What is Medicare Part D or Medicare Advantage plan cost-sharing?

With any type of insurance, when you need coverage or have a claim, a certain

amount of the cost is paid by your insurance company - in our case, your Medicare Part D plan (or Medicare

Advantage plan) - and the remainder of the coverage cost is paid by you - or, in

some situations, some of the coverage cost may be paid by other parties such as a benevolent group or your state or Medicare or the US

Government or a pharmaceutical manufacturer).

So, "Cost-Sharing" usually refers to the portion of your Medicare Part D plan coverage or Medicare Advantage plan coverage that you pay - such as $40 to fill a 30-day Tier 3 brand-name prescription or $20 to visit your primary care physician (PCP) or $75 to see an in-network healthcare specialist.

We may say, "if you go to see your in-network doctor, you will have $5 cost-sharing or a $5 copay" or "if you purchase a Tier 5 Specialty drug, you will pay 33% of the retail drug price as co-insurance".

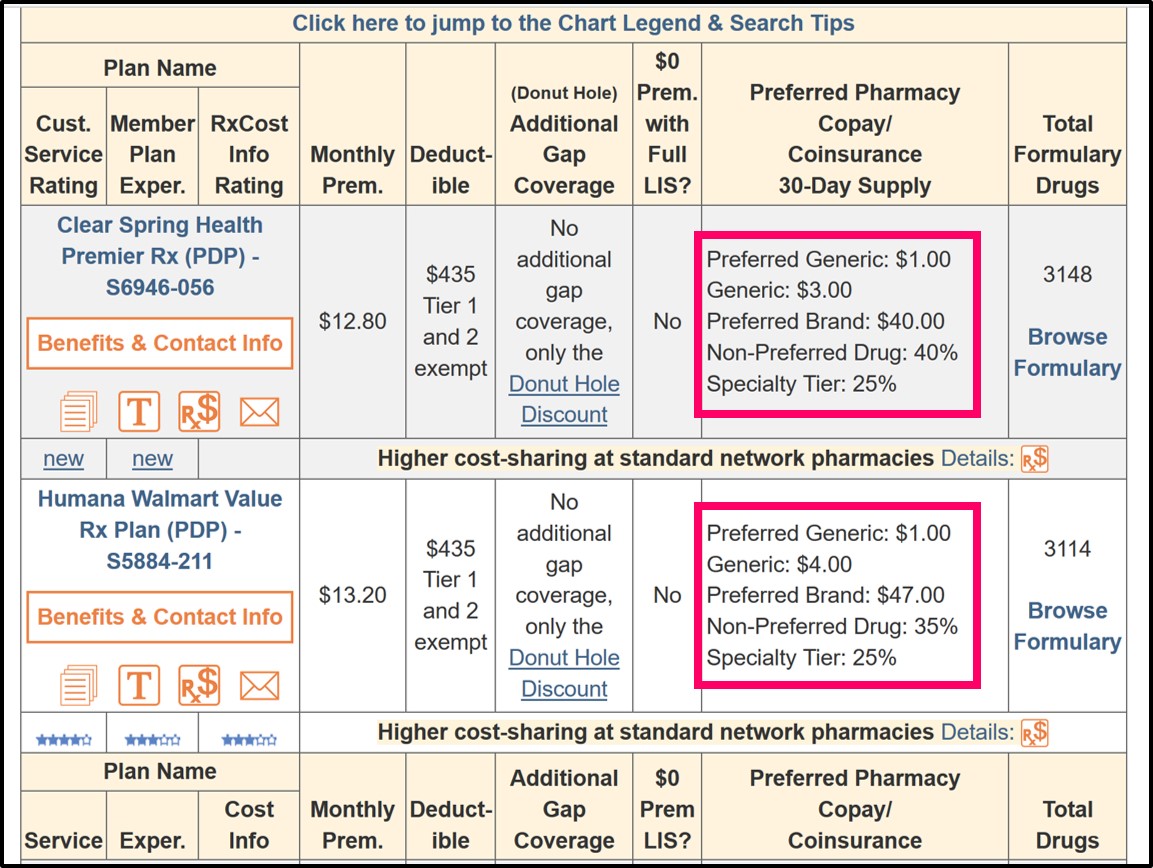

Your Medicare Part D drug plan's cost-sharing can vary depending on whether you are using a standard or preferred network pharmacy.

