If I qualify for Extra Help, will my monthly Medicare drug plan premium be $0?

It depends on the Part D plan you choose. If your Medicare Part D prescription

drug plan has a monthly premium below (or close to)

your state's Low-Income Subsidy (LIS) Benchmark premium,

and it does not have supplemental Part D coverage,

then your Medicare Part D plan premium will be covered and you will pay $0 per month.

Example of LIS-qualifying $0 Medicare Part D plan

If you already qualify for both Medicare and Medicaid (dual-eligible), you automatically qualify for Medicare Part D Extra Help or the Low-income Subsidy (LIS) program - and if your state has a LIS benchmark premium of $25 - and you enroll in a Medicare Part D plan with standard benefits that has a $20 premium, then your monthly premium should be $0.

Example of a Medicare Part D plan not qualifying for the LIS $0 premium

However, if your chosen Medicare Part D plan's monthly premium is over your state benchmark amount, (or has supplemental Part D coverage), you will be charged a portion of the plan's premium.

Using the same example above, if you qualify for the Medicare Part D Low-income Subsidy program - and your state has a LIS benchmark premium of $25 - and you enroll in a Medicare Part D plan with standard benefits that has a $30 premium, then your monthly premium should be $5 - since your Part D plan with standard coverage has a premium over the state's $30 benchmark.

Example of a Medicare Part D plan with enhanced features not qualifying for the LIS $0 premium

As a third possibility, if your chosen plan has supplemental Part D coverage, you will be charged the portion of the plan premium that is allocated to the supplemental drug coverage.

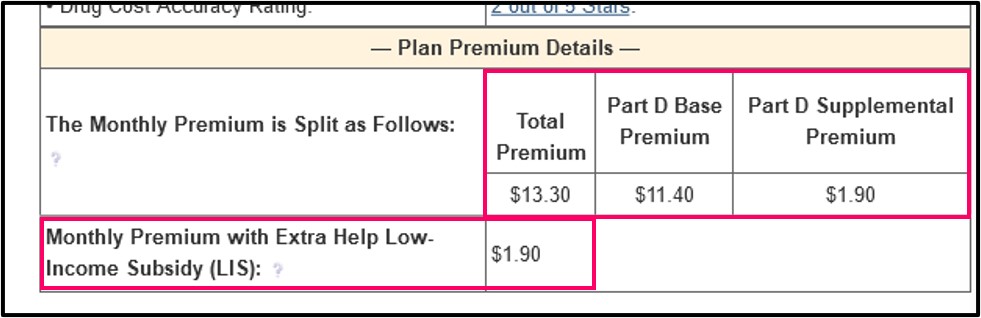

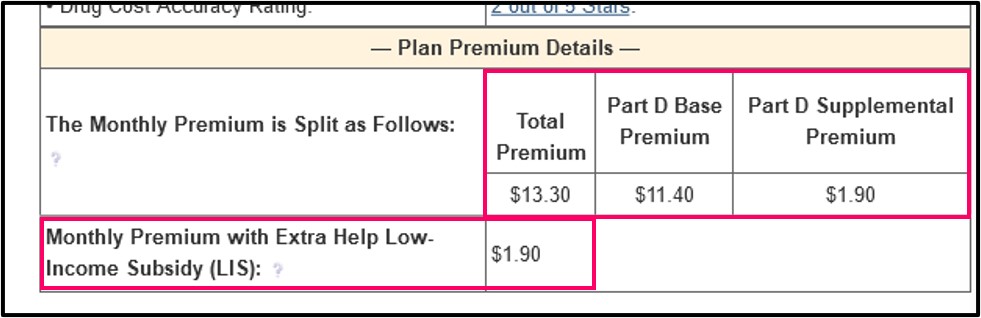

For example, the 2024 Florida SilverScript SmartSaver (PDP) plan has a monthly premium of $13.30 - and the 2024 Florida benchmark is $37.74; however, the $13.30 SilverScript monthly premium is broken into two parts: (1) $11.40 Part D base premium and (2) $1.90 Part D supplemental premium. So even if you qualify for the 2024 LIS subsidy, you would still be charged $1.90 per month, even though the $13.30 total premium is well below Florida's $37.74 benchmark premium.

