2025 Medicare Part D Outlook

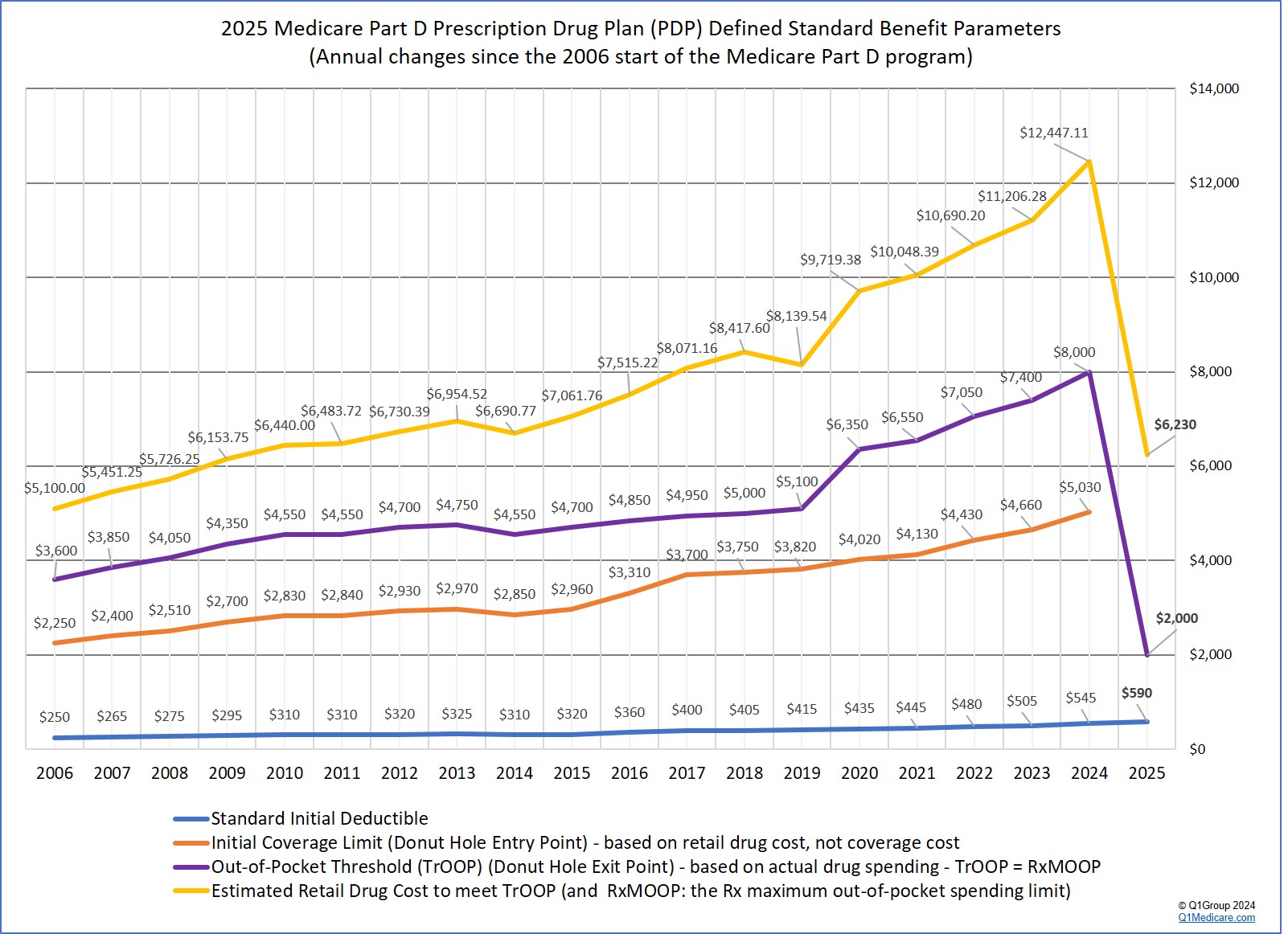

Below are the finalized 2025 defined standard Medicare Part D prescription drug plan parameters as released by the Centers for Medicare and Medicaid Services (CMS), April 2024.- Chart comparing 2021 through 2025 defined standard Medicare Part D prescription drug plan parameters

2025 Tools and Links

» 2025 PDP-Planner: Out-of-Pocket Cost Calculator» 2025 MA-Finder: Medicare Advantage Plan Finder

» MA-Compare: Review Changes in each 2024 Medicare Advantage Plan for 2025

» 2025 PDP-Finder: Stand-Alone Prescription Drug Plan Finder

» PDP-Compare: How did each 2024 Part D Plan Change in 2025?

