have any drug coverage because you do not need prescriptions - or you purchase drugs from a discount pharmacy - or use a mail order service - or use a Drug Discount card - see the next section below for more information about possible permanent late-enrollment penalties for not choosing to enroll into a Medicare Part D plan when you are initially eligible.

Question: When can I join a Medicare Part D plan?

You will have an initial opportunity to join a Medicare drug plan and then you can change your drug plan using annual or special enrollment periods:

(1) Initial Enrollment Period (IEP) - If you are new to Medicare, you have an Initial Enrollment Period that is a seven (7) month window beginning three (3) months before your month of eligibility, plus the month of eligibility, and ends three (3) months after your month of eligibility. If you enroll in the three months prior to your month of Medicare eligibility, your effective date is the 1st day of your month of eligibility.

So if you turn 65 (or become Medicare eligible) in April, your IEP begins January and continues through July (January, February, March April, May, June, and July).

If you enroll into a Medicare Part D plan during your month of eligibility (such as when you turn 65) or during the three months following the month of Medicare eligibility, your Medicare Part D plan will be effective on the 1st day of the month following receipt of your enrollment.

(2) Annual Medicare Open Enrollment Period (AEP) - If you are already eligible for Medicare (such as over 65), you can change Medicare plans during the annual Medicare Open Enrollment Period . The AEP starts each year on October 15th and continues through December 7th with your Medicare Part D plan becoming effective on January 1st of the new plan year.

(3) Special Enrollment Periods (SEP) - If you are outside of your IEP or AEP, then you may be able to use a Special Enrollment Period for an extraordinary reason to change plans outside of the scheduled enrollment periods (for example, you move outside of your plan's service area or you enter a long-term care facility). If you are entitled to an SEP, your Medicare Part D plan will become effective on 1st day of the month following the receipt of your enrollment. See our Special Enrollment Period FAQ for more details and examples of SEPs.

(4) Medicare Advantage Open Enrollment Period (MA-OEP) - If you are enrolled in a Medicare Advantage plan, you will also be provided an additional enrollment period outside of your IEP or AEP. The Medicare Advantage Open Enrollment Period starts January 1st and continues through March 31st. During the MA-OEP, a person can change or drop their Medicare Advantage plan and return to Original Medicare Part A and Part B - and can add a stand-alone Medicare Part D plan for their drug coverage.

Question: How do I enroll into or change Medicare Part D plans?

There are several ways to join a Medicare drug plan, but no matter how you enroll in a Medicare Part D or Medicare Advantage plan, your cost and coverage are the same.

(1) Call a Medicare representative - If you have are ready to enroll in a new Medicare plan, and are eligible for enrollment, you can telephone 1-800-MEDICARE (1-800-633-4227) and enroll directly through a Medicare representative. The Medicare representative can process your enrollment into any Medicare Part D or Medicare Advantage plan directly over the telephone and enrollment only takes a few minutes. Once the enrollment is completed, the Medicare representative will provide you with a enrollment confirmation which you should record and keep in a safe place - just in case you need to refer to the enrollment process.

(2) Enroll through a local insurance agent who represents your desired Medicare Part D plan or Medicare Advantage plan.

A local insurance agent is specifically trained to represent certain Medicare plans and should be able to provide answers to many of your coverage questions, provide you with printed plan materials, and help you complete the enrollment application.

(3) Enroll with a local volunteer or Senior advocate or Medicare counselor.

You usually can find a number of local volunteers, such as SHIP volunteers or volunteers at local churches or Senior Center volunteers who can help you evaluate your Medicare Part D and Medicare Advantage plan options. Most volunteers receive special training that can provide you with an unbiased perspective of all available plans and the volunteers usually work with the Medicare.gov Plan Finder to complete the enrollment process.

(4) Enroll over the telephone with an insurance agent who represents multiple Medicare Part D plans or Medicare Advantage plans.

A number of large insurance agencies or brokers provide call centers for telephone enrollment. These call centers use licensed and certified insurance agent that may represent multiple Medicare plans in your area and can provide you with personal enrollment service over the telephone.

(5) Enroll online through Medicare.gov site or a Medicare plan's website.

