How is Medicare Part D Catastrophic Coverage changing in 2024?

Important: Starting in 2024 - no additional costs for formulary Medicare Part D drugs once a person reaches Catastrophic Coverage.

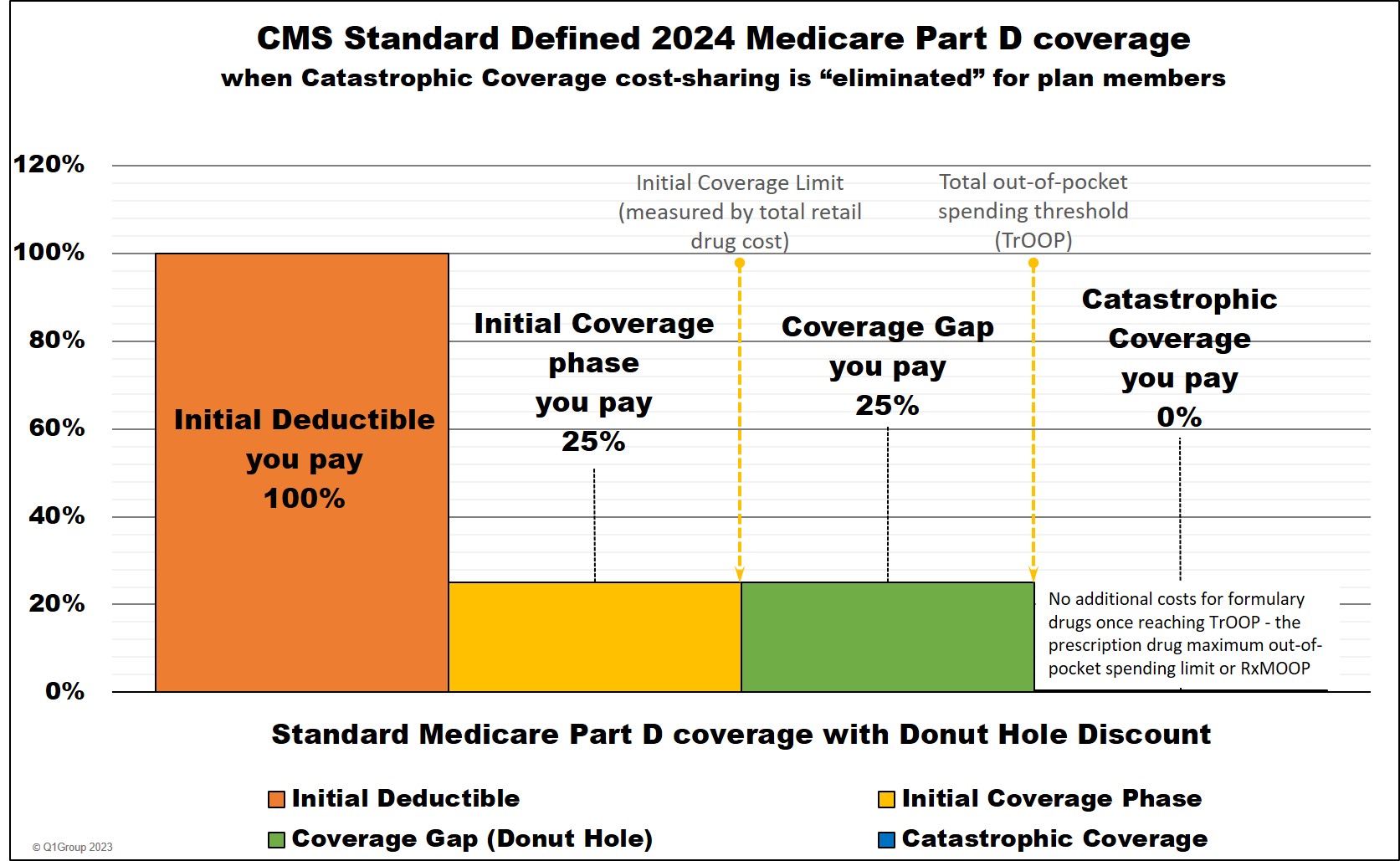

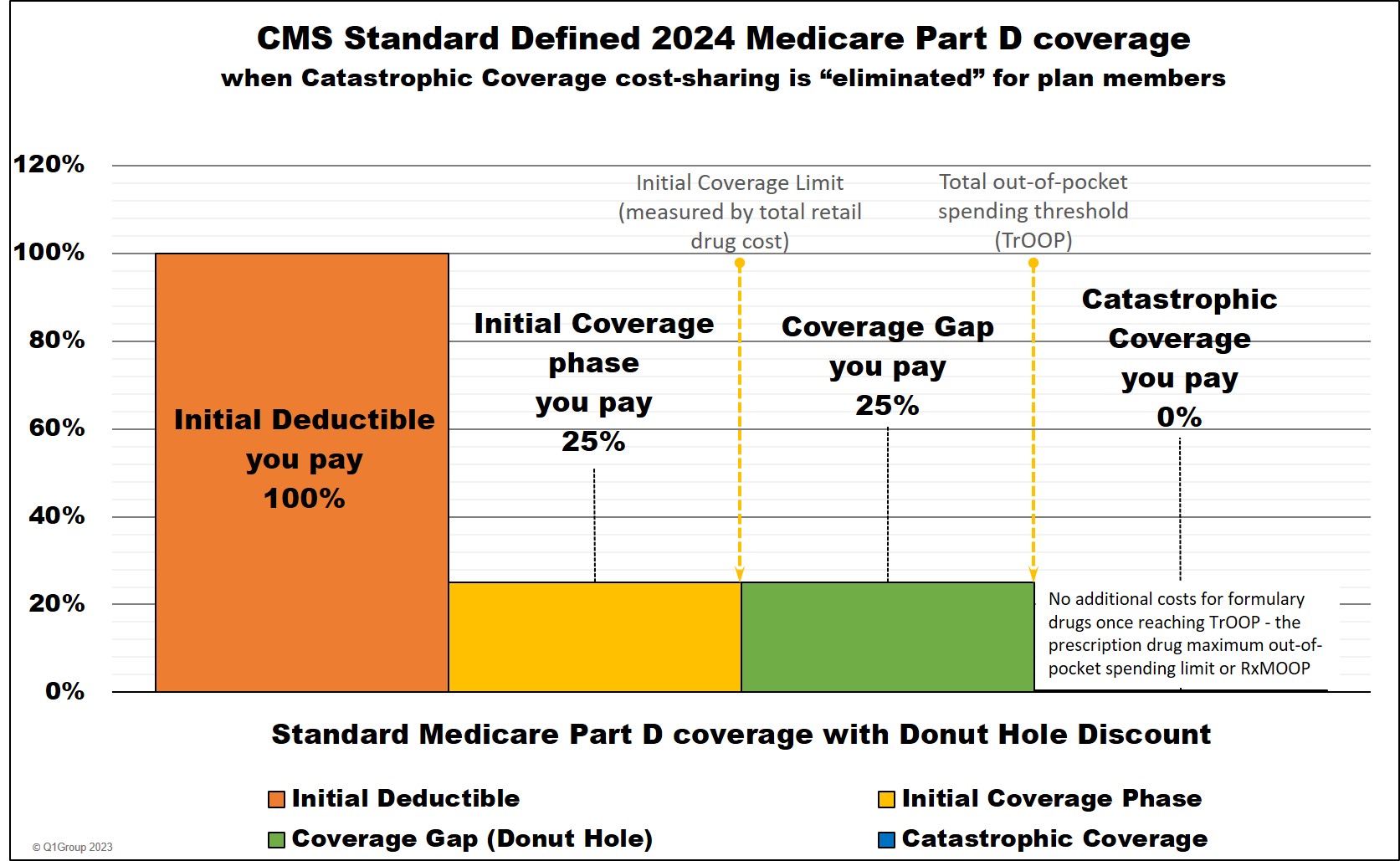

Based on the Inflation Reduction Act, 2024 Medicare Part D Catastrophic Coverage will remain the fourth and final part of your Medicare Part D prescription drug plan coverage - however - cost-sharing for formulary drugs purchased in the Catastrophic Coverage phase will be eliminated for all Medicare beneficiaries - through the remainder of the year.

Question: How does Catastrophic Coverage fit into my Medicare drug plan and annual spending?

Your Medicare Part D plan will have four possible phases or parts.

(1) The Initial Deductible. If your Medicare Part D plan has an initial deductible, you will pay 100% of this amount ($545 in 2024 and $590 in 2025) (unless certain drugs are excluded from the deductible, such as Tier 1 and Tier 2 drugs).