Where can you see more? You can see this example in the Medicare Part D plan's Plan Premium Details section on the plan benefits page.

Question: Can a Medicare Part D plan have a negative "Base" premium?

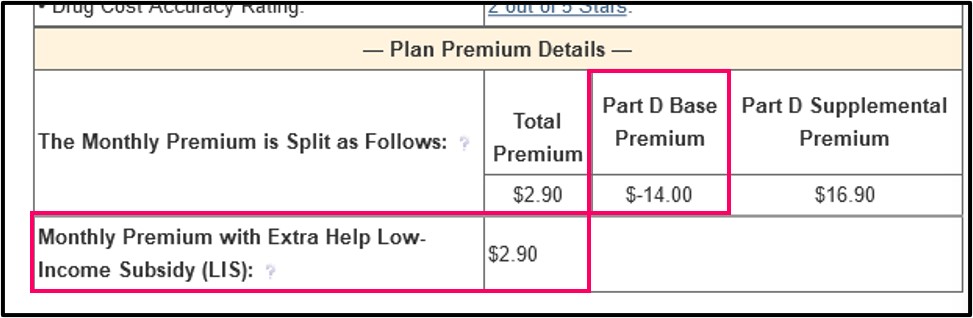

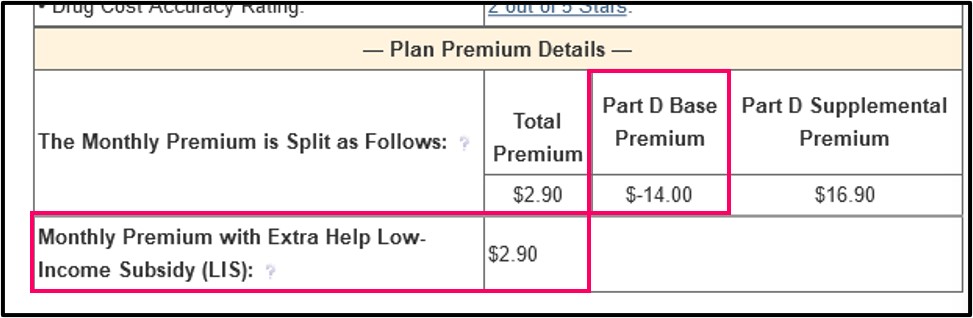

Yes. The federal government (Medicare) makes a monthly payment to each Medicare Part D plan on behalf of each plan member, and if this payment is higher than the drug plan's cost for basic Part D coverage, the plan allocates this over payment back to the plan member via a negative Part D "base" premium.

For example, the 2024 Louisiana Wellcare Value Script (PDP) has a total premium of $2.90, made up of a Part D base premium of $-14.00 and a Part D supplemental premium of $16.90. All plan members, including people receiving the LIS benefit, would have a monthly premium of $2.90. Once again, you can see these values on our plan details page by clicking the plan name or the "details" button under the plan name.

Question: Where can I see my state's LIS Benchmark Premium?

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the LIS Benchmark data for each states. You can see the current state benchmarks and how these benchmark values have changed over the past years in our article: "2024 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006".

Example of LIS-qualifying $0 Medicare Part D plan

If you already qualify for both Medicare and Medicaid (dual-eligible), you automatically qualify for Medicare Part D Extra Help or the Low-income Subsidy (LIS) program - and if your state has a LIS benchmark premium of $25 - and you enroll in a Medicare Part D plan with standard benefits that has a $20 premium, then your monthly premium should be $0.

Example of a Medicare Part D plan not qualifying for the LIS $0 premium

However, if your chosen Medicare Part D plan's monthly premium is over your state benchmark amount, (or has supplemental Part D coverage), you will be charged a portion of the plan's premium.

Using the same example above, if you qualify for the Medicare Part D Low-income Subsidy program - and your state has a LIS benchmark premium of $25 - and you enroll in a Medicare Part D plan with standard benefits that has a $30 premium, then your monthly premium should be $5 - since your Part D plan with standard coverage has a premium over the state's $30 benchmark.