You can enroll online through the Medicare.gov Plan Finder website (https://www.medicare.gov/plan-compare) - or directly through your chosen Medicare plan's website (such as: https://www.humana.com/medicare or https://www.aetnamedicare.com/). Again, when you enroll online, you should be provided a confirmation code at the end of the enrollment process - record this confirmation code (along with the date of enrollment) as proof of the successful online enrollment.

Question: So am I required to join a Medicare Part D drug plan?

No. As noted, the Medicare Part D program is voluntary and you are not required to join a drug plan or even use your drug plan when buying drugs (we discuss this topic in more detail below). Some people don't use any medications, so they do not want a drug plan or some people decide to just purchase their prescriptions at a discount pharmacy or they may have a drug plan, but use a Drug Discount Card or some people purchase their medications outside of the United States as they travel.

However, again, if you are without some form of "creditable" drug coverage when you are eligible for a Part D drug plan and then later join a Medicare Part D plan, you probably will pay a permanent late-enrollment penalty that is assessed for each month you are without drug coverage.

Question: How does Medicare Part D drug coverage actually work?

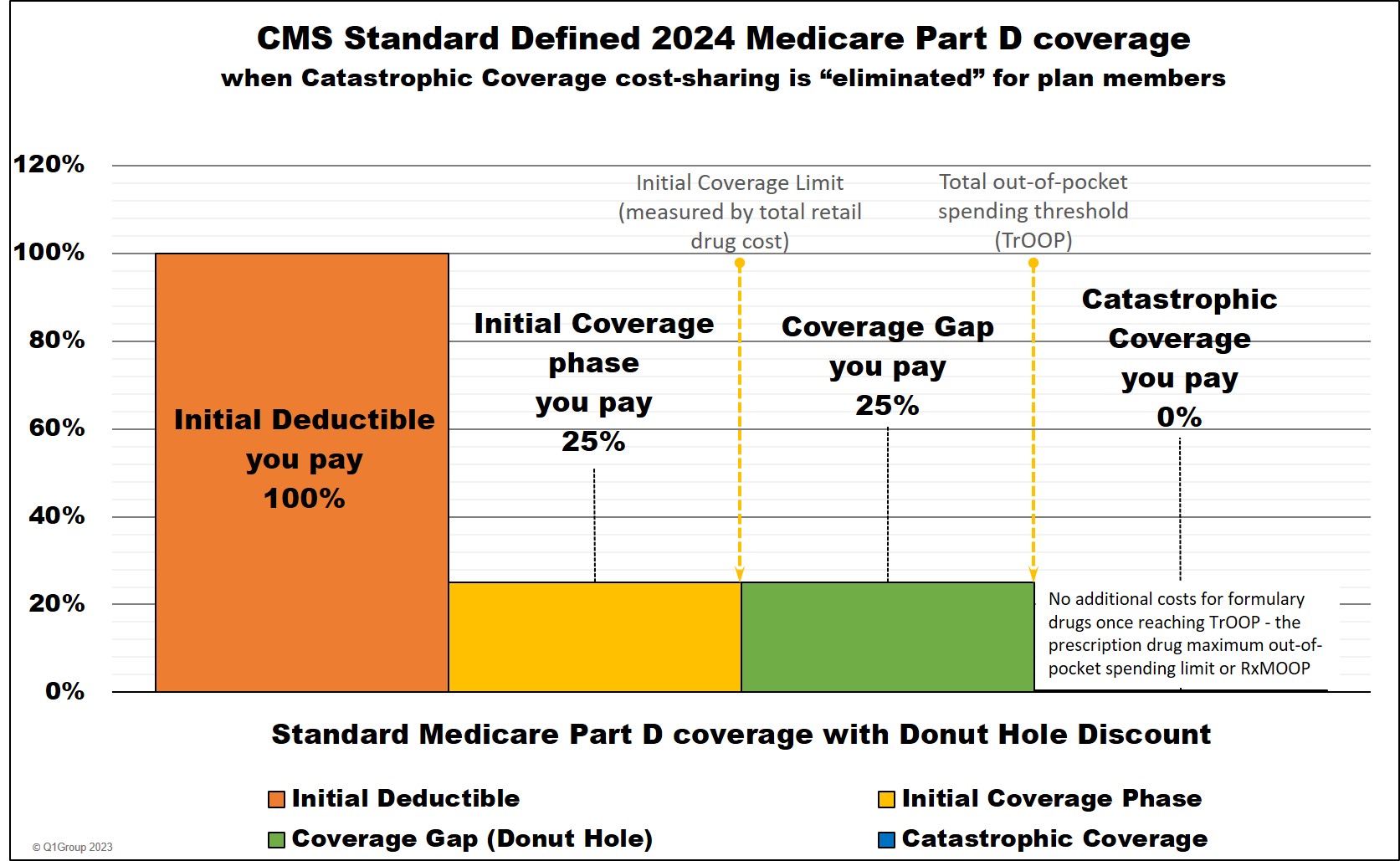

Like other types of insurance, Medicare Part D coverage is divided into different parts or phases (deductible, initial coverage, coverage gap, catastrophic coverage) - and you usually pay different cost-sharing for your drugs in each different phase.

So, if you have not yet spent your deductible, and you buy a drug that cost $100, you will pay the full $100 - and your deductible will be reduced by the $100 you spent.

Most Medicare Part D plans have a deductible, but many people enroll in a Medicare prescription drug plan (PDP or MAPD) with a $0 deductible and effectively skip-over this first part.

Also, some Medicare Part D plans will exclude less-expensive drugs (such as Tier 1 and Tier 2 generics) from the plan's initial deductible, so coverage for some drugs begins even though you have not met the initial deductible.

(2) The Initial Coverage Phase is the second part of your Part D coverage where you and your Medicare Part D plan will share in the cost of your covered medications. The cost of a drug purchase is based on your plan's cost-sharing (such as a $30 copayment for a drug or pay 25% of retail drug costs as coinsurance).

So, if you have met your deductible, and you buy a drug that cost $100 with a $30 copay, you will pay the $30.

When the retail value of your drug purchases exceeds your Initial Coverage Limit (ICL), you will leave your Initial Coverage Phase and enter the Coverage Gap or Donut Hole.