(2) The Initial Coverage phase. After meeting your initial deductible or if your Medicare plan has a $0 deductible, you will share the cost of your drugs with your plan during this phase. Once the retail value of your drug purchases reaches the Initial Coverage Limit (ICL) $5,030 in 2024, (not what you paid, but the retail value), you will exit the Initial Coverage Phase and enter the Donut Hole or Coverage Gap.

(3) The Coverage Gap or Donut Hole. During the Donut Hole, you will receive a discount on the price of your Medicare Part D drugs until you have spent a certain amount out-of-pocket ($8,000 in 2024) or TrOOP threshold and then you will exit the Donut Hole and enter the Catastrophic Coverage phase.

Important Fact: 2024 is the last year that the Donut Hole will exist.

In 2025, the Inflation Reduction Act eliminates the Coverage Gap (Donut Hole) phase. Medicare Part D beneficiaries will stay in the Initial Coverage phase until their out-of-pocket spending for Part D formulary drugs (TrOOP) reaches the maximum out-of-pocket spending limit for Part D formulary drugs (RxMOOP) - which is set at $2,000 for 2025. After reaching the RxMOOP - which is set at $2,000 for 2025, Medicare Part D beneficiaries will enter the Catastrophic Coverage and have a $0 copay (no additional costs) for all formulary Medicare Part D drugs through the remainder of the year.

(4) The Catastrophic Coverage phase. The fourth and final phase of your Medicare Part D plan coverage.

Question: How do my drug costs change throughout my 2024 Medicare drug plan coverage?

Here is how example formulary drug purchases are calculated throughout your Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide) - and how your drug purchases apply to entering and exiting the Coverage Gap.

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** you pay nothing for all formulary medications for the remainder of the year. (80% paid by Medicare, 20% paid by Medicare plan, and 0% by plan member)

"n/a" - "not applicable" to this phase or part of your Medicare Part D plan coverage

Question: How much will you actually spend to reach the $8,000 out-of-pocket threshold (TrOOP) and have no additional formulary drug costs for the remainder of 2024?

Between about $3,333 and $8,000. What you actually pay before reaching your Medicare Part D plan's $8,000 out-of-pocket threshold or RxMOOP will depend on the mix of generic and brand-name prescriptions you use each year and here are three (3) examples of how your actual out-of-pocket costs will vary depending on your prescriptions:

(Example 1) Exiting the Donut Hole when your formulary drug mix is the predicted 92.59% brand drugs and 7.41% generic drugs

Your actual out-of-pocket costs should be around $3,429 if you purchase the predicted mix of generics and brand-name drugs.

Using Medicare's past drug usage estimate*, the average person will have purchases of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole.

So, assuming your 2024 Part D plan has a standard $545 deductible and the retail cost of your drugs is about $1,038 per month, you can estimate your actual annual out-of-pocket drug costs to be around $3,429 before meeting the $8,000 TrOOP and exiting the 2024 Donut Hole (this example is not considering the extra 3% added to adjust for vaccines and insulin coverage). CMS estimates that the total retail value of your drug purchases needed to exit the Donut Hole would be around $12,447 (not adjusting for dispensing and vaccine fees).

*Based on past drug purchasing data, CMS estimates that a person will use a mix of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole (an increase in estimated brand-name drug use as compared to the 2023 estimated Donut Hole mix of 92.13% brand drugs and 7.87%).

(Example 2) Exiting the Donut Hole when your formulary drug purchases are 100% brand drugs.

Example: If you were using only one expensive brand-name medication, such as "Stelara 90mg/ml", the retail cost of your medication would be around $29,000 to over $33,000 per month (see Q1Rx.com/FL/57894006103). And if this was the first drug purchase of the year, you would go through your Initial Deductible, Initial Coverage Phase, and Coverage Gap all at once with a total out-of-pocket costs of around $3,333 (or if you have a $0 deductible plan, your out-of-pocket estimate will be slightly less at $3,032) - assuming 25% standard cost-sharing.

This $3,333 out-of-pocket cost would be the total cost of your formulary prescriptions for the remainder of the year - you would pay no additional cost for your formulary Part D drugs.

