What is my Medicare Part D plan's Initial Coverage Phase?

The Initial Coverage phase is the second part of your Medicare Part D drug plan and follows the Initial Deductible (if your plan has a deductible). During this phase, you and your Medicare Part D plan share in the cost of your formulary drugs (for example, you pay $47 for a $500 drug).

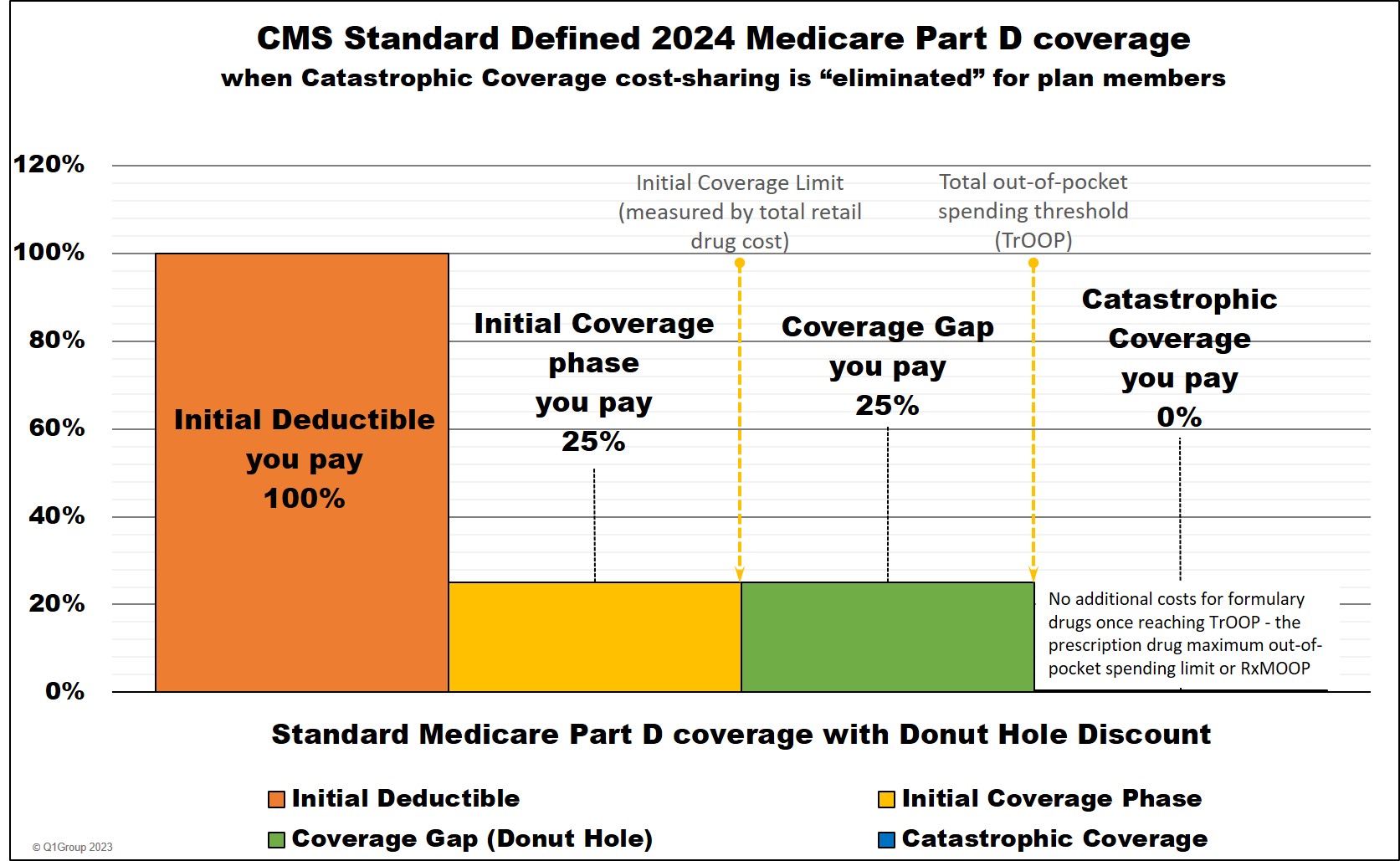

