What exactly is TrOOP or Total Out-of-Pocket costs?

TrOOP or your total out-of-pocket cost is the total amount you will spend in a year on your formulary drugs before exiting the Coverage Gap (or Donut Hole) and entering the Catastrophic Coverage of your Medicare Part D prescription drug plan.

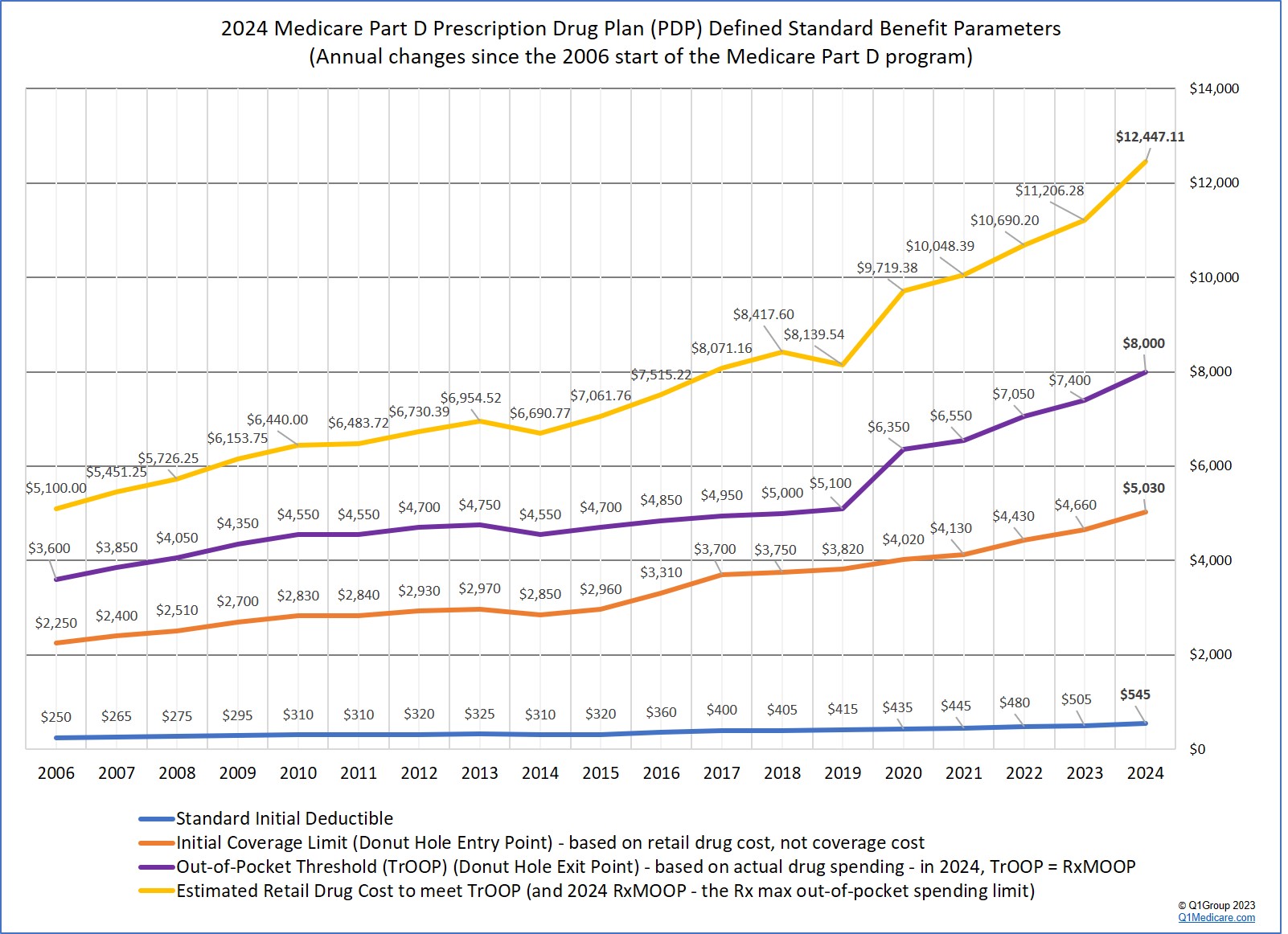

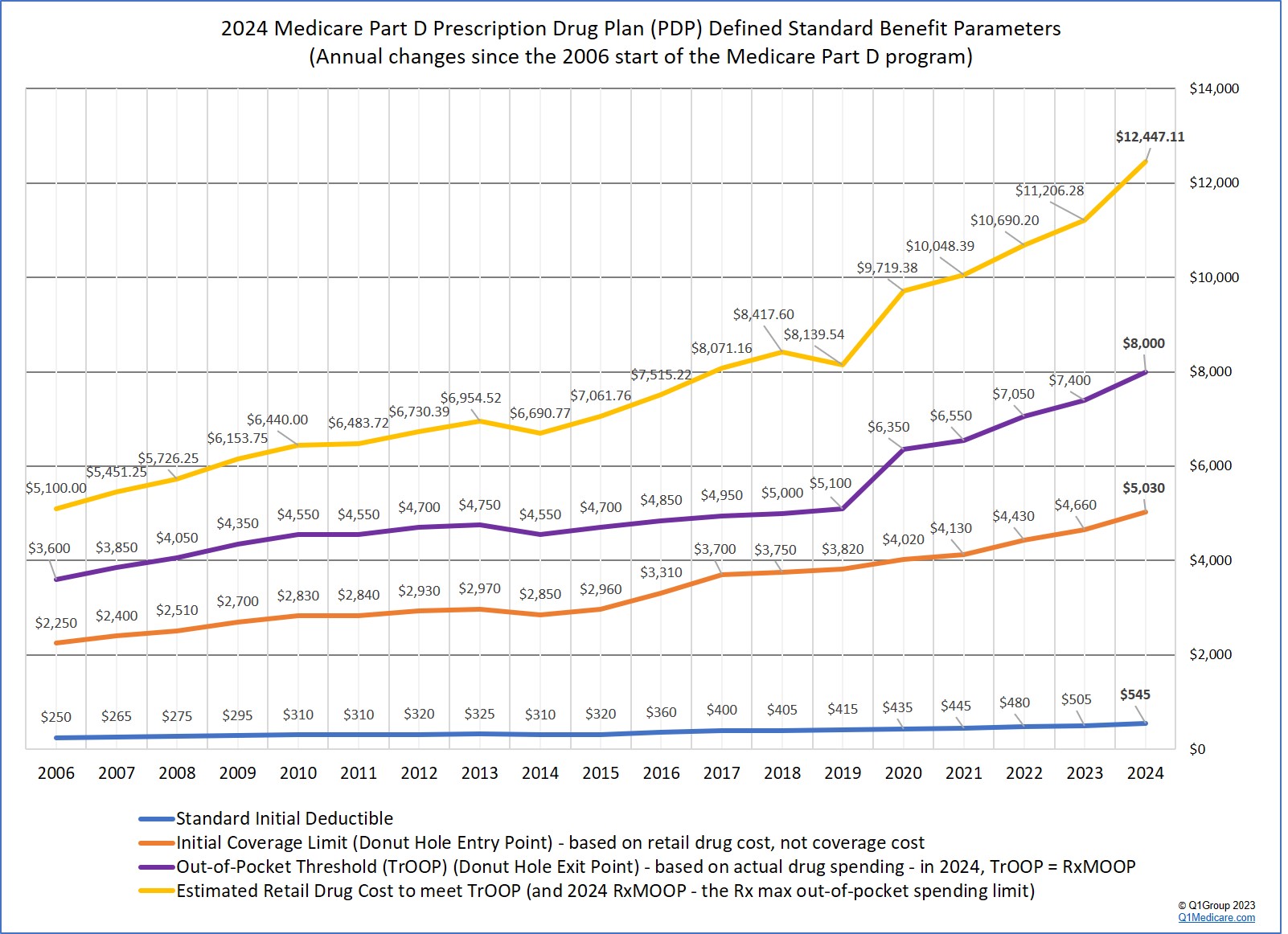

The Medicare Part D TrOOP Threshold changes each year. You can view the changes in the TrOOP Threshold over the years here:

q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php

In 2024, a Medicare Part D plan member will not have any out-of-pocket costs for formulary drug purchases after reaching the plan's total out-of-pocket threshold (TrOOP) of $8,000. Therefore, the 2024 TrOOP will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

The Medicare Part D TrOOP Threshold changes each year. You can view the changes in the TrOOP Threshold over the years here:

q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php

In 2024, the Inflation Reduction Act (IRA) of 2022 eliminates beneficiary cost-sharing in the Catastrophic Coverage phase.

In 2024, a Medicare Part D plan member will not have any out-of-pocket costs for formulary drug purchases after reaching the plan's total out-of-pocket threshold (TrOOP) of $8,000. Therefore, the 2024 TrOOP will become the prescription drug maximum out-of-pocket spending threshold (RxMOOP).