Medicare Part D coverage is only for a calendar year, starting January 1st and ending December 31st with many people spending most of the year in the Initial Coverage Phase and never entering the Donut Hole phase.

The Initial Coverage Limit is not measured by what you spend on medications. Instead, the ICL is the total retail value of your prescription drug purchases. So the ICL is the amount that you pay for your prescriptions plus what your Medicare Part D plan is paying.

For example, if you buy a drug with a $120 retail cost in 2024 - and you pay a $30 copay for the drug (your Medicare Part D plan pays the other $90), the total $120 retail cost is credited toward your 2024 Initial Coverage Limit of $5,030. In this case, after the $120 drug purchase, you have $4,910 remaining in drug purchases before entering the 2024 Donut Hole.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once you exceed the Initial Coverage Limit and where you now receive a Donut Hole Discount. Since 2020, you receive a 75% discount on formulary drugs purchased while in the Donut Hole -- you will pay 25% of your plan's negotiated retail cost for any formulary medication. You can read more about the Donut Hole Discount here: Q1News.com/1009

(4) The Catastrophic Coverage Phase is the fourth and last phase of your Medicare Part D plan coverage and you enter only once your total out-of-pocket drug costs (or TrOOP) exceed a certain point ($8,000 in 2024).

During this part of coverage, you exit the Donut Hole or Coverage Gap and you pay nothing for your formulary drug purchases for the remainder of the year.

TrOOP is what you have spent out-of-pocket for medications, but does not include your monthly premiums. Also, although you receive a 75% discount on brand-name drugs in the Donut Hole (you pay 25% of retail), you will actually get 95% of the retail price credited toward your 2024 TrOOP. So, if you purchase a brand-name drug in the Donut Hole with a retail cost of $100, you pay $25 (you get 75% discount) and you get $95 credited toward your TrOOP or Donut Hole exit point.

(Please note: this is a good thing because you will need to spend less to get out of the Donut Hole phase and enter the Catastrophic Coverage phase.)

Monthly premiums, $0 premiums, Give-Back plans: More about your monthly Medicare plan premium

If you join a Medicare Part D prescription drug plan, you will pay a monthly premium ranging from only a few dollars up to over 100 dollars. If you join a Medicare Advantage plan (MAPD), you may have a $0 premium - and, depending on the MAPD, may actually get a portion of your Medicare Part B premium rebated back to you (a "dividend" or giveback plan). Your monthly premiums may also vary depending on the benefits of your selected Medicare Part D plan or Medicare Advantage plan and your resident state.