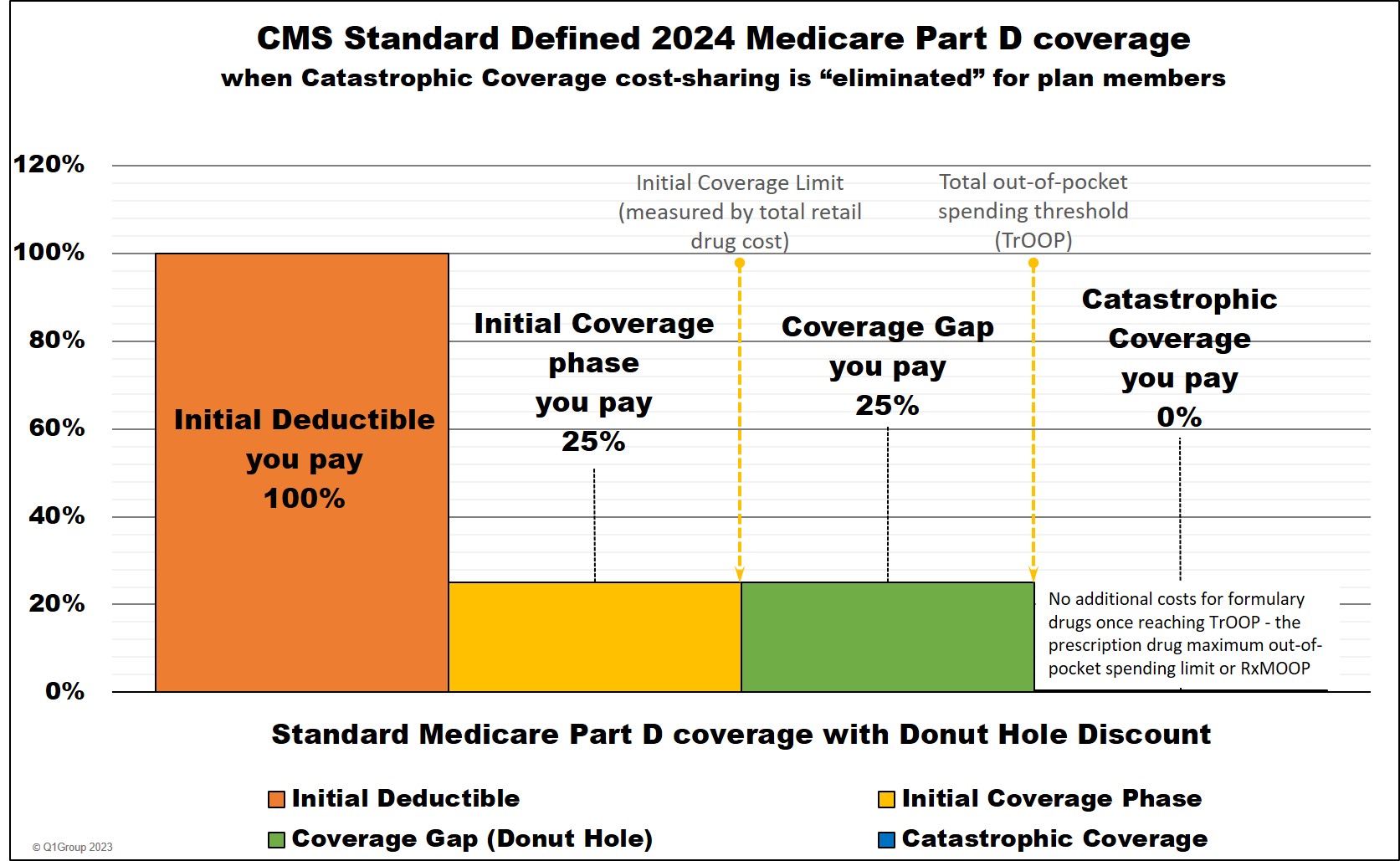

As a review, 2024 Medicare Part D prescription drug plans have four different parts of coverage: (1) the Initial Deductible (in some plans), (2) the Initial Coverage phase, (3) the Coverage Gap (Donut Hole), and (4) Catastrophic Coverage (where you will have a $0 copay for formulary drugs). See below for 2025 coverage updates.