Example of a Medicare Part D plan with enhanced features not qualifying for the LIS $0 premium

As a third possibility, if your chosen plan has supplemental Part D coverage, you will be charged the portion of the plan premium that is allocated to the supplemental drug coverage.

For example, the 2024 Florida SilverScript SmartSaver (PDP) plan has a monthly premium of $13.30 - and the 2024 Florida benchmark is $37.74; however, the $13.30 SilverScript monthly premium is broken into two parts: (1) $11.40 Part D base premium and (2) $1.90 Part D supplemental premium. So even if you qualify for the 2024 LIS subsidy, you would still be charged $1.90 per month, even though the $13.30 total premium is well below Florida's $37.74 benchmark premium.

Where can you see more? You can see this example in the Medicare Part D plan's Plan Premium Details section on the plan benefits page.

Question: Can a Medicare Part D plan have a negative "Base" premium?

Yes. The federal government (Medicare) makes a monthly payment to each Medicare Part D plan on behalf of each plan member, and if this payment is higher than the drug plan's cost for basic Part D coverage, the plan allocates this over payment back to the plan member via a negative Part D "base" premium.

For example, the 2024 Louisiana Wellcare Value Script (PDP) has a total premium of $2.90, made up of a Part D base premium of $-14.00 and a Part D supplemental premium of $16.90. All plan members, including people receiving the LIS benefit, would have a monthly premium of $2.90. Once again, you can see these values on our plan details page by clicking the plan name or the "details" button under the plan name.

Question: Where can I see my state's LIS Benchmark Premium?

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the LIS Benchmark data for each states. You can see the current state benchmarks and how these benchmark values have changed over the past years in our article: "2024 State Low-Income Subsidy Benchmark Premium Amounts - with a comparison of benchmark changes since 2006".

Question: Where can I see if a Medicare Part D plan qualifies for a $0 premium?

You can see whether a Medicare Part D plan has a premium meeting the state’s LIS benchmark using our Medicare Part D Plan Finder where we show all Part D plans available in each state and indicate whether the plans qualify for the $0 LIS benchmark premium.

Here is an example link to the stand-alone California Medicare Part D plans (you can choose a link to view plans in another state): PDP-Finder.com/CA