» 2025 Plan Overview by State

» 2025 Overview by CMS Region

» PDP-Facts: 2025 Part D Plan Statistics

» PDP-Facts: 2025 Beyond the Numbers

» 2025 Quick Plan facts

» Guided Help Searching 2025 Prescription Drug Plans

» Browse Any 2025 Part D Plan Formulary

» 2025 Part D Formulary Search By Drug Letter

» 2025 Q1Rx Part D Drug Finder

» Search for 2025 Medicare Plans by Plan ID

» Search for 2025 Medicare Plans by Formulary ID

Latest News on Medicare for 2025

2025 defined standard Medicare Part D prescription drug plan parameters

Each year, the Centers for Medicare and Medicaid Services (CMS) releases the Medicare Part D drug plan benefit parameters for the "Defined Standard Benefit" plan and the Low-Income Subsidy (LIS) benefits. Medicare Part D plan providers then can use these standardized benefit parameters to determine drug plan coverage for the next plan year.The CMS "Part D Benefit Parameters for Defined Standard Benefit" outline the minimum allowable Medicare Part D plan coverage. However, CMS allows Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible instead of the standard deductible).

Accordingly, although an actual Part D drug plan's coverage can vary from the CMS standardized benefits, you can use these parameters as a preview of how your Medicare Part D plan coverage may change in January, 2025. Actual Medicare drug plan options and benefit details will be available for your review beginning October 1, 2024.

Here are a few highlights of the defined standard Medicare Part D plan changes from 2024 to 2025. And the chart below shows the changes in defined standard Medicare Part D design for plan years 2021, 2022, 2023, 2024 and 2025.

- Initial Deductible:

The Initial Deductible is an amount you will pay yourself before your Medicare drug plan coverage begins to pay a share of the retail drug cost. Insulin and ACIP vaccines covered by your Medicare drug plan are always excluded from the deductible - and some drug plans will exclude certain low-costing drugs tiers from the deductible. The standard Initial Deductible will decrease from $545 in 2024 to $590 in 2025. - Initial Coverage Limit (ICL):

The Initial Coverage Limit will cease to exist in 2025 and the ICL will instead be replaced by the annual out-of-pocket spending threshold (TrOOP or RxMOOP). Accordingly, the 2024 ICL (retail cost of formulary drug purchases before entering the Coverage Gap) of $5,030 will be replaced with the 2025 annual out-of-pocket spending limit (TrOOP or RxMOOP) of $2,000 - equating to a total retail formulary drug cost of around $6,380 (excluding covered Insulin and Vaccine costs). - Coverage Gap (Donut Hole):

The Coverage Gap phase is eliminated in 2025. - Total annual out-of-pocket spending threshold (TrOOP or RxMOOP):

The annual out-of-pocket spending limit will decrease from $8,000 in 2024 to $2,000 in 2025. The TrOOP threshold now represents the maximum out of pocket spending limit for formulary drugs (RxMOOP).

- The Catastrophic Coverage phase:

The Catastrophic Coverage phase will remain the third phase of Medicare Part D coverage, however, since January 1st, 2024, Medicare beneficiaries will no longer pay any cost for formulary drugs purchased in the Catastrophic Coverage stage (after exceeding the annual TrOOP threshold or RxMOOP).

