Why does your Q1Medicare Formulary Browser include drugs not found in my drug plan's printed formulary?

Since most Medicare drug plans provide coverage for over 3,000 prescription medications - plans may have both a printed version of their "comprehensive" or complete formulary - and a smaller, "abridged" version of the complete formulary that includes only a partial listing of all the drugs covered by the plan.

So, when new plan materials are mailed to plan members, some Medicare drug plans will send only the smaller printed "abridged" formulary - with the larger, complete printed formularies available upon request.

Where to review any complete Medicare Part D formulary?

Both our Formulary Browser (view all drugs covered by a single Medicare drug plan) and Q1Rx® Drug Finder (view all drug plans covering a single, specific drug) show the comprehensive formulary data (or a complete set of all formulary drugs).

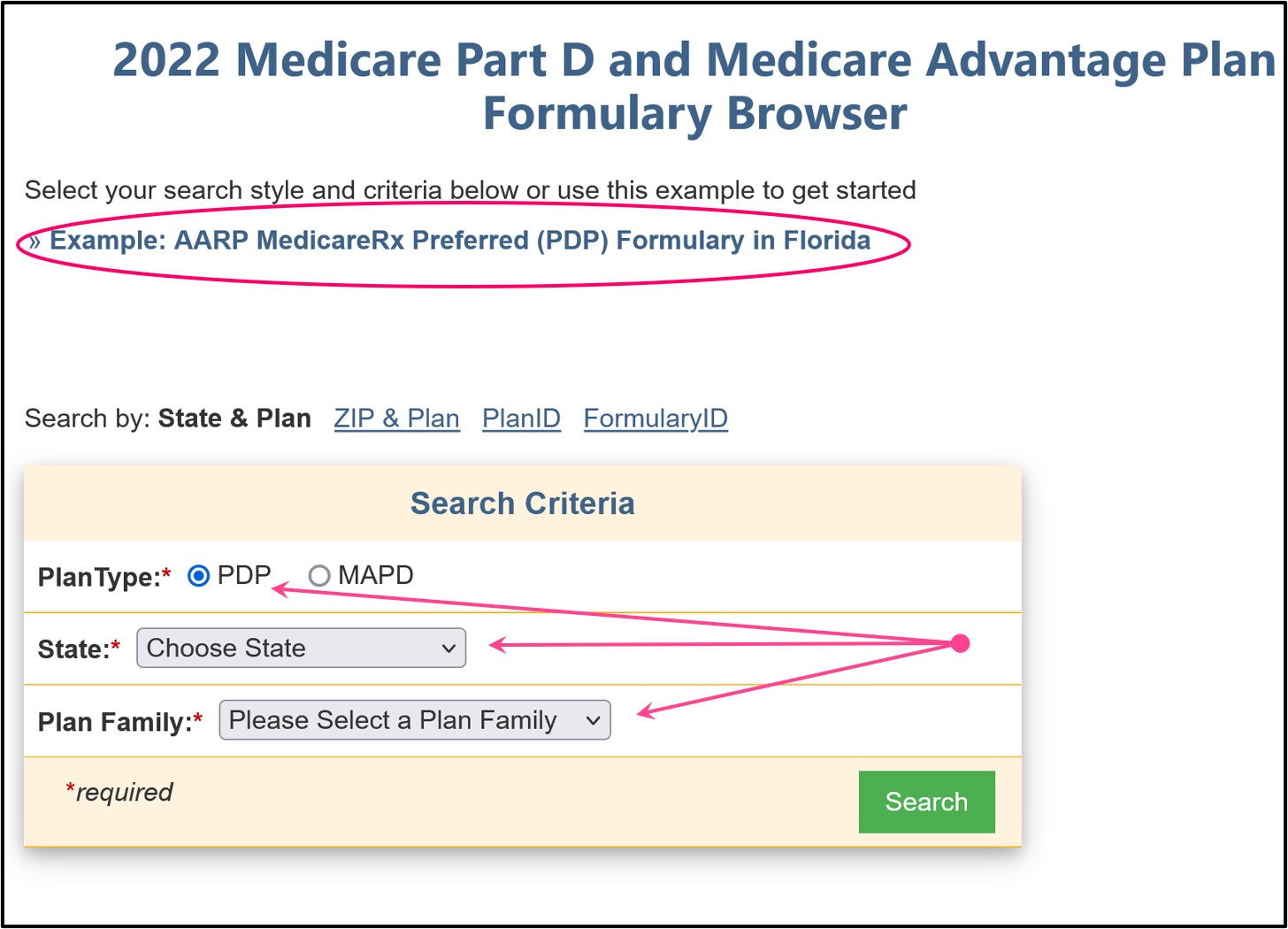