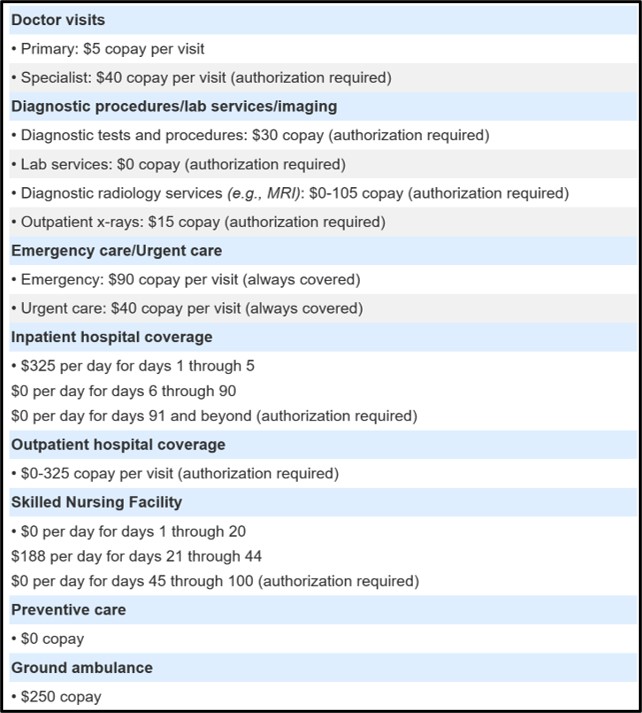

And your Medicare Advantage plan's cost-sharing can vary depending on whether you are visiting a healthcare provider who is in-network or out-of-network.

Below are examples of Medicare Part D prescription drug cost-sharing information shown within our Medicare Part D Plan Finder (PDP-Finder.com/CA) and healthcare cost-share information in our Medicare Advantage Plan Finder (MA-Finder.com/90210).

So, "Cost-Sharing" usually refers to the portion of your Medicare Part D plan coverage or Medicare Advantage plan coverage that you pay - such as $40 to fill a 30-day Tier 3 brand-name prescription or $20 to visit your primary care physician (PCP) or $75 to see an in-network healthcare specialist.

We may say, "if you go to see your in-network doctor, you will have $5 cost-sharing or a $5 copay" or "if you purchase a Tier 5 Specialty drug, you will pay 33% of the retail drug price as co-insurance".

Your Medicare Part D drug plan's cost-sharing can vary depending on whether you are using a standard or preferred network pharmacy.

And your Medicare Advantage plan's cost-sharing can vary depending on whether you are visiting a healthcare provider who is in-network or out-of-network.

Below are examples of Medicare Part D prescription drug cost-sharing information shown within our Medicare Part D Plan Finder (PDP-Finder.com/CA) and healthcare cost-share information in our Medicare Advantage Plan Finder (MA-Finder.com/90210).

Please note that the prescription drug cost-sharing information shown below is for "preferred network pharmacies" - and depending on your drug plan, you may pay higher cost-sharing at standard network pharmacies. You can also click on the plan name to see more information about each Medicare plan.

For Medicare Advantage plan healthcare cost-sharing, you can start at MA-Finder.com, enter your ZIP, see a list of Medicare Advantage plans in your area, and then click on the plan name to see an overview of healthcare (and prescription drug) cost-sharing.

You may wish to telephone the Medicare Advantage plan (using the toll-free number provided on the same page) to confirm or clarify any cost-sharing details that you find unclear. (For example, "What will I pay if I visit an out-of-network healthcare provider without a referral from my primary care physician?")

Important: Medicare plan cost-sharing can change every year.