Chart comparing 2021 through 2025 defined standard Medicare Part D prescription drug plan parameters

Click here to see a comparison of plan parameters for all years since 2006

Medicare Part D Benefit Parameters for Defined Standard Benefit |

||||||

| Part D Standard Benefit Design Parameters | 2025* | 2024* | 2023 | 2022 | 2021 | |

| Deductible - In most situations, the beneficiary pays 100% of their drug costs until the deductible is met. | $590 | $545 | $505 | $480 | $445 | |

| Initial Coverage Limit (ICL) - Beginning with plan year 2025, the ICL is eliminated. Pre-2025, prior to reaching the ICL the beneficiary paid 25% of their drug costs and once the ICL was reached, the Coverage Gap (Donut Hole) began. | Not Applicable | $5,030 | $4,660 | $4,430 | $4,130 | |

| Out-of-Pocket Threshold (OOP threshold or RxMOOP) -

The Catastrophic Coverage phase begins

(and prior to 2025, the Coverage Gap ended

when Total Out-of-Pocket (TrOOP) costs exceed this value. Beginning with plan year 2025, the Coverage Gap phase is eliminated. |

$2,000 | $8,000 | $7,400 | $7,050 | $6,550 | |

| Total covered Part D drug out-of-pocket spending before entering Catastrophic Coverage (pre-2025 exiting the Coverage Gap) - (LIS). See note (1) below. | $6,230 | $11,477.39 | $10,516.25 | $10,012.50 | $9,313.75 | |

| Total estimated Part D drug out-of-pocket spending before entering Catastrophic Coverage (pre-2025 exiting the Coverage Gap) - (non-LIS). See note (2) below. | $6,230 | $12,447.11 plus a 75% discount on all formulary drugs |

$11,206.28 plus a 75% discount on all formulary drugs |

$10,690.20 plus a 75% discount on all formulary drugs |

$10,048.39 plus a 75% discount on all formulary drugs |

|

| Catastrophic Coverage Benefit:

Beginning with plan year 2024, beneficiary cost-sharing in the Catastrophic Coverage stage of the Medicare Part D coverage is eliminated - and shown below as not applicable. From 2006 through 2023 the Catastrophic Coverage cost-sharing was the greater of 5% or the values shown below. |

||||||

| Generic/Preferred Multi-Source Drug | Not Applicable | Not Applicable | $4.15 | $3.95 | $3.70 | |

| Other Drugs | Not Applicable | Not Applicable | $10.35 | $9.85 | $9.20 | |

Parameters for Medicare Beneficiaries qualifying for the Low-Income Subsidy (LIS) (Extra Help) program |

||||||

| Part D Full Benefit Dual Eligible (FBDE) Beneficiaries Parameters See note (3): | ||||||

| 2025* | 2024* | 2023 | 2022 | 2021 | ||

| • Deductible | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| • Copayments for Institutionalized Beneficiaries [category code 3] | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| • Copayments for Beneficiaries Receiving Home and Community-Based Services [category code 3] see note (4) | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| • Maximum Copayments for FBDE Non-Institutionalized Beneficiaries Up to or at 100% FPL [category code 2]: | ||||||

| • Up to Out-of-Pocket Threshold | ||||||

| - Generic / Preferred Multi-Source Drug | $1.60 | $1.55 | $1.45 | $1.35 | $1.30 | |

| - Other Drugs | $4.80 | $4.60 | $4.30 | $4.00 | $4.00 | |

| • Above Out-of-Pocket Threshold | Not Applicable | Not Applicable | $0.00 | $0.00 | $0.00 | |

| • Maximum Copayments for FBDE Non-Institutionalized Beneficiaries Between 100% and 150% FPL [category code 1]: | ||||||

| • Up to Out-of-Pocket Threshold | ||||||

| - Generic / Preferred Multi-Source Drug | $4.90 | $4.50 | $4.15 | $3.95 | $3.70 | |

| - Other Drugs | $12.15 | $11.20 | $10.35 | $9.85 | $9.20 | |

| • Above Out-of-Pocket Threshold | Not Applicable | Not Applicable | $0.00 | $0.00 | $0.00 | |

| Part D Full-Subsidy - Non-FBDE Beneficiary Parameters: | ||||||

| 2025* | 2024* | 2023 | 2022 | 2021 | ||

| Applied or eligible for QMB/SLMB/QI or SSI, income at or below

150% FPL and

resources ≤ $17,220 (individuals in 2024) or ≤ $34,360 (couples in 2024) [category code 1] see note (5).

