A note about the "closing" of the Donut Hole.

There are four possible parts to your Medicare prescription drug plan coverage:

(1) the Initial Deductible,

(2) the Initial Coverage phase,

(3) the 2024 Coverage Gap or Donut Hole (this phase will be eliminated in 2025), and

(4) Catastrophic Coverage (although not eliminated, in 2024 and beyond, you will have $0 cost-sharing for formulary drugs purchased after reaching Catastrophic Coverage).

And - although we commonly say that the Donut Hole effectively "closed" in 2020 since you receive a 75% discount on all formulary drugs purchased in the Donut Hole - the Donut Hole or Coverage Gap still remains the third part of your Medicare Part D coverage.

(But, as noted, in 2025 and beyond, the Donut Hole or Coverage Gap phase will be completely eliminated from all Medicare Part D drug plans.)

So - in 2024 you will still leave your Medicare Part D plan's second part or Initial Coverage phase once your retail drug costs exceed the Initial Coverage Limit and enter the Coverage Gap (Donut Hole) where the cost of your formulary medications can actually increase, decrease, or stay the same. However, in 2025, when you reach the $2,000 prescription drug maximum out-of-pocket spending limit, you will enter Catastrophic Coverage and pay no additional costs for formulary drugs through the remainder of the year - there will be no Donut Hole.

Example #1

You pay more for your formulary drugs when you enter the Donut Hole - even with the 75% Donut Hole discount.

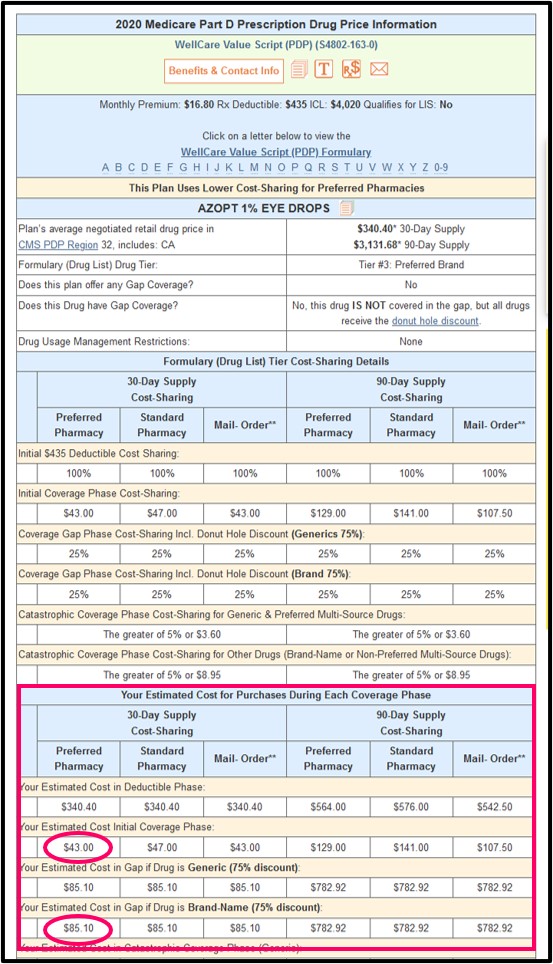

In this first example, we will assume your Tier 3 preferred brand-name medication (AZOPT ® 1% EYE DROPS (10.000 ML ) (NDC: 00065027510)) has a negotiated retail cost around $340 and your Medicare Part D plan has a $43 copay for this drug during your Initial Coverage Phase.

Based on these number you would find that you will pay more for your medication when you enter the Donut Hole - even with the 75% Donut Hole discount.

In this example, you pay a $43 copay for this medication in the Initial Coverage Phase (before entering the Coverage Gap). Then in the Coverage Gap, you will receive a 75% Donut Hole discount

on all formulary drugs and pay 25% of the retail drug price or around $85 (25% of $340) for the same formulary drug.

In summary, you pay:

(1) $340 before meeting your Initial Deductible (if you have an Initial Deductible),

(2) $43 while in the Initial Coverage phase,

(3) $85 in the Coverage Gap or Donut Hole, and

(4) $0 in the 2024 Catastrophic Coverage.

Question: Where can I see the details of the different cost for my drugs throughout my Medicare Part D drug coverage?

When using our Drug Finder (Q1Rx.com), you can choose your drug (enter the drug name or 11-digit NDC), click on the copay amount ($43 in this example), and then view the details of the drug cost in different phases of your Medicare Part D plan.