You can estimate 2024 out-of-pocket costs and Donut Hole timing using our 2024 Out-of-Pocket cost calculator (note: we do have a limit as to the amount of a single purchase that a person can enter): PDP-Planner.com/2024

Please also note that this $3,333 total annual drug cost figure is an estimate assuming a $545 Initial Deductible - and 25% cost-sharing through the Initial Coverage Phase - and you may have additional dispensing fees -- and, if you purchased other medications at the same time (generic and brand), the order in which the different prescriptions were processed by your Part D plan may affect your final cost.

In this example of purchasing only one brand-name medication (where you receive 95% of the retail drug price in the Donut Hole toward your $8,000 out-of-pocket threshold), you will reach the $8,000 threshold by spending $3,333 yourself and receiving credit for $4,667 from the drug manufacturer's contribution to the 75% brand-name Donut Hole Discount.

Your actual costs should be $8,000 which is the 2024 out-of-pocket threshold if you only purchase generic formulary drugs.

Based on the Inflation Reduction Act, 2024 Medicare Part D Catastrophic Coverage will remain the fourth and final part of your Medicare Part D prescription drug plan coverage - however - cost-sharing for formulary drugs purchased in the Catastrophic Coverage phase will be eliminated for all Medicare beneficiaries - through the remainder of the year.

Question: How does Catastrophic Coverage fit into my Medicare drug plan and annual spending?

Your Medicare Part D plan will have four possible phases or parts.

(1) The Initial Deductible. If your Medicare Part D plan has an initial deductible, you will pay 100% of this amount ($545 in 2024 and $590 in 2025) (unless certain drugs are excluded from the deductible, such as Tier 1 and Tier 2 drugs).

(2) The Initial Coverage phase. After meeting your initial deductible or if your Medicare plan has a $0 deductible, you will share the cost of your drugs with your plan during this phase. Once the retail value of your drug purchases reaches the Initial Coverage Limit (ICL) $5,030 in 2024, (not what you paid, but the retail value), you will exit the Initial Coverage Phase and enter the Donut Hole or Coverage Gap.

(3) The Coverage Gap or Donut Hole. During the Donut Hole, you will receive a discount on the price of your Medicare Part D drugs until you have spent a certain amount out-of-pocket ($8,000 in 2024) or TrOOP threshold and then you will exit the Donut Hole and enter the Catastrophic Coverage phase.

Important Fact: 2024 is the last year that the Donut Hole will exist.

In 2025, the Inflation Reduction Act eliminates the Coverage Gap (Donut Hole) phase. Medicare Part D beneficiaries will stay in the Initial Coverage phase until their out-of-pocket spending for Part D formulary drugs (TrOOP) reaches the maximum out-of-pocket spending limit for Part D formulary drugs (RxMOOP) - which is set at $2,000 for 2025. After reaching the RxMOOP - which is set at $2,000 for 2025, Medicare Part D beneficiaries will enter the Catastrophic Coverage and have a $0 copay (no additional costs) for all formulary Medicare Part D drugs through the remainder of the year.

(4) The Catastrophic Coverage phase. The fourth and final phase of your Medicare Part D plan coverage.

Question: How do my drug costs change throughout my 2024 Medicare drug plan coverage?

Here is how example formulary drug purchases are calculated throughout your Medicare Part D plan (using the CMS defined standard benefit Medicare Part D plan as a guide) - and how your drug purchases apply to entering and exiting the Coverage Gap.

|

When you purchase a formulary medication |

|||||||

|

Example Retail |

You Pay |

Amount counting toward your ICL |

Amount counting toward your TrOOP |

||||

|

Part 1 - Initial Deductible |

$100 |

$100 |

$100 |

$100 |

|||

|

Part 2 - Initial Coverage Phase * |

$100 |

$25 |

$100 |

$25 |

|||

|

Part 3 - Coverage Gap - brand-name drug purchase ** |

$100 |

$25 |

n/a |

$25+$70 |

|||

|

Part 3 - Coverage Gap - generic drug purchase *** |

$100 |

$25 |

n/a |

$25 |

|||

|

Part 4 - Catastrophic Coverage (all formulary drugs) **** |

$100 |

$0 |

n/a |

n/a |

|||

* 25% coinsurance

** 75% Brand-name Discount

*** 75% Generic Discount

**** you pay nothing for all formulary medications for the remainder of the year. (80% paid by Medicare, 20% paid by Medicare plan, and 0% by plan member)

"n/a" - "not applicable" to this phase or part of your Medicare Part D plan coverage

Question: How much will you actually spend to reach the $8,000 out-of-pocket threshold (TrOOP) and have no additional formulary drug costs for the remainder of 2024?