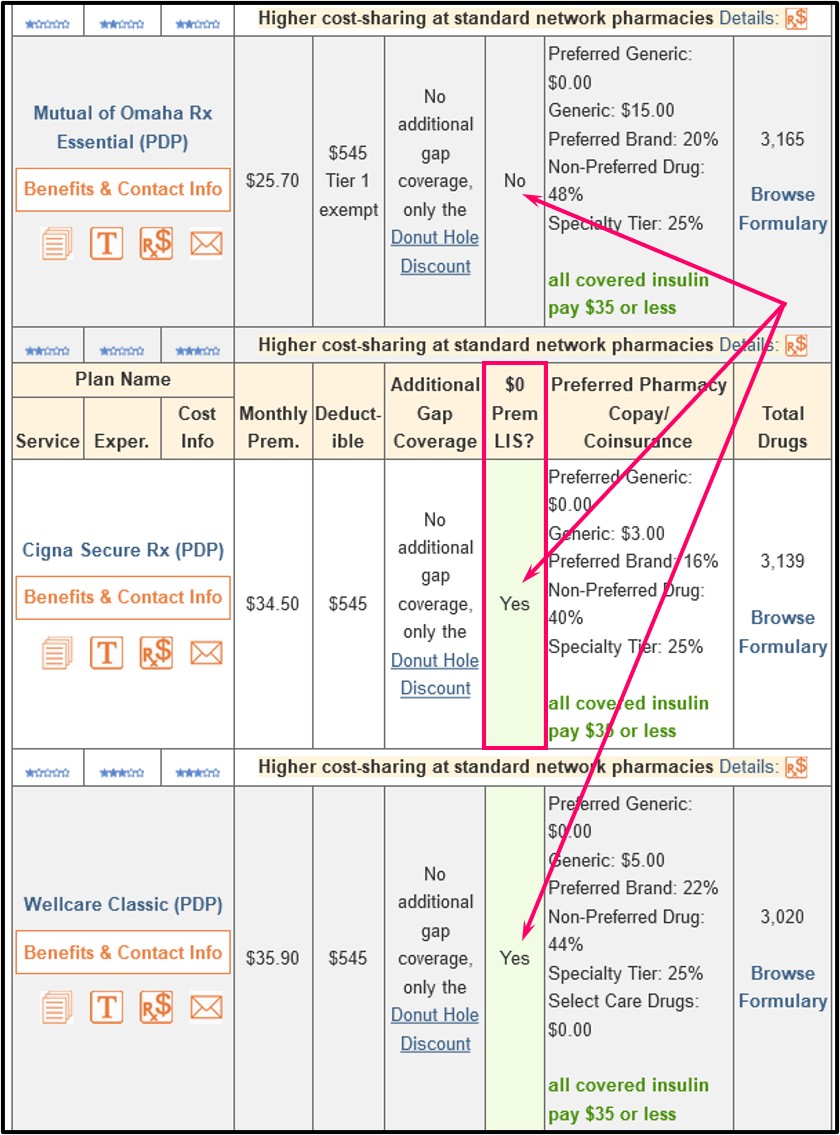

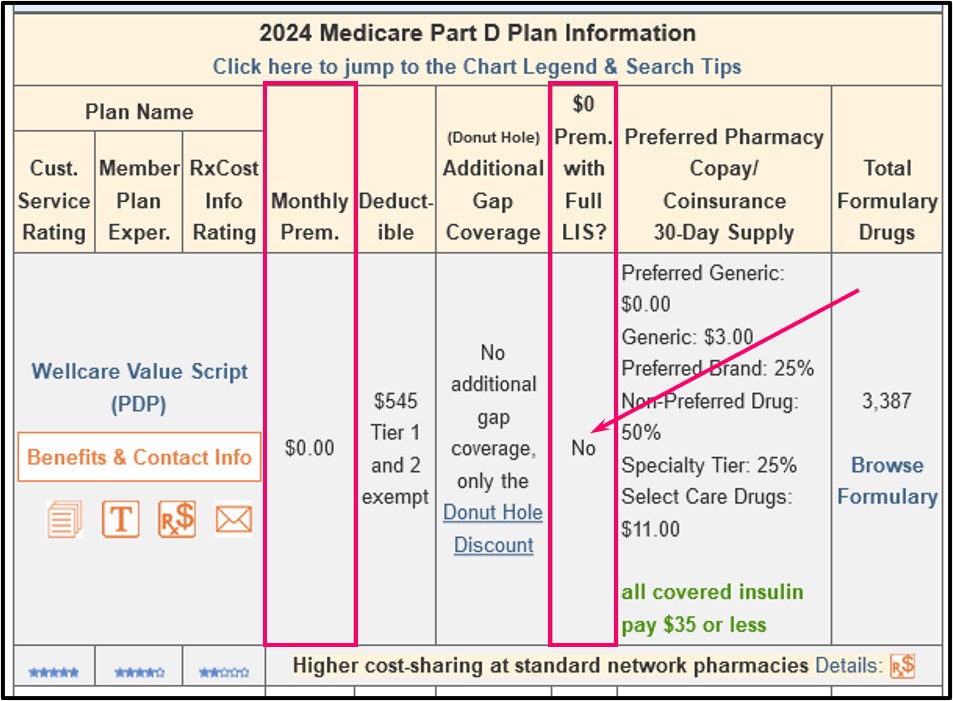

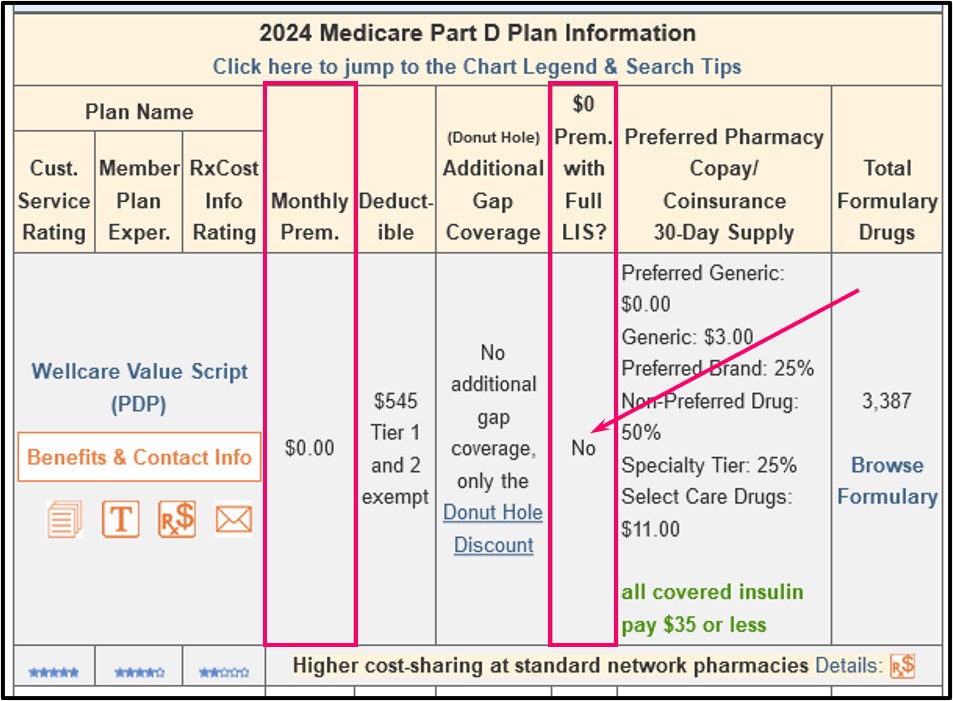

You will notice in our PDP-Finder results page that we have a column showing "$0 Prem. with Full LIS?" and plans that have a $0 premium are indicated with a "Yes" within a mint-green background.

Keep in mind that 2023 was the last year for partial-Extra Help. For plan year 2024 and beyond, the Inflation Reduction Act (IRA) of 2022 increases full-Extra Help benefits to people at or below 150% of FPL and consequently, the current partial-Extra Help (135% to 150% of FPL) designation will be eliminated.