In this example, you can see that you will be paying almost twice as much ($85.10) for the same drug when reaching the Donut Hole - even though the Donut Hole is considered "closed".

Example #2

You save money on formulary drugs when you enter the Donut Hole with the 75% Donut Hole discount.

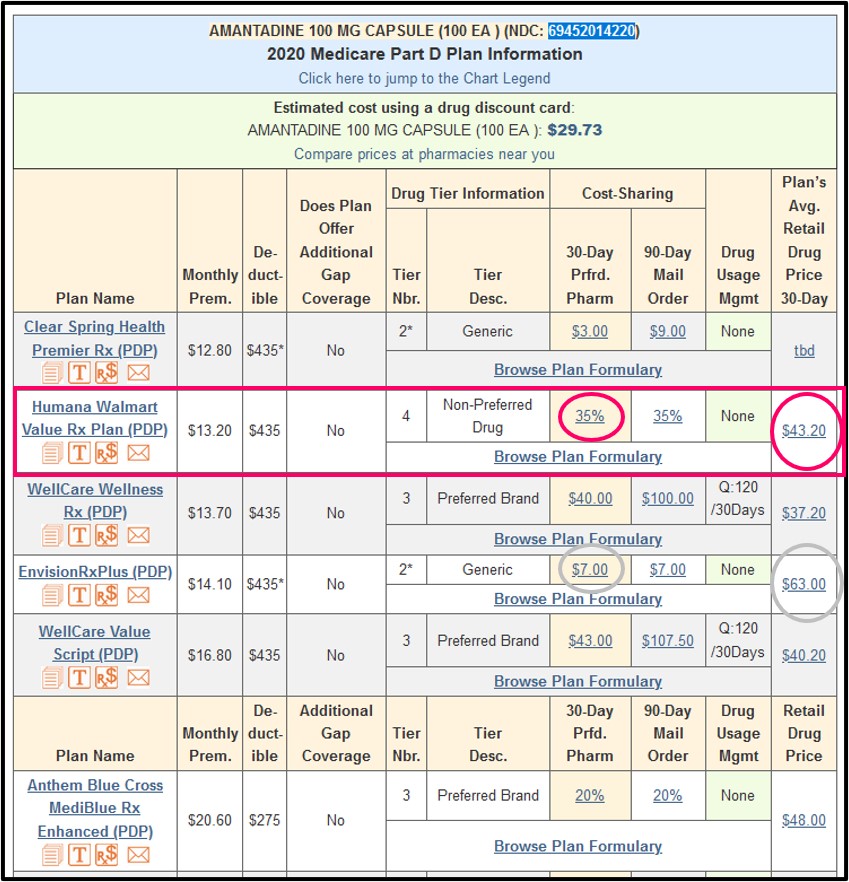

As another example, if your

Tier 4 non-preferred drug’s retail cost is $43.20, with 35% coinsurance your coverage cost would be $15.20 (you pay 35% of your plan's $43.20 retail drug price) during the Initial Coverage Phase.

Since this is a generic formulary medication (AMANTADINE is the generic for Symmetrel ®), you will receive a 75% generic drug discount and pay only $10.80 for the generic while in the Donut Hole (25% of the $43.20 retail cost) - that is, you pay less than while in the Donut Hole for this formulary drug as compared to your plan’s initial $15.12 coinsurance.

In summary, you pay:

(1) $43.20 before meeting your Initial Deductible (if you have an Initial Deductible),

(2) $15.12 while in the Initial Coverage phase,

(3) $10.80 in the Coverage Gap or Donut Hole, and

(4) $0 in the 2024 Catastrophic Coverage.

Please notice: In the graphic above, you can also see other examples of how your retail drug cost can compare to your cost-sharing, such as the $63 retail drug cost with a $7 copay (and, costing twice as much or $15.75 for the same drug while in the Donut Hole - 25% of $63).

If you click on the example 35% cost-sharing value, you can see in the Q1Rx Drug Finder chart that the Donut Hole discount is calculated for both generic drugs and brand-name drugs (although the values are the same with both receiving a 75% discount) ($10.80) and this can be compared to the full retail drug cost during the initial deductible phase ($43.20) and the cost-sharing during the Initial Coverage Phase ($15.12) - again, showing a savings when (or if) you enter the Donut Hole.