You move through these stages of your Medicare drug coverage either based on the amount of money you spend on formulary drugs or the retail value of your prescription drug purchases, depending on the coverage phase. Most people will remain in the Initial Coverage phase for the year with only a small percentage of Medicare beneficiaries ever entering the Coverage Gap or Catastrophic Coverage phase.

(1) The Initial Deductible is where you pay 100% of your retail drug costs until you reach your deductible amount ($545 in 2024 and $590 in 2025). Many people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase.

(2) The Initial Coverage phase is the part of your drug coverage where you and your Medicare Part D plan share the cost of your formulary medications either as a fixed co-pay or a percentage of retail cost. Standard cost-sharing in the Initial Coverage phase is 25%, but your Medicare drug plan may have fixed copays for different formulary tiers. For example, if you purchase a mediation with a $100 retail cost, you may pay a $30 copay (and the plan pays $70) or you pay $25 coinsurance (and the plan pays $75). And since most people remain in their Medicare Part D plan's Initial Coverage phase, most people will consistently pay about the same price for their formulary drugs (or relatively the same price as retail drug prices increase) throughout the whole year.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once you exceed the Initial Coverage Limit and where you receive the Donut Hole discount on any formulary drug purchases.

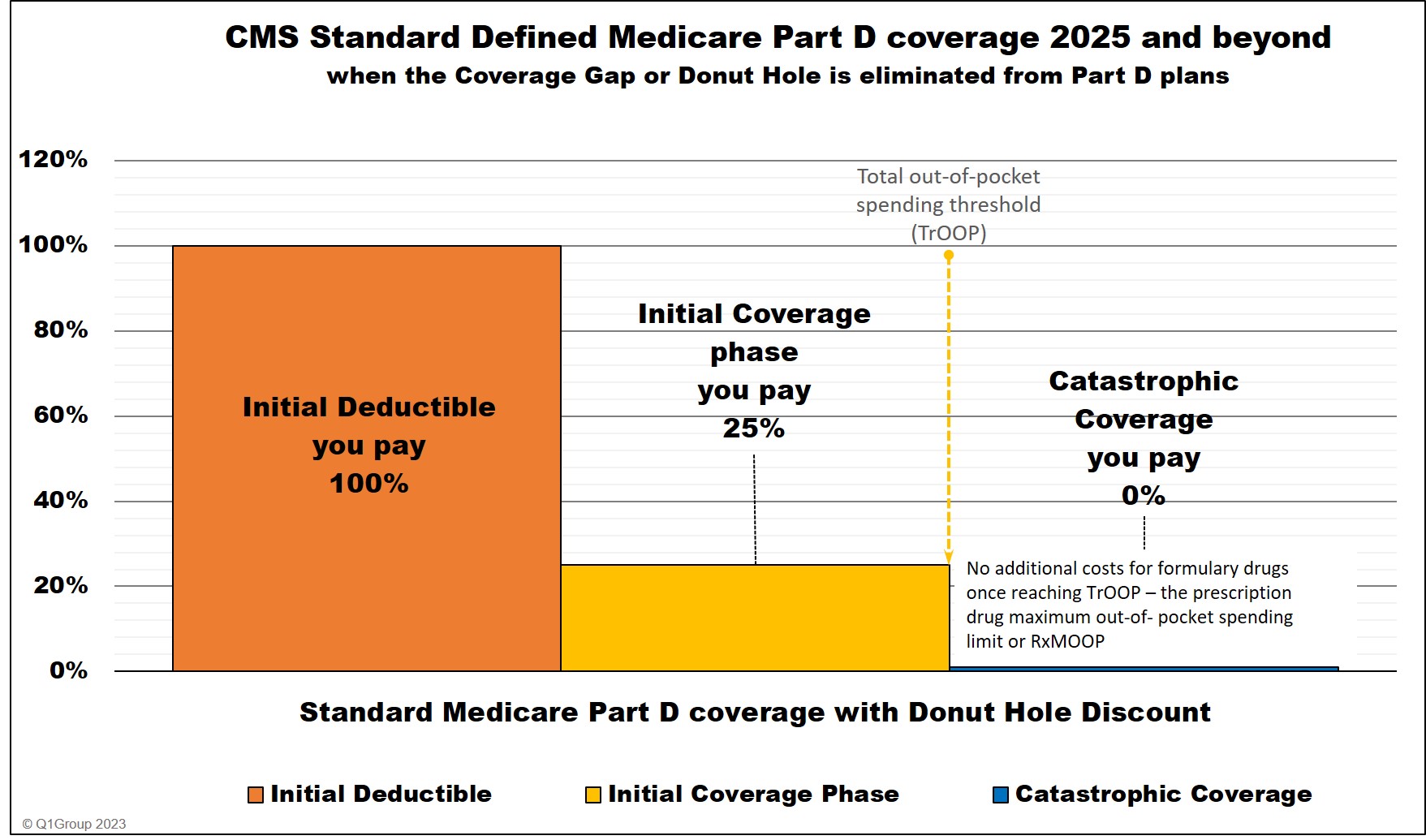

Important Fact: The Coverage Gap or Donut Hole will be eliminated in 2025.

The Inflation Reduction Act (IRA) will remove the Coverage Gap (Donut Hole) in 2025. Medicare Part D beneficiaries will stay in the Initial Coverage phase until they reach the maximum cap on out-of-pocket spending for Part D formulary drugs - RxMOOP - which is set at $2,000 for 2025. After reaching RxMOOP Medicare Part D beneficiaries will have a $0 copay for all formulary drugs.