Remember that what you pay this year for cost-sharing may not be the same as what your Medicare plan charges for cost-sharing next year. In fact, most likely, your Medicare plan will change cost-sharing designs each year - meaning you may pay more next year. You can read more about plan changes in example article here: Examples of how 2023 Medicare Part D plans can change prescription cost-sharing designs. (Examples from 2022)

Examples of Medicare Part D and Medicare Advantage cost-sharing:

You can find more information about your Medicare Part D or Medicare Advantage plan's cost-sharing by looking in your plan's documentation: Summary of Benefits, Annual Notice of Change (ANOC), or Explanation of Benefits.

If you need these documents, please call your plan using the toll-free number found on your Member ID card or your plan's printed documents and speak with one of your plan's Member Services representatives. If you cannot find this information, telephone a Medicare representative at 1-800-633-4227 for assistance.

Remember that what you pay this year for cost-sharing may not be the same as what your Medicare plan charges for cost-sharing next year. In fact, most likely, your Medicare plan will change cost-sharing designs each year - meaning you may pay more next year. You can read more about plan changes in example article here: Examples of how 2023 Medicare Part D plans can change prescription cost-sharing designs. (Examples from 2022)

Examples of Medicare Part D and Medicare Advantage cost-sharing:

- Initial Deductible:

During the initial deductible, you will pay 100% of the coverage costs (unless your plan excludes Tier 1 and Tier 2 drugs from the formulary). So if you purchase a medication with a retail cost of $100, you pay the $100. After you have met your initial deductible, your Medicare plan will begin to pay a portion of the coverage costs. So if your plan has a $435 deductible, you pay the first $435 and then your Medicare Part D plan will begin to pay a portion of the costs. Not all Medicare Part D plans have an initial deductible ($0 deductible plans) and the amount of the deductible can vary between plans.

- Co-Payment:

You pay a flat or fixed amount for a specific medication, no matter how the drug's retail price changes. For instance, if you buy a medication that usually costs $100 retail, you may only pay a co-pay of $30. If the medication becomes more expensive and the retail price increases to $500, you will still only pay the $30 co-pay. If your medication only costs $25, you will pay $25 and not the $30 co-pay because you never pay more than retail.

- Co-Insurance:

You pay a percentage of the retail price for a specific medication. If the drug's retail price increases, you will pay more for the same drug. For instance, if you buy a medication that usually costs $100, you may pay co-insurance of 25% or $25. If the medication becomes more expensive and the retail price increases to $500, you will still pay 25% or $125 for the same medication.

Important: As the retail prices fluctuate (increase) for medications or healthcare, co-insurance costs can change (increase), so accurately predicting your annual medical spending is difficult (if not impossible). So, in general, co-payment may be a more "stable" form of cost-sharing as compared to co-insurance which can change throughout the year.

- Coverage Gap or Donut Hole Discounts:

Since 2020, the cost-sharing in the Donut Hole will be 25% of retail for all generic and brand-name formulary drugs, meaning, you will pay 25% of retail costs. Here is a link showing how the Donut Hole discount has increased over the years, before reaching 25%: Q1FAQ.com/470 - however, it is possible that your Medicare drug plan will provide you with additional coverage in the Donut Hole and your cost-sharing may be less than 25% of retail prices.

- Cost-sharing in the Catastrophic Coverage phase:

If you spend beyond your Total Out-of-Pocket limit (TrOOP) and exit the Coverage Gap or Donut Hole, you will pay the greater of a flat-fixed price (for example, $3.70 for generics and $9.20 for brands) or 5% of the retail cost for generic and brand-name medications.

You can find more information about your Medicare Part D or Medicare Advantage plan's cost-sharing by looking in your plan's documentation: Summary of Benefits, Annual Notice of Change (ANOC), or Explanation of Benefits.

If you need these documents, please call your plan using the toll-free number found on your Member ID card or your plan's printed documents and speak with one of your plan's Member Services representatives. If you cannot find this information, telephone a Medicare representative at 1-800-633-4227 for assistance.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service