See resources for prior years. Prior to 2024, the full-subsidy income limit was ≤ 135% FPL. | ||||||

| • Deductible | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | |

| • Maximum Copayments up to Out-of-Pocket Threshold | ||||||

| - Generic / Preferred Multi-Source Drug | $4.90 | $4.50 | $4.15 | $3.95 | $3.70 | |

| - Other Drugs | $12.15 | $11.20 | $10.35 | $9.85 | $9.20 | |

| • Maximum Copay above Out-of-Pocket Threshold | Not Applicable | Not Applicable | $0.00 | $0.00 | $0.00 | |

| Partial-Subsidy Parameters (Partial-LIS was eliminated January 1, 2024, when Full-LIS was expanded to include former partial-LIS): | ||||||

| 2025* | 2024* | 2023 | 2022 | 2021 | ||

| Prior to 2024, Partial-LIS included beneficiaries who have applied for benefits and have income below 150% FPL and limited resources [category code 4] (5). See resources for prior years. | ||||||

| • Deductible | Not Applicable | Not Applicable | $104.00 | $99.00 | $92.00 | |

| • Coinsurance up to Out-of-Pocket Threshold | Not Applicable | Not Applicable | 15% | 15% | 15% | |

| • Maximum Copayments above Out-of-Pocket Threshold | ||||||

| - Generic / Preferred Multi-Source Drug | Not Applicable | Not Applicable | $4.15 | $3.95 | $3.70 | |

| - Other Drugs | Not Applicable | Not Applicable | $10.35 | $9.85 | $9.20 | |

| *These parameters reflect additional plan coverage required for covered insulin products under section 1860D-2(b)(9) of the Act, as added by section 11406 of the IRA, and ACIP-recommended vaccines under section 1860D-2(b)(8) of the Act, as added by section 11401 of the IRA. | ||||||

| (1) For a beneficiary who is not considered an "applicable beneficiary" (i.e. the beneficiary is LIS-eligible), as defined at section 1860D-14A(g)(1) of the Social Security Act, and is not eligible for the Medicare Coverage Gap Discount Program, this is the amount of total drug spending required to reach the OOP threshold in the defined standard benefit. Medicare notes, that in 2024, "There was a 7 percent adjustment for the estimated total covered Part D spending at catastrophic for non-applicable beneficiaries, because beneficiaries take a longer time to reach the catastrophic phase threshold when they pay less cost sharing for insulins and vaccines (no more than $35 copay per month's supply of insulin and $0 copay on ACIP-recommended adult vaccines) under the 2024 defined standard benefit." | ||||||

| (2) For a beneficiary who is an "applicable beneficiary" (non-LIS), as defined at section 1860D-14A(g)(1) of the Act, and is eligible for the Medicare Coverage Gap Discount Program, this is the estimated average amount of total drug spending required to reach the OOP threshold in the defined standard benefit. Medicare notes, that in 2024, "there was a 9 percent adjustment for the estimated total covered Part D spending at catastrophic for applicable beneficiaries, because beneficiaries take a longer time to reach the catastrophic phase threshold when they pay less cost sharing for insulins and vaccines (no more than $35 copay per month's supply of insulin and $0 copay on ACIP-recommended adult vaccines) under the 2024 defined standard benefit". | ||||||

(3) The LIS eligibility categories and corresponding cost-sharing benefits are sometimes

referred to using category codes as follows:

| ||||||

| (4) Per section 1860D-14(a)(1)(D)(i) of the Act, full-benefit dually eligible beneficiaries who are receiving home and community-based services qualify for zero cost sharing if the individuals (or couple) would have been institutionalized otherwise. | ||||||

| (5) The resource limits for CY 2025 will be provided via the annual HPMS memo entitled "2025 Resource and Cost-Sharing Limits for Low-Income Subsidy (LIS)" that is expected to be released during the usual timeframe after the September 2024 CPI has been made available by the Bureau of Labor Statistics. Additionally, these amounts include $1,500 per person for burial expenses. Also, beneficiaries that would have been eligible for the partial LIS benefit had the IRA not been enacted will be eligible for the full LIS benefit if they meet either of the resource standard described at sections 1860D-14(a)(3)(D) or (E) of the Act. | ||||||

Click here to see a comparison of plan parameters for all years since 2006

Medicare Part D standard benefit trends 2006 to 2025

The graph below shows the finalized Medicare Part D defined standard benefit parameters.