(4) The Catastrophic Coverage phase is the last phase of your Medicare Part D plan and you enter once your total out-of-pocket drug costs (TrOOP) exceed a certain point (over $8,000 in 2024 and $2,000 in 2025). Once you enter the Catastrophic Coverage phase, you will have no cost ($0) for all formulary medications for the remainder of the year.

As a review, 2024 Medicare Part D prescription drug plans have four different parts of coverage: (1) the Initial Deductible (in some plans), (2) the Initial Coverage phase, (3) the Coverage Gap (Donut Hole), and (4) Catastrophic Coverage (where you will have a $0 copay for formulary drugs). See below for 2025 coverage updates.

You move through these stages of your Medicare drug coverage either based on the amount of money you spend on formulary drugs or the retail value of your prescription drug purchases, depending on the coverage phase. Most people will remain in the Initial Coverage phase for the year with only a small percentage of Medicare beneficiaries ever entering the Coverage Gap or Catastrophic Coverage phase.

(1) The Initial Deductible is where you pay 100% of your retail drug costs until you reach your deductible amount ($545 in 2024 and $590 in 2025). Many people will enroll in a Medicare prescription drug plan with a $0 deductible and effectively skip-over this first phase.

(2) The Initial Coverage phase is the part of your drug coverage where you and your Medicare Part D plan share the cost of your formulary medications either as a fixed co-pay or a percentage of retail cost. Standard cost-sharing in the Initial Coverage phase is 25%, but your Medicare drug plan may have fixed copays for different formulary tiers. For example, if you purchase a mediation with a $100 retail cost, you may pay a $30 copay (and the plan pays $70) or you pay $25 coinsurance (and the plan pays $75). And since most people remain in their Medicare Part D plan's Initial Coverage phase, most people will consistently pay about the same price for their formulary drugs (or relatively the same price as retail drug prices increase) throughout the whole year.

(3) The Coverage Gap or Donut Hole is the plan phase you enter once you exceed the Initial Coverage Limit and where you receive the Donut Hole discount on any formulary drug purchases.