Between about $3,333 and $8,000. What you actually pay before reaching your Medicare Part D plan's $8,000 out-of-pocket threshold or RxMOOP will depend on the mix of generic and brand-name prescriptions you use each year and here are three (3) examples of how your actual out-of-pocket costs will vary depending on your prescriptions:

(Example 1) Exiting the Donut Hole when your formulary drug mix is the predicted 92.59% brand drugs and 7.41% generic drugs

Your actual out-of-pocket costs should be around $3,429 if you purchase the predicted mix of generics and brand-name drugs.

Using Medicare's past drug usage estimate*, the average person will have purchases of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole.

So, assuming your 2024 Part D plan has a standard $545 deductible and the retail cost of your drugs is about $1,038 per month, you can estimate your actual annual out-of-pocket drug costs to be around $3,429 before meeting the $8,000 TrOOP and exiting the 2024 Donut Hole (this example is not considering the extra 3% added to adjust for vaccines and insulin coverage). CMS estimates that the total retail value of your drug purchases needed to exit the Donut Hole would be around $12,447 (not adjusting for dispensing and vaccine fees).

*Based on past drug purchasing data, CMS estimates that a person will use a mix of 92.59% brand drugs and 7.41% generic drugs while in the 2024 Donut Hole (an increase in estimated brand-name drug use as compared to the 2023 estimated Donut Hole mix of 92.13% brand drugs and 7.87%).

(Example 2) Exiting the Donut Hole when your formulary drug purchases are 100% brand drugs.

Example: If you were using only one expensive brand-name medication, such as "Stelara 90mg/ml", the retail cost of your medication would be around $29,000 to over $33,000 per month (see Q1Rx.com/FL/57894006103). And if this was the first drug purchase of the year, you would go through your Initial Deductible, Initial Coverage Phase, and Coverage Gap all at once with a total out-of-pocket costs of around $3,333 (or if you have a $0 deductible plan, your out-of-pocket estimate will be slightly less at $3,032) - assuming 25% standard cost-sharing.

This $3,333 out-of-pocket cost would be the total cost of your formulary prescriptions for the remainder of the year - you would pay no additional cost for your formulary Part D drugs.

You can estimate 2024 out-of-pocket costs and Donut Hole timing using our 2024 Out-of-Pocket cost calculator (note: we do have a limit as to the amount of a single purchase that a person can enter): PDP-Planner.com/2024

Please also note that this $3,333 total annual drug cost figure is an estimate assuming a $545 Initial Deductible - and 25% cost-sharing through the Initial Coverage Phase - and you may have additional dispensing fees -- and, if you purchased other medications at the same time (generic and brand), the order in which the different prescriptions were processed by your Part D plan may affect your final cost.

In this example of purchasing only one brand-name medication (where you receive 95% of the retail drug price in the Donut Hole toward your $8,000 out-of-pocket threshold), you will reach the $8,000 threshold by spending $3,333 yourself and receiving credit for $4,667 from the drug manufacturer's contribution to the 75% brand-name Donut Hole Discount.

(Example 3) Exiting the Donut Hole when your formulary drug purchases are 100% generic drugs.

Your actual costs should be $8,000 which is the 2024 out-of-pocket threshold if you only purchase generic formulary drugs.

Question: So, what is the minimum average monthly retail drug cost needed to enter 2024 Catastrophic Coverage?

About $1,038 in 2024. If your monthly retail drug costs average more than $1,038 in 2024, you will probably exit the Donut Hole or Coverage Gap and enter the Catastrophic Coverage phase. But, since your Medicare Part D plan will change every year, your spending to enter Catastrophic Coverage will also change.

We are estimating the retail drug cost necessary for reaching the total out-of-pocket spending threshold (TrOOP) and entering Catastrophic Coverage based on annual plan parameters and estimated spending habits during the Donut Hole. As an example, for 2024, the Centers for Medicare and Medicaid Services (CMS) estimates that most people purchase a mix of about 7.4% generics and 92.6% brand-name drugs while in the Donut Hole (and this average "mix" of brands and generics changes every year).