TrOOP includes, not only your actual out-of-pocket costs for formulary drugs, but also the drug costs that someone may have paid on your behalf (for example, the pharmaceutical manufacturers who cover 70% of your brand-name Donut Hole discount).

The Centers for Medicare and Medicaid Services (CMS) explains that,

"[Total or] True out-of-pocket (TrOOP) costs are the expenses that count toward a person’s Medicare drug plan out-of-pocket threshold. TrOOP costs determine when a person’s catastrophic coverage portion of their Medicare Part D prescription drug plan will begin."

To this CMS definition, we often add that TrOOP is also known as the Donut Hole exit point. In other words, TrOOP defines when you exit the Donut Hole or Coverage Gap and enter into the Catastrophic Coverage phase of your Medicare Part D prescription drug plan. See chart of TrOOP limit for each plan year.

Your drug purchases count toward TrOOP when they meet these conditions:

- Your generic or brand-name drugs are on your Medicare Part D prescription drug plan’s formulary or drug list OR

- Your prescriptions were not on your plan's formulary, but you

are allowed to count the coverage costs toward true out-of-pocket costs

because you requested a coverage determination (formulary exception) that was granted by your Medicare plan and your non-formulary drugs are now covered by your plan - AND

- Your medications were purchased at one of your Medicare plan's network pharmacies.