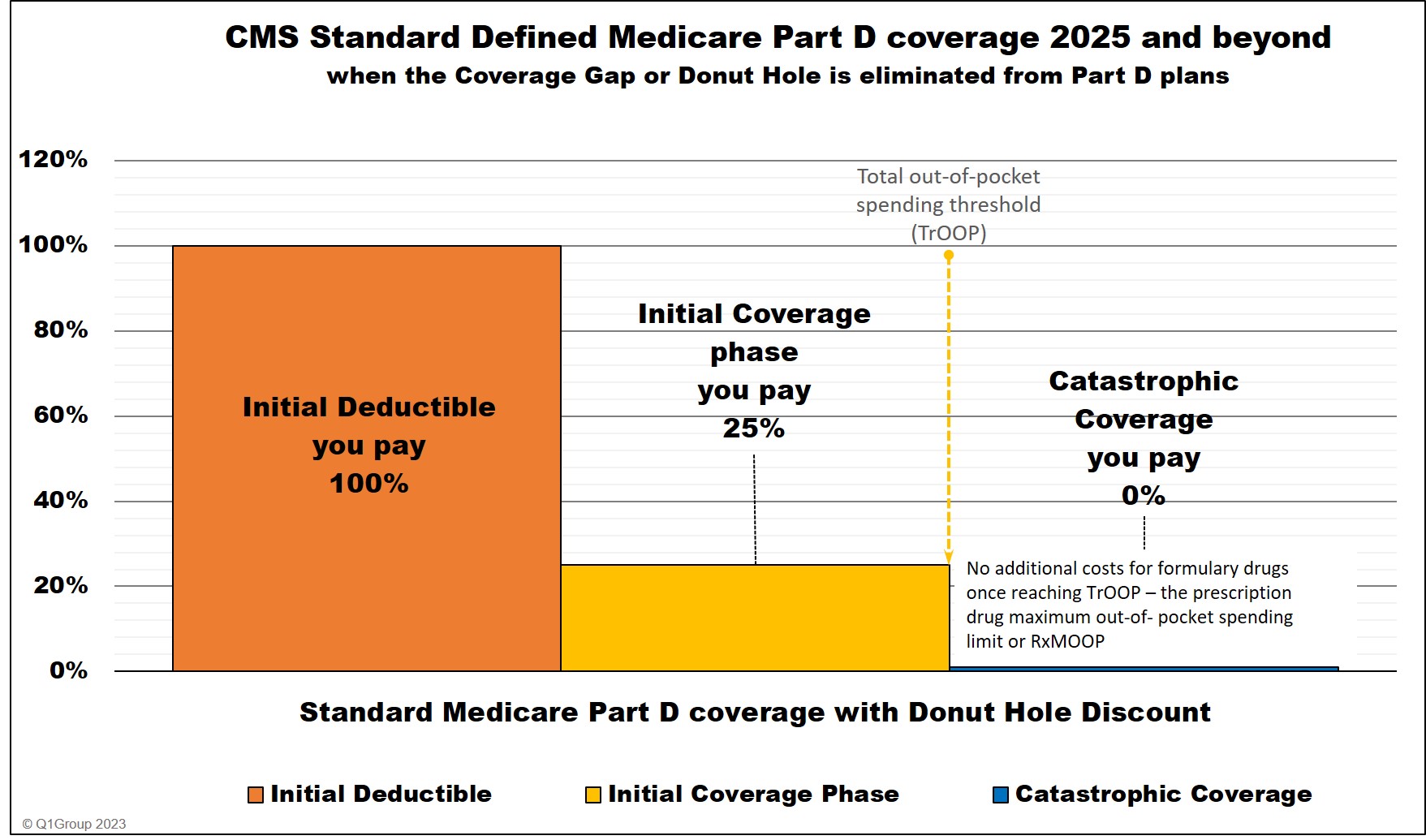

Important Fact: The Coverage Gap or Donut Hole will be eliminated in 2025.

The Inflation Reduction Act (IRA) will remove the Coverage Gap (Donut Hole) in 2025. Medicare Part D beneficiaries will stay in the Initial Coverage phase until they reach the maximum cap on out-of-pocket spending for Part D formulary drugs - RxMOOP - which is set at $2,000 for 2025. After reaching RxMOOP Medicare Part D beneficiaries will have a $0 copay for all formulary drugs.

