You exit the Donut Hole or Coverage Gap portion of your prescription drug coverage and enter into your Medicare Part D drug plan's Catastrophic

Coverage phase when your total out-of-pocket drug spending exceeds a certain level or threshold (TrOOP). In 2023, when you have spent over $7,400 for formulary Medicare Part D medications, you will exit the Donut Hole ($8,000 in 2024).

Your out-of-pocket or TrOOP threshold can (and probably will) change every year.

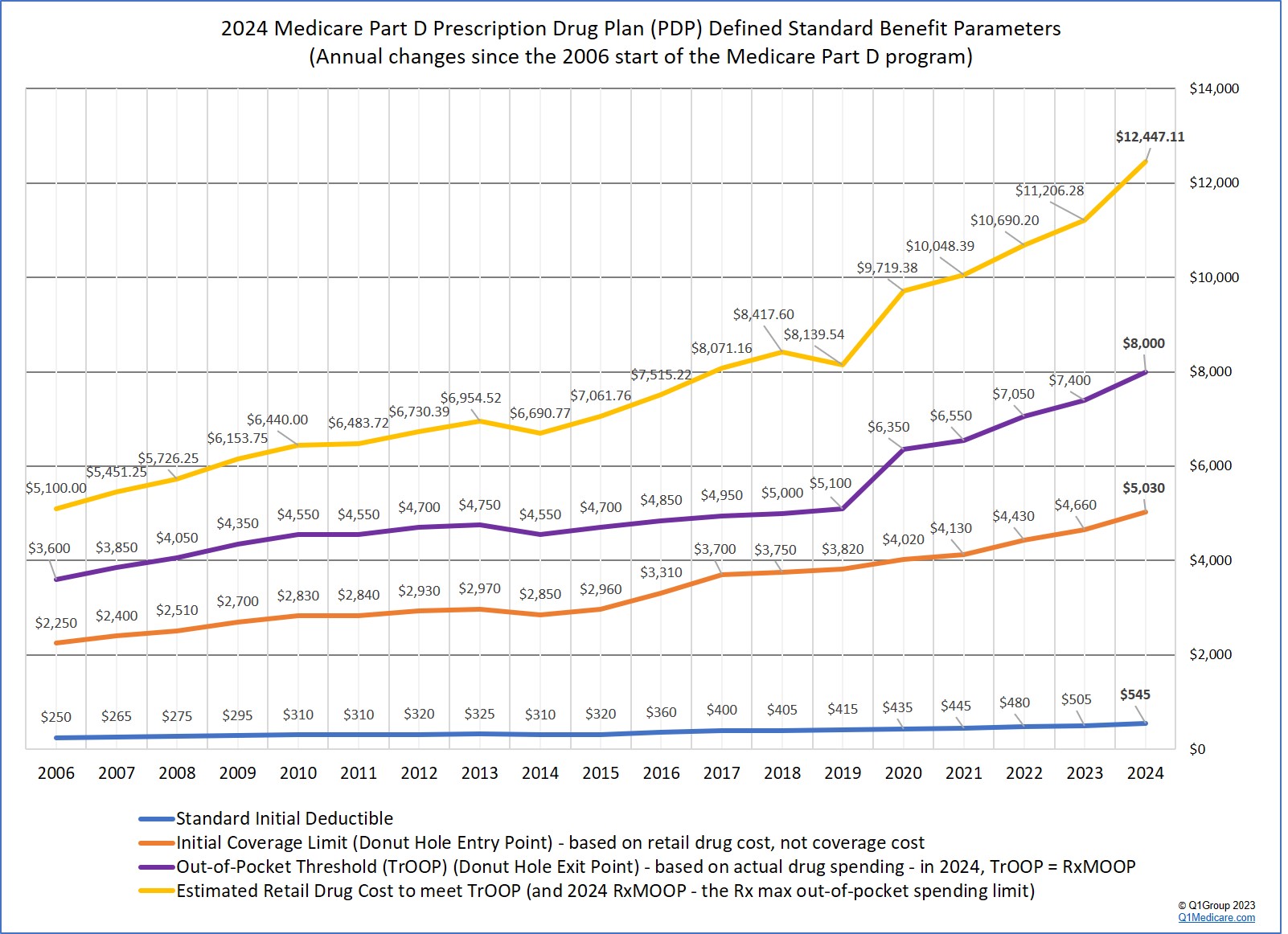

Your out-of-pocket spending threshold or TrOOP or Donut Hole exit point changes each year, for example in 2019, the TrOOP threshold was $5,100, in 2023 TrOOP jumped to $7,400, and in 2024, TrOOP will increase to $8,000. As reference, you can view the table below or click on the following link to see how the out-of-pocket threshold has changed since 2006: q1medicare.com/PartD-The-MedicarePartDOutlookAllYears.php

Question: What determines when I exit the Donut Hole, retail drug cost or my actual out-of-pocket cost?

Either number (as shown in the chart above) - but we use total out-of-pocket cost. As can be seen from the chart, total retail drug cost and total out-of-pocket cost represent the same concept, but since the introduction of the Donut Hole discount, the relationship between the numbers has become more confusing and a bit less relevant since brand name drug purchases in the Donut Hole also receive credit for the 70% of the brand-name retail drug price paid by the drug manufacturer.

Before the start of the Donut Hole discount in 2011, with a little math, a person could easily calculate their Donut Hole exit point (or when a person enters the Catastrophic Coverage phase) using either the person's total out-of-pocket spending (TrOOP) or their total retail drug cost.

Nowadays, with the Donut Hole discount, it is easier to explain when a person exits the Donut Hole using only total out-of-pocket spending. Therefore, we use two different numbers when defining entering or exiting your Medicare drug plan’s Donut Hole or Coverage Gap:

(1) Retail Drug Costs: You enter the Donut Hole based on the total negotiated retail value of your medications. For instance, when the total value of the retail cost of your 2023 drug purchases exceeds the Initial Coverage Limit of $4,660 ($5,030 in 2024), you leave your Medicare Part D plan's Initial Coverage Phase and enter into the Donut Hole or Coverage Gap.

(2) Total out-of-pocket spending: You exiting the 2023 Donut Hole based on out-of-pocket spending (not retail drug cost). After your actual spending for covered Medicare Part D medications has reached $7,400 ($8,000 in 2024), you exit the Donut Hole. (Remember, 70% of the brand-name drug discount counts toward meeting this total out-of-pocket spending amount).

How does this work?

Initial Coverage Phase: If you are in your Medicare Part D plan’s Initial Coverage Phase (before the Donut Hole), and you purchase a medication with a $100 retail cost, and pay your Medicare Part D plan’s $30 co-payment out of your own pocket (the Medicare plan pays the other $70), you get $30 credit toward the $7,400 Donut Hole exit point and $100 toward meeting your $4,660 Initial Coverage Limit. (The $30 is just used as an example co-payment, the actual cost depends on your chosen Medicare Part D plan.)

Donut Hole Phase: When you are in the 2023 Donut Hole and you buy the same $100 medication, and your Medicare plan does not have any Donut Hole coverage, you will get a 75% discount on all brand-name drugs bought in the Donut Hole, or a 75% discount on generic drugs purchased in the Donut Hole.

If your $100 medication was a brand-name drug, then you will pay only $25 - but, you will get credit for the $95 toward meeting your $7,400 out-of-pocket threshold or Donut Hole exit point. This $95 represents the $25 that you paid and the $70 that was paid on your behalf by the brand-name drug manufacturer. You do not get credit for the $5 that was paid by your Medicare Part D plan.

Scrolling down to the bottom chart on this page illustrates how the retail price and the out-of-pocket costs compare throughout the Medicare Part D plan phases – with variations based on the Donut Hole discount at the bottom.

Sources include:

https://www.cms.gov/files/document/2020-medicare-trustees-report.pdf

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service