For more information about when (or if) you will enter Catastrophic Coverage, please see our FAQ: Can I estimate whether I will enter Catastrophic Coverage?

Question: What do I pay in Catastrophic Coverage if I qualify for the Medicare Part D Extra Help program?

Starting in plan year 2024, once reaching the Catastrophic Coverage phase of coverage, all Medicare beneficiaries pay nothing ($0) for their formulary medication purchases for the remainder of the year.

Important: You only get Catastrophic Coverage for formulary medications.

Keep in mind that the Catastrophic Coverage phase cost-sharing ($0 copay) only applies to medications that are on your Part D plan's formulary (or drug list). Therefore, if you take an expensive medication that is not covered on you Medicare Part D formulary, you will be responsible for 100% of the drug's cost even when in the Catastrophic Coverage phase.

Question: Can I choose a Medicare Part D plan with lower-costing or better Catastrophic Coverage?

Not lower cost-sharing, but yes, you can choose a Part D drug plan with broader coverage of all your medications. As noted above, starting with plan year 2024, there is no cost-sharing ($0) for all formulary drug purchases while in the Catastrophic Coverage phase. However, you will need to make sure that your Medicare Part D drug plan covers all of your formulary drugs. If you use a non-formulary drug, you will not have the benefit of the $0 Catastrophic Coverage cost-sharing.

Question: What should I do if I use a non-formulary drug and have reached Catastrophic Coverage?

Pay full retail cost and ask your plan to cover the medication. As noted, your $0 Catastrophic Coverage copay is only for your formulary drugs. If you are using a non-formulary drug, you will, instead, pay the full retail drug cost.

Therefore, if you reach the Catastrophic Coverage phase, and you begin using a non-formulary medication, you may wish to file for a formulary exception to have the drug added to your Medicare Part D plan coverage so that it will be covered during all phases of your Medicare Part D coverage. Your Medicare plan does not automatically grant a formulary exception request and you may need to appeal a negative decision. If your Medicare prescription drug plan does approve your request, the medication will usually be added to the specialty drug tier.

Question: Do Catastrophic Coverage costs change over the years?

In the past, yes - but not after 2023. Prior to 2024, Catastrophic Coverage costs changed each year. For plan year 2024 and beyond, you pay nothing for your formulary drug purchases - and this $0 cost-sharing is not predicted to change in the foreseeable future.

However, back in 2023, if you were using a brand-name drug with a retail cost of $100, your coverage cost in the 2023 Catastrophic Coverage phase was $10.35 (since $10.35 is greater than $5 - or 5% of $100). But, if you were using a brand-name drug that has a $400 retail cost you paid $20 (since $20 - or 5% of $400 is greater than the standard 2023 copay of $10.35). You can also click here to see a chart of Medicare Part D plan parameters for all years since 2006.