As an example, when you scroll down through the 2024 California Part D plans, the Cigna Secure Rx (PDP) shows a $34.50 premium and "Yes" in the "$0 Prem. with Full LIS?". So anyone who qualifies for LIS in 2024 would have a $0 premium because this plan meets the Low-Income Subsidy benchmark premium for California. When you look at the LIS Benchmark page, you see that the 2024 California LIS benchmark premium is $40.98.

If a plan does not qualify for the Low-Income Subsidy $0 Premium, the "$0 Prem. with Full LIS?" column will state "No" with a grey background.

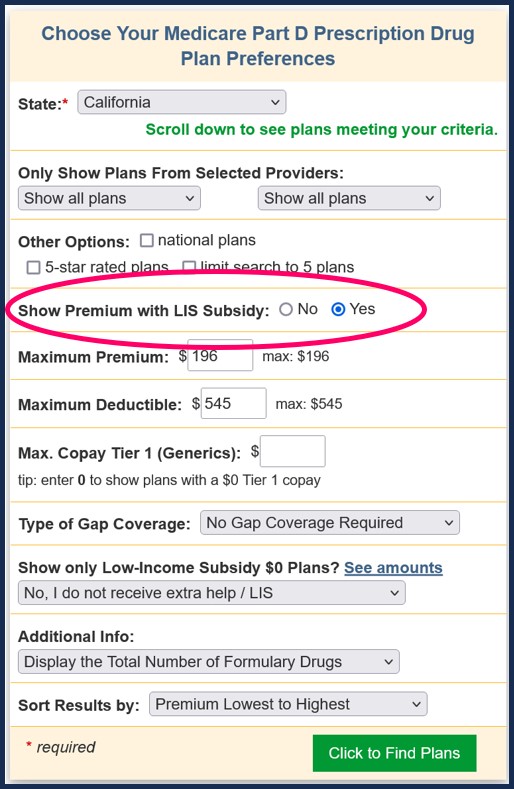

Tip: Using Q1Medicare Medicare Part D Plan Finder LIS $0 premium search filter.