- Or your Medications were purchased at an out-of-network pharmacy in accordance with

the plan’s out-of-network policy (for instance, this was an emergency

fill and no network pharmacy was available and you submitted the

prescription to your Medicare Part D plan).

CMS also provides the following:

What payments count toward your TrOOP?

What payments count toward your TrOOP?

- The annual initial deductible, that is, the amount a

person pays for their Medicare Part D covered prescriptions before their

Medicare Part D drug plan begins to pay. Most Medicare Part D plans

have an initial deductible and begin with coverage after the deductible

is met. So, if your Medicare Part D plan has an initial deductible,

you pay 100% of the cost of your medications -- up to your initial

deductible limit -- and then your Medicare Part D plan begins to pay

along with your co-insurance or co-payment. What you pay during the

initial deductible phase counts toward your TrOOP.

- Your formulary drug cost-sharing, that is, the amount a

person pays for each Medicare Part D plan covered prescription drug

after their drug plan begins to pay (i.e., your co-payments or

coinsurance). So, if you have a $30 co-payment for a particular

medication that is covered by your Part D prescription drug plan, you

get TrOOP credit for the $30. If someone else, like a friend or family

member, makes the payment for you (say, $30 in this example), then this

amount is also counted toward TrOOP. So if your medication has a retail

cost of $100, and your coverage cost is $30, your Medicare plan pays

the other $70, and you get the $30 counted toward TrOOP.

- Any payments a person makes during their plan’s coverage gap.

This includes what you pay and what others pay on your behalf (for

instance, the brand-name drug manufacturer is paying 70% of your

brand-name drug cost while you are in the Donut Hole and this 70% of

retail cost is counted toward your TrOOP or Donut Hole exit point). For

example, if you purchase a formulary brand-name Medicare

Part D drug in the Coverage Gap or Donut Hole

- you will get the Donut Hole

discount of 75% (you pay 25%) and get credit for 95% of the retail

cost toward

TrOOP. Using the example from above, if your brand-name

formulary drug has a negotiated retail cost of $100, you will pay

$25 (25% of the

retail price) and $70 (or 70%) will be paid by the Pharmaceutical

Industry (the additional 5% will be paid by your Medicare Part D plan,

but does not count toward TrOOP). So, you pay

$25, but you will receive $95 (95%) credit toward your TrOOP.

- Any payments for drugs made by any of the following programs or organizations on your behalf:

- Any money a person enrolled in the Medicare drug plan uses

from their Medical Savings Account (MSA), Health Savings Account (HSA),

or Flexible Spending Account (FSA).

- Payments made by family members or friends

- "Extra-Help" from Medicare (Low-Income Subsidy LIS)

- Indian Health Services (IHS)

- AIDS Drug Assistance Programs (ASAPs)

- Most Charities (unless they’re established, run, or

controlled by the person’s current or former employer or union or by a

drug manufacturer’s Patient Assistance Program (PAP) operating outside

Part D)

- Qualified State Pharmaceutical Assistance Programs (SPAPs)

- The brand-name drug manufacturers providing discounts under the Medicare coverage gap discount program (see how the discount changed each year -- up until 2020, after which all formulary drugs receive a 75% discount and the Donut Hole is considered "closed").

- Any money a person enrolled in the Medicare drug plan uses

from their Medical Savings Account (MSA), Health Savings Account (HSA),

or Flexible Spending Account (FSA).

- The cost-sharing portion paid by a Medicare drug plan (for

example, for a $100 medication, you pay $20 and your plan pays $80, only

the $20 counts toward your TrOOP),

- Your monthly Medicare plan premiums,

- Drugs purchased outside the United States and its territories (for instance, drugs purchased in Mexico),

- Drugs not covered on the Medicare Part D plan formulary or drug list,

- Drugs covered by the plan that are excluded by Medicare law -

for instance, drugs for hair growth that are covered by your plan as a

supplemental or bonus drug do not count toward TrOOP (see Excluded Medicare Part Drugs),

- Over-the-counter drugs or vitamins (even if they are required by your Medicare Part D plan as part of Step Therapy),

- Finally, CMS notes: Payments don’t count toward a person’s

TrOOP costs if they’re made by (or reimbursed to the person enrolled in a

Medicare drug plan) by any of the following:

- Group health plans such as the Federal Employees Health Benefit Program (FEHBP) or employer or union retiree coverage

- Government-funded health programs such as Medicaid,

TRICARE, Workers’ Compensation, the Department of Veterans Affairs (VA),

Federally Qualified Health Centers (FQHCs), Rural Health Clinics

(RHCs), the Children’s Health Insurance Program (CHIP), and black lung

benefits

- Other third-party groups with a legal obligation to pay for the person’s drug costs

- Patient Assistance Programs (PAPs) operating outside the Part D benefit

- Other types of insurance

Please note: You must let your Medicare drug plan know if you are receiving coverage from one or more of the third parties listed above that pay a part of your out-of-pocket costs for prescription drugs.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service