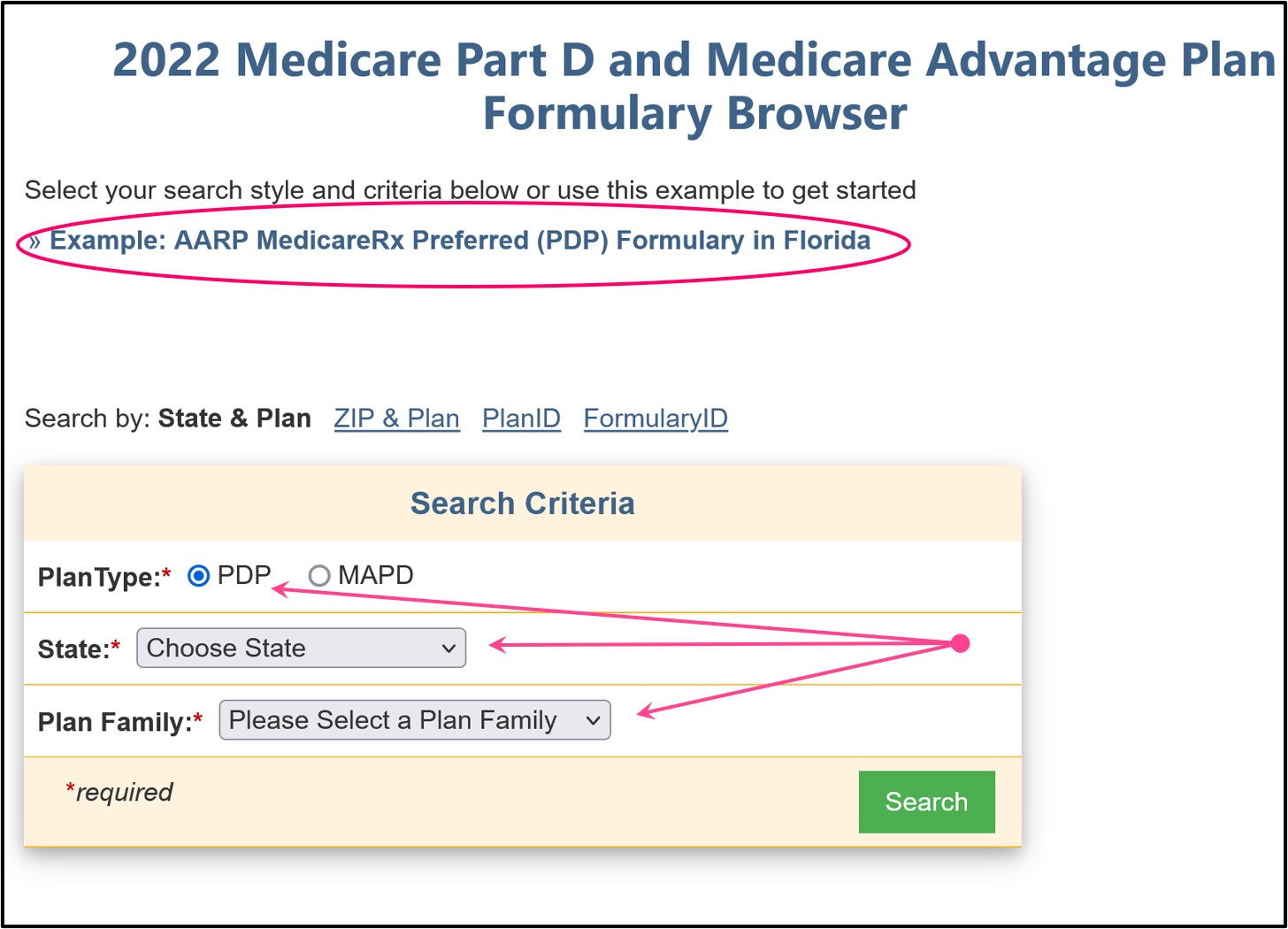

When you click on the above "Formulary Browser" link, you can choose "PDP" (stand-alone Medicare Part D plan) or "MAPD" (Medicare Advantage plan that includes drug coverage). The "PDP" selection is pre-chosen by default.

You can then choose your state from the “State” drop-down box and choose your “Plan Family” from the drop-down box (such as “AARP plans” – then click the green “Search” button and you will see the plans available from this provider in your state and you can choose one of those plans to see the formulary. The drugs are listed alphabetically.

After seeing the results of your Formulary Browser search, you can also click on the icon after the drug name and you can see all of the Medicare Part D plans in Virginia that also cover this same medication and at what cost. (This is a direct link to our Q1Rx Drug Finder tool (found at Q1Rx.com) and you can change the prescription name to whatever you wish.)