You can see a list of all Medicare Part D plans in your state using our Medicare Part D Plan Finder (PDP-Finder.com/FL). You can see a list of all Medicare Advantage plan in your ZIP Code region using our Medicare Advantage Plan Finder (MA-Finder.com/90210).

You can learn more about the Medicare Part D plan premiums in your area by calling Medicare at 1-800-633-4227.

Getting financial assistance with prescription drug costs and Medicare Part A or Medicare Part B costs.

The Medicare Part D Extra Help program is available to help people with limited financial resources pay for their monthly premiums and drug costs. The Extra Help or Low-Income Subsidy (LIS) program is based on a Medicare beneficiary's income and assets (or financial resources). For more information, please contact your state Medicaid office. Medicare Savings Programs are also available and, depending on your finances, may help pay Medicare Part A and/or Medicare Part B premiums, and maybe some Medicare Part B costs.

Warning: Medicare Part D and Medicare Advantage plans can change each year.

Please note that Medicare Part D and Medicare Advantage plans change each year. For example, if you are eligible for Medicare in 2025, the Medicare Part D plans that you review in 2024, may not be available to you in 2025. If you find that your same Medicare plan is available next year, the plan can (and probably will) have different costs, coverage, and healthcare providers.

Bottom Line: Be prepared to review your Medicare plan options each year to ensure the most economic and complete coverage.

Medicare Part D and Medicare Advantage plans are offered in specific Service Areas, such as multiple-states, counties, ZIP code areas, or parts of a highly-populated city such as New York or Los Angeles. Our Q1Medicare.com tools are designed to provide people with an overview of all Medicare plan options in their area or region.

Choosing a Medicare Part D or Medicare Advantage plan.

There is no "right" way to choose a Medicare Part D or Medicare Advantage plan. In general, we simply advise people to choose a plan that most economically covers their current health and prescription needs. This means you will want to ensure that a Medicare Part D plan covers your prescription drugs and accepts your local pharmacy or pharmacies as part of the plan's pharmacy network (or preferred pharmacy network). You will look at monthly plan premiums, the initial deductible, coverage cost, and usage management restrictions. Sound like too much work? No problem, as noted below there is assistance available to help with your decision.

But what if I don't really need drug coverage?

Choosing a Medicare plan may be based on your risk tolerance. For instance, people who are not taking any (or only a few) medications, can find the lowest costing Medicare prescription drug plan (or Medicare Advantage plan that includes prescription coverage), check for medication coverage, and decide whether they:

(1) Simply enroll in a Medicare plan with the lowest priced monthly premium just to avoid any future late-enrollment premium penalty or

(2) Decide to pay a little more per month for a Medicare Part D plan with a $0 deductible and/or a larger formulary and/or a more familiar insurance company name - just in case their health changes during the plan year or

(3) Choose not to enroll in any Medicare Part D plan this year, save the monthly premiums, and plan to pay the late-enrollment penalty if they ever choose to join a Medicare Part D or Medicare Advantage plan in the future. (Please Note: Yes, the monthly penalties can add up and here is a chart showing how your penalty costs can increase over time: Q1FAQ.com/590).

But what if taking financial risks is not an option to you?

People with more complex medication or healthcare needs must spend more time ensuring that their specific needs are covered by a Medicare Part D or Medicare Advantage plan.

For example, if you have a particular plan in mind (such as a local Medicare Advantage HMO that is provided by the large university or hospital system in your area), then you can review all of the coverage details we have online and then telephone the plan to learn whether their healthcare providers are included in the Medicare Advantage plan's network.

Need a place to begin?

To get started, you can begin on our homepage (Q1Medicare.com) and see the box that is entitled "Review 202X Medicare Part D Plans" with a listing of state abbreviations for stand-alone Medicare Part D prescription drug plans. For example, if you live in the Commonwealth of Virginia, choose "VA", you will be taken to an overview of all Medicare Part D prescription drug plans in Virginia. Or use: PDPFinder.com/VA