If you select "Yes" for the "Show Premium with LIS Subsidy" question in the criteria box, the premiums shown for all plans will be the LIS Subsidy premium. For example, when "Yes" is checked, you will note that the SilverScript SmartSaver (PDP) shows a premium of $2.10 and the SilverScript Choice (PDP) shows a premium of $14.20.

Both of our Medicare plan finders (PDP-Finder.com/FL or MA-Finder.com) and Medicare plan comparison tools (MA-Compare.com and PDP-Compare.com) tools show if a plan qualifies for the LIS $0 monthly premium.

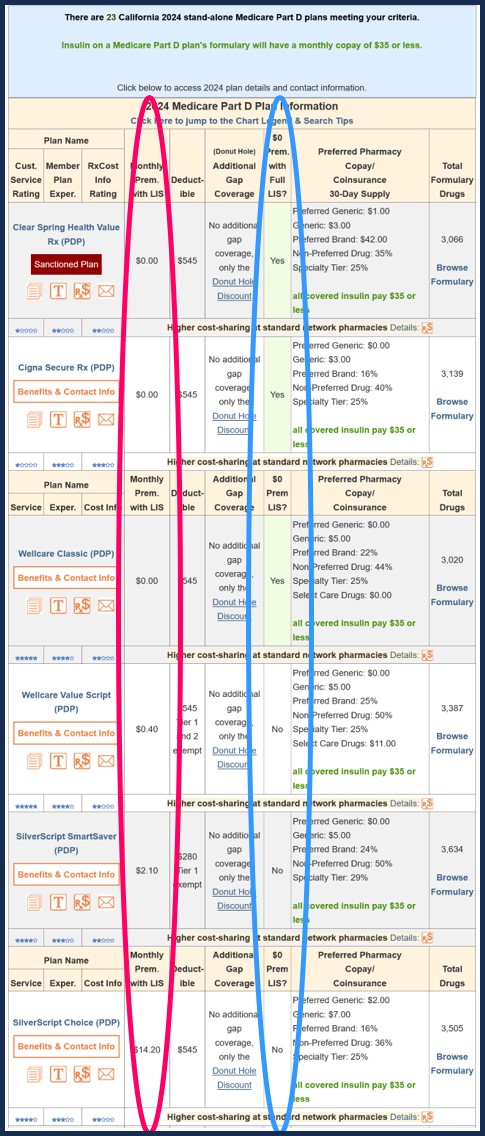

Example showing the Medicare Part D plan premiums and premiums when qualifying for LIS

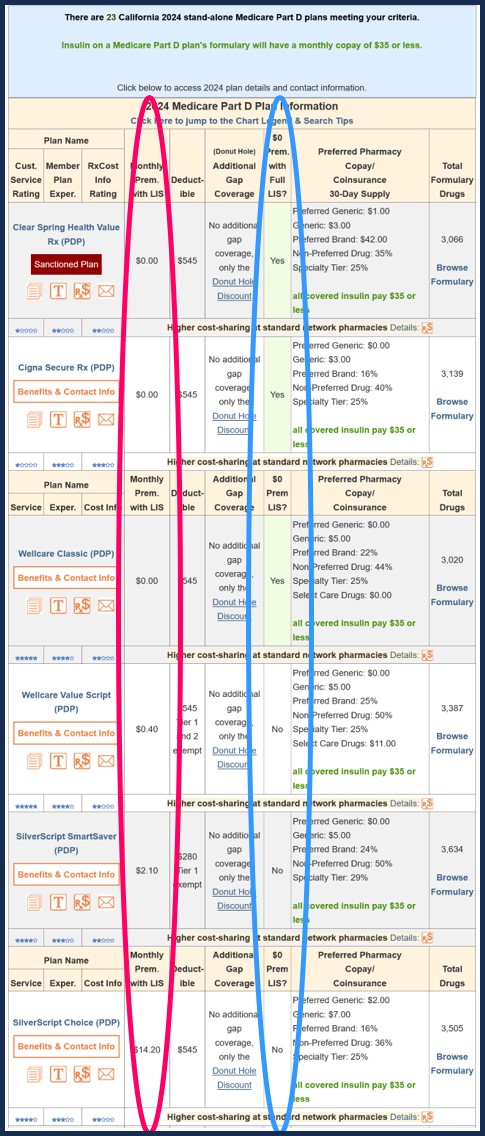

Our PDP-Finder.com 2024 California Medicare Part D plans - LIS premium search shows there are 23 plans available in California ranging in premium from $0 to $147.40. To see the 2024 LIS subsidy premium, just select "Yes" in the "Show Premium with LIS Subsidy" field in the criteria box (look for the red oval as shown in the image above).