For assistance (and example screens) using the Formulary Browser, please see our Frequently Asked Question (FAQ):

Do you have an online Formulary Browser to view all prescription drugs covered by any Medicare Part D plan?

also found at Q1FAQ.com/205

So, when new plan materials are mailed to plan members, some Medicare drug plans will send only the smaller printed "abridged" formulary - with the larger, complete printed formularies available upon request.

Where to review any complete Medicare Part D formulary?

Both our Formulary Browser (view all drugs covered by a single Medicare drug plan) and Q1Rx® Drug Finder (view all drug plans covering a single, specific drug) show the comprehensive formulary data (or a complete set of all formulary drugs).

When you click on the above "Formulary Browser" link, you can choose "PDP" (stand-alone Medicare Part D plan) or "MAPD" (Medicare Advantage plan that includes drug coverage). The "PDP" selection is pre-chosen by default.

You can then choose your state from the “State” drop-down box and choose your “Plan Family” from the drop-down box (such as “AARP plans” – then click the green “Search” button and you will see the plans available from this provider in your state and you can choose one of those plans to see the formulary. The drugs are listed alphabetically.

After seeing the results of your Formulary Browser search, you can also click on the icon after the drug name and you can see all of the Medicare Part D plans in Virginia that also cover this same medication and at what cost. (This is a direct link to our Q1Rx Drug Finder tool (found at Q1Rx.com) and you can change the prescription name to whatever you wish.)

For assistance (and example screens) using the Formulary Browser, please see our Frequently Asked Question (FAQ):

Do you have an online Formulary Browser to view all prescription drugs covered by any Medicare Part D plan?

also found at Q1FAQ.com/205

Going directly to our Q1Rx® Drug Finder: To use our Q1Rx Drug Finder, you can start at Q1Rx.com, then enter your chosen drug name, click the green "Search" button, and then choose the drug strength and packaging and again click "Search".

What is the Q1Rx Drug Finder? also found at Q1FAQ.com/217

Missing your plan's complete formulary?

If the printed formulary (or drug list) you received is not the complete (or comprehensive) formulary, there will be a telephone number on the formulary document that you can call to have a comprehensive drug list mailed to you - or you should see information where you can download a larger, complete formulary - or you will find a link to the Medicare drug plan's online formulary search.

Important: Formularies can change at any time of the year.

Your Medicare Part D drug plan formulary can change throughout the plan year and new drugs may be added to your Medicare drug plan (especially generic medications that are newly-released) - and a Medicare plan will often reissue new versions of the plan's complete formulary throughout the year.

And since a drug plan's formulary can change at any time during the year, it is possible that our Q1Medicare formulary data may be slightly behind the newest drug releases - so, to double-check about the latest drugs added to your Medicare plan, please call your plan's Member Services department (the toll-free number is on your Member ID card) or visit the plan's website and check the plan's online formulary tools.

Important: Your Medicare plan may also cover Bonus Drugs that are not usually covered by the Medicare Part D program.

Please also keep in mind that our Formulary Browser and Q1Rx Drug Finder do not show coverage of bonus or supplemental drugs or non-Part D drugs (such as Rogaine® for hair loss or Viagra® for ED).

However, your Medicare drug plan may cover these drugs as an additional drug plan benefit and this coverage will be shown within your plan documentation.

Remember that coverage of non-Part D or supplemental drugs will not count toward your Medicare Part D spending limits.

If the printed formulary (or drug list) you received is not the complete (or comprehensive) formulary, there will be a telephone number on the formulary document that you can call to have a comprehensive drug list mailed to you - or you should see information where you can download a larger, complete formulary - or you will find a link to the Medicare drug plan's online formulary search.

Important: Formularies can change at any time of the year.

Your Medicare Part D drug plan formulary can change throughout the plan year and new drugs may be added to your Medicare drug plan (especially generic medications that are newly-released) - and a Medicare plan will often reissue new versions of the plan's complete formulary throughout the year.

And since a drug plan's formulary can change at any time during the year, it is possible that our Q1Medicare formulary data may be slightly behind the newest drug releases - so, to double-check about the latest drugs added to your Medicare plan, please call your plan's Member Services department (the toll-free number is on your Member ID card) or visit the plan's website and check the plan's online formulary tools.

Important: Your Medicare plan may also cover Bonus Drugs that are not usually covered by the Medicare Part D program.

Please also keep in mind that our Formulary Browser and Q1Rx Drug Finder do not show coverage of bonus or supplemental drugs or non-Part D drugs (such as Rogaine® for hair loss or Viagra® for ED).

However, your Medicare drug plan may cover these drugs as an additional drug plan benefit and this coverage will be shown within your plan documentation.

Remember that coverage of non-Part D or supplemental drugs will not count toward your Medicare Part D spending limits.

Browse FAQ Categories

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service