Click here to see a comparison of plan parameters for all years since 2006

2025 Medicare Part D program changes beyond the standard parameters

The 2022 Inflation Reduction Act (IRA) identified many improvements to the standard Medicare Part D drug benefit to be rolled out between 2023 and 2029. The following are highlights of the Part D related IRA updates that will be in place for the 2025 plan year:- No cost-sharing for Medicare Part D formulary drugs purchased after reaching the 2025 TrOOP threshold of $2,000.

Medicare Part D beneficiaries will have a $2,000 maximum cap on out-of-pocket spending for Part D formulary drugs (RxMOOP). In 2025, the $2,000 RxMOOP should be approximately reached when a person purchases Medicare Part D formulary drugs with a retail value totaling $6,380 (not considering covered Insulin and Vaccines). In short, starting in 2025, Medicare Part D beneficiaries will not spend more than $2,000 out-of-pocket for formulary drugs.

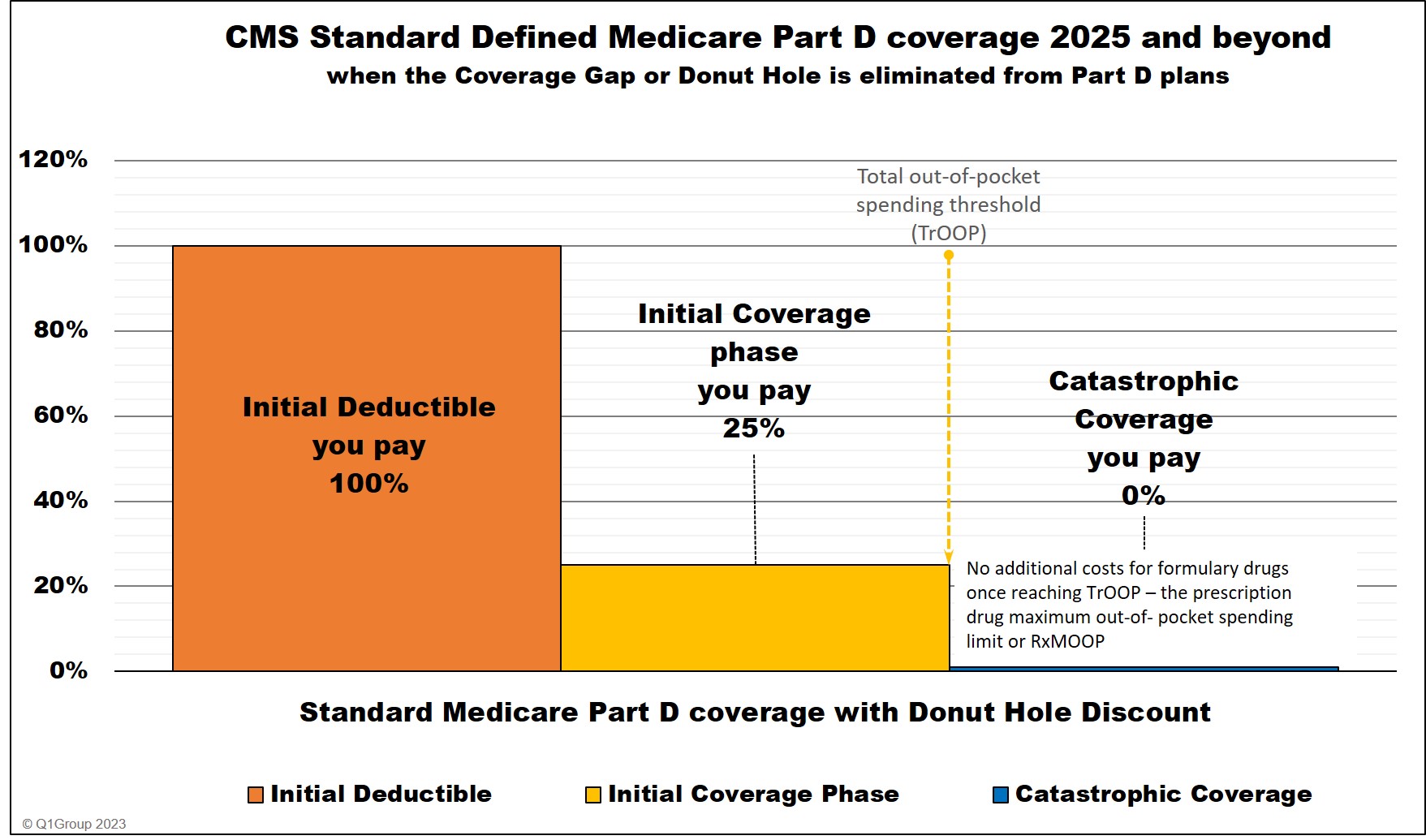

- Change to Medicare Part D plan designs: Coverage Gap phase eliminated.

With the addition of the $2,000 RxMOOP, Medicare Part D plans would have only two parts of coverage (or less): (1) the Initial Deductible (if any) and (2) the Initial Coverage Phase that would continue until December 31 of the plan year - or cease when the plan member's out-of-pocket spending reached $2,000 and the person has no additional costs for Part D formulary drugs. Medicare Part D plans would no longer have the Part D Coverage Gap (Donut Hole with the accompanying Donut Hole discount). And Medicare Part D beneficiaries would have no additional costs for formulary drugs once reaching the Catastrophic Coverage phase.

Medicare Part D coverage 2025 and beyond

- A person's drug costs can be evenly spread over the year