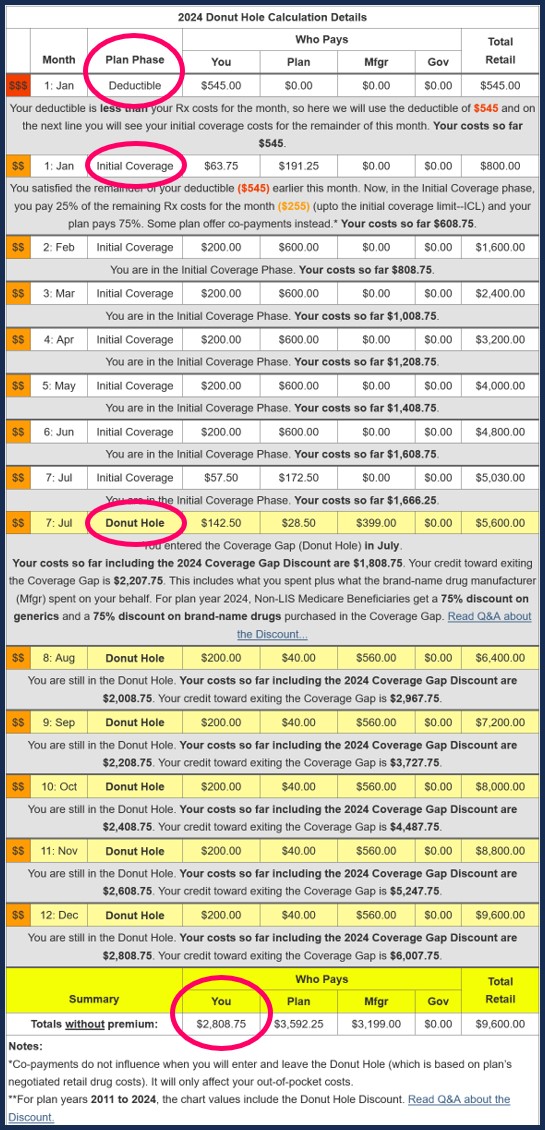

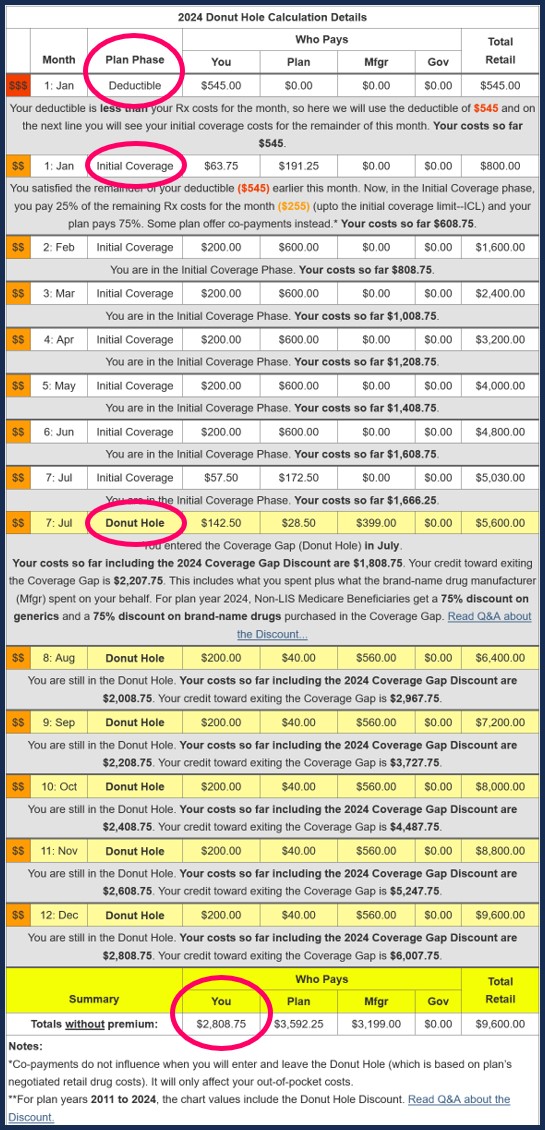

To help you visualize the phases of your Medicare Part D prescription drug plan coverage,

we have a Donut Hole Calculator or 2024 PDP-Planner

online illustrating the changes in your monthly estimated costs based on the established

2024 standard Medicare Part D plan limits mentioned above.

And to give you an overview of your Medicare Part D spending . . . our 2024 PDP-Planner.

We also have several examples online to help you get started with our PDP-Planner tool. You can click here for a 2024 example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month - resulting in annual out-of-pocket drug spending of about $2,809) and then change the monthly drug cost to whatever you wish.

Question: Who pays for my drug coverage when I reach the 2024 Catastrophic Coverage phase?

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% co-insurance for calculating cost-sharing.

* 25% co-pay or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

Question: How many Medicare Part D beneficiaries actually enter into the Catastrophic Coverage phase?

About 1.5 million people in 2019 (up from 1 million in 2015). According to research published on July 23, 2021 from the Kaiser Family Foundation, about 1.5 million people in 2019 who do not qualify for the Low-Income Subsidy (LIS) entered Catastrophic Coverage. (see www.kff.org/medicare/issue-brief/millions-of-medicare-part-d- enrollees-have-had-out-of -pocket-drug-spending-above- the-catastrophic-threshold-over-time)

According to earlier research from the Kaiser Family Foundation, "3.6 million Medicare Part D enrollees had total drug spending above the catastrophic coverage threshold [in 2015]. Of this total, 2.6 million enrollees received low-income subsidies [LIS], but 1 million enrollees did not, and incurred out-of-pocket drug spending above the catastrophic threshold." [emphasis added]

(For more information, please see www.kff.org/medicare/issue-brief/no-limit-medicare-part-d-enrollees-exposed-to-high-out-of-pocket-drug-costs-without-a-hard-cap-on-spending/)

And to give you an overview of your Medicare Part D spending . . . our 2024 PDP-Planner.