(4) The Catastrophic Coverage phase is the last phase of your Medicare Part D plan and you enter once your total out-of-pocket drug costs (TrOOP) exceed a certain point (over $8,000 in 2024 and $2,000 in 2025). Once you enter the Catastrophic Coverage phase, you will have no cost ($0) for all formulary medications for the remainder of the year.

Entering the Initial Coverage Phase

If your Medicare Part D plan has an Initial Deductible (the first phase of drug coverage), you will pay the Initial Deductible before entering the Initial Coverage phase.

However, some Medicare Part D plans will have an Initial Deductible, but exclude the lower-costing (Tiers 1 and Tier 2) drugs from the deductible, so you will skip the deductible for any of these low-costing formulary drugs and start in at your Initial Coverage phase for these drugs. In addition, all insulins covered by a Medicare drug plan will not be subject to the plan's deductible and will be treated as if the purchase was in the Initial Coverage phase.

If your Medicare plan has a $0 deductible, you will enter the Initial Coverage phase immediately, skipping over the first phase.

Exiting the Initial Coverage Phase and entering the 2024 Coverage Gap

When the retail value of your drug purchases exceeds your Initial Coverage Limit (ICL or Donut Hole entry point), you will leave your Initial Coverage phase and enter the Coverage Gap or Donut Hole.

Please note that the Initial Coverage Limit (ICL) is not measured by what you have spent on medications. Instead, the ICL is the total retail value of your prescription drug purchases. So this is the amount that you pay for your prescriptions plus what your Medicare Part D plan is paying.

For example, if you purchase a $1,000 formulary drug and you pay a $47 copay (the Medicare Part D plan pays the other $953), the total $1,000 retail cost is credited toward your ICL (the 2024 standard Initial Coverage Limit is $5,030 . In this example, after the $1,000 drug purchase, you have $4,030 remaining in drug purchases before entering the 2024 Donut Hole ($5,030 - $1,000).

The standard Initial Coverage Limit (entry point to the Coverage Gap or Donut Hole) can vary each year. For instance, the Initial Coverage Limit is $5,030 in 2024 as compared to the Initial Coverage Limit of $2,250 in 2006.

You can view the standard Initial Coverage Limits for the past several years here: q1medicare.com/2024

Reminder about comparing drug plans:

You may find that your Medicare drug plan's retail

drug prices are not the same as other Medicare Part D plan's.

In other

words, you might buy a medication like

ADVAIR DISKUS MIS (250/50)

and your plan will have a retail price of $630, although you may only

pay a $42 copay. However, a friend with a different Part D plan may use

the same medication and have a $46 copay, but the retail price for their

plan is around $415.So, the same medication can have similar cost-sharing, but different negotiated retail prices depending on the Medicare plan - and the different retail costs have different impacts on the Initial Coverage Limit - and when you enter the Coverage Gap or Donut Hole.

At times, the Initial Coverage Limit can also vary between Medicare Part D plan providers. With the approval of Medicare (or CMS) Medicare Part D plans are allowed to deviate from the annual standard Initial Coverage Limit value and a few companies may offer Part D plans with lower Initial Coverage Limits - although this is rare in today's market.

Reminder about expensive drug purchases that may straddle multiple plan phases at one time:

As you can imagine, if your purchase of an expensive medication (for example, with a retail cost of over $6,000), your coverage costs may be $702 or less, but the retail cost may exceed the Initial Coverage Limit and push you through the Initial Coverage phase and into the Coverage Gap - with just one single purchase.

As another example, if you purchased an expensive Tier 5 Specialty Tier drug with a high retail cost, for example $15,175, you would go through all phases of your drug plan at one time. The total cost of your first annual $15,175 purchase would be around $3,333 calculated as: $545 deductible + $1,121 in initial coverage phase + $1,667 in the Coverage Gap + $0 in the Catastrophic Coverage phase (you pay $0 for formulary drugs when you reach Catastrophic Coverage).

Browse FAQ Categories

Pets are Family Too!

Use your drug discount card to save on medications for the entire family ‐ including your pets.

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service