A sampling of the results are shown below. The red oval shows the monthly LIS subsidy premium. The blue oval shows whether the plan qualifies for the full LIS $0 monthly premium. As mentioned above, 2023 was the last year for partial-Extra Help. For plan year 2024 and beyond, full-Extra Help benefits are extended to people at, or below 150% of the federal poverty level or FPL.

As you can see in the above chart, if you receive the LIS subsidy (towards the bottom of the red oval), you would be charged a premium of $2.10 per month for the 2024 California SilverScript SmartSaver plan or $14.20 for the 2024 California SilverScript Choice plan.

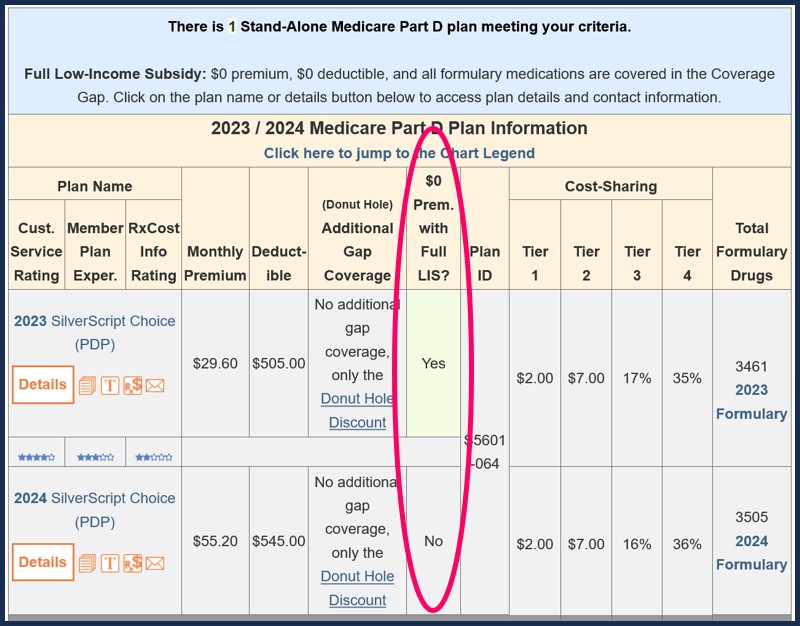

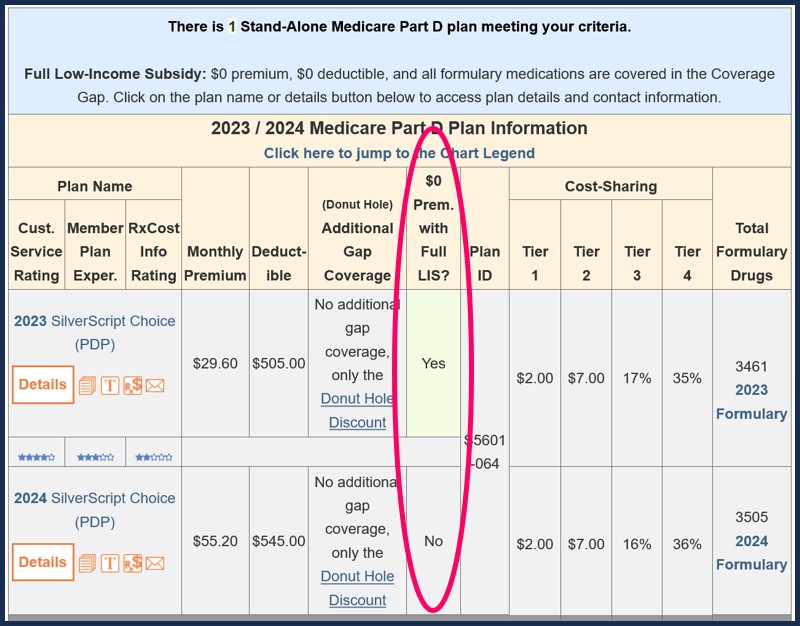

Example showing how a Medicare Part D plan can qualify for the $0 LIS premium one year, but not the next