We also have several examples online to help you get started with our PDP-Planner tool. You can click here for a 2024 example of a Medicare beneficiary with relatively high monthly prescription drug costs (retail prescription drug cost of $800 per month - resulting in annual out-of-pocket drug spending of about $2,809) and then change the monthly drug cost to whatever you wish.

Question: Who pays for my drug coverage when I reach the 2024 Catastrophic Coverage phase?

Below is a chart showing how example formulary drug purchases are paid throughout your Medicare Part D plan coverage -- using the CMS defined standard benefit Medicare Part D plan with a fixed 25% co-insurance for calculating cost-sharing.

|

Plan Year 2024 When you purchase a Part D formulary medication with a $100 retail cost |

||||||

| Retail Cost | You Pay | Your Medicare drug plan pays |

Pharma Mfgr. pays |

Federal Govern. pays |

Amount counting toward your TrOOP Threshold |

|

| Initial Deductible | $100 | $100 | $0 | $0 | $0 | $100 |

| Initial Coverage phase * | $100 | $25 | $75 | $0 | $0 | $25 |

| Coverage Gap - brand-name ** | $100 | $25 | $5 | $70 | $0 | $95 |

| Coverage Gap - generic *** | $100 | $25 | $75 | $0 | $0 | $25 |

| Catastrophic Coverage (brand drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

| Catastrophic Coverage (generic drug) **** | $100 | $0 | $20 | $0 | $80 | n/a |

* 25% co-pay or cost-sharing

** 75% Brand-name Discount

*** 75% Generic Discount

**** In 2024, the Catastrophic Coverage phase will still exist, but a plan member will not have any out-of-pocket costs for formulary drugs after reaching the plan's $8,000 total out-of-pocket threshold (TrOOP).

Question: How many Medicare Part D beneficiaries actually enter into the Catastrophic Coverage phase?

About 1.5 million people in 2019 (up from 1 million in 2015). According to research published on July 23, 2021 from the Kaiser Family Foundation, about 1.5 million people in 2019 who do not qualify for the Low-Income Subsidy (LIS) entered Catastrophic Coverage. (see www.kff.org/medicare/issue-brief/millions-of-medicare-part-d- enrollees-have-had-out-of -pocket-drug-spending-above- the-catastrophic-threshold-over-time)

According to earlier research from the Kaiser Family Foundation, "3.6 million Medicare Part D enrollees had total drug spending above the catastrophic coverage threshold [in 2015]. Of this total, 2.6 million enrollees received low-income subsidies [LIS], but 1 million enrollees did not, and incurred out-of-pocket drug spending above the catastrophic threshold." [emphasis added]

(For more information, please see www.kff.org/medicare/issue-brief/no-limit-medicare-part-d-enrollees-exposed-to-high-out-of-pocket-drug-costs-without-a-hard-cap-on-spending/)

Browse FAQ Categories

Have a Prescription Not Covered by Your Medicare Plan?

Prescription Discounts are

easy as 1-2-3

easy as 1-2-3

- Locate lowest price drug and pharmacy

- Show card at pharmacy

- Get instant savings!

Your drug discount card is available to you at no cost.

Q1 Quick Links

- Sign-up for our Medicare Part D Newsletter.

- PDP-Facts: 2024 Medicare Part D plan Facts & Figures

- 2024 PDP-Finder: Medicare Part D (Drug Only) Plan Finder

- PDP-Compare: 2023/2024 Medicare Part D plan changes

- 2024 MA-Finder: Medicare Advantage Plan Finder

- MA plan changes 2023 to 2024

- Drug Finder: 2024 Medicare Part D drug search

- Formulary Browser: View any 2024 Medicare plan's drug list

- 2024 Browse Drugs By Letter

- Guide to 2023/2024 Mailings from CMS, Social Security and Plans

- Out-of-Pocket Cost Calculator

- Q1Medicare FAQs: Most Read and Newest Questions & Answers

- Q1Medicare News: Latest Articles

- 2025 Medicare Part D Reminder Service