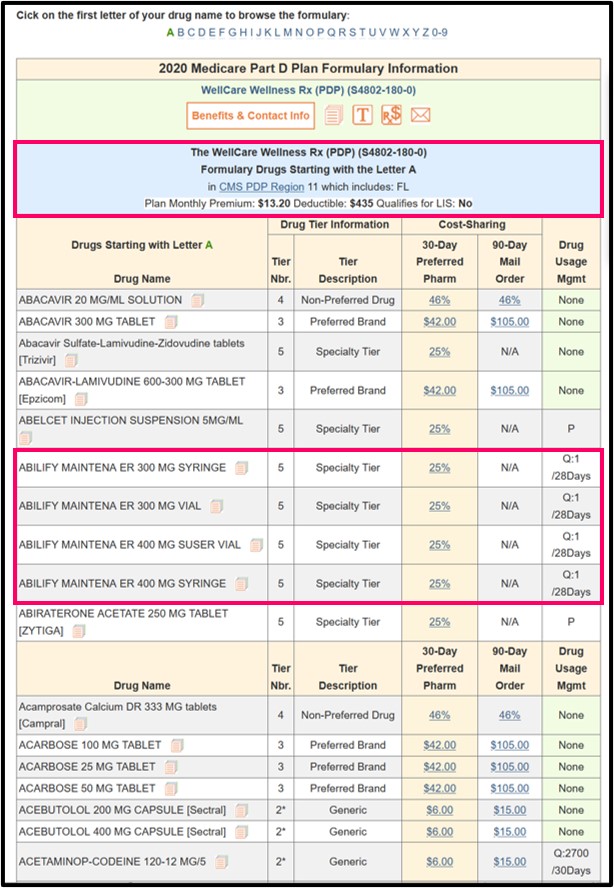

On this page, you can see the name of the Medicare Part D plans, the monthly premium, the initial deductible, and the copayment rate for the different drug tiers.

If you wish to see the medications covered by any Medicare Part D plan, you can click on the "Browse Formulary" link on the right side of the chart. You can also click on the icons under the plan names for more plan details and plan contact information.

An example of using the Formulary Browser

Here is an example link to the first page of the 2020 Humana Walmart Value Rx Plan formulary in Virginia:

q1medicare.com/formularybrowser/?stateReg=07VA &contractId=S5884&planId=186

(IMPORTANT, Be sure to make sure you are looking at formulary or Medicare plan information for the current enrollment year).

From this 2020 example link, you can see the medication names and packaging information, drug tier number, tier description, cost-sharing and usage management restrictions (if any). Using our Formulary Browser, you can always change the name of the Medicare Part D plan and state to browse other formularies.

If you are looking for a Medicare Advantage plan (with Medicare Part A, Medicare Part B, and possibly Medicare Part D coverage), you can start on the Q1Medicare homepage and choose the right-box entitled "Find a 20xx Medicare Advantage Plan". You can then enter your Zip Code or choose the state and county to see the Medicare Advantage plans available in your chosen Service Area. (Medicare Part D plans are available state-wide, Medicare Advantage plans are offered on a ZIP code or county area or partial-county area.)

As an example, here are the Medicare Advantage plans available in Fairfax County, Virginia: MAFinder.com/22033

Again, you can see the basic coverage details of all these Medicare Advantage plans in the list, along with Medicare Part D prescription drug coverage details, if included on the plan (or MAPD). The icon below the Medicare Advantage plan name that looks like a small stack of paper will show all of the coverage details for a specific Medicare Advantage plan.

If you have specific questions, you can browse our FAQ section found here: Q1FAQ.com

We also have the CMS Medicare & You Handbook online, alone with our supplemental notes and information:

q1medicare.com/ PartD-MedicareAndYouCMSGuideToMedicare.php

Need additional help?

If you feel lost or overwhelmed along the way, you can always contact Medicare directly at 1-800-633-4227, select the prescription drug option, and then choose the option to speak with a Medicare representative or say "representative" during the menu options.

Once connected, you can explain your situation to a Medicare representative and ask them to help you find a Medicare Advantage plan or Medicare Part D prescription drug plan that most economically covers your health and medication needs - or you can ask specific questions about a particular Medicare plan or the Medicare Part D program in general.

As noted above, if you find a suitable Medicare Advantage plan or Medicare Part D plan and are eligible to enroll into the plan, the Medicare representative can process your enrollment into your chosen Medicare plan directly over the telephone - and the process only takes a few minutes. A Medicare representative is not compensated for a Medicare plan enrollment and provides you with an unbiased view of all available Medicare Part D plans or Medicare Advantage plans.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service