In this example from our 2023/2024 PDP-Compare.com, you can see how a 2023 California Part D plan qualifying for the LIS $0 premium no longer qualifying for the LIS $0 premium in 2024. In this example, if you qualified for LIS in 2023 you would have a $0 premium and in 2024, if you still qualified for LIS, you would have a premium of $14.20 (see graphic above) - same plan name, but different monthly premium.

This example also reminds us that all Medicare Part D plans, even Part D plans that do not qualify for the LIS $0 premium, can offer their plans at a reduced premium for people qualifying for LIS or receiving Extra Help. In the above example, instead of paying $55.20 for a 2024 SilverScript, a person qualifying for LIS would pay $14.20 a month.

Also, a Medicare Part D plan that does not qualify for the LIS $0 premium can still have a $0 premium for all plan members, whether qualified for LIS or not. In the end, the result is the same: a $0 monthly premium.

Using the Medicare.gov Plan Finder with Extra Help

On the Medicare.gov Plan Finder, you may notice that "$0" appears under the premium column, it means that your extra help will cover the premium for that plan. If you qualify for LIS and an amount above $0 appears under the "premium" column, it means you will have to pay part of the premium because extra help won’t cover all of the plan premium. In short, you would be responsible for paying this monthly amount if you choose to enroll in the plan.

Our PDP-Finder.com 2024 California Medicare Part D plans - LIS premium search shows there are 23 plans available in California ranging in premium from $0 to $147.40. To see the 2024 LIS subsidy premium, just select "Yes" in the "Show Premium with LIS Subsidy" field in the criteria box (look for the red oval as shown in the image above).

A sampling of the results are shown below. The red oval shows the monthly LIS subsidy premium. The blue oval shows whether the plan qualifies for the full LIS $0 monthly premium. As mentioned above, 2023 was the last year for partial-Extra Help. For plan year 2024 and beyond, full-Extra Help benefits are extended to people at, or below 150% of the federal poverty level or FPL.

As you can see in the above chart, if you receive the LIS subsidy (towards the bottom of the red oval), you would be charged a premium of $2.10 per month for the 2024 California SilverScript SmartSaver plan or $14.20 for the 2024 California SilverScript Choice plan.

Example showing how a Medicare Part D plan can qualify for the $0 LIS premium one year, but not the next

In this example from our 2023/2024 PDP-Compare.com, you can see how a 2023 California Part D plan qualifying for the LIS $0 premium no longer qualifying for the LIS $0 premium in 2024. In this example, if you qualified for LIS in 2023 you would have a $0 premium and in 2024, if you still qualified for LIS, you would have a premium of $14.20 (see graphic above) - same plan name, but different monthly premium.

This example also reminds us that all Medicare Part D plans, even Part D plans that do not qualify for the LIS $0 premium, can offer their plans at a reduced premium for people qualifying for LIS or receiving Extra Help. In the above example, instead of paying $55.20 for a 2024 SilverScript, a person qualifying for LIS would pay $14.20 a month.

Also, a Medicare Part D plan that does not qualify for the LIS $0 premium can still have a $0 premium for all plan members, whether qualified for LIS or not. In the end, the result is the same: a $0 monthly premium.

Using the Medicare.gov Plan Finder with Extra Help

On the Medicare.gov Plan Finder, you may notice that "$0" appears under the premium column, it means that your extra help will cover the premium for that plan. If you qualify for LIS and an amount above $0 appears under the "premium" column, it means you will have to pay part of the premium because extra help won’t cover all of the plan premium. In short, you would be responsible for paying this monthly amount if you choose to enroll in the plan.

Browse FAQ Categories

Check for Savings Using a Drug Discount Card

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service