Important: When your Medicare Part D plan treats Generic formulary drugs like Brand-name drugs

Please note that, as this Example 2 highlights, generic

drugs are not always organized on a generic or lower formulary drug

tier such as Tier 1 or Tier 2 (in this case, the generic is a Tier 4

Non-Preferred Drug).

In addition, you may find brand-name drugs on a generic drug tier.

However, you still will receive the 75% Donut Hole discount on all formulary drugs, no matter where the drug is placed

within your plan's formulary.

You pay the same price for the formulary drug when you enter the Donut Hole.

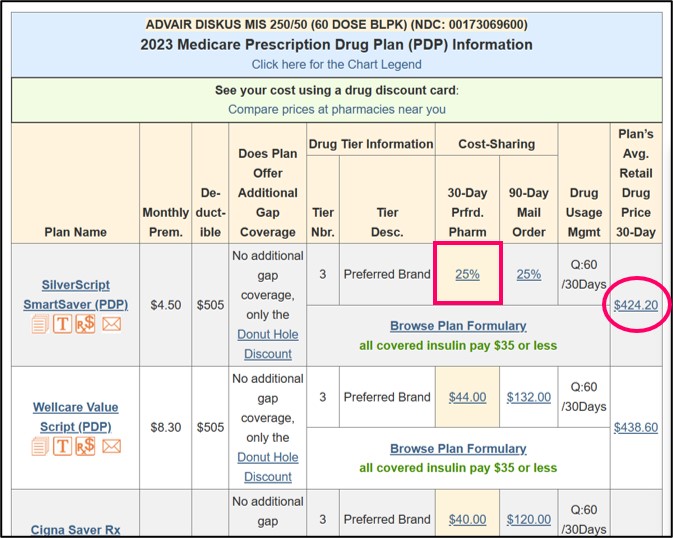

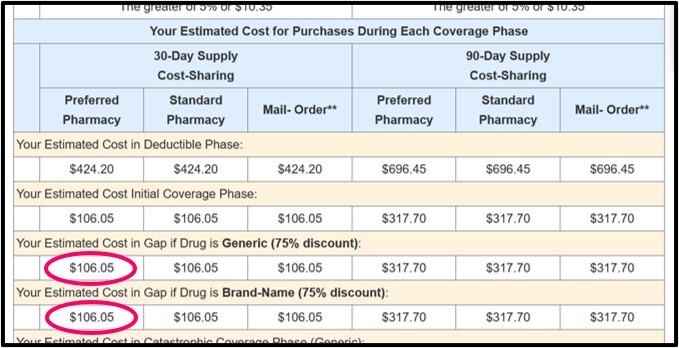

In this final example, we are showing a Tier 3 preferred brand-name medication (ADVAIR DISKUS MIS 250/50 (60 DOSE BLPK) (NDC: 00173069600) with a negotiated retail drug price of $424.20 and your Medicare Part D plan has 25% cost-sharing for Tier 3 drugs (you pay 25% of the retail price) during your Initial Coverage Phase.

Based on these number you would find that you will pay the same for your medication when you enter the Donut Hole with the 75% Donut Hole discount (where you also pay 25% of your plan's retail drug price).

In summary, you pay:

(1) $424.20 before meeting your Initial Deductible (if you have an Initial Deductible),

(2) $106.05 while in the Initial Coverage phase,

(3) $106.05 in the Coverage Gap or Donut Hole, and

(4) $0 in the 2024 Catastrophic Coverage (no cost-sharing when you reach Catastrophic Coverage).

The Bottom Line: Plan ahead for potentially higher drug costs when you reach the Donut Hole or Coverage Gap.

Even when the Donut Hole "closed" with a 75% discount on both brand-name and generic drugs - you may find that your out-of-pocket drug costs increase

when you enter the Donut Hole - so if you are currently paying less

than 25% of the retail price for your drugs (such as a $10 copay for a

$100 drug), you may wish to begin budgeting for potential cost increases

as you begin to approach the Coverage Gap phase of your Medicare Part D

plan (where you would then pay $25 for the same $100 formulary drug

when in the Gap).

- No enrollment fee and no limits on usage

- Everyone in your household can use the same card, including your pets

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2025 Medicare Part D plan Facts & Figures

- 2025 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2024/2025 Medicare Part D plan changes

- 2025 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2024 to 2025

- Drug Finder: 2025 Medicare Part D drug search

- Formulary Browser: View any 2025 Medicare plan's drug list

- 2025 Browse Drugs By Letter

- Guide to Consumer Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2026 Medicare Part D Reminder Service