Medicare Part D plans are required to provide plan members an option allowing people to spread their monthly prescription drug costs evenly over the year. For example, if a person purchases an expensive medication in January 2025 and the cost exceeds the $2,000 out-of-pocket threshold, the person could spread the $2,000 cost evenly over the entire year to lessen the impact of a single $2,000 payment with $167 monthly payments.

Inflation Reduction Act (IRA): Changes to Medicare Part D prescription drug coverage 2023 and beyond.

Federal Poverty Level Guidelines: Extra Help / Low-Income Subsidy (LIS) Qualifications

The Extra Help / Low-Income Subsidy (LIS) qualifications using the 2024 Federal Poverty Level (FPL) guidelines are shown below. The 2024 FPL guidelines will be used for determining LIS qualifications at the beginning of the 2025 plan year.Since January 1, 2024, full-LIS was increased to 150% of FPL and partial-LIS was eliminated.

If your income is at or below 150% of the FPL ($22,590 if you are single or $30,660 for married couples), you could qualify for the full Low-Income Subsidy (resource limits also apply - see chart above). Remember, the LIS subsidy helps to pay both your monthly plan premium and drug costs.

Learn more in our article, 2024 Federal Poverty Level Guidelines (FPL): 2024/2025 LIS Qualifications and Benefits.

| Full Low-Income Subsidy Income Requirements (150% of FPL) using the 2024 Federal Poverty Level Guidelines (FPL) | |||

| Persons in Family | 48 Contiguous States & D.C. | Alaska | Hawaii |

| 1 | $22,590 | $28,215 | $25,965 |

| 2 | $30,660 | $38,310 | $35,250 |

| 3 | $38,730 | $48,405 | $44,535 |

| 4 | $46,800 | $58,500 | $53,820 |

| 5 | $54,870 | $68,595 | $63,105 |

| 6 | $62,940 | $78,690 | $72,390 |

Click here for additional family member figures and for partial-LIS figures. Learn more about the Extra-Help program.

Sign-up for our 2026 Reminder Service

2026 Medicare Part D Plan Reminder Service

If you would like for us to send you an email as the 2026 Medicare Part D plan information becomes available, as it is updated and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

8am to 5pm MST

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service